Choosing a location for a new solar module factory is one of the most consequential decisions an entrepreneur can make. While machinery and technology are critical, the physical site shapes long-term operational costs, logistical efficiency, and access to a skilled workforce. An optimal location can become a strategic advantage, while a poor choice creates persistent hurdles.

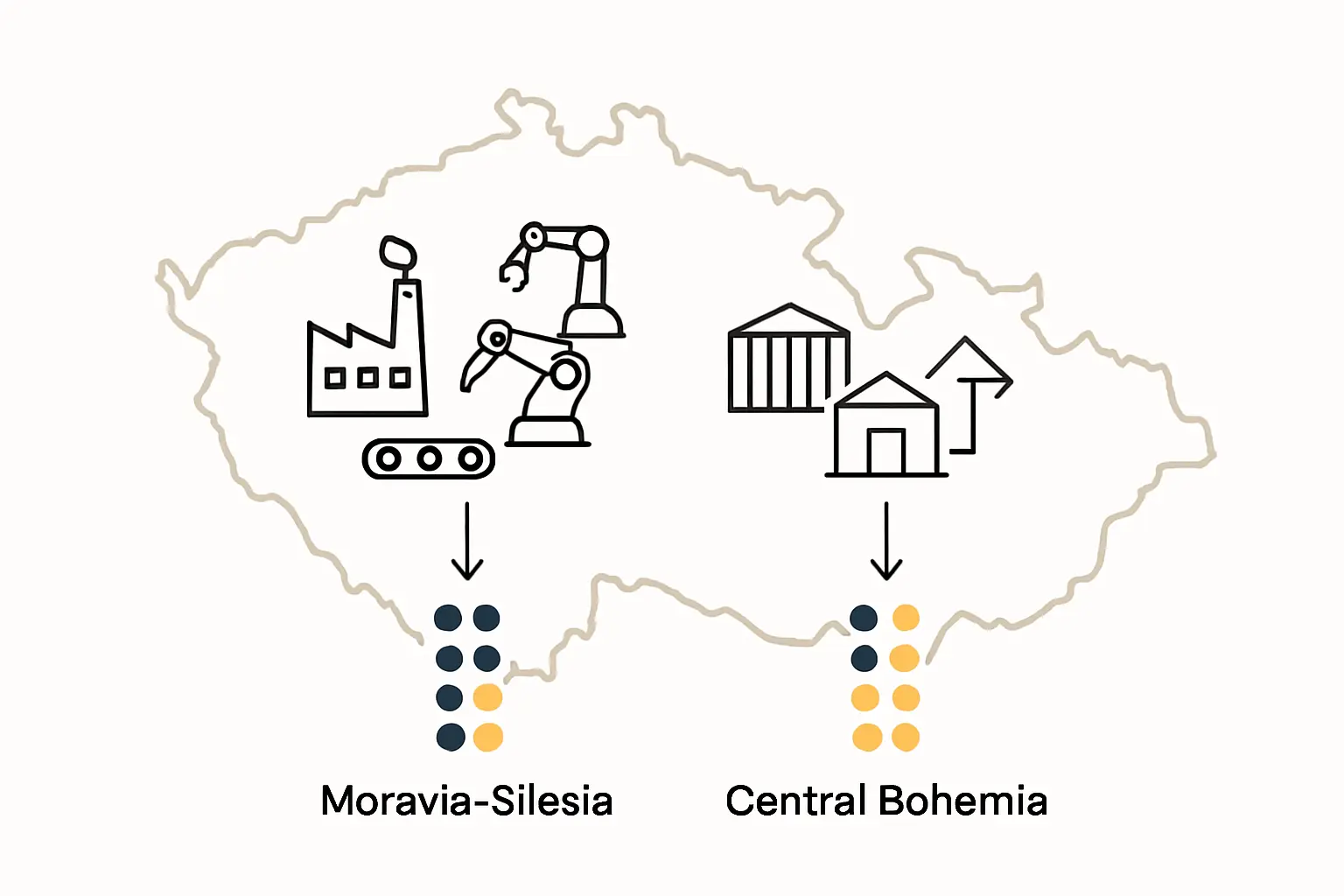

This analysis uses two prominent industrial regions in Czechia—Moravia-Silesia and Central Bohemia—as a case study to illustrate this complex evaluation process. The principles examined here are universally applicable, whether an investor is considering a site in Central Europe, the Middle East, or Africa. Understanding these trade-offs is fundamental to planning a successful solar module manufacturing line.

