An investor reviewing a business plan for a new solar module factory might first focus on the daunting capital required for machinery and equipment. In jurisdictions actively competing for clean technology investment, however, that initial outlay is only part of the financial equation. A deeper analysis reveals how strategic government programs can fundamentally alter a project’s viability, often returning a substantial portion of the initial investment.

This guide explains the principle of incentive stacking, using Canada’s policy framework as a practical example. Here, we detail how investors can combine powerful federal programs with provincial-level support to de-risk their investment and significantly improve the financial return of a new solar manufacturing facility. Understanding this layered approach is essential for any entrepreneur or company considering entry into this sector.

Table of Contents

Understanding the Foundation: Canada’s Federal Incentives

At the federal level, the Canadian government has implemented a robust strategy to build a domestic clean energy supply chain. This push is driven by the need for energy security and economic competitiveness, particularly in response to programs like the U.S. Inflation Reduction Act (IRA). For a prospective solar manufacturer, these federal programs represent the first and most significant layer of financial support.

The Clean Technology Manufacturing Investment Tax Credit (CTM ITC)

The cornerstone of this federal strategy is the Clean Technology Manufacturing Investment Tax Credit. This isn’t merely a reduction in future taxes; it’s a refundable tax credit, a critical distinction for a new enterprise. Being refundable means the credit can result in a direct cash payment from the government, providing a vital injection of capital early in a project’s life.

Key features of the CTM ITC include:

- A 30 percent Credit Rate: The program offers a 30 percent refundable tax credit on the capital cost of new machinery and equipment used to manufacture solar components, including polysilicon, wafers, cells, and modules.

- Program Timeline: This 30 percent rate applies to assets acquired and made available for use from 2024 through 2031. The rate then phases down to 20 percent in 2032 before being eliminated after 2034.

- Impact on Cash Flow: Because the credit is refundable, it directly reduces the net capital required from the investor, strengthening the project’s balance sheet from day one.

Strategic and Financing Support Programs

Beyond the CTM ITC, two other federal programs can be relevant for larger-scale projects:

- Strategic Innovation Fund (SIF): A discretionary fund aimed at supporting large-scale, transformative projects, typically with costs over $10 million. This competitive fund supports activities from research and development to the commercialization of new technologies.

- Canada Infrastructure Bank (CIB): The CIB can offer low-cost, long-term financing for projects that are in the public interest. A solar factory that is part of a larger green infrastructure initiative may qualify for its support.

The Provincial Layer: Amplifying Federal Support

While federal programs provide a strong foundation, Canadian provinces compete fiercely to attract investment. They offer a second layer of incentives, often tailored to their economic strengths and development goals, allowing an investor to stack benefits.

Case Study: Ontario’s Manufacturing Corridor

As Canada’s manufacturing heartland, Ontario offers programs designed to leverage its industrial infrastructure and skilled workforce. The Regional Development Program (RDP), for example, provides co-investment funding to support business expansion, modernization, and job creation in specific regions. A solar manufacturing project that commits to creating a certain number of jobs could be eligible for significant non-repayable grants.

Case Study: Quebec’s Integrated Financial Ecosystem

Quebec operates a highly integrated support system through Investissement Québec (IQ). This government corporation acts as a single point of contact for investors, offering a suite of financial tools including loans, loan guarantees, and equity participation. Programs like ESSOR are specifically designed to support investment projects that enhance productivity and competitiveness, making IQ a strong potential partner for a new manufacturing facility.

