Many international investors view solar module manufacturing through a narrow lens, often assuming that production must be located in established Asian hubs to be competitive. This perspective, however, overlooks a powerful strategic advantage available elsewhere: using geography and trade policy to unlock preferential market access. For an entrepreneur considering the solar industry, a factory in Egypt presents a compelling case that extends far beyond production costs.

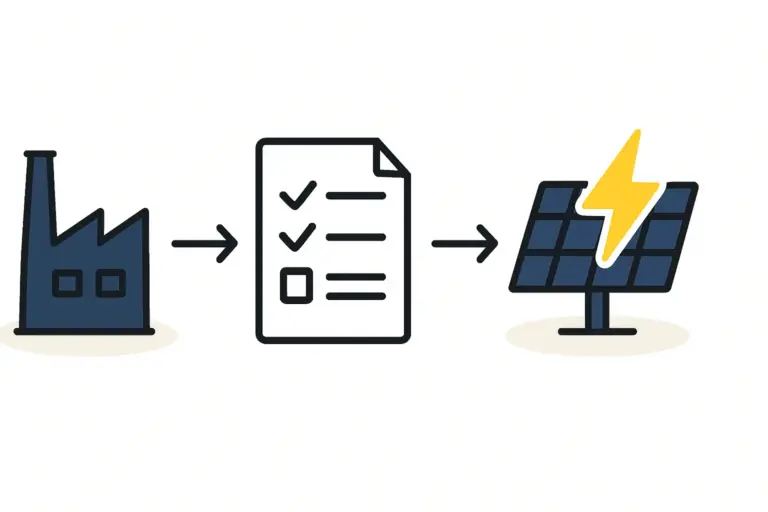

A solar module manufacturing facility in Egypt can be strategically positioned as an export hub for Africa, Europe, and the Middle East. The focus is not on the technical aspects of production but on the business case built upon Egypt’s unique network of international trade agreements. By understanding these frameworks, an investor can develop a distribution model with significant competitive advantages.

Why Egypt is More Than Just a Location: A Strategic Gateway

Egypt’s geographical position at the crossroads of Africa, Europe, and Asia is a clear logistical asset. Proximity to the Suez Canal, one of the world’s most critical maritime trade routes, provides direct shipping lanes to key consumer markets. The true strategic value, however, lies in the legal and economic frameworks that connect Egypt to its neighbors.

Decades of targeted trade diplomacy have resulted in a series of agreements that grant Egyptian-made goods preferential access to some of the world’s fastest-growing energy markets. For a solar module manufacturer, this means the ‘Made in Egypt’ label can be a key that unlocks markets and reduces tariff-related costs faced by competitors from other regions.

