For entrepreneurs, entering a new industrial sector often starts with a clear market signal. In Djibouti, that signal is one of the highest electricity tariffs in the region, often exceeding US$0.25 per kilowatt-hour. This single data point turns the challenge of high energy costs into a substantial business opportunity: establishing local solar module manufacturing to serve a market with an urgent need for energy independence and cost reduction.

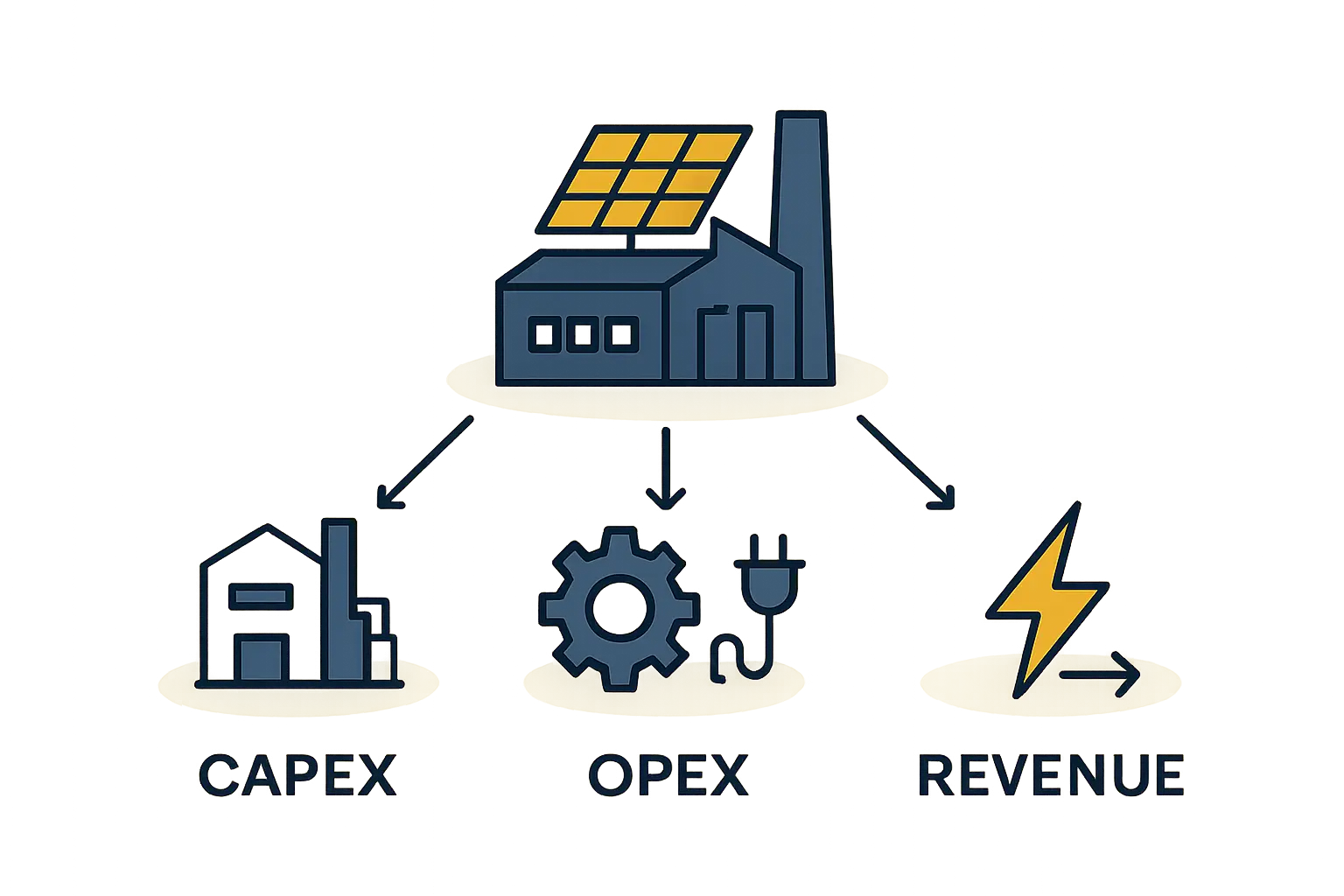

This article presents a sample financial model for a 50-megawatt (MW) solar module assembly plant in Djibouti. It is designed not as a definitive investment plan but as an educational framework to help business professionals understand the key cost drivers, revenue potential, and strategic factors involved. The following analysis explores the capital expenditures (CAPEX), operational expenditures (OPEX), and projected revenue, all within the unique economic context of Djibouti.

