An investor reviews a promising business plan for a new solar module factory in Brazil. The numbers are compelling: strong domestic demand for renewable energy, abundant sunshine, and a vast market. On paper, the projected return on investment looks excellent.

Yet, months into the project, unforeseen taxes strain the budget, customs delays push the timeline back by weeks, and administrative costs soar far higher than anticipated. This experience is a classic introduction to a uniquely Brazilian business challenge: the ‘Custo Brasil’, or the ‘Brazil Cost’.

This guide unpacks the concept, detailing its components and explaining its practical impact on a manufacturing venture. Understanding these hidden operational costs isn’t a deterrent—it’s the first step toward building a resilient and profitable enterprise in Brazil.

Table of Contents

What Exactly is the ‘Custo Brasil’?

The ‘Custo Brasil’ is not a formal tax or a specific fee. It’s a widely used term for the combination of structural, bureaucratic, and economic factors that makes the cost of doing business in Brazil more expensive than in many other countries. This operational friction can slow down projects and inflate budgets if not properly managed.

Think of it as the gap between a project’s theoretical cost on a spreadsheet and its actual cost in the real world. According to studies by institutions like the National Confederation of Industry (CNI), these costs can significantly impact a company’s competitiveness. For a foreign investor, particularly in a capital-intensive industry like solar module manufacturing, anticipating these factors is essential for accurate financial planning.

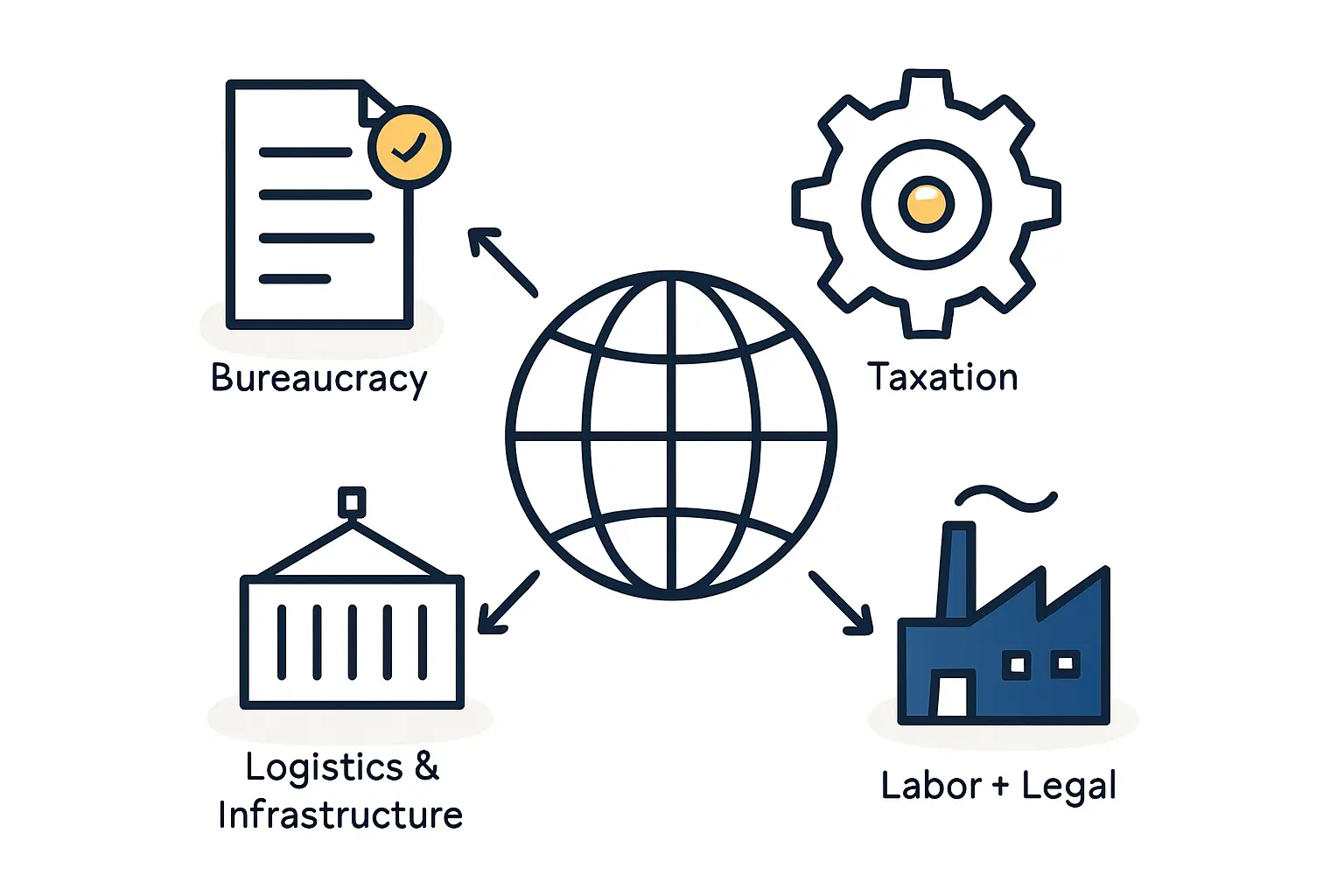

The Key Components of the ‘Brazil Cost’

The ‘Custo Brasil’ is multifaceted, with costs stemming from four primary areas that affect a new manufacturing business.