The Strategic Importance of Location in Solar Manufacturing

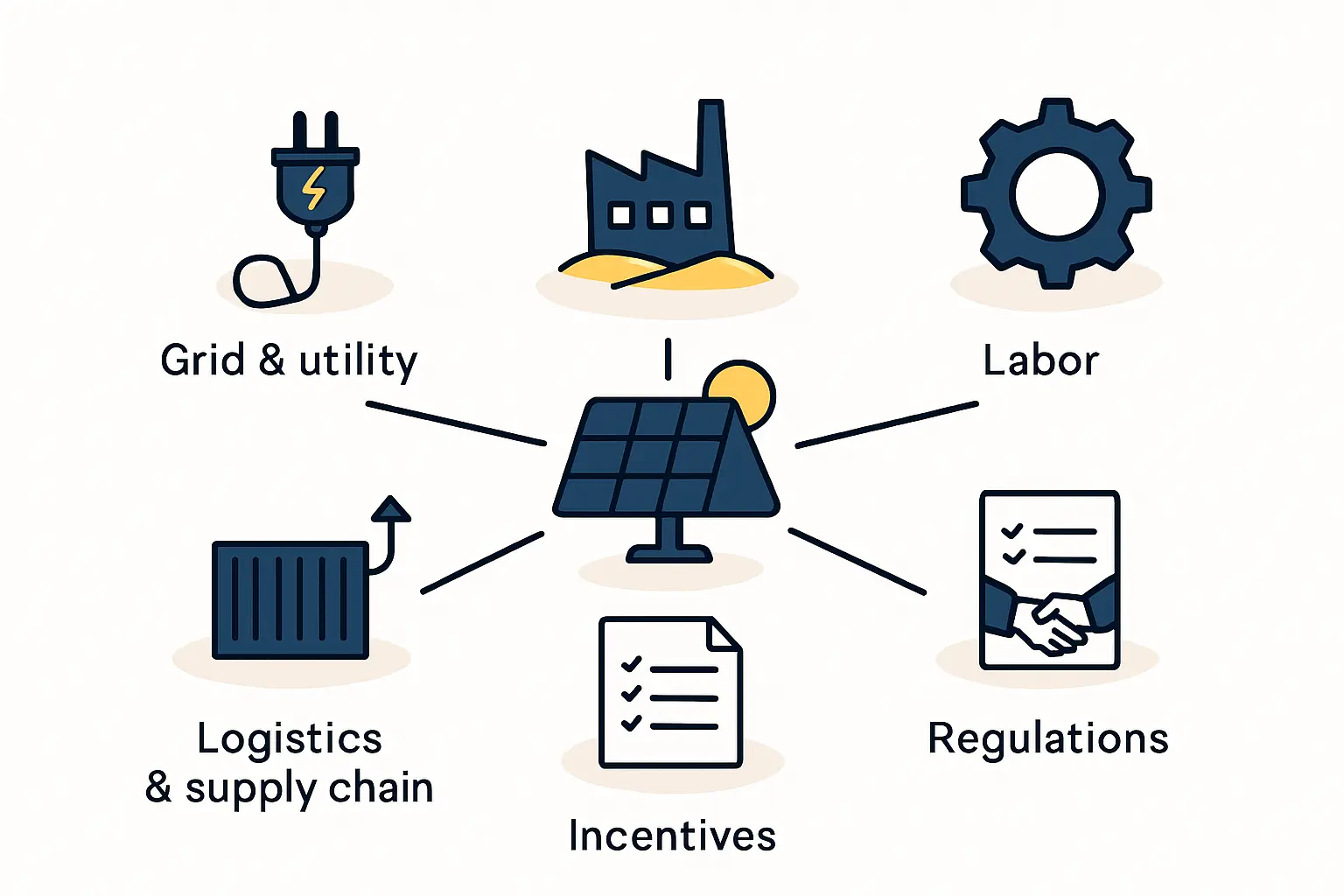

Site selection extends far beyond securing a piece of real estate. It requires balancing several key business factors:

- Labor: Availability, skill set, and cost of the local workforce.

