For many entrepreneurs in the renewable energy sector, the initial financial analysis can be a significant hurdle. The capital required to establish a modern manufacturing facility is substantial, and the timeline to profitability can seem long.

In certain strategic locations, however, government incentives can fundamentally change the financial equation, turning a challenging investment into a highly attractive opportunity. Eritrea is one such location, with a well-defined framework of fiscal incentives designed to attract precisely this kind of industrial development.

This article offers a detailed look at the tax holidays and customs duty exemptions available to investors in Eritrea’s renewable energy manufacturing sector. It explains the legal foundation, eligibility criteria, and the practical impact these incentives have on a project’s financial viability, particularly for those planning to establish a solar module production line.

Understanding the Eritrean Investment Framework

The primary legal instrument governing foreign and domestic investment in Eritrea is Investment Proclamation No. 18/1991. This proclamation establishes a clear, stable framework to encourage private sector participation in the nation’s economy.

The central body responsible for administering this framework is the Eritrean Investment Centre (EIC). The EIC acts as the main point of contact for investors, facilitating the application and approval process for new ventures.

The proclamation aims to create a competitive investment climate by offering a package of fiscal incentives. For entrepreneurs in the solar industry, two of these are particularly significant: tax holidays on corporate profits and exemptions from customs duties on imported capital goods.

Key Financial Incentives for Solar Manufacturing Investors

For a capital-intensive project like a solar module factory, these government-backed incentives directly address the two largest financial pressure points: initial setup costs and the time it takes to achieve positive cash flow.

