An international investor evaluating Brazil for a new solar panel factory might initially see an apparent competitive advantage, basing their labor cost calculations on a simple conversion of local salary ranges to euros or dollars.

However, this initial calculation is often misleading. After consulting with local experts, many discover the true, fully-loaded cost of an employee is nearly double the base salary. This common scenario highlights a critical aspect of entering the Brazilian market: a complex and highly protective **Brazil labor** environment that requires careful navigation.

For entrepreneurs planning to start a solar panel factory in Brazil, understanding the intricacies of its labor laws is not just a matter of compliance; it’s fundamental to sound financial modeling and operational success. This guide provides an overview of the key employment factors, from legal frameworks and cost structures to the availability of skilled labor.

Table of Contents

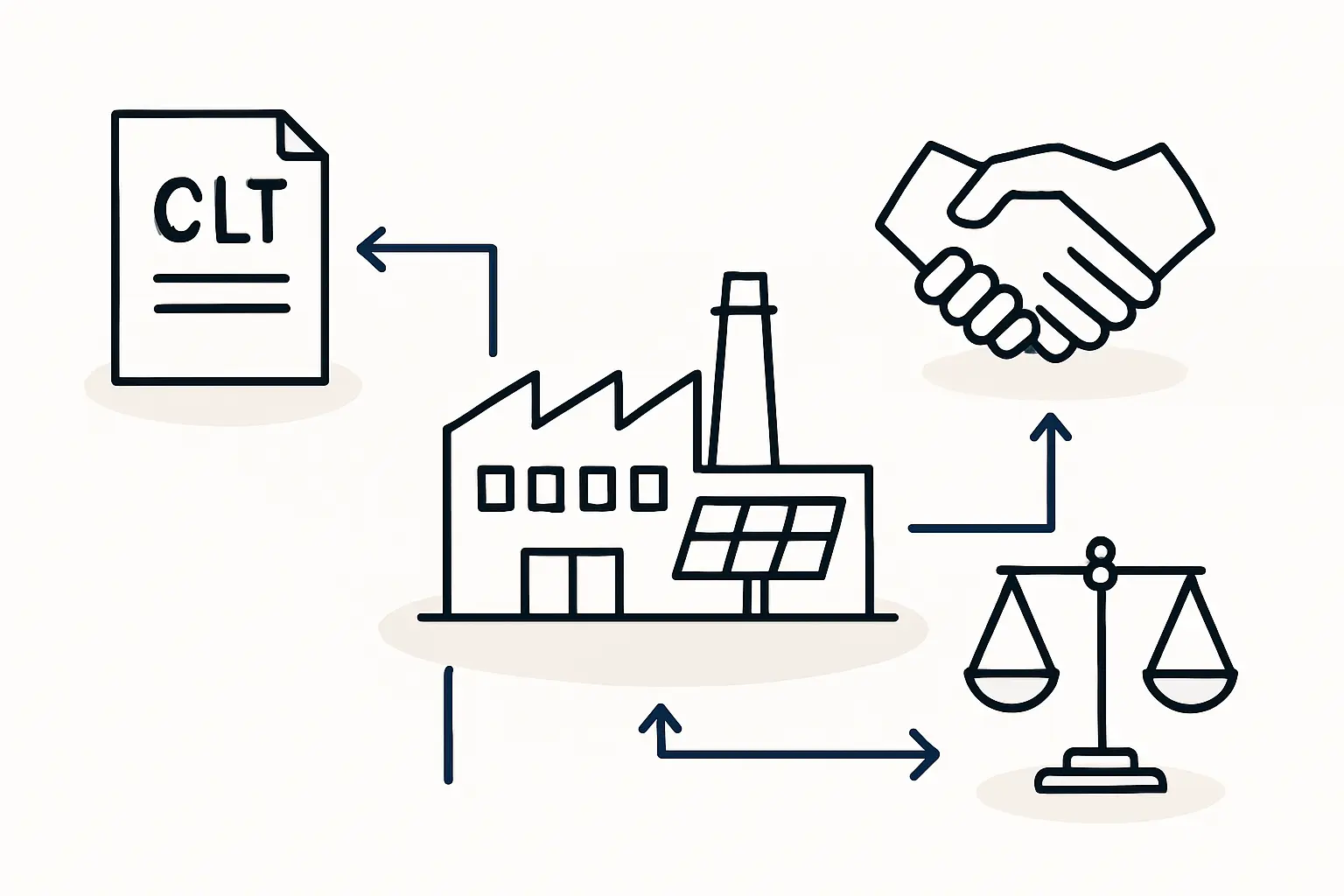

Understanding Brazil’s Labor Framework: The CLT and Its Implications

The cornerstone of Brazilian labor law is the Consolidação das Leis do Trabalho (CLT). Established in the 1940s, this comprehensive legal code was designed primarily to protect employees, and its statutes are rigorously enforced.

