For entrepreneurs considering the solar manufacturing sector, the initial capital outlay for equipment and facilities presents a significant financial hurdle. In emerging markets eager for industrial development, however, government incentives can dramatically alter the business case.

The Republic of Chad, through its National Investment Charter, offers a compelling framework designed to attract foreign direct investment, particularly in strategic sectors like renewable energy. This guide provides a detailed overview of the fiscal benefits available to prospective solar module manufacturers under Chad’s investment codes. Understanding these provisions is a critical first step in evaluating the financial viability of establishing a production facility in the heart of Central Africa.

Table of Contents

Understanding Chad’s Strategic Vision for Industrialization

Chad’s National Investment Charter, codified in Law No. 006/PR/2018, is more than just a set of tax rules; it is a clear statement of the country’s economic development strategy. The government aims to diversify its economy away from oil, create skilled employment, and promote technology transfer by encouraging investment in new sectors.

Solar energy production is a priority area, and local solar module manufacturing supports several key national objectives:

- Energy Independence: Reducing reliance on imported fuel and strengthening the national grid.

- Economic Diversification: Building a sustainable industrial base for long-term growth.

- Job Creation: Developing a skilled workforce in a high-growth technology sector.

An investor planning to build a solar factory directly supports these national goals, positioning the project as a strong candidate for the most advantageous incentives.

Key Fiscal Benefits Under the National Investment Charter

The Charter provides a range of significant financial incentives through its “Privileged Regimes,” designed to reduce both initial setup costs and the ongoing tax burden for a designated period.

Customs and Duties Exemptions

Perhaps the most immediate financial benefit is the exemption from all customs duties and taxes on imported equipment, machinery, and materials needed for the production facility. For a solar module manufacturing project, this applies to:

- The complete set of solar panel manufacturing machines, including stringers, laminators, and testers.

- Initial stocks of raw materials, such as solar cells, EVA film, backsheets, and glass.

- Essential spare parts required for the production line.

This exemption directly lowers the initial capital expenditure, a substantial cost for any 20-50 MW solar module production line.

Tax Exemptions and Reductions

Once operational, a qualifying enterprise benefits from extensive tax holidays to support its crucial growth phase. These often include:

- Corporate Income Tax (BIC): A full exemption for five to ten years, depending on the investment regime and project location. This allows the business to reinvest early profits into operations or expansion.

- Value Added Tax (VAT): Exemption on the purchase of equipment and, in some cases, the raw materials required for production.

- Property and Business Taxes: Reductions or exemptions from various local taxes, such as the business license tax (patente) and property tax on developed land, for the duration of the incentive period.

Guarantees for Foreign Investors

Beyond fiscal incentives, the Charter provides critical legal and financial guarantees to build investor confidence. These include the freedom to repatriate capital and profits, subject to foreign exchange regulations, and the assurance of fair and equitable treatment, placing foreign investors on an equal footing with national enterprises.