Tax Holidays: A Period of Profit without Taxation

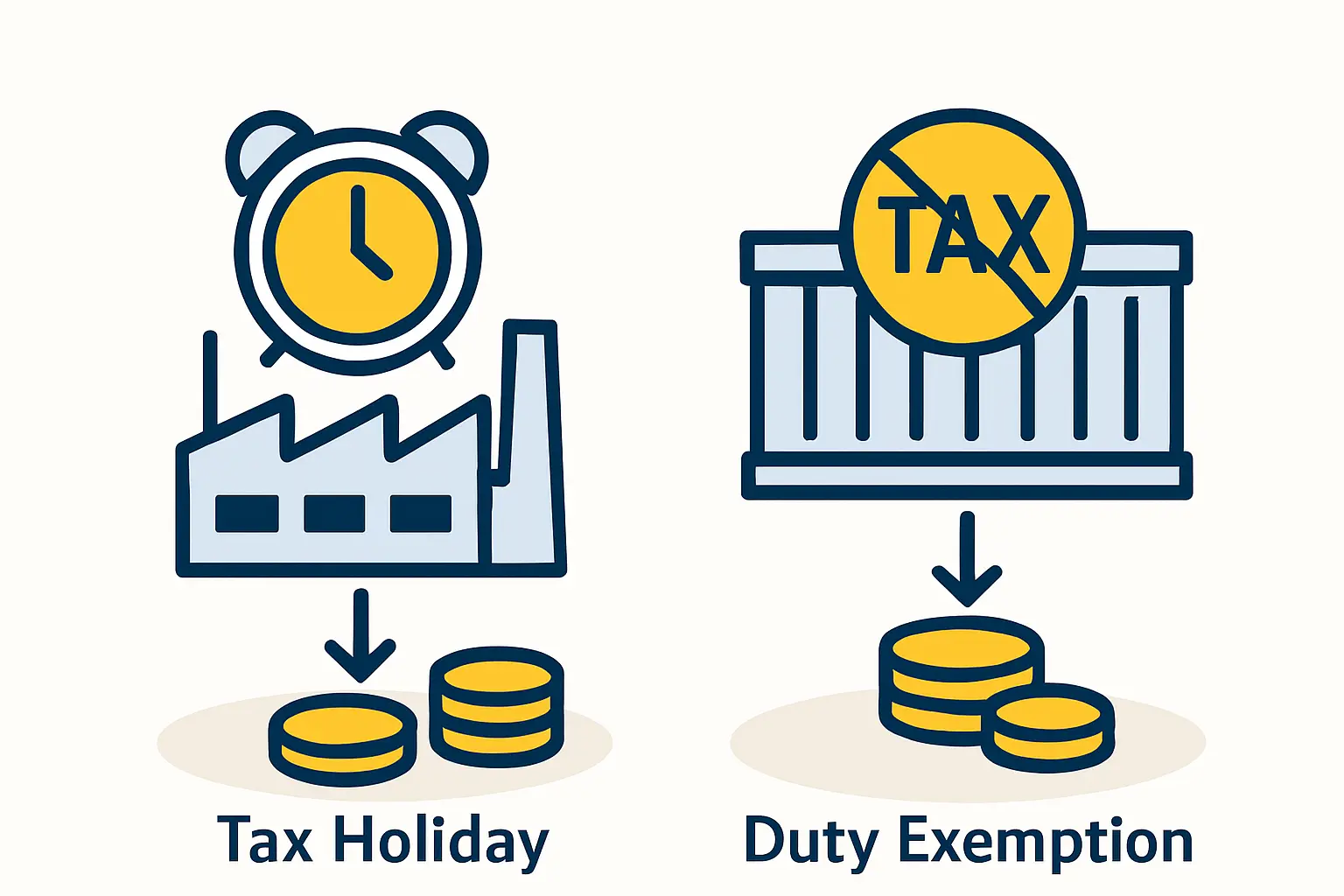

A tax holiday is a temporary period during which a new business is exempt from paying corporate income tax. Under Eritrean law, new investment projects can be granted a tax holiday of up to five years. The exact duration is determined by the Eritrean Investment Centre based on the project’s sector, investment volume, and strategic importance to the national economy.

-

Impact on Profitability: This exemption means that for the first several years of operation—a critical period for recovering initial costs—all profits can be reinvested in the business or returned to investors without being taxed. This significantly accelerates the project’s break-even point and enhances its overall return on investment (ROI).

-

Eligibility: To qualify, an investor must first secure an Investment License from the EIC. The project proposal must demonstrate its viability and contribution to the local economy, such as through job creation and technology transfer. Renewable energy manufacturing is considered a priority sector, making such projects strong candidates for the maximum holiday period.

Customs Duty Exemptions: Reducing Initial Capital Expenditure

The exemption from customs duties on imported capital goods offers the most immediate financial benefit. Setting up a solar panel factory requires importing sophisticated machinery and equipment, which represents a major portion of the initial investment.

-

Scope of Exemption: Investment Proclamation No. 18/1991 allows for a 100% exemption from customs duties and import taxes on all necessary capital goods, machinery, equipment, and construction materials. Spare parts imported for the project may also be exempted for up to five years.

-

Practical Savings: This provision creates substantial direct savings. For a project involving a turnkey solar manufacturing line, these duties could otherwise add a considerable percentage to the total cost. Eliminating this expense lowers the barrier to entry and frees up capital for operational expenses or other strategic purposes.

Eligibility and Application Process: A Step-by-Step Guide

Accessing these incentives is a structured process managed by the Eritrean Investment Centre. A clear understanding of the procedure is essential for any prospective investor.

Who is Eligible?

The incentives are available to both foreign investors and Eritrean nationals, ensuring a level playing field. The fundamental requirement is the submission of a sound investment proposal that aligns with the country’s development priorities. A well-structured business plan for solar manufacturing is the cornerstone of a successful application.

