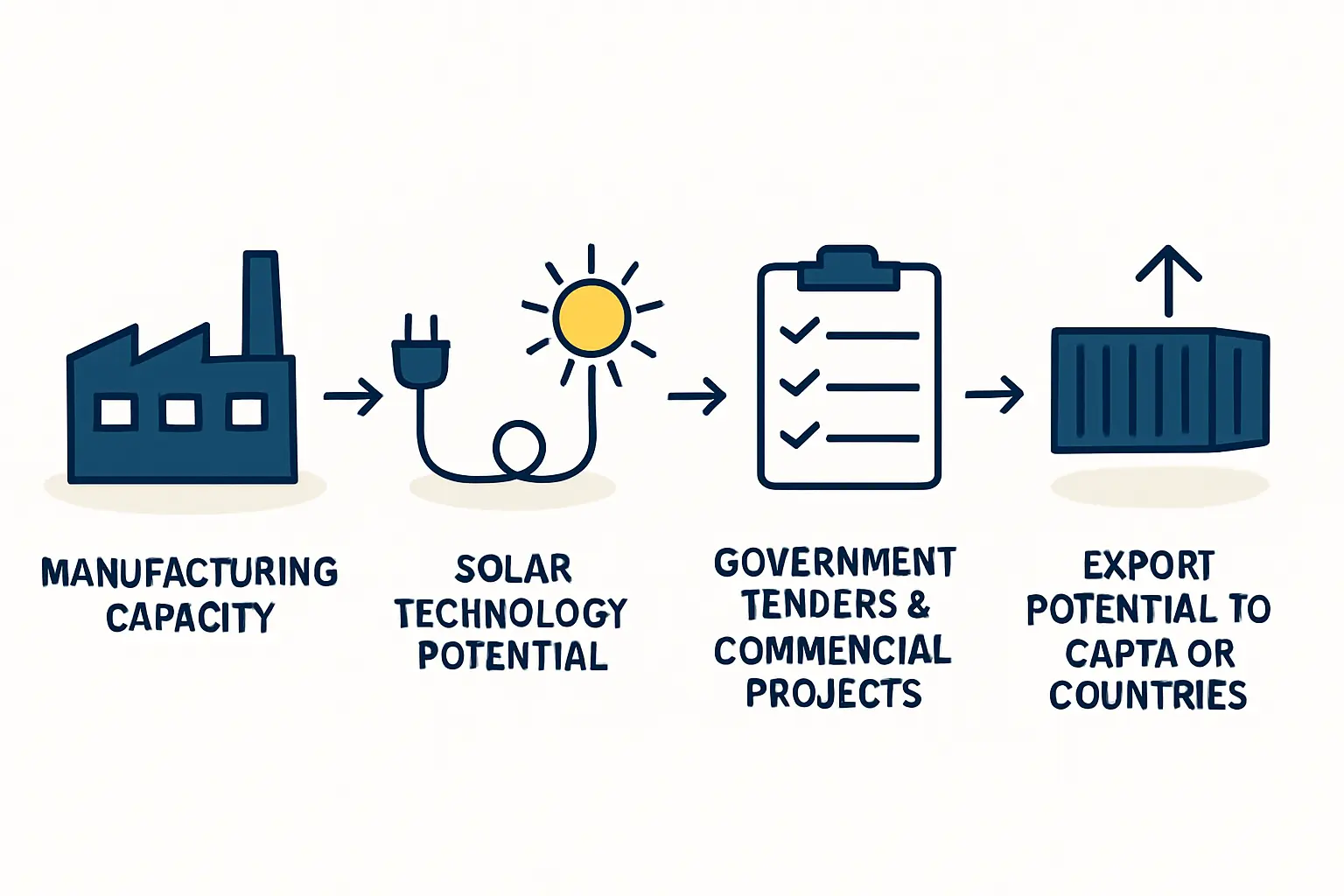

Many entrepreneurs considering the solar manufacturing sector often focus first on the technical aspects of production. Yet a successful venture begins not with machinery, but with a clear understanding of the market.

For an investor evaluating El Salvador, the central question is straightforward: Who will purchase the solar modules produced, and in what quantity? The answer lies in analyzing both a growing domestic market and a significant, often overlooked, regional export opportunity. This article provides a business-focused framework for evaluating this demand—the foundation for any robust business plan.

Understanding El Salvador’s Domestic Solar Market Drivers

El Salvador presents a compelling case for domestic solar module manufacturing, driven by a combination of government policy, commercial needs, and a strategic push for energy independence.

Government Initiatives and Public Tenders

The foundation of El Salvador’s renewable energy push is its National Energy Policy (2020-2050), which sets an ambitious target of generating 60% of the country’s energy from renewable sources. This policy is not merely a statement of intent; it is actively implemented through public tenders managed by institutions like the Comisión Ejecutiva Hidroeléctrica del Río Lempa (CEL).

These tenders for utility-scale solar projects create a predictable, large-scale source of demand. For a new manufacturer, supplying modules to these projects—either directly or as a partner—can provide a stable revenue stream and help achieve initial production targets.

The Commercial and Industrial (C&I) Sector

Beyond government projects, the most dynamic source of demand comes from the private sector. Businesses across El Salvador—from manufacturing plants and agricultural operations to retail centers—face high electricity costs and occasional grid instability. Solar energy offers a direct solution to both challenges.