Unlike in many other regions, employment terms are not purely a matter of private contract; they are heavily regulated by the CLT. For any foreign entrepreneur, attempting to manage HR and payroll without specialized local legal and accounting counsel represents a significant risk. The system’s complexity makes strict adherence to the law the only sustainable path forward.

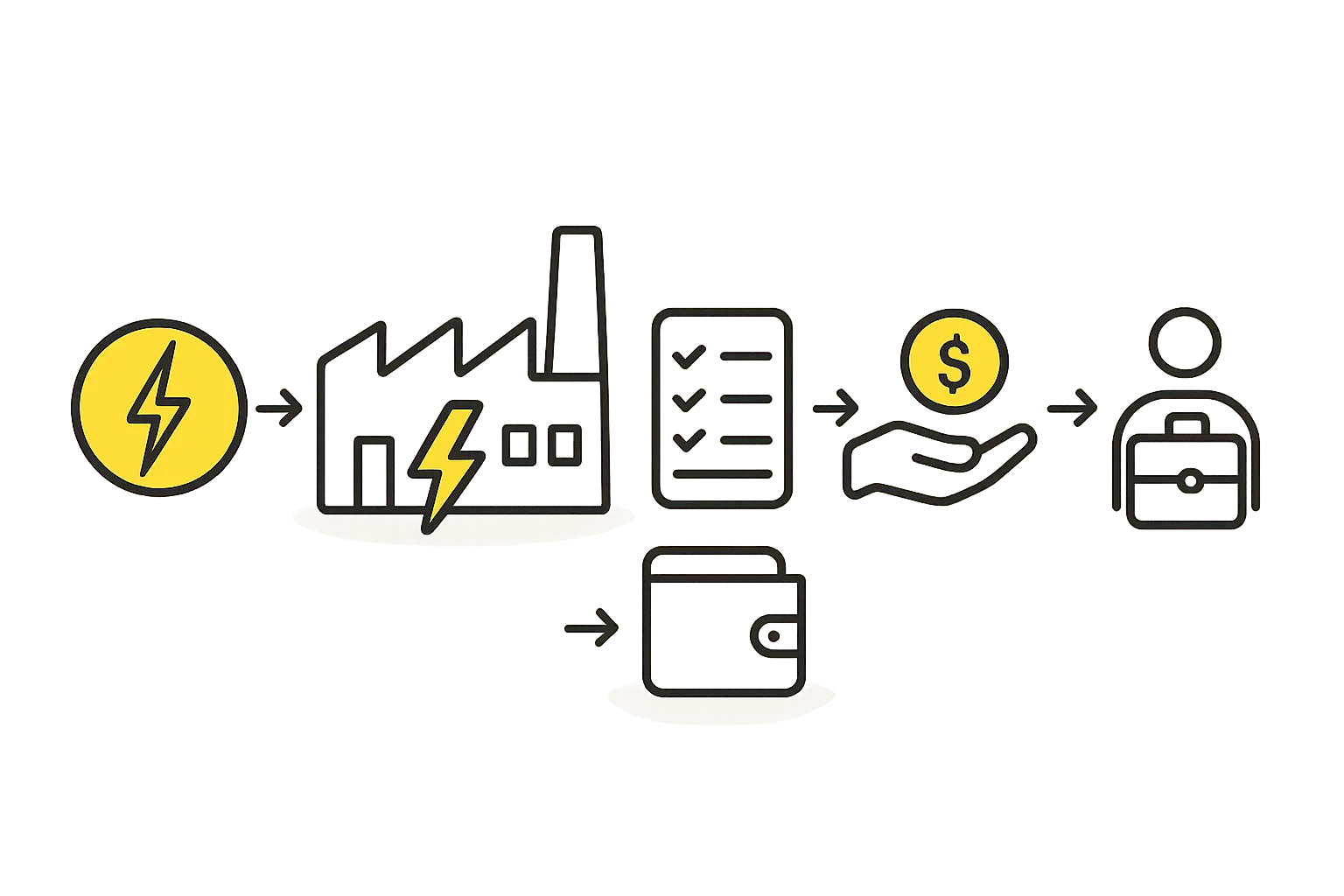

The True Cost of Employment: Beyond the Monthly Salary

The most frequent miscalculation for new investors is underestimating the total cost of labor. The monthly salary is merely the starting point, as several mandatory charges and benefits add substantially to an employer’s total cost per employee.