Unlocking Key Markets: A Guide to Egypt’s Core Trade Agreements

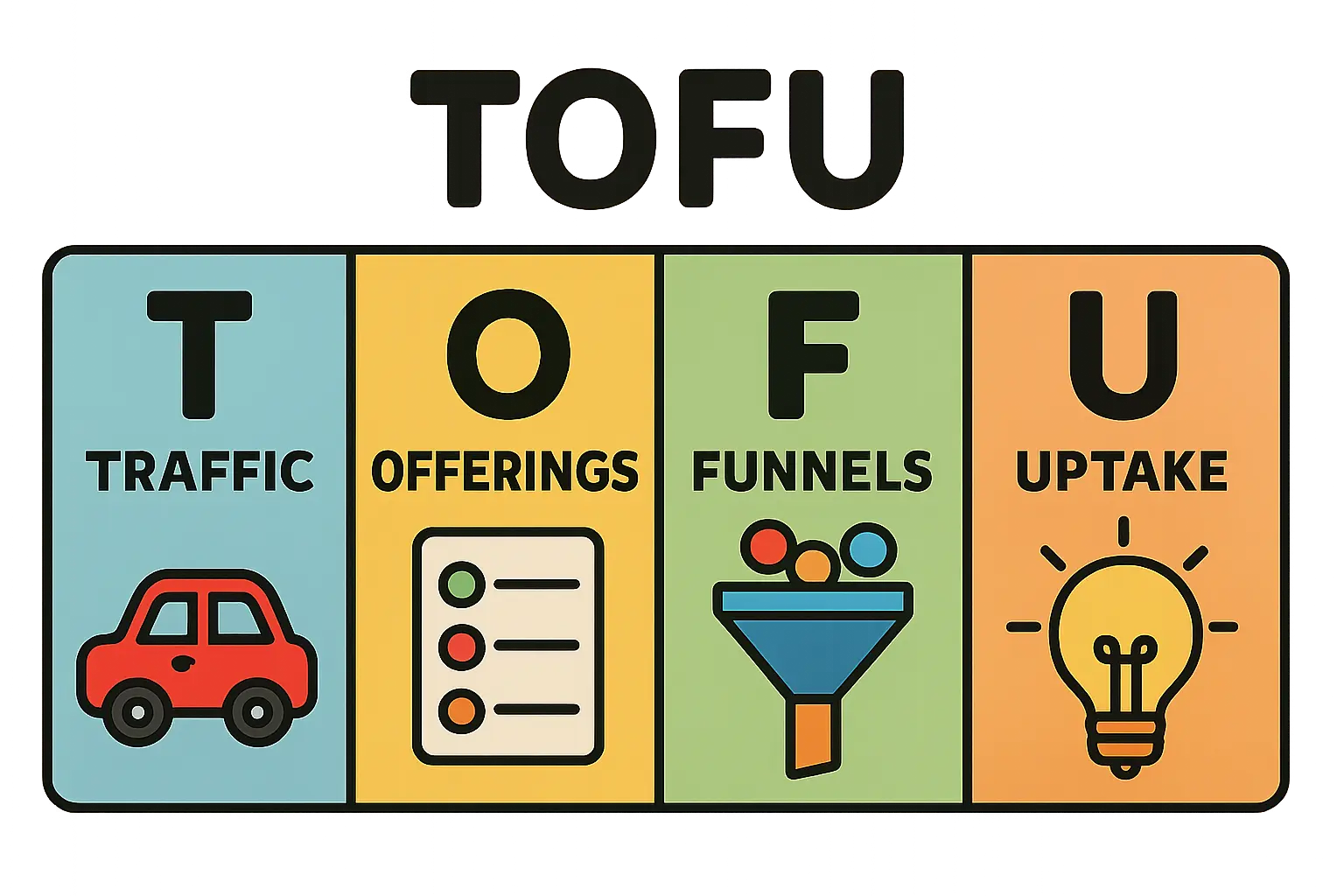

These agreements are not merely political documents; they are powerful commercial tools that should be central to any solar panel manufacturing business plan. They function by eliminating or significantly reducing customs duties for goods that meet specific ‘rules of origin.’

The African Continental Free Trade Area (AfCFTA): Accessing a Continent

The AfCFTA is one of the most ambitious trade projects globally, aiming to create a single market for goods and services across 54 African nations. For a solar module manufacturer in Egypt, this agreement is transformative.

- Market Size: It provides potential access to a market of over 1.3 billion people with rapidly growing energy needs.

- Tariff Reduction: AfCFTA is designed to eliminate tariffs on 90% of goods, making Egyptian-made solar panels more price-competitive in countries from Nigeria to South Africa.

- Simplified Trade: The agreement also reduces non-tariff barriers, such as complex customs procedures and quotas, streamlining distribution across the continent.

The Common Market for Eastern and Southern Africa (COMESA): A Regional Powerhouse

COMESA is a more established free trade area comprising 21 member states, primarily in Eastern and Southern Africa. It offers a stable and mature framework for regional trade.

- Duty-Free Access: Goods originating from Egypt can enter other COMESA member states—such as Kenya, Ethiopia, and Zambia—without customs duties.

- Established Procedures: As a long-standing organization, COMESA has well-defined customs documentation and clearance systems, which reduces administrative hurdles for exporters.

The EU-Egypt Association Agreement: A Bridge to Europe

This agreement provides Egyptian industrial products, including solar modules, with duty-free access to the entire European Union market—a significant advantage as Europe seeks to diversify its solar supply chain. To leverage this, modules must not only meet rules of origin but also adhere to stringent European quality and safety standards, such as IEC certifications.

