Recent developments in Colombia have captured the attention of international investors in the renewable energy sector. In May 2024, the government eliminated import tariffs on key components for solar panel manufacturing—a clear signal of its commitment to fostering a domestic production industry.

While this is a significant step, entrepreneurs looking to establish a solar panel factory in the country must look beyond the headline. The most strategic and financially sound approach often lies within a well-established but frequently misunderstood framework: the Colombian Zona Franca (Free Trade Zone) system.

Here, we’ll break down the core benefits of operating a solar manufacturing facility from a Zona Franca, explore how the system interacts with national incentives, and detail the practical implications of importing essential components and machinery.

Table of Contents

A Favorable Climate for Solar Investment

Colombia’s government has been steadily building a framework to attract investment in renewable energy. The foundation was laid with Law 1715 of 2014, which introduced benefits like VAT exemption and accelerated depreciation for renewable energy projects.

The most recent and direct support for manufacturers came with Decree 0501, effective May 7, 2024. This decree removed the previous 5% customs duty on several critical raw materials for solar module assembly, including:

- Solar cells,

- Silicon ingots,

- Backsheets,

- EVA (Ethylene Vinyl Acetate) encapsulant foil, and

- Junction boxes.

This national policy immediately reduces the landed cost of these components, making local assembly more competitive against finished imported modules. While this is one of the most direct incentives a government can offer, it only addresses customs tariffs for a specific list of goods. For a comprehensive, long-term financial strategy, the Zona Franca system offers a much broader range of advantages.

The Zona Franca Advantage: Beyond National Incentives

A Zona Franca in Colombia is a designated geographical area that, for legal and customs purposes, is considered outside the national customs territory. Businesses operating within these zones are known as “Industrial Users” and are granted a special set of rules for trade and taxation.

Key Benefits for a Solar Module Manufacturer

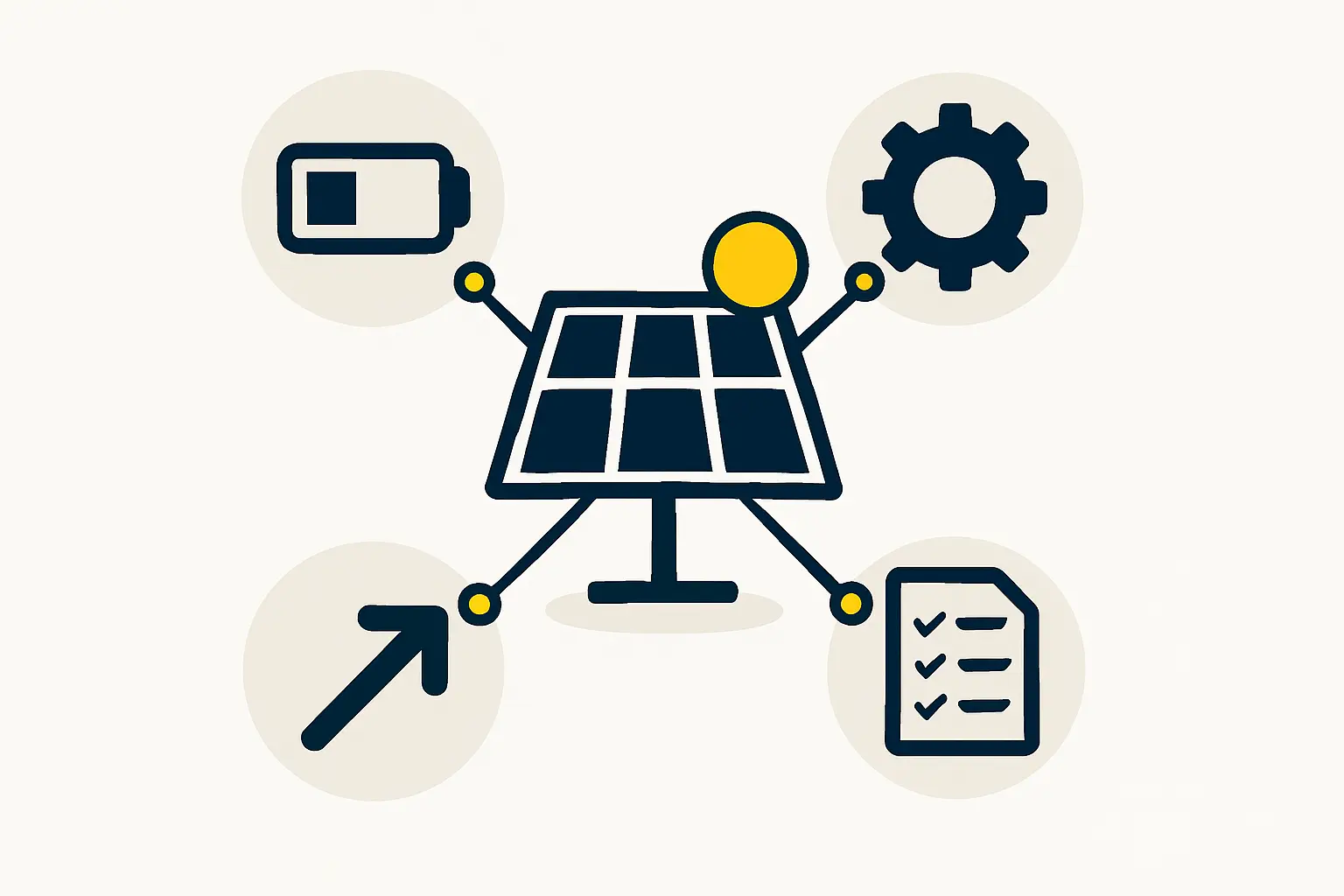

For entrepreneurs planning a solar module factory, operating from within a Zona Franca offers three fundamental advantages that go far beyond simply eliminating tariffs on a few components.

