With funding secured, a location chosen, and a robust business plan in place, an entrepreneur now faces a critical, often underestimated phase: moving millions of dollars in specialized manufacturing equipment and raw materials from global suppliers into the country. This is not simple shipping; it is a complex logistical operation that can determine whether a project launches on time and within budget.

The Port of Guayaquil is the primary gateway for any new industrial venture in Ecuador. Understanding its procedures, regulations, and on-the-ground realities is fundamental to a successful project. This guide outlines the key considerations for importing capital goods through Guayaquil, from customs navigation to inland transportation, providing a clear roadmap for leaders planning to enter Ecuador’s growing renewable energy sector.

Understanding the Strategic Importance of the Port of Guayaquil

As Ecuador’s main commercial port, Guayaquil handles over 70% of the country’s non-oil foreign trade. Its extensive container terminals and logistics infrastructure make it the natural entry point for the heavy machinery and sensitive components required for a solar module production line. Consequently, any logistical planning for a factory setup must center on the port’s operational framework.

Navigating this hub successfully requires a detailed understanding of the national customs authority and the digital systems that govern all import activities.

Navigating Ecuador’s Customs Framework

The primary governing body for all import and export activities is the Servicio Nacional de Aduana del Ecuador (SENAE). All customs procedures are managed through its comprehensive digital platform, Ecuapass. For an investor, engaging with this system is not optional—it is the mandatory channel for declaring goods, paying taxes, and obtaining clearance.

The Customs Declaration Process Step-by-Step

Given the complexity and financial value of the cargo, attempting to manage customs without professional assistance is ill-advised. The first step for any serious importer is to contract a licensed and reputable customs agent (Agente de Aduanas). This agent acts as the legal representative, navigating the Ecuapass system on behalf of the importing company.

The typical process follows these key stages:

-

Submission of the Declaration: Before the vessel arrives, the customs agent submits the Documento Único de Importación (DUI), which contains detailed information about the cargo, its value, origin, and tariff classification.

-

Inspection Channel Assignment: Once the DUI is accepted, the Ecuapass system assigns an inspection channel. This step is critical, as it determines the speed of clearance.

- Green Channel: Automatic approval. The cargo can be cleared after tax payment.

- Orange Channel: Documentary review. SENAE officials will scrutinize the submitted paperwork for accuracy and consistency.

- Red Channel: Physical and documentary inspection. The container will be opened and the goods physically inspected to verify that they match the declaration.

-

Tax and Duty Payment: The agent liquidates the applicable taxes and duties, which must be paid before the cargo can be released.

-

Cargo Release: Upon confirmation of payment and completion of any required inspections, SENAE issues the release order, allowing the cargo to be moved out of the port.

This process, from vessel arrival to cargo release, typically takes between 7 and 15 days. However, complications from incorrect documentation or a red channel inspection can lead to significant delays.

Tariffs, Taxes, and Investment Incentives

A crucial part of budgeting the overall capital investment for a solar factory involves accurately forecasting import-related costs. While Ecuador has standard import taxes, it also offers significant incentives for new productive investments, particularly in strategic sectors like renewable energy.

Capital Goods and Renewable Energy Incentives

The Production, Commerce and Investment Organic Code (COPCI) is the central legal framework governing new investments in Ecuador. Article 9.1 of this code establishes potential exemptions from import duties (ad valorem tariffs) on capital goods, machinery, and raw materials for companies undertaking new, productive investments.

To qualify for these benefits, the investment project must be approved by the relevant government bodies. This requires a formal application process demonstrating the project’s economic contribution. Obtaining these exemptions can substantially reduce the initial setup costs of a solar factory, but navigating the application process requires expert legal and administrative guidance.

Standard Import Taxes to Account For

Even with duty exemptions, certain taxes still apply to all imports. Financial models must account for:

-

ISFODINFA (0.5%): A tax allocated to the Children’s Development Fund, calculated on the CIF (Cost, Insurance, and Freight) value of the goods.