The Art of Stacking: How to Combine Incentives Correctly

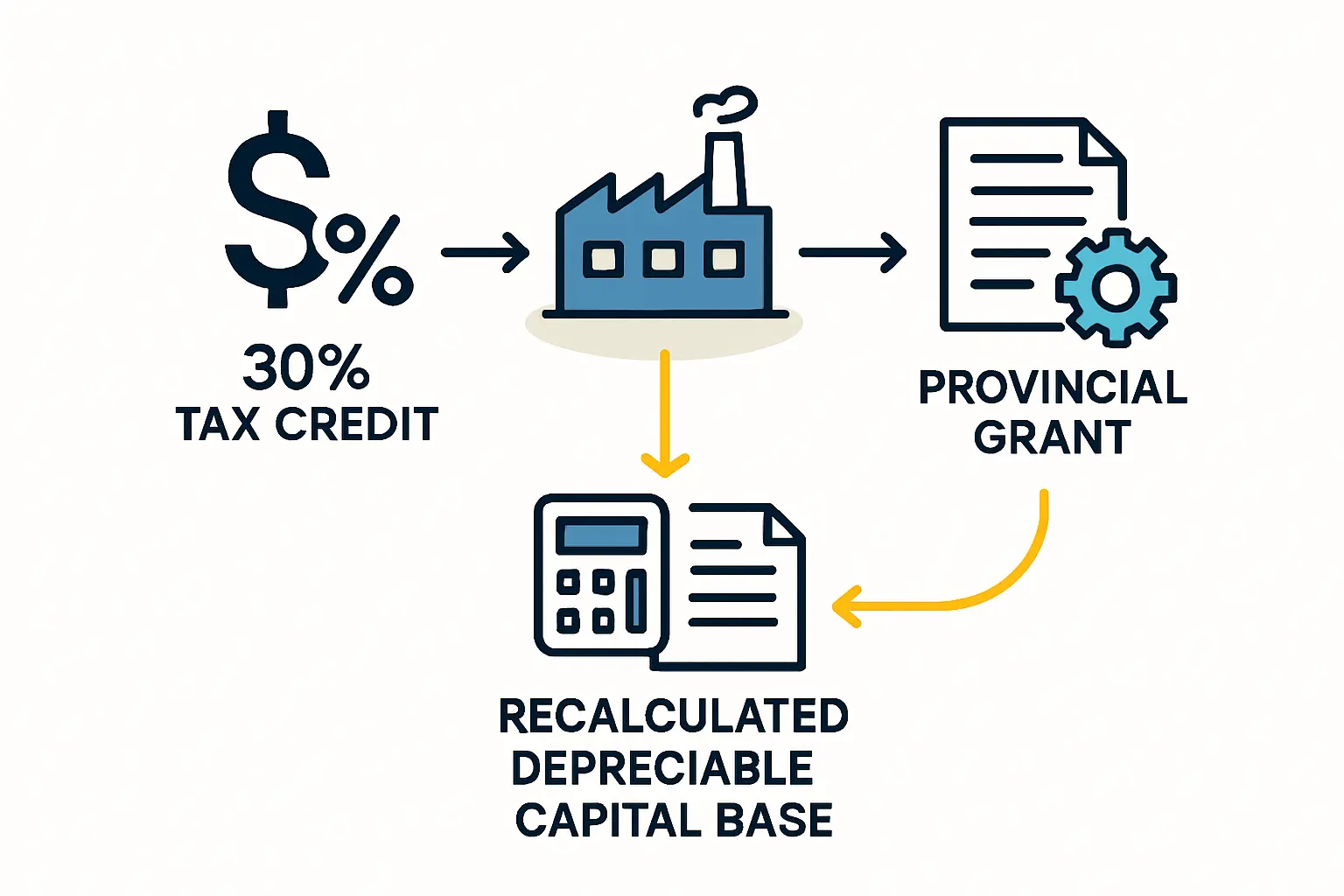

Combining federal and provincial incentives is a powerful strategy, but it requires a precise understanding of the rules. The process is not as simple as adding the full value of each program together; the interaction between them, particularly the concept of stacking limits, must be calculated carefully.

The Critical Rule: Understanding Stacking Limits

The key principle is that most forms of government assistance, such as a provincial grant, reduce the capital cost base on which the federal CTM ITC is calculated. This logic prevents investors from receiving incentives on a portion of an investment already paid for by another public body.

This is not a penalty but a methodical rule to ensure a fair distribution of public funds while still providing a compelling incentive package.

A Practical Example: Calculating the Net Investment

To illustrate how stacking works, consider a hypothetical solar module factory project:

- Total Eligible Equipment Cost: $10,000,000.

- Provincial Grant Secured: Suppose the project secures a 15 percent grant from a program like Ontario’s RDP, which amounts to $1,500,000.

- Adjusted Base for Federal ITC: The provincial grant reduces the capital cost base eligible for the CTM ITC.

$10,000,000 (Initial Cost) – $1,500,000 (Provincial Grant) = $8,500,000 (Adjusted Base). - Calculate the CTM ITC: The 30 percent federal credit is applied to this new, adjusted base.

$8,500,000 x 0.30 = $2,550,000. - Calculate Total Government Support:

Provincial Grant: $1,500,000.

Federal Refundable Tax Credit: $2,550,000.

Total Combined Assistance: $4,050,000. - Net Investor Capital Required: The final capital the investor must provide for the equipment is significantly reduced.

$10,000,000 (Initial Cost) – $4,050,000 (Total Assistance) = $5,950,000.

In this scenario, a strategic combination of provincial and federal programs covers over 40 percent of the equipment cost. This fundamentally changes the project’s risk profile, payback period, and overall attractiveness.

Strategic Considerations for International Investors

While this guide uses Canada as a case study, the underlying principles apply globally. Nations worldwide are developing policies to attract clean technology manufacturing. When evaluating a potential location, whether in the Middle East, Africa, or North America, investors should thoroughly investigate the local incentive landscape.

Based on J.v.G.’s experience setting up turnkey lines globally, this analysis is a critical first step in determining project feasibility. For investors seeking to understand the complete process of how to start a solar panel manufacturing business, this incentive analysis should be a core component of initial planning, not an afterthought.

Frequently Asked Questions (FAQ)

Q: What is the difference between a tax credit and a grant?

A: A grant is a direct, non-repayable transfer of funds from a government body to a recipient. A tax credit is an amount that can be subtracted from taxes owed. A refundable tax credit, like the CTM ITC, is particularly valuable because if the credit is larger than the taxes owed, the government pays the difference in cash.

Q: Are these incentives guaranteed?

A: Eligibility-based tax credits like the CTM ITC are generally claimable as long as the investor meets all specified criteria for the equipment and its use. Discretionary funding programs, such as provincial grants or the federal SIF, are competitive and not guaranteed. They require a strong business case and a formal application process.

Q: How long does it take to receive these funds?

A: Timelines vary. Tax credits are claimed when filing corporate income tax returns, and the timing of a refund depends on the tax agency’s processing cycle. Grants and contributions have specific disbursement schedules outlined in their funding agreements, which may be tied to project milestones.

Q: Do I need a local partner to access these programs?

A: While not always mandatory, having a local presence or experienced advisors can be highly beneficial. They can help navigate the specific application processes, ensure compliance with all requirements, and build relationships with the relevant economic development agencies.

Conclusion and Next Steps

Incentive stacking is a powerful financial tool that can transform a high-capital venture into a de-risked, highly competitive investment. The Canadian framework demonstrates how well-aligned federal and provincial policies can create one of the most attractive environments globally for solar manufacturing.

For any entrepreneur, the key takeaway is that the sticker price of a new factory is not the final price. A thorough investigation into available government support is an essential part of due diligence. This analysis is a critical component of a comprehensive solar panel manufacturing business plan, allowing for an accurate projection of capital requirements, cash flow, and long-term profitability.