For many entrepreneurs and investors, the prospect of entering the solar manufacturing industry is both promising and complex. The global shift toward renewable energy presents a clear opportunity, yet the specifics of factory investment, operational costs, and potential returns can be unclear, especially for those without a background in photovoltaics. This challenge is particularly acute in emerging markets where local data is scarce.

This article outlines a financial framework for a hypothetical 25 MW solar module assembly plant in Eritrea. By breaking down the essential cost and revenue components, it offers a practical guide for any business professional evaluating such an investment, whether in the Horn of Africa or another developing region.

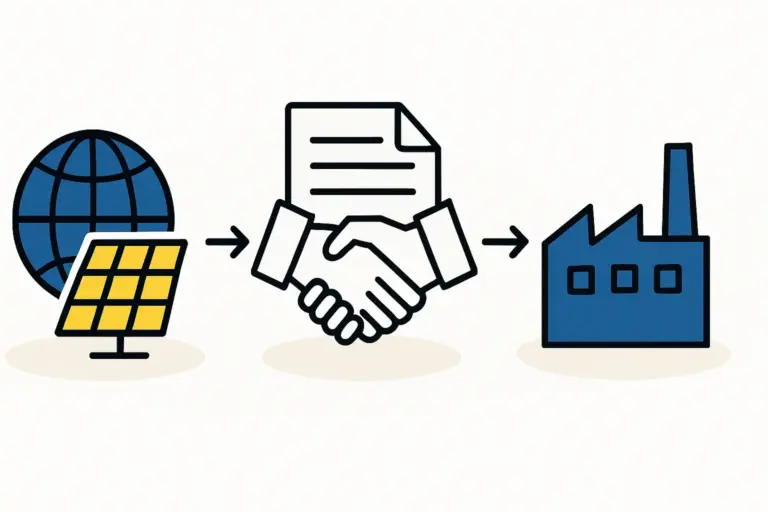

The Strategic Case for Local Solar Manufacturing in Eritrea

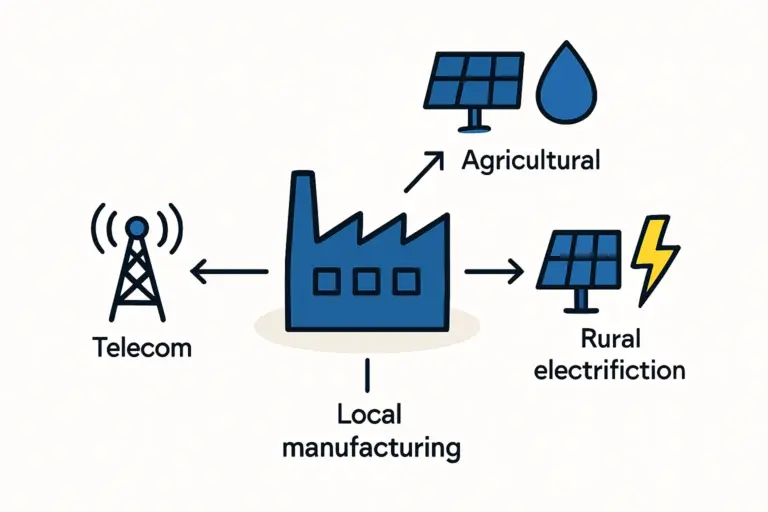

Eritrea, like many nations in the region, has immense solar potential but faces challenges with energy access and grid stability. Establishing a local solar module factory addresses several strategic objectives simultaneously:

- Energy Independence: Reducing reliance on imported fuel and finished solar panels enhances national energy security.

- Economic Development: A manufacturing facility creates skilled jobs, fosters a local supply chain, and retains capital within the country.

- Customized Products: Locally produced modules can be designed specifically to withstand regional climate conditions, like high ambient temperatures and dust, which impact performance and longevity.

- Reduced Costs: Eliminating international shipping costs and import tariffs on finished modules can make solar energy more affordable for local projects.

A 25 MW facility is often considered an ideal entry point. It is large enough to achieve economies of scale and serve significant projects, yet small enough to be a manageable first step into the industry.

Deconstructing the Investment: Capital Expenditures (CAPEX)

Capital Expenditures, or CAPEX, are the upfront investments required to establish the factory before production can begin. For a 25 MW solar module assembly line, these costs fall into three main categories.

Core Production Machinery

This is the heart of the factory. A semi-automated 25 MW production line includes several key machines working in sequence to assemble solar modules. The essential equipment includes:

- Automatic Stringer Machine: Connects individual solar cells into strings.

- Layup Station: Assembles the layers of the module (glass, EVA, cell strings, backsheet).

- Laminator: Fuses the layers together under heat and vacuum to create a durable, weatherproof laminate.

- Framing Machine: Attaches the aluminum frame to the laminate.

- Sun Simulator (Flasher): Tests the finished module’s electrical performance under standard conditions.

The total investment for a complete, high-quality European-standard 25 MW line typically ranges from €1.5 million to €3 million. This variance depends on the level of automation and the manufacturer. A detailed guide to the function of each piece of solar manufacturing equipment can provide further technical context.

Factory Building and Infrastructure

The physical plant must be set up to house the production line. A 25 MW line requires a factory floor space of approximately 2,500 to 3,500 square meters. This area accommodates the machinery, raw material storage, finished goods warehousing, and administrative offices.