-

Value Added Tax (IVA/VAT): Currently at 12% (this rate is subject to legislative changes). It is calculated on the CIF value plus all other import duties and taxes.

For a multi-million dollar shipment of solar module manufacturing equipment, these taxes represent a significant cash outlay that must be planned for.

From Port to Factory: Inland Transportation Logistics

Once cargo is released from the port, the final and often challenging phase begins: inland transportation to the factory site. Moving large, heavy, and sensitive equipment requires specialized logistics providers with experience handling such cargo within Ecuador.

Route Planning and Infrastructure

While Ecuador’s main highways are generally in good condition, transporting oversized equipment may require detailed route surveys to account for bridges, overhead cables, and tight turns. The logistics partner must ensure the planned route can accommodate the machinery’s specific dimensions and weight. This planning must be coordinated with the team responsible for setting up your factory building to ensure the site is prepared for delivery and offloading.

Security and Insurance

For high-value shipments, security is a paramount concern. Standard practice in the region is to employ private, armed escorts for the entire journey from the port to the final destination. This measure mitigates the risk of theft or hijacking.

Comprehensive ‘all-risk’ cargo insurance is also non-negotiable. This policy should cover the goods from the moment they leave the supplier’s warehouse until they are safely installed and commissioned at the factory, providing financial protection against damage or loss during transit.

