Imagine securing a multi-million dollar deal for state-of-the-art solar manufacturing equipment. The machines are built, tested, and crated. They arrive at the Port of Malabo on schedule, a critical milestone for your new venture. But there they sit—for weeks, then months—entangled in a web of unforeseen customs declarations, tariff disputes, and documentation errors.

This costly and frustrating scenario is a reality for many unprepared investors. It underscores a critical truth: a solar factory’s success hinges not just on technology, but on mastering the logistics of importing it.

For entrepreneurs entering Equatorial Guinea’s emerging solar sector, understanding the customs and tariff landscape isn’t a secondary task—it’s a foundational pillar of project planning. This guide provides a clear overview of the procedures, costs, and potential challenges involved, helping ensure your equipment’s journey from the manufacturer to your factory floor is as efficient as possible.

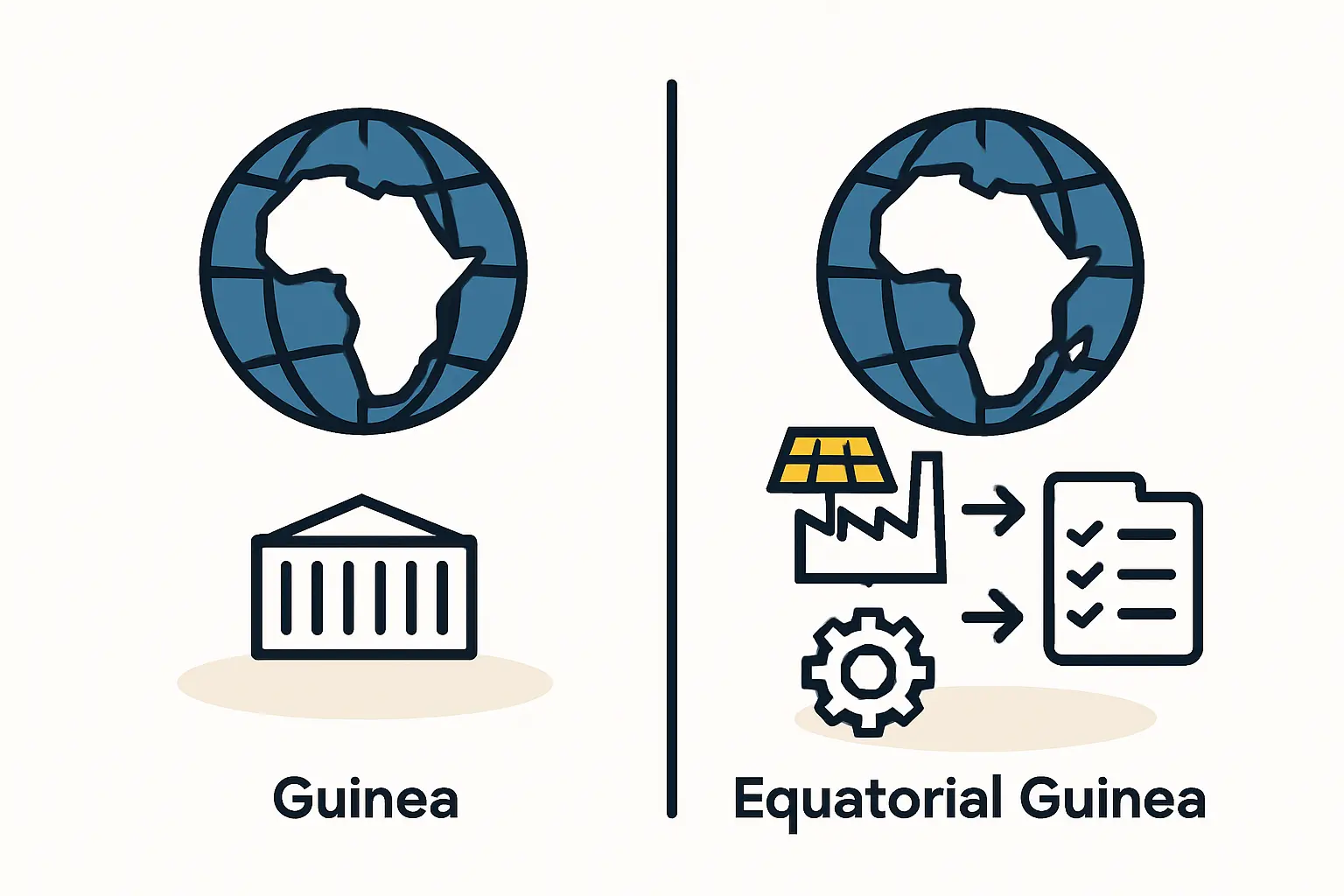

Understanding Equatorial Guinea’s Customs Framework

As a member of the Economic and Monetary Community of Central Africa (CEMAC), Equatorial Guinea operates within a harmonized customs union. This simplifies certain aspects of trade but also introduces specific regulations that every investor must understand.

