Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

Establishing a Solar Module Export Hub in Southern Brazil: A Strategic Guide to the Mercosur Market

While many entrepreneurs in solar manufacturing focus on their domestic markets, a powerful strategic opportunity is often overlooked: establishing a production hub in one country to serve an entire economic bloc, free of common import tariffs. Setting up a solar module factory in Southern Brazil offers exactly this advantage, creating a gateway to the vast Mercosur market.

This guide outlines the business case for such a venture, detailing its unique trade advantages, complex regulatory requirements, and a structured partnership model that puts this sophisticated strategy within reach, even for newcomers to the photovoltaic industry.

The Mercosur Advantage: A Protected Market of 270 Million People

Mercosur, the Southern Common Market, is the world’s fifth-largest economic bloc, comprising Brazil, Argentina, Uruguay, and Paraguay. For manufacturers, its foundational principle is powerful: products made within a member country can be exported to other members with a zero percent import tariff.

For a solar module producer in Brazil, this means modules can be sold into Argentina or Uruguay as if they were domestic goods, bypassing the significant tariffs typically applied to Asian imports. This creates an immediate and substantial competitive advantage, positioning a Brazilian factory as a preferred regional supplier.

Why Southern Brazil is the Strategic Choice

While Brazil is a large country, its southern states—primarily Santa Catarina and Rio Grande do Sul—offer a unique blend of logistical and geographic advantages for a Mercosur-focused export strategy.

Geographic Proximity

These states share borders with or are close to Argentina, Uruguay, and Paraguay, which simplifies ground logistics and reduces transport costs compared to other Brazilian regions.

Advanced Port Infrastructure

Major ports like Itajaí and Paranaguá are well-equipped to handle the import of raw materials (cells, glass, EVA) and the export of finished modules.

Industrial Foundation

The region has a strong industrial heritage, offering a skilled workforce and the reliable infrastructure critical for high-quality manufacturing operations.

This strategic positioning transforms a factory from a simple production site into a logistical hub designed for efficient, tariff-free regional distribution.

Navigating the Regional Regulatory and Certification Maze

The significant opportunity within Mercosur is protected by a complex regulatory environment, and navigating it successfully is the key to unlocking the market. New entrants must address two main challenges: local content regulations and multi-country product certifications.

Understanding Brazilian Content Rules and Incentives

Brazil encourages local manufacturing through programs like FINAME, which provides favorable financing for projects using components with a specified level of local content. Additionally, tax incentives like the ICMS (a state-level value-added tax) can vary by state, directly impacting the final cost structure of the modules.

Structuring production to meet these requirements is essential for financial viability. Based on experience gained from European PV manufacturers’ turnkey projects, optimizing the bill of materials and supply chain for these regulations is a critical early step.

The Challenge of Multi-Country Certification

While Mercosur streamlines trade, product certification remains a national responsibility. A module produced in Brazil for export to Argentina, for example, requires separate certifications for each market.

-

Brazil: Requires INMETRO certification, a mandatory process that verifies product safety and performance according to specific technical standards.

-

Argentina: Requires its own certification from an accredited body like IRAM.

-

Uruguay: Has its own standards, often managed by the UNIT organization.

Managing the certification process across multiple countries is a complex administrative and technical task. It requires coordinated testing, documentation, and factory audits for each target market.

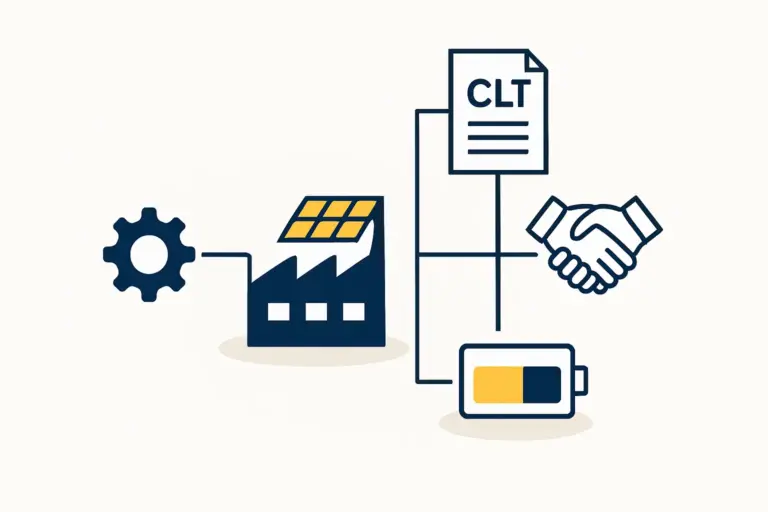

The European Industrial Solutions Provider Partnership Model: A Complete Turnkey Solution