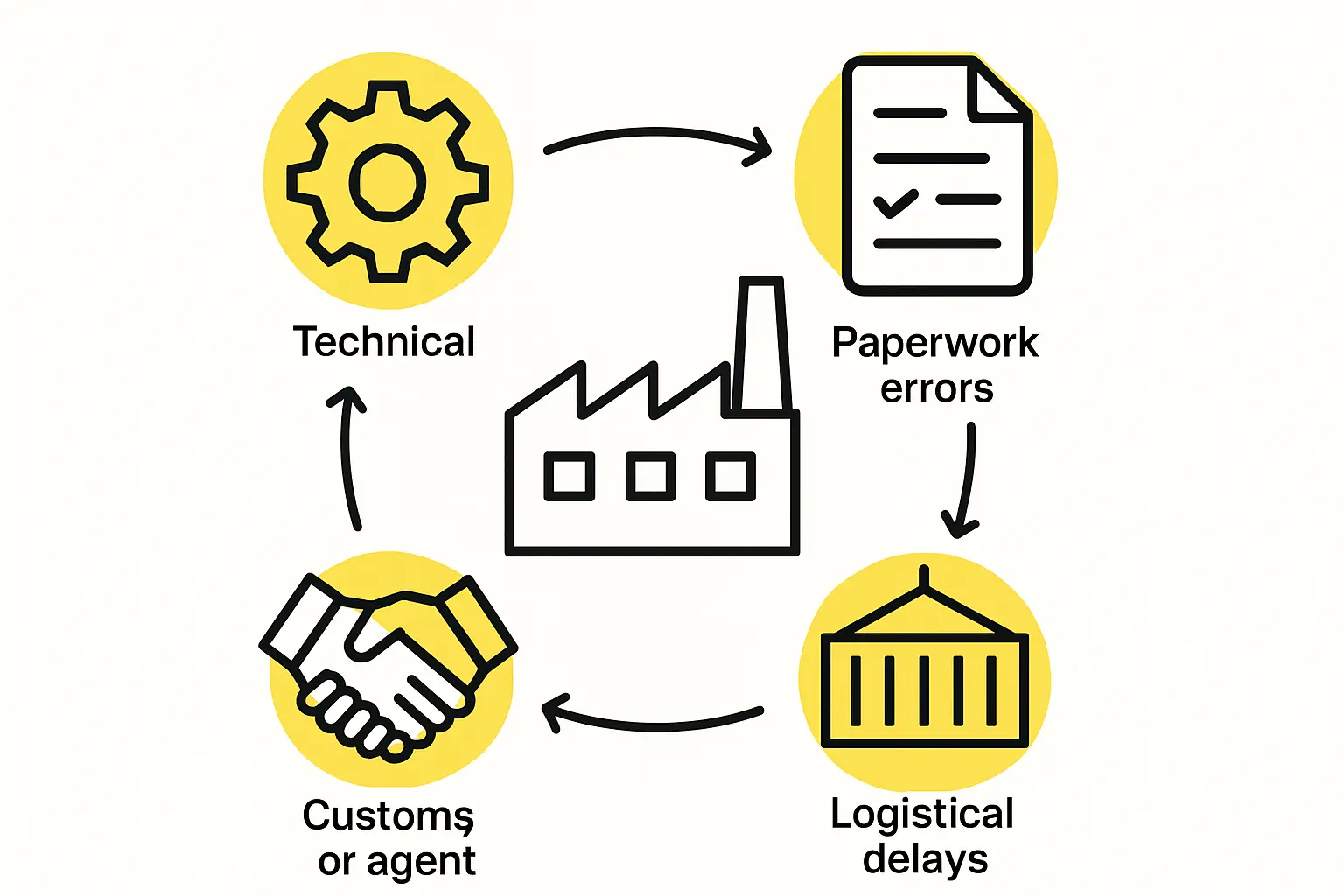

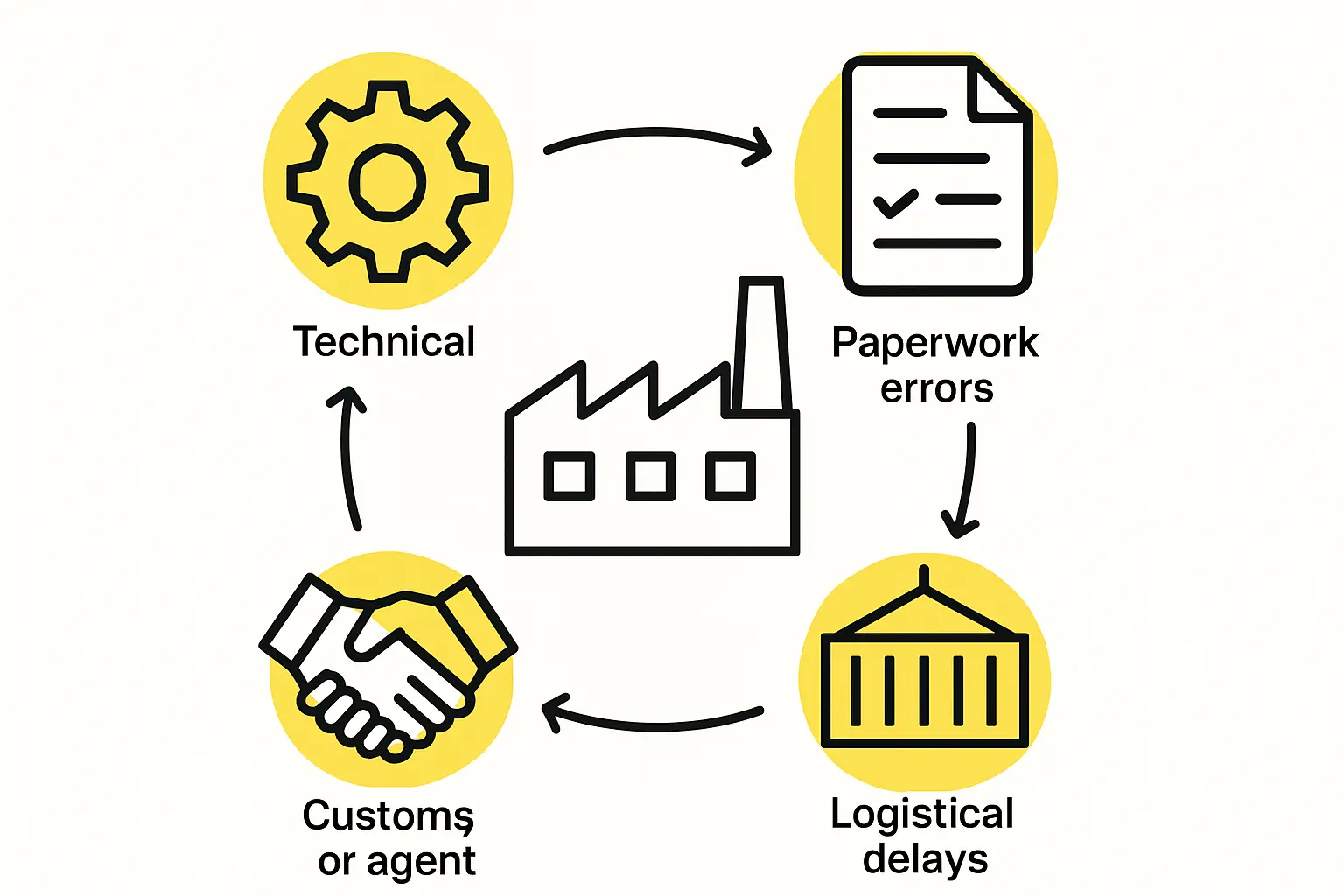

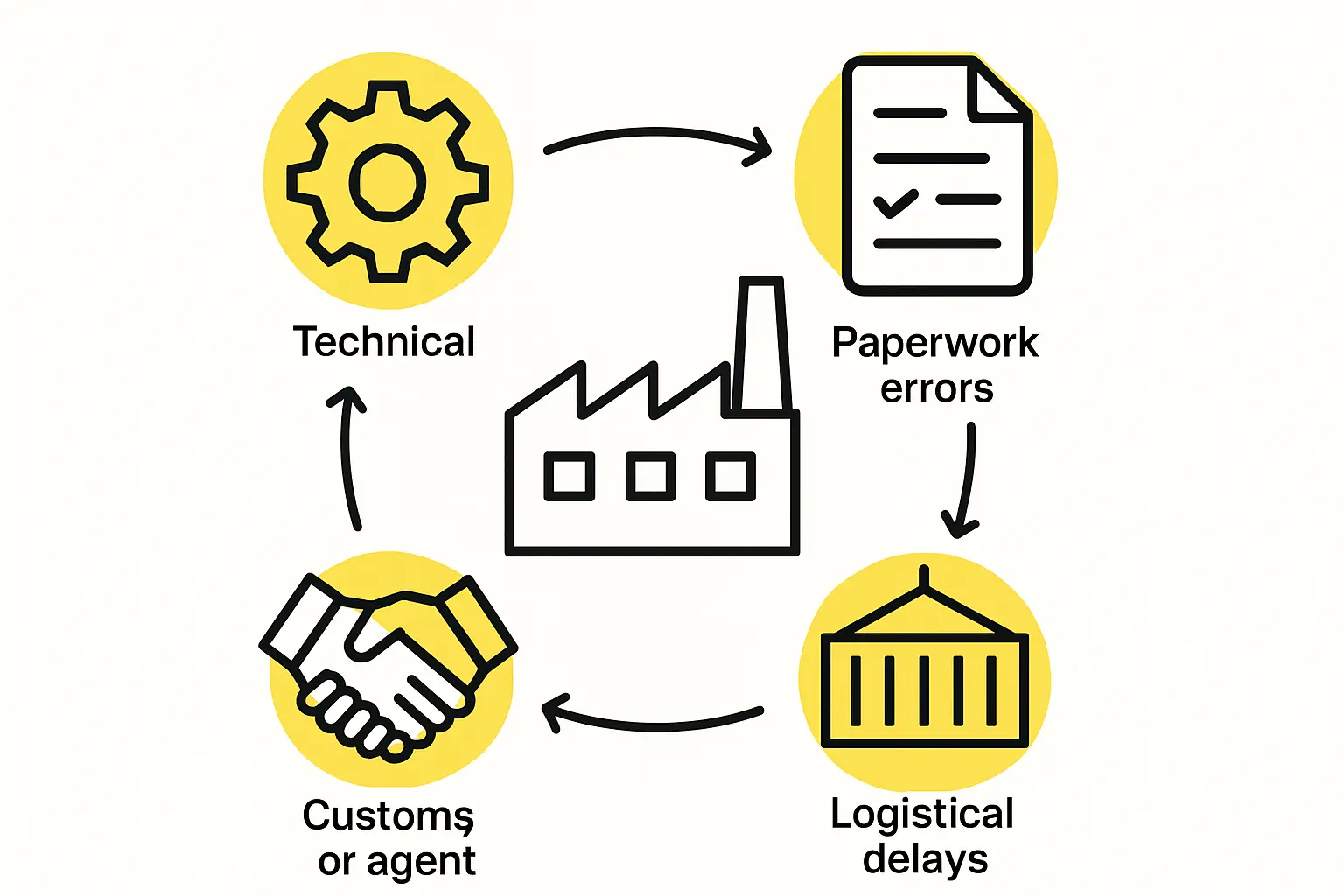

Common Challenges and How to Mitigate Them

Based on experience from J.v.G. turnkey projects in emerging markets, several common challenges can arise. Proactive planning is the key to mitigating them.

-

Challenge: Customs Delays. Incorrect tariff codes, valuation discrepancies, or incomplete paperwork can trigger intensive inspections and halt the clearance process.

Mitigation: Retain an experienced customs agent with a proven track record in capital goods. Ensure all documentation is flawless and submitted well in advance. -

Challenge: Hidden Costs. Demurrage (fees for using containers beyond the allotted free time) and port storage fees can accumulate rapidly during delays.

Mitigation: Build a 10–15% contingency into the logistics budget. Work with a logistics partner who provides a transparent, all-inclusive quote to minimize surprises. -

Challenge: Logistical Bottlenecks for Ongoing Supplies. The importation process is not a one-time event. A factory requires a continuous supply of raw materials like EVA film and backsheets.