1. Complex Bureaucracy and Regulatory Hurdles

Navigating Brazil’s administrative landscape requires specialized knowledge. The processes for importing goods, obtaining licenses, and ensuring regulatory compliance are notoriously complex.

For example, importing essential manufacturing equipment involves far more than shipping and payment. An investor must secure an import license (RADAR), correctly classify every item under a complex tariff code system (HS Code), and manage a significant volume of documentation.

Most businesses rely on a licensed customs broker, known as a despachante aduaneiro, to handle this process. Even a minor error in paperwork can lead to significant delays and fines, holding critical machinery at the port for weeks.

2. The Intricate Tax System

Brazil has one of the world’s most complex tax systems. Multiple layers of federal, state, and municipal taxes are levied on goods and services, often cascading as new taxes are applied on top of previous ones.

For a solar manufacturer, key taxes include:

- IPI (Tax on Industrialized Products): A federal value-added tax.

- ICMS (Tax on Circulation of Goods and Services): A state-level value-added tax with varying rates across Brazil’s 26 states and the Federal District.

- PIS/COFINS: Federal social contributions levied on revenue.

Calculating the final tax burden is complex and requires expert local accounting advice. A robust financial model, as outlined in the guide to preparing a solar factory business plan, must account for these complex and variable tax obligations to project profitability accurately.

3. Logistical and Infrastructure Challenges

Brazil is a vast country with immense resources, but its infrastructure hasn’t always kept pace with its economic growth, creating logistical challenges that add to operational costs.

Port congestion, a heavy reliance on road transport over long distances, and inconsistent infrastructure quality between regions can lead to higher transportation costs and unpredictable delivery times. For a solar factory, this affects both the initial delivery of heavy machinery and the ongoing supply chain for raw materials like glass, EVA, and solar cells. These logistical costs can account for a surprisingly high percentage of a finished solar module’s final cost.