The Application Procedure

-

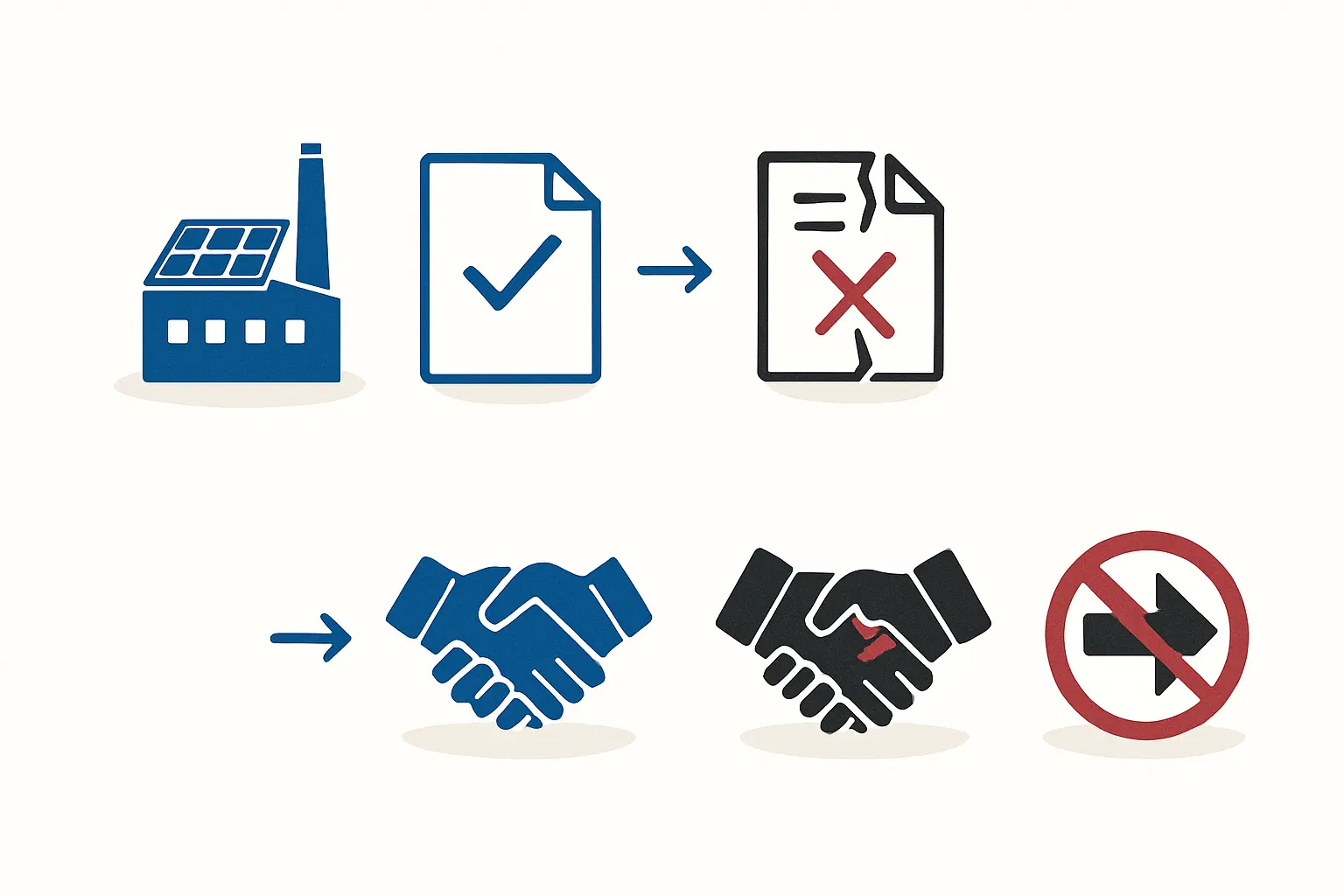

Proposal Submission: The investor submits a formal application to the Eritrean Investment Centre. This application must include a detailed project proposal outlining the business concept, technical specifications, market analysis, and financial projections.

-

EIC Review: The EIC evaluates the proposal based on its economic feasibility, potential for job creation, environmental impact, and alignment with national goals.

-

Issuance of Investment License: Upon approval, the EIC issues an Investment License. This legal document officially recognizes the project, grants it the right to operate in Eritrea, and specifies the fiscal incentives granted, such as the duration of the tax holiday and the scope of duty exemptions.

Based on experience from numerous J.v.G. turnkey projects, the clarity and thoroughness of the initial application are paramount. A professional and comprehensive business plan significantly streamlines the approval process.

The Strategic Advantage for Solar Entrepreneurs

For an entrepreneur entering the solar manufacturing space, Eritrea’s incentive package offers a powerful competitive advantage. The combination of a growing regional demand for renewable energy and a supportive fiscal environment creates a compelling business case.

-

Reduce Startup Costs: Duty exemptions directly lower the initial capital outlay, making the project more financially accessible.

-

Achieve Profitability Faster: A five-year tax holiday allows the business to retain 100% of its profits during its crucial early growth phase.

-

Enhance Project Viability: Together, these incentives improve key financial metrics, making the project more attractive to lenders and equity partners. This is particularly relevant in emerging markets, where demonstrating a robust financial model is essential for securing financing.

Frequently Asked Questions (FAQ)

What is the corporate tax rate in Eritrea after the tax holiday expires?

Once the tax holiday period concludes, the business becomes subject to the standard corporate income tax rate stipulated by Eritrean law.

Are there provisions for the repatriation of profits for foreign investors?

Yes, Investment Proclamation No. 18/1991 guarantees foreign investors the right to freely and fully remit profits, dividends, and interest income in their currency of choice.

Can these incentives be applied to the expansion of an existing factory?

Yes, incentives may be granted for the expansion or upgrading of an existing enterprise. The application would be reviewed by the EIC based on the merits of the expansion plan.

Is there a specified minimum investment amount to qualify for these incentives?

The proclamation does not set a rigid minimum investment threshold. The focus is on the viability, scale, and strategic value of the proposed project rather than a specific monetary figure.

Conclusion: Translating Policy into Opportunity

Eritrea’s investment policies provide a clear and advantageous pathway for entrepreneurs looking to establish solar manufacturing operations. The tax holidays and duty exemptions are not abstract legal clauses; they are practical financial tools that directly reduce risk and enhance profitability.

However, realizing these benefits requires diligent preparation. A successful venture is built on thorough planning, technical expertise, and a comprehensive understanding of the local regulatory landscape. For business professionals exploring this opportunity, the first step is to develop a robust business plan that not only meets the requirements of the Eritrean Investment Centre but also lays the groundwork for a sustainable and profitable enterprise.