Other Key Agreements: Agadir and GAFTA

- Agadir Agreement: This agreement facilitates free trade between Egypt, Jordan, Morocco, and Tunisia, providing focused access to key North African markets.

- Greater Arab Free Trade Area (GAFTA): This framework eliminates most tariffs among 17 member states, opening up markets across the Middle East and North Africa for Egyptian-manufactured goods.

The ‘Made in Egypt’ Requirement: Turning a Rule into an Advantage

To benefit from these trade agreements, solar modules must legally be considered products of Egyptian origin. This is determined by ‘Rules of Origin,’ which typically require a certain percentage of the product’s value to be added within the country.

For Egypt, this threshold is often around 40% local content. This does not mean 40% of the raw materials must be Egyptian. Instead, value is added through:

- The assembly process itself (labor and factory overhead).

- The use of any locally sourced components (such as aluminum frames or junction boxes).

- The overall transformation of imported raw materials (like solar cells and glass) into a finished product.

Designing a turnkey solar module production line with these requirements in mind is crucial. The manufacturing process itself is the primary driver of local value addition, making it relatively straightforward for a well-planned factory to meet these origin criteria.

Building the Export-Oriented Business Case

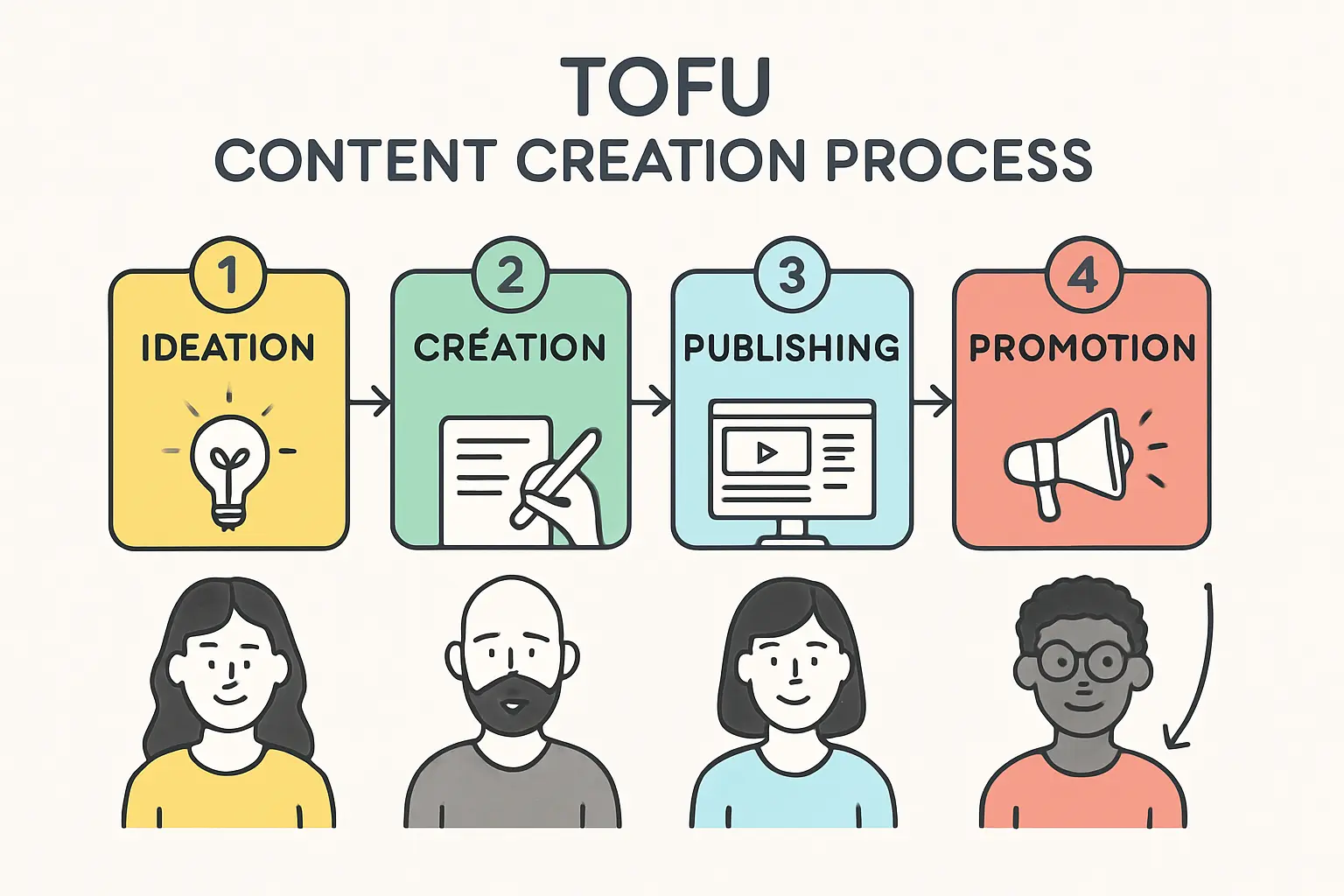

An effective export strategy is built upon these trade agreements, moving from theoretical benefits to a practical action plan.

Step 1: Market Selection and Analysis

Rather than attempting to serve all available markets, a successful strategy focuses on a select few. An investor should analyze potential target countries within AfCFTA or COMESA based on:

- Existing demand for renewable energy.

- Government incentives for solar projects.

- Logistical feasibility and shipping costs.

- Political and economic stability.

Step 2: Logistics and Supply Chain Planning

While Egypt’s location is a major asset, managing logistics remains a critical operational task. This involves securing reliable shipping partners, understanding customs clearance procedures at both ends, and planning for inland transportation. Effective planning can mitigate potential delays and ensure products reach customers on schedule.

Step 3: Financial Projections and Pricing Strategy

The tariff savings achieved through trade agreements directly impacts the final cost to the customer. This competitive advantage should be modeled in the business plan’s financial projections. This allows an Egyptian-based manufacturer to compete effectively on price with producers from other regions who may face 15-25% import duties in the same target markets.