- Logistics: Proximity to raw material suppliers and target markets.

- Infrastructure: Quality of transport networks, energy supply, and digital connectivity.

- Costs: Price of land and construction, local wage levels, and utility rates.

- Regulatory Environment: Local incentives, permitting processes, and business support.

A miscalculation in any of these areas can impact everything from production uptime to the final cost of the product.

An Overview of Czechia’s Industrial Landscape

Situated in the heart of Europe, Czechia presents a compelling case for industrial investment. It boasts a strong manufacturing tradition, a stable political environment within the European Union, and highly developed infrastructure. Its location provides excellent access to both Western and Eastern European markets.

Within the country, two regions stand out for industrial development, each with a distinct profile: the historically industrial Moravia-Silesian Region and the modern, logistics-focused Central Bohemian Region.

Profile: The Moravia-Silesia Region (MSK)

Known as the “steel heart” of the country, Moravia-Silesia is undergoing a significant economic transformation. Its industrial legacy provides a unique foundation for modern manufacturing ventures.

Core Strengths

The region’s history in heavy industry, such as coal mining and steel production, has cultivated a deep pool of technical and engineering talent. This background translates into a workforce with hands-on experience in complex manufacturing processes. Furthermore, local institutions like VŠB-Technical University of Ostrava ensure a steady supply of new engineering graduates.

From a financial perspective, MSK also offers considerable advantages. The regional unemployment rate, at approximately 5.3%, is higher than the national average, suggesting a more readily available labor pool. This availability is reflected in labor costs, with an average monthly wage around CZK 38,970—noticeably lower than in regions closer to the capital. The government also frequently supports this post-industrial region with investment incentives aimed at attracting new industries and fostering economic diversification.

Logistical Advantages

Moravia-Silesia’s location bordering Poland and Slovakia makes it a natural gateway to Central and Eastern Europe. The Leoš Janáček Airport Ostrava is a significant cargo hub, facilitating air freight and material transport. Major industrial parks like Ostrava-Mošnov are specifically designed to leverage these logistical connections.

Potential Challenges

Investors must consider the region’s industrial past. While its workforce is skilled, specific training may be required to adapt heavy manufacturing expertise to the precision-oriented demands of solar PV production. Additionally, some sites may have environmental legacies that require careful due diligence.

Profile: The Central Bohemia Region (SČK)

Surrounding the nation’s capital, Prague, the Central Bohemian Region is a dynamic economic powerhouse defined by modern logistics, high-tech manufacturing, and its deep connections to Western Europe.

Core Strengths

Proximity to Prague provides access to a large, diverse, and highly educated workforce. The region is the center of Czechia’s automotive and electronics industries, with major international players like Škoda Auto and Foxconn operating there. This creates a rich ecosystem of expertise in automation, quality control, and sophisticated supply chain management.

The infrastructure is among the best in Central Europe. Key motorways, such as the D1 and D5, provide direct routes to Germany and the rest of the EU. Václav Havel Airport Prague, the country’s largest international airport, offers extensive global passenger and cargo connections.

Logistical Advantages

For businesses targeting Western European markets, SČK’s location is unparalleled. Well-developed road and rail networks ensure efficient transport of both raw materials and finished solar modules. Industrial parks like CTPark Prague East and P3 Prague D11 are strategically positioned along these major transport corridors.

Potential Challenges

The region’s success brings its own challenges. The labor market is highly competitive, with a very low unemployment rate of around 2.7%. This drives up wages, with the regional average at approximately CZK 43,967. Land and rental costs for industrial properties are also significantly higher than in other parts of the country. Competition for skilled technicians is intense.

A Comparative Framework for Decision-Making

Choosing between these two regions requires a clear understanding of an investor’s specific priorities.

-

Factor: Labor Pool

Moravia-Silesia (MSK): Larger, more available workforce with industrial background.

Central Bohemia (SČK): Tighter labor market, high competition for skilled workers.