The Strategic Advantage of Djibouti for Solar Manufacturing

Before breaking down the numbers, it’s crucial to understand why Djibouti presents such a compelling case for this venture. Several unique economic and geographic factors converge to create a favorable environment.

- High Energy Costs: The prevailing electricity prices create immediate demand for cheaper, locally produced energy solutions like solar panels.

- Government Support: Under its “Vision Djibouti 2035” plan, the government is committed to achieving 100% renewable energy. This includes investment incentives such as tax exemptions and streamlined administrative processes for new ventures in the sector.

- Logistical Hub: Djibouti’s strategic location and modern port facilities provide a crucial advantage for both importing raw materials and exporting finished modules to neighboring markets like Ethiopia and Somalia.

- Abundant Solar Resource: With solar irradiation levels around 2,200 kWh/m² per year, the country is a prime location for solar energy generation, ensuring strong local demand for high-performance modules.

These factors help mitigate inherent risks and create a solid foundation for a profitable manufacturing operation.

Estimated Capital Expenditure (CAPEX)

The initial investment is the most significant financial hurdle for any new manufacturing plant. For a 50 MW semi-automated assembly line, the CAPEX can be broken down into several core categories.

1. Machinery and Production Equipment

Representing the largest portion of the initial outlay, this category includes the key machines required to assemble solar modules. A robust setup of solar module manufacturing equipment is fundamental to ensuring product quality and production efficiency.

- Semi-Automated Assembly Line (50 MW): €3,000,000 – €4,500,000

- Testing and Quality Control Equipment (e.g., Sun Simulator, EL Tester): €500,000 – €750,000

- Auxiliary Equipment (Forklifts, Compressors, etc.): €200,000 – €300,000

Estimated Sub-Total for Equipment: €3,700,000 – €5,550,000

2. Building and Infrastructure

A suitable facility is critical. While costs vary based on leasing versus constructing, the budget must account for a facility of approximately 3,000–5,000 square meters. This includes production space, warehousing for raw materials and finished goods, and administrative offices.

- Building Renovation or Construction: €500,000 – €1,500,000

- Utility Connections (Power, Water, Internet): €50,000 – €150,000

Estimated Sub-Total for Infrastructure: €550,000 – €1,650,000

3. Initial Working Capital and Other Costs

This category covers the funds needed to begin operations before revenue is generated.

- Initial Raw Material Inventory (3 months): €1,000,000 – €1,500,000

- Shipping, Installation, and Commissioning: €400,000 – €600,000

- Training and Technology Transfer: €100,000 – €200,000

- Contingency Fund (10% of total): €565,000 – €890,000

Total Estimated CAPEX: €5,815,000 – €9,790,000 (approx. US$6.2M – US$10.5M)

Annual Operational Expenditure (OPEX) Projections

Once the factory is operational, ongoing costs determine its long-term profitability. OPEX is primarily driven by raw materials and labor.

1. Bill of Materials (BOM)

The cost of raw materials for producing solar panels is the single largest recurring expense. This assumes a production of 50 MW per year (approx. 137,000 modules at 365W each) and an average material cost of €0.20–€0.25 per Watt.

Annual BOM Cost: 50,000,000 W * €0.225/W = €11,250,000

2. Labor Costs

A 50 MW facility typically requires a workforce of 40–60 employees, including operators, technicians, quality control staff, and management. Labor costs in Djibouti are competitive, but skilled positions may require higher wages.

