For investors eyeing Colombia as a promising market for solar module manufacturing—buoyed by government support for renewables and growing energy demand—the question is no longer if, but where.

The decision often narrows to two leading contenders: the sprawling capital, Bogotá, or the industrial powerhouse, Medellín. While logistics, land costs, and local incentives are crucial, it is the availability and nature of skilled labor that will ultimately dictate a factory’s long-term success.

This analysis breaks down the technical labor pools in Colombia’s two main cities, offering a framework for entrepreneurs to evaluate which location best aligns with their operational strategy. The choice isn’t simply about finding employees; it’s about securing the right technical competencies to build a resilient and competitive manufacturing operation.

Table of Contents

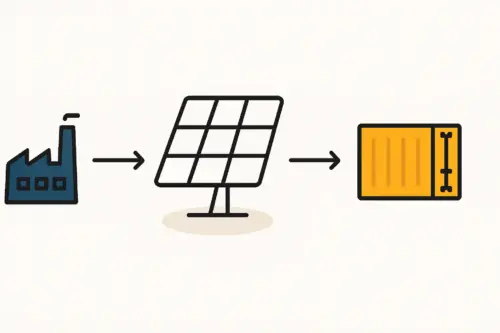

The Critical Role of Skilled Labor in Solar Manufacturing

Before comparing the cities, it’s worth understanding why the local labor market is so fundamental. A modern solar module assembly line, even a semi-automated one, relies on a team of trained technicians and engineers.

These team members aren’t just performing repetitive tasks; they are responsible for process quality, machine maintenance, and operational efficiency.

Key roles in a typical 20-50 MW factory include:

- Machine Operators: Technicians trained to manage specific equipment like stringers, laminators, and testers.

- Quality Control (QC) Technicians: Staff who perform visual inspections, electroluminescence (EL) testing, and IV-curve analysis.

- Maintenance Engineers: Professionals with electrical and mechanical expertise to ensure machinery uptime.

- Process Engineers: Specialists who optimize the production flow and troubleshoot manufacturing issues.

The quality of this team directly impacts production yield, module reliability, and profitability. While our Overview of Colombian Labor Market for Solar Manufacturing provides a national context, a city-level analysis is crucial for making a final site decision.