Strategic Implication: MSK may be better for large-scale operations requiring many technicians; SČK suits highly automated facilities. -

Factor: Labor Costs

Moravia-Silesia (MSK): Lower (Avg. ~CZK 38,970/month).

Central Bohemia (SČK): Higher (Avg. ~CZK 43,967/month).

Strategic Implication: Lower operational spending in MSK can significantly impact long-term profitability. -

Factor: Logistics Focus

Moravia-Silesia (MSK): Gateway to Poland, Slovakia, and Eastern Europe.

Central Bohemia (SČK): Hub for Germany and Western Europe.

Strategic Implication: The choice depends entirely on the primary target markets for the finished solar modules. -

Factor: Operational Costs

Moravia-Silesia (MSK): Lower land/rental costs; potential for incentives.

Central Bohemia (SČK): Higher land/rental costs due to proximity to Prague.

Strategic Implication: The initial investment and ongoing fixed costs will be substantially different. -

Factor: Industrial Ecosystem

Moravia-Silesia (MSK): Traditional heavy industry, engineering focus.

Central Bohemia (SČK): High-tech, automotive, advanced logistics focus.

Strategic Implication: SČK provides access to an ecosystem of automation and electronics suppliers.

The Ideal Investor Profile

Moravia-Silesia is well-suited for an investor focused on cost control, scale, and serving the growing markets of Central and Eastern Europe. The lower operational costs and available labor pool support a business model based on production volume and price competitiveness.

Central Bohemia is the logical choice for an investor prioritizing speed to market in Western Europe, advanced automation, and access to a high-tech talent ecosystem. The higher costs are offset by superior logistical connections to key western markets and a workforce familiar with cutting-edge manufacturing.

Beyond the Region: Universal Principles for Site Selection

This Czech case study highlights principles that apply to any site selection process globally:

-

Align Location with Market Strategy: Your factory’s location must support your supply chain and distribution strategy. Do not choose a site that is geographically disconnected from your primary suppliers or customers.

-

Conduct a Thorough Labor Market Analysis: Look beyond unemployment rates. Investigate the specific skills available, the presence of vocational schools or universities, and local wage expectations.

-

Evaluate the Total Cost of Operation: The purchase price of land is just one component. Factor in energy costs, local taxes, logistics, and labor costs to understand the full financial picture. J.v.G. Technology GmbH’s experience in establishing turnkey factories confirms that these ongoing operational costs are just as critical as the initial capital expenditure.

-

Verify Infrastructure Reliability: For solar manufacturing, a stable and sufficient power supply is non-negotiable. Confirm the capacity and reliability of the local electricity grid before committing to a site.

Frequently Asked Questions (FAQ)

How much space is needed for a starter solar factory?

A typical small-to-medium scale facility (e.g., 20–50 MW annual capacity) requires between 2,500 and 5,000 square meters. This includes space for the production line, raw material storage, finished goods warehousing, and administrative offices. A detailed factory layout is essential during the planning phase.

What kind of electrical infrastructure is required?

A solar module production line is energy-intensive. A reliable connection to the medium-voltage grid is typically necessary, with a dedicated transformer station for the facility. The exact power requirement depends on the capacity and specific machines used, but this is a critical point to confirm with local utility providers early in the process.

Are government grants a deciding factor?

Incentives can be beneficial, especially in regions designated for economic development like Moravia-Silesia. However, they should not be the primary reason for choosing a location. The fundamental business case—access to labor, logistics, and markets—must be strong on its own. Grants should be seen as a bonus that improves the return on investment, not as the foundation for it.

How long does it take to set up a factory after selecting a site?

Once a site is secured and permits are obtained, the process of installing equipment, commissioning the line, and training staff typically takes between 6 to 12 months. This timeline can be influenced by equipment delivery lead times and the efficiency of local contractors.

Conclusion and Next Steps

The decision between a region like Moravia-Silesia and Central Bohemia is a strategic choice between two different business models: one prioritizing cost efficiency and scale, the other prioritizing proximity to high-tech ecosystems and Western markets.

By carefully analyzing the trade-offs in labor, logistics, and cost, an investor can select a site that not only accommodates a production line but actively contributes to the long-term success and profitability of the business. This methodical approach is the first step in transforming a business concept into a successful manufacturing operation.