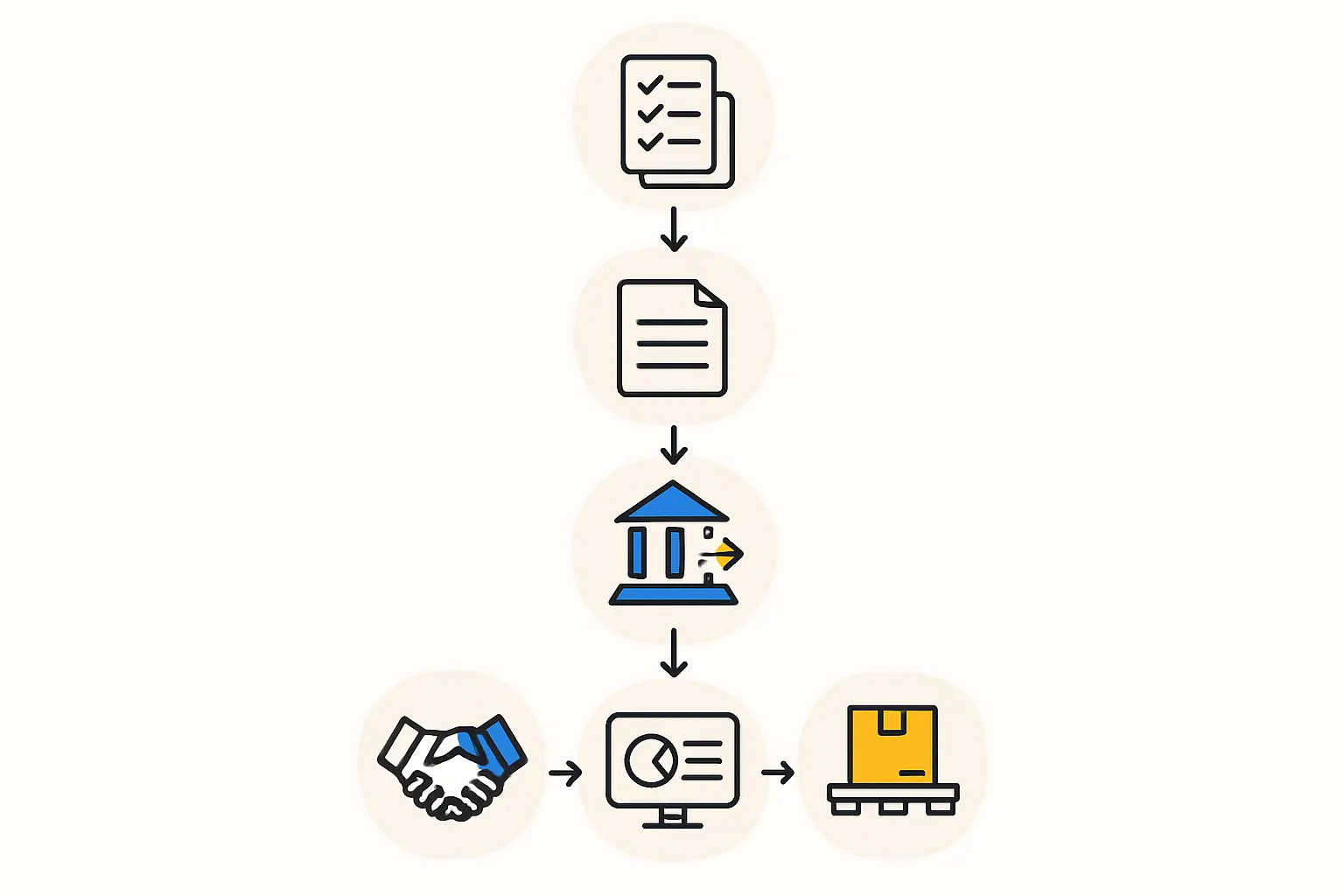

Navigating the Eligibility and Application Process

Accessing these benefits requires a formal application and approval process. Success depends on meticulous preparation and a clear understanding of the requirements.

Who is Eligible? (The Privileged Regimes)

The Charter outlines several “regimes” based on the size and nature of the investment. A new solar module facility would typically apply for approval under one of the privileged regimes for new enterprises. Eligibility generally depends on a minimum investment threshold and a commitment to creating a specific number of local jobs. Renewable energy projects are explicitly encouraged and often fast-tracked for consideration.

The Application Steps

The central body for managing investment applications is the National Agency for Investment and Exports (ANIE). The process generally follows these steps:

- Company Registration: An investor must first legally establish a company in Chad.

- Investment File Submission: The investor must prepare and submit a comprehensive investment file to ANIE. This file is the cornerstone of the application and must be exceptionally detailed.

- File Contents: A robust application includes a complete solar factory business plan, technical descriptions of the proposed factory, detailed financial projections, evidence of funding, and a plan for local employment and training.

- Review and Approval: An inter-ministerial committee reviews the file, assessing the project’s alignment with national development goals.

- Issuance of “Agrément”: Upon approval, the government issues an official decree, or “Agrément,” that formalizes the company’s eligibility for the specified incentives.

Experience with turnkey projects shows that a well-prepared application, one that clearly demonstrates a project’s economic and social benefits, is crucial for a smooth approval process.

Common Challenges and Strategic Considerations

While the incentive framework is attractive, prospective investors must be aware of potential challenges:

- Bureaucratic Processes: The application and approval timeline can be lengthy. Patience and persistent follow-up are essential.

- Documentation Standards: The requirements for the investment file are stringent. Missing information or inconsistencies can lead to significant delays.

- Local Compliance: Incentives do not exempt a company from its obligations under Chad’s labor, environmental, and commercial laws.

These factors underscore the importance of thorough due diligence and the value of engaging local expertise. A detailed feasibility study is a non-negotiable prerequisite before committing capital.

Frequently Asked Questions (FAQ)

Q: How long does the approval process for investment incentives typically take?

A: While official timelines may be stated, investors should realistically budget for a process that can take several months, from initial company registration to the final issuance of the “Agrément.”

Q: Are these incentives available for factory expansions as well as new projects?

A: Yes, the Investment Charter includes provisions for existing companies undertaking significant expansion projects, though the specific benefits may differ from those offered to new enterprises.

Q: What happens after the initial tax exemption period ends?

A: After the incentive period expires, the company becomes subject to Chad’s standard tax regime. The initial tax holiday is designed to allow the business to achieve profitability and stability before assuming a full tax burden.

Q: Can a foreign national fully own a company in Chad?

A: Yes, Chad’s legal framework permits 100% foreign ownership of companies in most sectors, including manufacturing.

Q: Is there a specific minimum investment amount required to qualify?

A: Yes, the Charter’s different “regimes” are tied to specific minimum investment thresholds. A comprehensive review of these requirements is necessary to determine which regime a project would qualify for.

Chad’s National Investment Charter presents a powerful opportunity to de-risk and enhance the profitability of a solar manufacturing venture. The substantial fiscal benefits can significantly shorten the payback period and improve the long-term return on investment.

However, capitalizing on this opportunity requires more than just capital. It demands a strategic approach, meticulous planning, and a deep understanding of the local administrative landscape. For the serious entrepreneur, the next logical step is to develop a bankable business plan tailored to the specific requirements of ANIE and the Investment Charter.