When exploring European manufacturing bases, many entrepreneurs focus on established industrial centers, often overlooking one of the continent’s most strategic and supportive locations. As a member of the European Union, Croatia offers a unique combination of market access, a skilled workforce, and a compelling framework of investment incentives designed specifically to attract high-value industries like solar module manufacturing.

This guide outlines the financial and operational benefits available to businesses establishing solar production facilities in Croatia, focusing on its designated industrial and free zones. Understanding these incentives is the first step toward evaluating the country as a potential manufacturing hub.

Understanding Croatia’s Core Investment Framework

Croatia’s support for foreign investment is founded on the Act on Investment Promotion (AIP). This legislation outlines a clear, tiered system of incentives based on investment size, the number of new jobs created, and project location.

The goal is to provide predictable, long-term benefits that reduce operational costs and accelerate an investor’s return on capital. These are not abstract promises but legislated benefits designed to attract manufacturing operations that contribute to the nation’s economic development and green transition goals.

Corporate Income Tax (CIT) Abatements: A Primary Incentive

A substantial reduction in the standard Corporate Income Tax rate is one of the most significant advantages offered. The duration and percentage of this tax relief are directly tied to the scale of the investment and job creation.

Micro-Enterprise Incentives

Projects with an initial capital investment between €50,000 and €1 million that create at least five new jobs are eligible for a 50% reduction in CIT for up to five years. This tier is designed to support smaller, specialized production lines or pilot projects.

Mid-Scale Investment Incentives

An investment between €1 million and €3 million that generates a minimum of 10 new jobs qualifies for a substantially larger incentive: a 75% reduction in CIT for up to 10 years. This provides a decade of significantly reduced tax liability during the critical growth phase.

Large-Scale Project Incentives

For major manufacturing facilities with an investment exceeding €3 million and creating at least 15 new jobs, the government offers its maximum incentive: a 100% reduction in CIT for up to 10 years. This effectively creates a tax-free decade of operation—a powerful financial advantage for any large-scale solar factory. A clear understanding of the full investment requirements for a solar factory is essential to properly structure a project to meet these thresholds.

Direct Financial Support for Capital and Labor

Beyond tax relief, the Croatian framework offers direct cash grants to offset initial setup costs. This non-repayable funding reduces the upfront financial burden and helps de-risk the investment.

Cash Grants for Equipment Costs

Investors can receive non-repayable cash grants for up to 20% of the actual cost of new machinery and equipment for qualifying capital expenditures. In a solar module factory, this can translate into millions of euros in direct support for the core assets involved in setting up a production line.

Grants for Job Creation

To encourage employment, the government also offers grants of up to €9,000 per new position created. This incentive is particularly valuable in regions with unemployment rates above the national average, such as the eastern region of Slavonia, making it a priority development zone.