Mitigation: Develop a long-term relationship with a reliable logistics provider to create a streamlined, repeatable process for all future material imports.

Frequently Asked Questions about Importing to Ecuador

How long does customs clearance typically take in Guayaquil?

Under normal circumstances with proper documentation, the process from vessel arrival to cargo release takes between 7 and 15 days. However, delays caused by inspections or administrative issues can extend this period significantly.

Do I need a local company to import the equipment?

Yes. All imports must be conducted through a legally constituted Ecuadorian company that is registered as an importer with SENAE. A foreign entity cannot import goods directly in its own name.

Can I benefit from a Free Trade Zone (Zona Franca)?

Ecuador has Special Economic Development Zones (ZEDEs), which function similarly to Free Trade Zones. Setting up within a ZEDE can offer significant tax and customs benefits, especially if a portion of the production is intended for export. However, this requires a specific legal and operational structure and may not be suitable for all projects focused solely on the domestic market.

What is the most common mistake first-time importers make?

The most common and costly error is providing incomplete or inaccurate commercial invoices and packing lists. Discrepancies between the documents and the physical cargo are a primary trigger for customs penalties and extended delays.

Laying the Logistical Foundation for Your Solar Factory

Importing the core assets for a solar module factory is a mission-critical phase that lays the foundation for the entire project. Success is not a matter of chance but the result of meticulous planning, collaboration with seasoned local experts, and a thorough understanding of Ecuador’s regulatory landscape.

By anticipating challenges related to customs, taxes, and inland transport, entrepreneurs can de-risk this crucial stage of their investment. A well-managed logistics strategy ensures that expensive equipment arrives safely, on time, and without unexpected costs, clearing the way for a smooth transition from construction to production. For those beginning this journey, pvknowhow.com offers a structured e-course to help with this and all other aspects of factory planning.