1. Comprehensive Customs Duty and VAT Exemption

The most critical benefit is that any goods entering a Zona Franca from another country—whether raw materials, components, machinery, or spare parts—are not legally considered “imported” into Colombia. Consequently:

- No customs duties are paid upon arrival for any item, not just those listed in Decree 0501. This includes materials like aluminum frames, glass, and specialized manufacturing equipment.

- No Value-Added Tax (VAT, or IVA in Colombia) is paid on these imports. This creates a substantial cash flow advantage, as the business does not have to pay the 19% VAT upfront and wait for reimbursement.

The materials can be stored, processed, and assembled into finished solar modules within the zone, all while remaining in this tax-exempt state.

2. Simplified and Efficient Logistics

Operating within a Zona Franca significantly streamlines customs procedures. Clearance is often faster and less bureaucratic than at a standard port of entry, which reduces the risk of costly delays and allows businesses to manage inventory and production schedules with greater certainty.

3. Preferential Corporate Income Tax Rate

Industrial Users within a Zona Franca are subject to a preferential corporate income tax rate of 20%, a significant reduction from Colombia’s general rate of 35%. This tax advantage applies to income from sales to foreign markets and, under certain conditions, to the national market, directly improving the venture’s long-term profitability and return on investment.

The Import Process: A Step-by-Step Comparison

To understand the practical impact, consider the journey of a container of solar cells from its port of origin to a factory in Colombia.

Scenario A: Direct Import to a Factory Outside a Zona Franca

- Arrival: The container arrives at a Colombian port (e.g., Cartagena or Buenaventura).

- Customs Declaration: A detailed import declaration is filed.

- Tax Payment: Although the customs tariff for solar cells is now 0% due to Decree 0501, the importer must still clear customs and pay the 19% VAT (IVA) on the value of the goods. While it may be recoverable later, this represents a significant upfront cash outlay.

- Clearance & Release: Once all paperwork is approved and taxes are settled, the goods are released for transport to the factory. Any delay during this stage can disrupt the entire production schedule.

Scenario B: Import to a Factory Inside a Zona Franca

- Arrival: The container arrives at a Colombian port.

- Transit Declaration: A simplified transit document is used to move the container directly to the designated Zona Franca.

- Entry to Zone: The goods enter the Zona Franca. No customs duties or VAT are paid. The process is typically swift.

- Processing: The solar cells are moved to the factory within the zone and used in the production line to manufacture finished solar modules.

The finished modules can then be:

- Exported: Shipped directly from the Zona Franca to another country with no Colombian export taxes.

- “Nationalized”: Formally imported from the Zona Franca into the Colombian national market. At this point, the applicable taxes (duties and VAT) are calculated and paid on the value of the finished solar module, not the individual components.

This model offers immense flexibility and financial efficiency, especially for businesses with both domestic and international customers.

Strategic Considerations for Investors

The decision to set up within a Zona Franca is a strategic one that hinges on the project’s scale and ambition.

When a Zona Franca is the Superior Choice

- Significant Import Volume: For factories with planned production capacities of 20 MW or higher, the cumulative VAT savings and simplified logistics for a constant flow of raw materials make the Zona Franca model highly advantageous.

- Export-Oriented Business Model: If a significant portion of the finished modules is intended for export to neighboring countries in Latin America or the Caribbean, the Zona Franca is an ideal structure.

- Long-Term Vision: The preferential income tax rate offers a stable, long-term financial benefit that improves the project’s overall profitability and attractiveness to financiers.

- Complex Machinery Imports: The ability to import the entire suite of production line equipment without upfront VAT payments can save hundreds of thousands, if not millions, of dollars in initial capital expenditure. Based on experience from J.v.G. turnkey projects, this is a critical factor during the setup phase.

While becoming a registered Industrial User in a Zona Franca requires careful planning and documentation, the long-term operational and financial benefits typically far outweigh the initial setup effort for any serious manufacturing project.

Frequently Asked Questions (FAQ)

Q: Do the new 0% tariffs make the Zona Franca system irrelevant?

A: No. The 0% tariff is limited to a specific list of components and only covers customs duties. By contrast, the Zona Franca system offers a much broader set of benefits, including the deferral of 19% VAT on all imported goods (components, machinery, spare parts), streamlined logistics, and a significantly lower corporate income tax rate.

Q: What is the process for selling modules from a Zona Franca into the Colombian market?

A: This process is known as “nationalization.” The finished solar modules are formally imported from the free trade zone into the Colombian national customs territory. At this stage, the manufacturer pays any applicable duties and VAT on the value of the finished product.

Q: Can I import machinery for my factory under Zona Franca rules?

A: Yes. Capital goods, such as laminators, stringers, and testing equipment for the production line, can be brought into the Zona Franca without paying upfront customs duties or VAT. This is a major advantage, reducing the initial investment required to equip the factory.

Q: Are there specific Zona Francas that are better for solar manufacturing?

A: The choice of Zona Franca depends on a detailed feasibility study. Key factors include proximity to major maritime ports (like Cartagena, Barranquilla, or Buenaventura), availability of skilled labor, local infrastructure, and the specific administrative support offered by the zone’s operator.