The 13th Salary and Vacation Bonus

By law, every employee in Brazil is entitled to a “13th salary,” an additional one-month payment made at the end of the year. Additionally, employees taking their annual vacation receive their regular pay plus a vacation bonus equivalent to one-third of their monthly salary. These are not discretionary bonuses but legally mandated components of annual compensation.

FGTS: The Severance Guarantee Fund

Employers must deposit 8% of an employee’s gross monthly salary into a government-managed fund called the Fundo de Garantia do Tempo de Serviço (FGTS). This amount is not deducted from the employee’s pay but is an additional cost for the employer. The fund serves as a form of severance pay, accessible to the employee upon termination without just cause.

Termination Costs: A Critical Planning Factor

Dismissing an employee without just cause in Brazil triggers significant costs. In addition to serving a notice period (or paying in lieu of it), the employer must pay a penalty of 40% of the total amount accumulated in the employee’s FGTS account throughout their tenure. This potential liability must be factored into long-term financial planning and risk management.

The Role of Unions (Sindicatos) in the Manufacturing Sector

Brazil has a strong tradition of industry-specific labor unions, known as sindicatos. These organizations are typically structured by economic sector and geographical region. A solar manufacturing plant in the state of São Paulo, for example, would fall under the jurisdiction of a different union than a similar plant in the state of Bahia.

These unions negotiate Collective Bargaining Agreements (CBAs) that establish minimum wages, benefits, and working conditions for their specific sector. Crucially, the terms of a CBA often exceed the minimums set by the CLT. Identifying and engaging with the correct union is an essential step in setting up operations, as these agreements will dictate your factory’s wage floor and benefit packages.

Sourcing and Developing Technical Talent

Although the labor framework presents challenges, Brazil’s solid base of industrial talent offers a significant advantage for new manufacturing ventures.

The National Skill Base: SENAI and Technical Schools

A key institution in Brazil’s technical education landscape is the Serviço Nacional de Aprendizagem Industrial (SENAI), a nationwide network of vocational schools renowned for producing well-trained technicians and industrial operators. Graduates from SENAI and other technical institutes typically possess strong foundational skills in mechanics, electronics, and industrial processes, making them prime candidates for a solar factory workforce.

The Need for Specialized Solar Training

While general technical aptitude is high, the specific processes involved in solar module assembly require dedicated training. Operators must be trained in the precise operation of key solar panel manufacturing machines, such as stringers, laminators, and testers.

Based on experience from turnkey projects, this specialized training is typically provided on-site by equipment engineers during the factory commissioning phase. Budgeting for this initial training is a critical part of the setup process.

Frequently Asked Questions (FAQ) for Investors

Q: What are the standard working hours in Brazil?

A: The standard work week is 44 hours, typically structured as eight hours per day from Monday to Friday and four hours on Saturday. Overtime is strictly regulated and paid at a premium.

Q: How significant is the risk of labor litigation?

A: Brazil has one of the highest rates of labor lawsuits in the world, which underscores the importance of rigorous compliance with the CLT and all relevant CBAs. Meticulous record-keeping and adherence to formal processes are the best defense.

Q: Are there major regional differences in labor costs?

A: Yes, absolutely. Wages and living costs vary significantly. For instance, managing **employee payroll in São Paulo, Brazil**—an industrialized southeastern state—is typically more expensive than in the northeastern region. The governing union and its CBA also drive significant local variations.

Q: What is a typical wage for a solar factory operator?

A: This can vary widely by region and the applicable CBA. While the national minimum wage provides a baseline, a skilled operator in an industrial zone can expect a wage significantly higher, as determined by union negotiations. Detailed local research is essential for accurate budgeting.

Strategic Considerations for Your Business Plan

Navigating Brazil’s labor environment requires a strategic approach from day one. The high ancillary costs of employment, the influence of unions, and the critical importance of legal compliance must be central to your operational and financial strategy.

A comprehensive business plan for solar panel manufacturing must therefore include a detailed, locally-advised breakdown of these labor-related expenses. Proactive engagement with legal and HR experts is not an optional expense but a foundational investment in the enterprise’s long-term stability and success. With the right guidance and diligent planning, establishing a compliant and productive workforce in Brazil is entirely achievable.