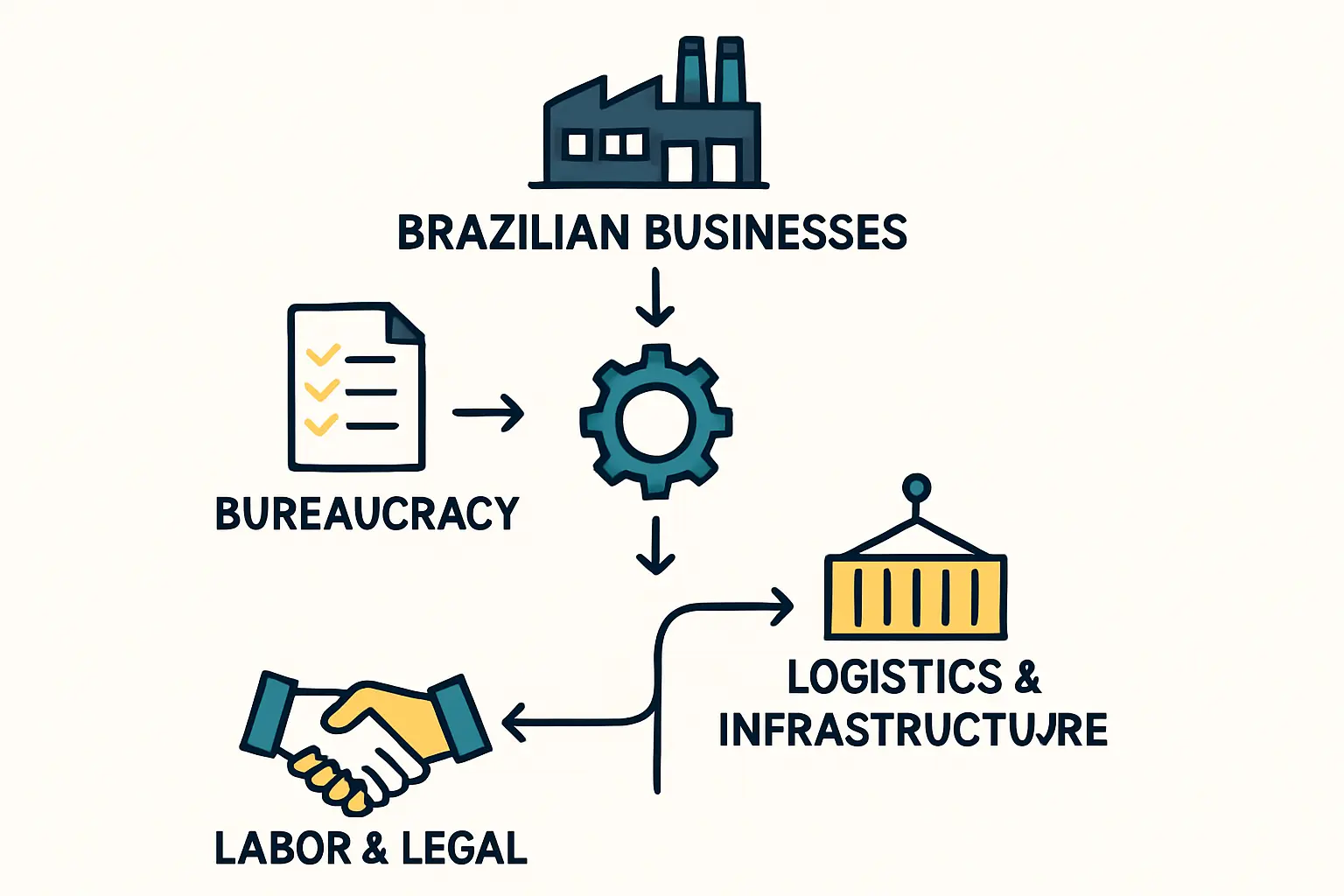

4. Rigid Labor and Legal Frameworks

Brazil has comprehensive and often rigid labor laws governing hiring, compensation, and termination. While designed to protect employees, these regulations can increase administrative overhead for employers. Navigating these laws without local legal counsel is inadvisable.

Furthermore, the judicial system can be slow, and commercial disputes often take years to resolve. This increases the risk associated with contractual disagreements and underscores the importance of clear, well-drafted agreements with local partners and suppliers.