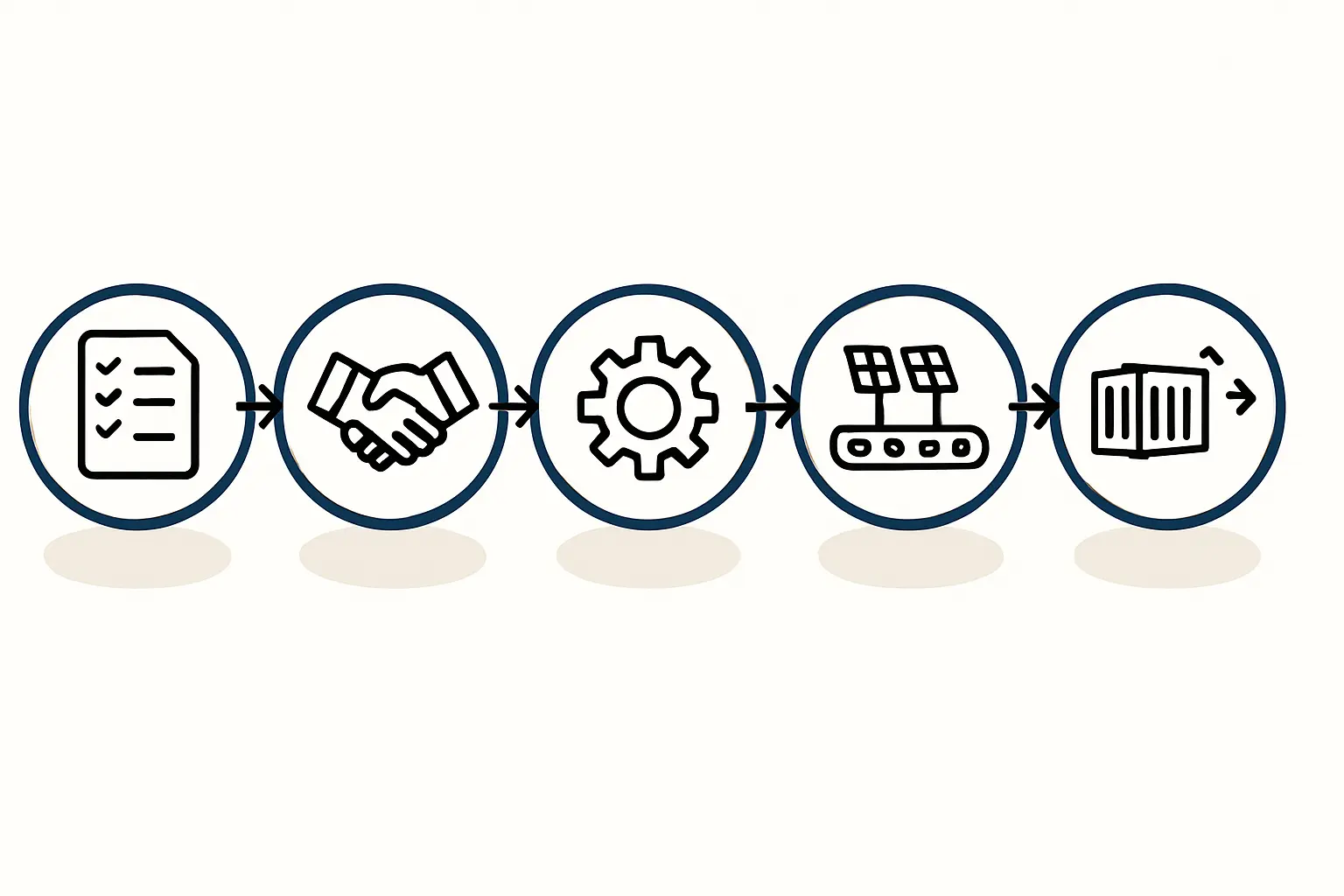

The Strategic Advantage of Croatia’s Free Zones

For export-focused manufacturers, Croatia’s designated free zones provide another layer of financial and logistical benefits. Located in strategic hubs like the Port of Rijeka or inland industrial centers like Osijek in Slavonia, these zones are structured to facilitate international trade.

Businesses operating within these zones benefit from two key advantages:

-

VAT Exemption: Goods brought into, produced within, and exported from a free zone are exempt from Value-Added Tax (VAT), significantly improving cash flow for businesses that import raw materials and export finished solar modules.

-

Simplified Customs Procedures: The zones operate under special customs regulations that streamline the import and export process and reduce administrative delays. This logistical efficiency is crucial for serving both the EU single market and the nearby, non-EU Balkan markets.

Local-Level Incentives and National Green Energy Funds

The support structure extends to the municipal level, where local governments—particularly in development-focused regions—may offer additional incentives. These can include reduced fees for utility connections or a complete exemption from communal contributions, a local tax based on building volume that can represent a significant cost for a new factory.

Croatia’s National Recovery and Resilience Plan (NPOO) has also allocated substantial funding to accelerate the green transition. Projects in the renewable energy sector, including manufacturing, may be eligible for further grants and financing opportunities under this EU-backed program. Crafting a comprehensive business plan that aligns with these national green energy goals can unlock additional support.

Frequently Asked Questions (FAQ)

What is the minimum investment required to qualify for incentives?

To qualify for the first tier of incentives under the Act on Investment Promotion, a project must have a minimum investment of €50,000 and create at least five new jobs.

Are these incentives available to non-EU companies?

Yes, the Croatian investment promotion framework is designed to attract foreign direct investment from around the globe. Companies from outside the European Union are eligible for the same set of incentives.

How complex is the application process?

The application is a formal procedure that requires careful preparation, including a robust business plan, financial projections, and proof of funding. Based on J.v.G. turnkey project experience, engaging local administrative experts or consultants is highly recommended to ensure all requirements are met correctly.

Do these incentives apply to the entire country?

While the core AIP incentives are available nationwide, certain benefits—such as higher job creation grants or additional local support—are often enhanced for projects located in less developed counties or designated special economic zones like those in Slavonia.

Conclusion: A Strategic Entry Point into the European Market

Croatia presents a multi-layered and compelling incentive package for entrepreneurs and companies looking to establish a solar module manufacturing presence in Europe. The combination of significant corporate tax holidays, direct cash grants for equipment and jobs, and the logistical advantages of its free zones creates a highly competitive business environment.

For any investor considering this path, the next step is a detailed analysis of how these incentives align with a project’s financial model and strategic goals. Thorough planning and a clear understanding of the application process are key to leveraging these powerful opportunities.