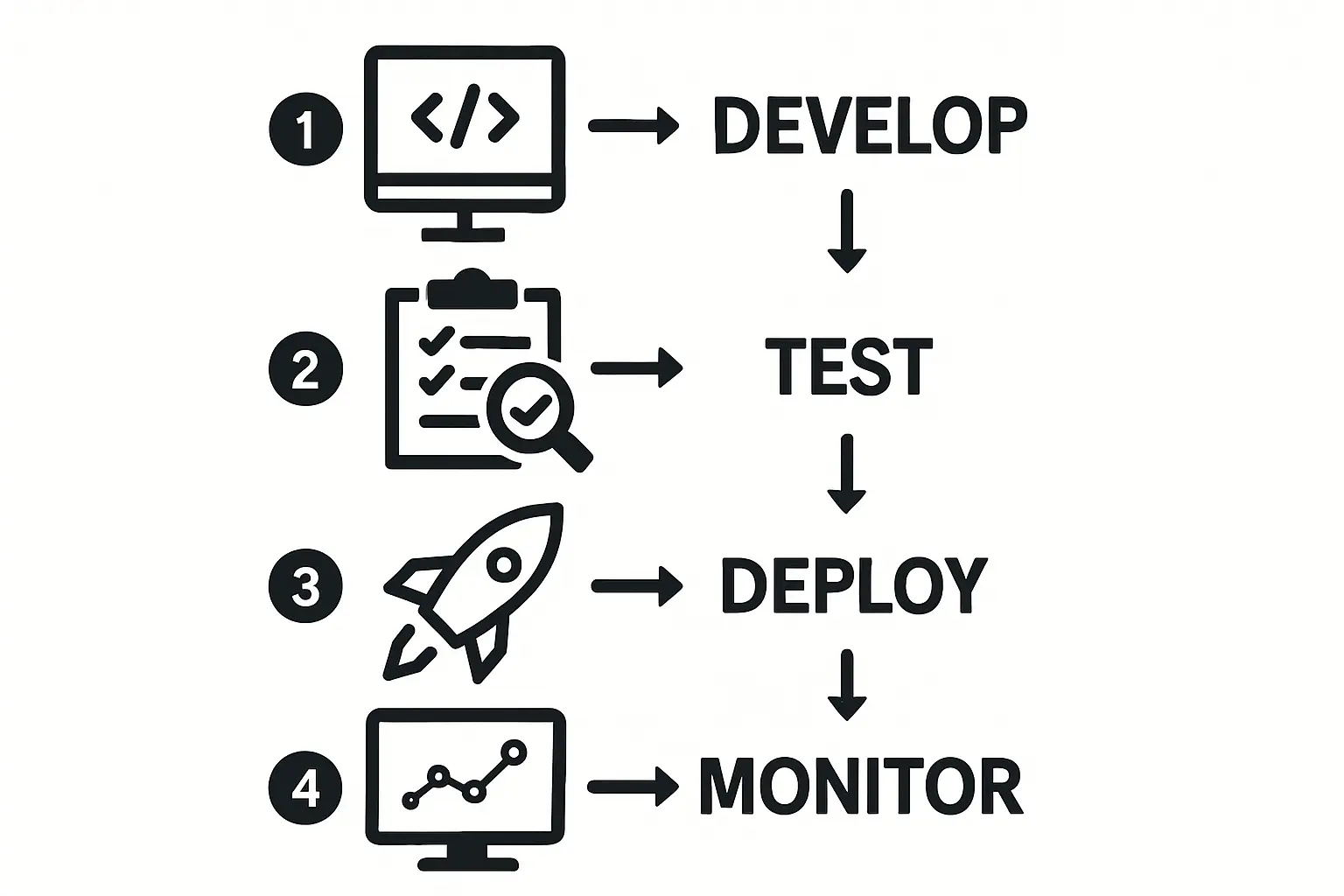

For an entrepreneur without a background in photovoltaics, these challenges can seem insurmountable, which is why partnering with an experienced technical consultant is the standard approach for market entry. Experienced European turnkey engineering team Technology provides a complete turnkey solar module factory solution, specifically designed to manage these complexities from concept to full operation.

This comprehensive model includes:

-

Business Plan and Financial Modeling: Developing a robust plan that accounts for regional tax incentives, logistics costs, and the investment requirements for a Mercosur-focused operation.

-

Factory Design and Layout: Designing an optimal factory layout for efficient workflow, from raw material intake to the dispatch of certified modules.

-

Equipment Sourcing and Commissioning: Selecting, procuring, and installing the right production machinery to meet both quality standards and local content rules.

-

Certification Management: Guiding the entire certification process for INMETRO, IRAM, and other regional standards, ensuring the final product is compliant for sale across Mercosur.

-

Team Training and Ramp-Up Support: Training the local operational team to run the factory efficiently and achieve target output and quality levels.

This approach allows the business owner to focus on commercial strategy while the technical partner handles the engineering, regulatory, and operational setup. As the experience of international investors like Mr. Goyal from India demonstrates, establishing a sophisticated manufacturing operation in a new region is an achievable goal with the right guidance.

Frequently Asked Questions (FAQ)

What are the primary advantages of manufacturing in Brazil for Mercosur?

The single greatest advantage is the 0% import tariff when exporting to Argentina, Uruguay, and Paraguay. This allows your product to be priced more competitively than modules imported from outside the bloc, which face significant duties.

Is a local Brazilian partner required to start a factory?

While not legally mandatory for a foreign investor, having a technical partner with deep experience in the Brazilian and South American markets is critical for effectively navigating local regulations, supply chains, and business practices.

How long does the INMETRO certification process typically take?

The timeline can vary but generally takes several months. It involves submitting technical documentation, sample testing at an accredited laboratory, and a factory audit. A well-managed process, guided by an experienced consultant, can prevent common delays.

What is a realistic production capacity for a new factory?

A common starting point for a new venture targeting the Mercosur region is an annual production capacity between 50 MW and 150 MW. This size is large enough to achieve economies of scale while keeping the initial investment manageable.

Next Steps in Your Exploration

Establishing a solar module export hub in Southern Brazil offers a structured path to capturing a significant share of the growing South American solar market, leveraging established trade agreements to build a durable competitive advantage.

For those serious about exploring this opportunity, the next step involves a deeper analysis of the financial and operational requirements. The educational materials and structured courses available on pvknowhow.com provide a clear framework for this detailed planning phase.

Download the Mercosur Solar Export Hub Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.