The Role of CEMAC and the Common External Tariff (CET)

The primary governing structure for imports is the CEMAC Common External Tariff (CET). This system classifies goods into four categories, each with a corresponding duty rate:

- Category I: Essential goods (0% duty)

- Category II: Raw materials and basic equipment (5% duty)

- Category III: Intermediate and miscellaneous goods (10% duty)

- Category IV: Consumer goods (20% duty)

Fortunately for investors in the industrial sector, most heavy machinery, including equipment for a turnkey solar module production line, typically falls into Category II, benefiting from a relatively low 5% duty rate.

Key Financial Components of an Import Declaration

When budgeting for equipment importation, it is crucial to account for all applicable taxes and fees beyond the base customs duty. The total cost is calculated based on the CIF value (Cost, Insurance, and Freight) of the goods.

- Customs Duty: Typically 5% for capital goods and machinery.

- Value Added Tax (VAT / IVA): The standard rate in Equatorial Guinea is 15%, applied to the CIF value plus the customs duty.

- CEMAC Community Integration Tax (TCI): A 1% levy applied to the CIF value.

- OHADA Levy: A 0.05% fee contributing to the Organization for the Harmonization of Business Law in Africa.

Based on these figures, an investor should budget for total import taxes and duties of approximately 21-23% of the equipment’s total CIF value. For a significant machinery investment, this represents a substantial capital outlay that must be factored into the initial budget for a 20-50 MW solar factory.

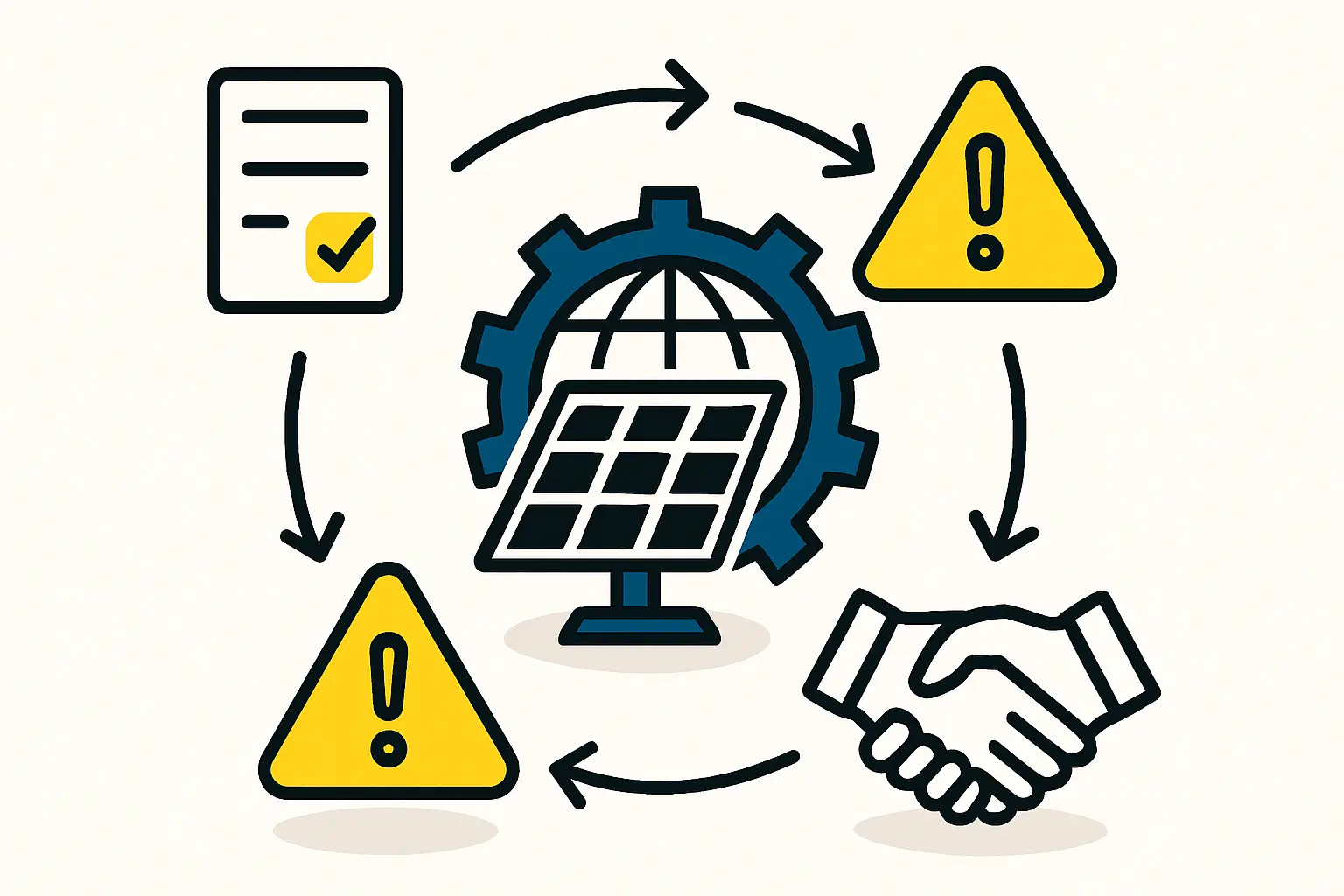

The Importation Process: A Step-by-Step Guide

Navigating the customs process requires meticulous preparation and adherence to established procedures. While engaging a licensed local customs broker is mandatory, understanding the steps involved empowers you to oversee the process effectively.