Common Challenges and Strategic Considerations

While the opportunity is significant, entrepreneurs must plan for regional challenges. Bureaucracy, currency fluctuations, and varying regulations require careful navigation. Success often depends on having strong local partners and a clear understanding of the administrative landscape. These are not deterrents but factors to be managed through diligent planning and expert guidance.

Frequently Asked Questions (FAQ)

Do I need to be a trade law expert to benefit from these agreements?

No. An entrepreneur needs to understand the strategic opportunity they present. The execution—handling documentation and customs clearance—is typically managed by logistics partners and customs brokers who specialize in these procedures. The key is to build the business strategy around the advantages these agreements offer.

What is the primary benefit of manufacturing in Egypt versus importing from Asia?

While production costs are a factor, the primary benefit is preferential market access. Tariff savings from trade agreements can create a more significant price advantage in African and European markets than a small difference in manufacturing cost. This allows for a more competitive landing price for the end customer.

How much of the solar module needs to be ‘local’ to qualify?

Generally, the ‘local content’ or ‘value-added’ requirement is around 40%. This is typically achieved through the labor, overhead, and processing costs of assembling the module in an Egyptian factory, even if most raw components like solar cells are imported.

How does an export strategy affect the type of factory I should build?

An export-focused strategy influences several key decisions. Production capacity should be aligned with projected demand from target export markets. The factory must also be equipped to produce modules that meet the specific certification standards (like IEC or UL) required by those markets, particularly the European Union.

Your Next Steps in Strategic Planning

Understanding Egypt’s strategic trade position is the first step in building a robust, export-oriented solar manufacturing business. The true advantage lies not just in a factory’s location, but in leveraging a network of agreements to create sustainable commercial opportunities.

This framework transforms a solar factory from a simple production site into a powerful distribution hub. For those ready to move from concept to execution, the next step is to explore the practicalities of starting a solar panel factory and turning this strategic vision into an operational reality.