The Real-World Impact on a Solar Manufacturing Project

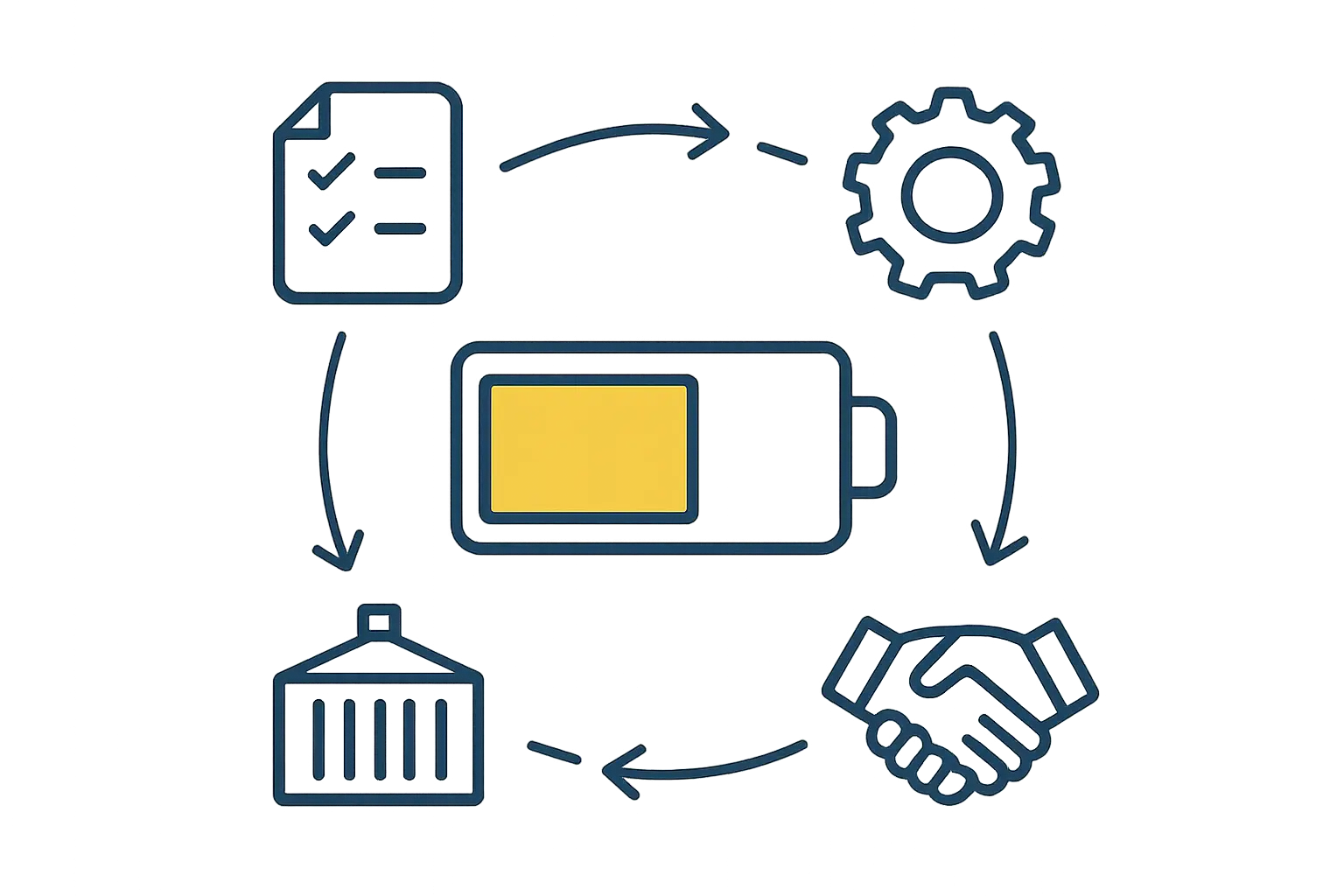

These components aren’t just theoretical—they have direct, measurable effects on setting up a new factory.

Timeline Extension: A standard project plan might allocate four weeks for shipping and customs clearance of primary machinery. Factoring in the ‘Custo Brasil’, a realistic estimate is closer to eight to twelve weeks to account for bureaucratic delays. This directly impacts the project’s start date and time-to-revenue.

Budget Inflation: The initial equipment cost is only part of the total investment. Experience from J.v.G. turnkey projects shows that taxes, import duties, and logistics fees can inflate the landed cost of solar manufacturing equipment by 20-40% compared to its Free on Board (FOB) price. This increase must be factored into the initial capital expenditure.

Operational Overhead: The complexity of tax and labor compliance means hiring a larger-than-expected administrative team or paying higher costs for outsourced professional services.

Strategic Navigation: Turning Challenges into an Advantage

While the ‘Custo Brasil’ presents real challenges, a sound strategy can make them manageable. Proactive planning can transform these potential pitfalls into a competitive advantage.

- Conduct Thorough Due Diligence: Invest time upfront to understand the specific tax and regulatory environment in the chosen state. Different states offer different ICMS rates and fiscal incentives.

- Engage Local Experts Early: Do not wait until a problem arises. Building relationships with a reliable customs broker, tax accountant, and law firm from the outset is a critical investment.

- Build in Contingencies: Prudent project management includes adding a buffer to both the budget and the timeline. A 15-20% financial contingency for unforeseen administrative and logistical costs is a realistic starting point.

- Structure for Simplicity: Work with advisors to choose the simplest and most efficient corporate and tax structure for the business.

By acknowledging and planning for the ‘Custo Brasil’, an investor can create a more accurate and resilient business case, setting the foundation for long-term success.

Frequently Asked Questions (FAQ)

Q: Is the ‘Custo Brasil’ an official tax I have to pay?

A: No, it’s not a formal tax. It’s a collective term for the extra costs incurred from bureaucracy, taxes, and logistical issues inherent in operating in the country.

Q: Can a foreign company manage customs and taxes without local help?

A: It is highly inadvisable. The system’s complexity and its constantly evolving rules mean professional local expertise is essential to ensure compliance and avoid costly penalties and delays.

Q: Does the ‘Custo Brasil’ affect all industries equally?

A: No. It disproportionately affects industries that rely heavily on imported capital goods and raw materials, such as solar module manufacturing. It also has a greater impact on businesses that distribute products across long distances within Brazil.

Q: Are there any government incentives that can help offset the ‘Brazil Cost’?

A: Yes, federal and state governments often offer fiscal incentives, such as tax reductions or exemptions, to attract investment in strategic sectors like renewable energy. However, accessing these benefits requires navigating another layer of bureaucracy and is best done with expert guidance.

A Realistic Path to Success in Brazil

The ‘Custo Brasil’ is an undeniable feature of the country’s business environment. It should be viewed not as an insurmountable barrier, but as a set of variables to be managed. Thousands of international companies operate successfully in Brazil by building these realities into their plans from day one.

For entrepreneurs and investors prepared to navigate this complexity with diligence and expert local support, Brazil remains one of the world’s most promising markets for solar energy. Informed preparation is the key to unlocking its vast potential. For investors developing a detailed market entry strategy, the essential next step is to explore the requirements for a turnkey factory setup tailored to the local environment.