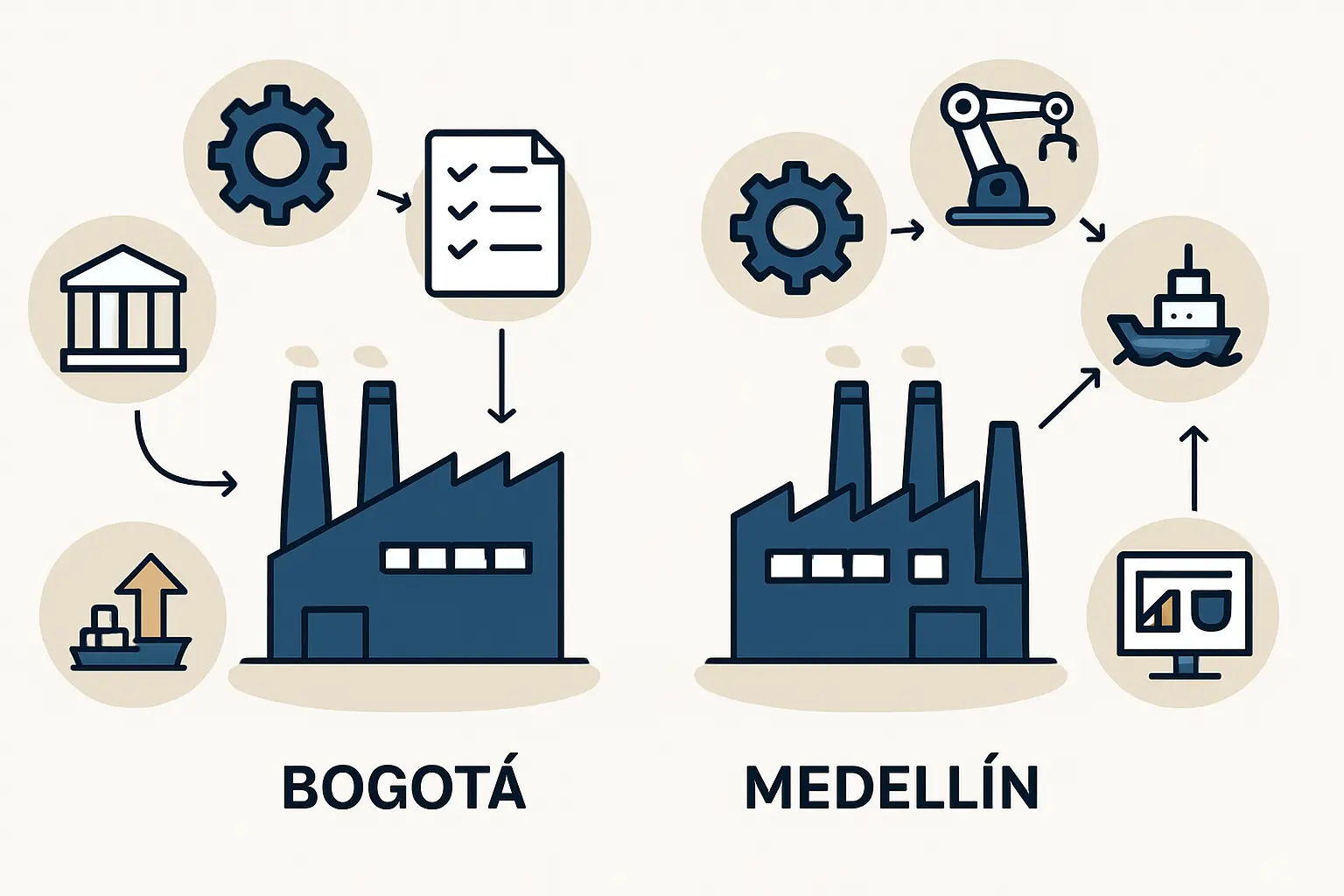

Bogotá: The Capital’s Diverse Talent Ecosystem

As Colombia’s economic and political center, the Bogotá Capital District and its surrounding industrial zones (Cota, Funza, Mosquera) offer an immense and diverse talent pool. The city is home to the country’s most prestigious universities and the largest concentration of campuses for the National Training Service (SENA), a key institution for technical education.

Strengths of Bogotá’s Labor Market

- Scale and Diversity: With a metropolitan population exceeding 11 million, the sheer volume of available workers is unmatched in Colombia. This includes a wide spectrum of professionals, from factory technicians to finance and logistics experts.

- Educational Infrastructure: The high density of universities and SENA centers ensures a continuous stream of graduates with foundational technical and engineering skills.

- International Hub: As the primary international gateway, Bogotá attracts talent from across Colombia and other Latin American countries, creating a more cosmopolitan workforce.

Potential Challenges

- High Competition: Because of its diverse economy, a solar factory will compete for top technical talent not only with other manufacturers but also with thriving service, technology, and financial sectors, which may offer more attractive compensation packages.

- Higher Salary Expectations: The cost of living and competition for labor can lead to higher wage demands compared to other regions.

- Logistical Hurdles: Significant traffic congestion can affect employee commutes and daily logistics, a factor to consider in operational planning.

Medellín: The Industrial and Innovation Powerhouse

Medellín has successfully transitioned from a traditional manufacturing center into a globally recognized hub for innovation. Its identity is deeply rooted in an industrial culture that has cultivated a workforce with strong hands-on engineering and production experience.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

The city’s “cluster” strategy and innovation district, Ruta N, foster a uniquely collaborative environment between academia, industry, and government.

Strengths of Medellín’s Labor Market

- Deep Industrial Experience: The region’s long history in sectors like textiles, automotive parts, and appliances has produced a labor pool with ingrained manufacturing discipline and strong mechanical and electrical skills.