CAPEX in this area includes:

- Land acquisition or long-term lease costs.

- Building construction or retrofitting an existing warehouse.

- HVAC systems, particularly for maintaining a clean, climate-controlled environment on the production floor.

While highly location-dependent, these costs are a critical component of the initial financial plan. The specific factory building requirements are crucial for ensuring efficient workflow and product quality.

Auxiliary Systems and Initial Setup

Beyond the main production line, several other one-time costs are also necessary:

- Compressed Air and Electrical Systems: Powering the machinery.

- Initial Spare Parts Inventory: Essential for minimizing downtime.

- Logistics: Shipping of equipment from the manufacturer, customs clearance, and insurance.

- Installation and Commissioning: Costs for expert technicians to install, calibrate, and start the production line.

Based on experience from J.v.G. turnkey projects, budgeting an additional 15-20% of the machinery cost for these auxiliary items is a reliable guideline.

Understanding Operational Costs (OPEX)

Operational Expenditures, or OPEX, are the recurring costs of running the factory once production begins. These costs directly influence the final price of each solar module.

Bill of Materials (BOM)

The single largest component of OPEX is the Bill of Materials—the cost of the raw materials needed for each module. This typically accounts for 75-85% of the total production cost per module. The primary materials are:

- Solar Cells

- Tempered Solar Glass

- EVA (Ethyl Vinyl Acetate) encapsulant films

- Backsheet (or a second pane of glass for Glass-Glass modules)

- Aluminum Frames

- Junction Boxes with cables and connectors

Securing a reliable and cost-effective supply chain for these materials is one of the most critical operational challenges for a new manufacturer.

Labor and Staffing

A semi-automated 25 MW line operating on a single shift typically requires a workforce of 25 to 35 employees. This includes:

- Machine operators

- Quality control technicians

- Maintenance engineers

- Warehouse and logistics staff

- Management and administrative personnel

While labor costs in Eritrea may be lower than in Europe or North America, investing in proper training is non-negotiable to ensure high-quality production and operational efficiency.

Utilities, Maintenance, and Overheads

This category includes all other recurring costs:

- Electricity: Powering the production line, especially the laminator.

- Rent or Lease Payments: If the building is not owned.

- Maintenance: Consumables and scheduled servicing for machinery.

- Certifications: Costs associated with obtaining and maintaining IEC or other international quality certifications.

- Administrative Costs: Salaries, office supplies, and other general business expenses.

Projecting Revenue and Profitability

With a clear understanding of costs, an investor can begin to project potential revenue and assess the viability of the business.

Production Volume and Sales Price

A 25 MW factory, operating at a standard utilization rate, can produce approximately 60,000 to 70,000 solar modules per year (assuming an average module power of 380-400 Wp).

Revenue is a simple calculation: Annual Production (in MW) x Average Selling Price per Watt ($/Wp).

The selling price is determined by the local market, where a domestic manufacturer has a key advantage: the ability to offer competitive pricing by avoiding the significant international freight and import duties that apply to finished panels from Asia or Europe. Potential sales channels include:

- Government-led utility-scale solar projects.

- Commercial and industrial rooftop installations.

- Distributors serving the residential solar market.

- Export to neighboring countries within a regional trade bloc.

A Sample Profitability Outlook

The gross margin per module is calculated as the selling price minus the total OPEX per module (BOM, labor, and overheads).

While precise figures depend on local material sourcing, labor rates, and market prices, a well-managed 25 MW facility can be a profitable venture. Financial models developed for J.v.G. turnkey projects often show that a factory of this size can achieve a payback period of 3 to 5 years, provided there is stable market demand and efficient operation.

Frequently Asked Questions (FAQ)

What is the total estimated investment to start a 25 MW factory?

A comprehensive budget should account for machinery, building preparations, and initial working capital for raw materials. A realistic total investment range is between €2.5 million and €5 million.

How long does it take to set up such a factory?

From placing the machinery order to starting commercial production, a typical timeline is 9 to 12 months. This includes manufacturing lead times, shipping, installation, and staff training.

Do I need a technical background to start this business?

No. Many successful factory owners are business professionals who partner with experienced technical consultants. The key is to have a strong business plan and rely on experts for the technical implementation. This is the core principle behind platforms like pvknowhow.com—to guide non-experts through the process.

Is 25 MW a good starting size?

Yes. It strikes an effective balance. It is large enough for commercial viability and to be taken seriously by material suppliers, yet small enough to keep the initial investment manageable and align with the demand of a developing national market.

What are the biggest financial risks?

The primary risks include volatility in the price of raw materials (especially solar cells), supply chain disruptions, currency fluctuations (as machinery and materials are often purchased in EUR/USD), and unforeseen changes in government energy policy or import tariffs.

Conclusion: From Model to Reality

Establishing a 25 MW solar module factory in a market like Eritrea is a significant industrial undertaking, but one built on a foundation of clear financial principles. By systematically analyzing capital expenditures, operational costs, and realistic revenue streams, an investor can transform a promising idea into a bankable business plan.

This financial model serves as a starting point. For investors ready to take the next step, our guide on how to start a solar factory provides the complete strategic roadmap for turning this model into reality.