Step 1: Pre-Shipment Documentation

Long before your equipment leaves its country of origin, your team and the supplier must prepare a comprehensive set of documents. Any inaccuracies or omissions at this stage are a primary cause of costly delays. Essential documents include:

- Commercial Invoice: Must detail the seller, buyer, description of goods, Harmonized System (HS) codes, and value.

- Bill of Lading (B/L) or Air Waybill (AWB): The contract of carriage between the shipper and the carrier.

- Packing List: An itemized list of the contents of each crate or container, including weights and dimensions.

- Certificate of Origin: Verifies the country where the goods were manufactured.

- Inspection Certificate: Equatorial Guinea often requires a pre-shipment inspection (PSI) from an authorized agency to verify the quality, quantity, and value of the goods.

Step 2: Customs Declaration and Brokerage

Upon arrival, your designated customs broker will use the documentation to file an official customs declaration with Equatorial Guinea’s customs authority, the Dirección General de Aduanas. This declaration includes the classification of goods using HS codes, which determines the applicable tariff rates. This step is critical, as misclassification can lead to penalties and delays.

Step 3: Inspection and Valuation

Equatoguinean customs officials reserve the right to physically inspect the shipment to verify that its contents match the declaration. They will also assess the declared value to ensure it aligns with market realities and prevent under-invoicing. This is why a transparent, accurate commercial invoice is paramount.

Step 4: Duty and Tax Payment and Final Release

Once the declaration is accepted and any inspection is complete, the customs authority issues a final assessment of duties and taxes owed. After your company settles this payment, a release order is granted, and the equipment can be moved from the port to your factory site. Based on experience with similar turnkey projects, a smooth clearance process can take two to three weeks, while one with documentation issues can extend beyond two months.

Logistical Challenges Beyond the Port

Clearing customs is only half the battle. The journey from the port—whether Malabo or Bata—to the final factory location presents its own logistical hurdles.

- Infrastructure: While port facilities have seen upgrades, inland transportation can be challenging. It is vital to plan the route, assess road quality, and secure suitable heavy-haulage trucks and cranes for unloading.

- Local Expertise: Partnering with a reliable local logistics firm is essential. They have the ground-level knowledge to navigate local conditions, handle permits for oversized cargo, and provide the manpower and equipment needed for safe transport and installation.

- Coordination: The hand-off from the customs broker to the logistics provider requires seamless coordination. This ensures that once the equipment is released, there is no delay in moving it to a secure location, minimizing the risk of damage or demurrage fees at the port.

Frequently Asked Questions (FAQ)

Q: Are there any investment incentives or tax exemptions for renewable energy projects in Equatorial Guinea?

A: Equatorial Guinea’s government has expressed strong interest in diversifying its economy and promoting renewable energy. While permanent, codified exemptions for solar manufacturing equipment may not exist, it is often possible to apply for special dispensations or benefits under the country’s investment code. This requires proactive engagement with government ministries and a well-prepared investment proposal.

Q: What are HS Codes and why are they so important?

A: The Harmonized System (HS) is an internationally standardized system of names and numbers used to classify traded products. Customs authorities use HS codes to determine the duties and taxes applicable to imported goods. Using the correct HS code for each piece of machinery (e.g., a laminator vs. a sun simulator) is crucial for a compliant and smooth customs declaration. Understanding the full solar panel manufacturing process helps in correctly identifying and classifying each machine.

Q: Can I manage the customs process myself to save costs?

A: In Equatorial Guinea, as in most countries, using a nationally licensed customs broker or clearing agent is mandatory for commercial imports. These professionals are registered with the customs authority, understand specific legal and procedural nuances, and are authorized to submit declarations on your behalf. Attempting to bypass this step is not a viable option.

Q: How should I choose a local customs and logistics partner?

A: Look for partners with documented experience handling heavy industrial machinery, not just general consumer goods. Ask for case studies or references from other industrial projects. Their familiarity with the specific requirements for capital equipment at the Ports of Malabo and Bata will be invaluable.

Successfully importing solar manufacturing equipment into Equatorial Guinea is a complex but manageable process. It demands early planning, rigorous attention to detail, and collaboration with experienced local partners. By treating logistics and customs clearance as a core component of your project strategy, you can avoid costly delays and lay a solid foundation for a successful and timely factory launch.