Estimated Annual Labor Cost: €300,000 – €500,000

3. Utilities and Factory Overhead

This includes electricity, water, rent/depreciation, maintenance, and administrative expenses. While the factory will use electricity, it could install its own solar array to significantly reduce this cost.

Estimated Annual Overhead: €400,000 – €600,000

Total Estimated Annual OPEX: €11,950,000 – €12,350,000

Revenue Projections and Profitability

Revenue depends on the final sale price of the modules. In a market like Djibouti, locally produced modules can be priced competitively against imports, which incur significant shipping and tariff costs.

Market Pricing

Assuming a conservative average selling price of €0.30–€0.35 per Watt, this price is competitive against imported panels while offering a healthy margin. To maintain quality at this price point, the complete solar panel manufacturing process must be optimized.

Annual Revenue: 50,000,000 W * €0.325/W = €16,250,000

Profitability Analysis

These projections point toward the following potential for gross profit and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

- Gross Annual Revenue: €16,250,000

- Total Annual OPEX: (€12,150,000)

- Annual EBITDA: €4,100,000

This simplified model indicates strong potential for profitability. Based on an initial investment (CAPEX) of approximately €7.8M (the midpoint of our range), the simple payback period would be less than two years. This is an attractive figure for industrial investments, but a detailed analysis must also account for financing costs, depreciation, and taxes.

Addressing Inherent Challenges

While the financial model is promising, any prudent investor must consider the challenges. Based on experience from J.v.G. turnkey projects in emerging markets, the primary obstacles include:

-

Logistics and Supply Chain: Securing a reliable and cost-effective supply of raw materials (solar cells, glass, aluminum frames) is critical. Djibouti’s port is an asset, but robust supply chain management is non-negotiable.

-

Skilled Labor: While a local workforce is available, specialized training for machine operators and quality control technicians will be necessary. Factoring in a comprehensive training program from the start is essential for success.

-

Market Competition: While local production has advantages, competition from large-scale international manufacturers remains. A focus on quality, local service, and tailored solutions for the regional climate can create a strong competitive edge.

Frequently Asked Questions (FAQ)

Q1: What is a realistic timeline for setting up a 50 MW solar factory?

From initial planning to full production, a realistic timeline is 10–14 months. This includes equipment procurement (4–6 months), shipping and installation (2–3 months), and commissioning and staff training (2–3 months).

Q2: How many employees are required for a 50 MW line?

A semi-automated 50 MW facility typically requires 40 to 60 employees across two shifts. This includes around 30-40 direct production operators, 5-8 technicians and engineers, and 5-10 administrative and management staff.

Q3: Are government incentives in Djibouti reliable for long-term planning?

The “Vision Djibouti 2035” initiative provides a strong policy framework. However, investors should conduct thorough due diligence and engage with local investment authorities like the National Investment Promotion Agency (NIPA) to confirm the specifics and longevity of tax exemptions and other support mechanisms.

Q4: What are the main risks outside of the financial projections?

The primary non-financial risks include potential political instability in the broader region affecting export markets, global fluctuations in raw material prices, and the challenge of maintaining consistent international quality standards (e.g., IEC certifications) to build brand credibility.

Conclusion and Next Steps

The financial model for a 50 MW solar factory in Djibouti reveals a powerful business case, rooted in high local energy demand and strong governmental support. The projected profitability and relatively short payback period make it an attractive proposition for entrepreneurs looking to enter the renewable energy sector.

However, success is not guaranteed by numbers alone. It requires meticulous planning, a deep understanding of technical processes, and a strategic approach to overcoming logistical and operational challenges. The opportunity lies not just in assembling solar panels, but in building a resilient business that contributes to Djibouti’s energy independence and economic growth.

For those considering this path, the next step is to develop a comprehensive business plan. This means moving from high-level estimates to detailed quotes, conducting a formal market study, and outlining a clear operational strategy. This structured planning, as detailed in guides on how to start a solar panel manufacturing business, is the foundation for building a successful enterprise.