- Engineering and Innovation Focus: The city has a high concentration of engineers and a culture that values technical problem-solving. This environment is conducive to process optimization and quality improvement.

- Strong Work Ethic: Anecdotal evidence from J.v.G. projects in similar industrial regions suggests that areas with a strong manufacturing heritage often exhibit a dedicated and stable workforce.

Potential Challenges

- Smaller Labor Pool: While specialized, the overall labor market is smaller than Bogotá’s, potentially making it more challenging to recruit for very specific or high-volume roles.

- Less Economic Diversity: The talent pool is more concentrated in industrial and technical fields, which may require bringing in commercial or financial expertise from outside the region.

A Head-to-Head Comparison for Site Selection

Making an informed decision requires comparing the cities across several key metrics for solar manufacturing.

Technical Education and Training

Both cities have excellent SENA branches, but their focus can differ. Bogotá’s centers offer a broader range of programs reflecting its diverse economy. In contrast, Medellín’s SENA programs are often tightly integrated with its industrial base, providing highly relevant, hands-on training for manufacturing roles. Investors would be wise to evaluate the specific curricula related to electronics, automation, and industrial maintenance in each city.

Relevant Industry Experience

A key consideration is who makes a better hire: a technician from a food processing plant in Bogotá, or one from an automotive parts factory in Medellín? The Medellín candidate likely possesses more transferable experience with the industrial automation, quality control protocols, and preventative maintenance schedules common in a structured manufacturing environment.

Labor Costs and Competition

While salaries in Bogotá may be nominally higher, the critical factor is value. A slightly more expensive but highly skilled technician from Medellín’s industrial ecosystem could deliver greater long-term value through higher efficiency and lower error rates. Furthermore, competition from non-industrial sectors in Bogotá can create upward pressure on wages for skilled technicians.

Ultimately, the quality of a workforce depends on more than just academic credentials. The availability of Key Certifications for Solar Factory Technicians can significantly shorten the training cycle and ensure a higher standard of work from day one. Experience from J.v.G. turnkey projects shows that a strong local technical school is often a more reliable source of line operators than a top-tier university.

Frequently Asked Questions (FAQ)

Q: What are the most critical technical roles for a startup solar factory?

A: For a semi-automated line of 20–50 MW, the most critical day-one roles are machine operators (especially for the stringer and laminator), quality control technicians familiar with testing procedures, and a maintenance engineer with both mechanical and electrical skills.

Q: Are there government incentives for hiring in either city?

A: Colombia offers national-level incentives for new investments and job creation, particularly in strategic sectors like renewable energy. Additionally, municipal governments in both Bogotá’s and Medellín’s industrial zones may offer local tax benefits or training support. Confirming these benefits requires specific due diligence with local investment promotion agencies like Invest in Bogotá and ACI Medellín.

Q: How much training is required for new hires without direct solar experience?

A: For technicians with a solid foundation in industrial maintenance or electronics, a structured 3-6 week training program is typically sufficient. This program, often delivered by the equipment supplier, covers machine operation, safety protocols, and quality control standards specific to PV module assembly.

Conclusion: Aligning Location with Strategy

The choice between Bogotá and Medellín isn’t a matter of one being definitively “better” than the other. It’s a strategic decision that depends on an investor’s priorities.

Bogotá is the logical choice for an operation that requires significant scale, a diverse range of professional skills (including non-technical roles), and superior international logistics. The trade-off is higher competition for talent and potentially higher operational costs.

Medellín presents a compelling case for a business focused on manufacturing excellence, process innovation, and building a core team with deep industrial DNA. The trade-off is a smaller, more specialized talent pool.

The site selection process is a foundational step in any business plan. Understanding the nuances of the local labor market helps prevent costly hiring mistakes and sets the stage for operational success. This location analysis informs every subsequent stage of planning, from factory layout to financial projections. This entire journey is detailed in our comprehensive guide on How to Start a Solar Module Factory.