For these C&I clients, the primary motivators are:

Cost Reduction: Solar power provides a hedge against volatile electricity prices and can significantly lower operational expenditures.

Energy Security: On-site power generation reduces reliance on the national grid, ensuring business continuity during outages.

Corporate Sustainability: Increasingly, international supply chains and corporate responsibility initiatives require businesses to demonstrate a commitment to renewable energy.

This growing C&I demand represents a high-value market segment for locally produced modules, as these clients often prioritize quality, local support, and timely delivery.

Residential and Small-Scale Projects

Though smaller in scale than C&I or utility projects, the residential solar market is also expanding. As module prices become more accessible and public awareness grows, demand from homeowners and small businesses contributes to the overall market volume. A local manufacturer is well-positioned to serve this segment through a network of local installers.

The Regional Export Opportunity: Looking Beyond El Salvador’s Borders

A significant strategic error would be to view El Salvador in isolation. Its geographic location and trade agreements transform it into a powerful hub for exporting to neighboring countries.

Leveraging CAFTA-DR for Duty-Free Access

El Salvador is a signatory to the Central America-Dominican Republic Free Trade Agreement (CAFTA-DR). This agreement provides manufacturers based in El Salvador with duty-free access to a combined market that includes Costa Rica, the Dominican Republic, Guatemala, Honduras, Nicaragua, and, critically, the United States.

For an entrepreneur, a factory in El Salvador isn’t just serving a market of 6.5 million people; it has preferential access to a regional market of over 50 million. This dramatically expands the potential return on investment for a solar module manufacturing plant.

Analyzing Demand in Neighboring Markets

Neighboring countries like Guatemala, Honduras, and Nicaragua share similar energy challenges and renewable energy goals. Guatemala, for instance, has a strong C&I sector and is actively developing new solar projects. Honduras boasts some of the highest solar irradiation levels in the region, making it a prime market, while Nicaragua is also focused on increasing its share of renewable energy generation.

Producing modules in El Salvador allows a manufacturer to ship products to these markets more quickly and cost-effectively than competitors in Asia or Europe, creating a distinct logistical advantage.

A Framework for Estimating Your Potential Market Share

A theoretical understanding of market drivers is useful, but a business plan requires concrete numbers. The following steps provide a basic framework for this analysis.

Step 1: Quantifying Domestic Demand

Begin by segmenting the local market and estimating the potential annual demand in megawatts (MW).

Public Tenders: Research past and upcoming tender announcements from the Salvadoran government and CEL. This provides a baseline for utility-scale demand.

C&I Sector: Analyze the number of large-scale commercial enterprises in the country. Estimate their average energy consumption to project the potential for rooftop and ground-mounted solar installations.

Distribution Channels: Engage with local solar installers to understand their average monthly or annual module procurement volumes.

This process helps build a data-driven model of the addressable domestic market. Based on J.v.G. Technology GmbH’s experience with turnkey projects, a new facility often targets an initial market capture of 5-10% of the estimated local demand in its first two years of operation.

Step 2: Assessing Regional Export Viability

A similar analysis is necessary for each target CAFTA-DR country. Key considerations include:

Logistics and Shipping Costs: What are the costs and timelines for transporting modules from El Salvador to Guatemala City, Tegucigalpa, or Managua?

Local Competition: Who are the incumbent module suppliers in those markets? What are their strengths and weaknesses?

Regulatory Landscape: Are there specific certifications or import requirements for solar modules in each country?

Step 3: Defining Your Niche and Production Capacity

With a detailed understanding of local and regional demand, the final step is to define your strategic position. Will your factory produce high-efficiency modules for the premium C&I market, or focus on standard, cost-effective modules for large tenders? This decision directly shapes the required investment in your solar production line and overall business strategy. An initial capacity of 20–50 MW is a common starting point for new entrants, offering a balance between investment scale and market entry capabilities.

Common Questions on Market Entry in El Salvador

What are the main challenges for a new solar manufacturer in this region?

The primary challenges include navigating regional logistics, understanding the specific technical and regulatory requirements of each export market, and competing with established international module suppliers. Building strong local distribution partnerships is essential for success.

How does El Salvador’s business environment support new investment?

Several factors strengthen the business environment for solar investment in El Salvador. The economy is dollarized, which eliminates currency exchange risk. The government has established clear policies supporting foreign investment and renewable energy. Its membership in CAFTA-DR provides a significant, stable advantage for export-oriented manufacturing.

What is a realistic initial production capacity for a new factory?

For an entrepreneur entering the market, a semi-automated line with an annual production capacity of 20 MW to 50 MW is a typical and realistic starting point. This scale allows for serving both domestic C&I projects and initial export orders without requiring the massive capital investment of a gigawatt-scale factory.

Conclusion: From Market Analysis to Business Plan

Evaluating the market size for a new solar module factory in El Salvador reveals a clear opportunity. The country offers a stable and growing domestic market, supported by government policy and strong commercial demand. More importantly, it serves as a strategic gateway to the broader Central American region, with preferential trade access that multiplies the potential market size.

A thorough market analysis is the essential first step in any serious investment consideration. It transforms a general idea into a quantifiable opportunity—providing the data needed to develop a credible financial model and a comprehensive business plan. For entrepreneurs without a technical background in photovoltaics, structured guidance through this process can be invaluable.