An entrepreneur planning to build a solar panel factory in Africa or the Middle East confronts a complex set of challenges. Beyond the technical aspects of production, they face significant administrative hurdles: navigating local bureaucracy, establishing a corporate structure credible to international investors and suppliers, and managing finances across different jurisdictions.

The core concern is often how to create a stable, internationally recognized business entity when the physical manufacturing operations are based in an emerging market. This challenge is leading many entrepreneurs to explore innovative corporate structures. One powerful yet often overlooked solution is to establish a ‘digital headquarters’ through Estonia’s e-Residency program. This unique European Union framework offers a robust, location-independent foundation for managing a solar manufacturing enterprise, effectively separating corporate governance from the physical location of the factory.

What is Estonian e-Residency?

Estonian e-Residency is a government-issued digital identity available to anyone in the world. It is not citizenship, a visa, or a tax residency permit. Instead, it grants the holder secure access to Estonia’s advanced digital services. For entrepreneurs, this unlocks the ability to establish and manage a legitimate EU-based company entirely online, from anywhere.

The program provides an e-Residency kit with a smart ID card and a card reader. This hardware, combined with secure PIN codes, allows for digital identification and carries the legal equivalent of a handwritten signature. Recognized throughout the European Union, this digital signature enables entrepreneurs to sign contracts, submit official documents, and manage company banking remotely.

Key Advantages for International Solar Entrepreneurs

For those looking to enter the capital-intensive field of solar manufacturing, the Estonian framework offers several strategic benefits that directly address common challenges.

Access to the European Union (EU) Legal Framework

An Estonian company operates within the stable and highly respected legal and financial framework of the EU. This lends it immediate credibility when dealing with international partners. When sourcing high-precision machinery from German or Swiss suppliers, for instance, or seeking project financing from international development banks, an EU-registered entity can significantly streamline negotiations and build trust.

A Favourable Tax System for Growth

Perhaps the most compelling advantage for a new manufacturing venture is Estonia’s unique corporate tax system. Estonian companies have a 0% corporate income tax on all reinvested and retained profits. Tax is levied at a flat rate of 20% only when profits are distributed to shareholders as dividends.

For a new solar factory, where the initial investment is substantial and early profits must be reinvested into expanding capacity or purchasing new equipment, this system is invaluable. It allows capital to be compounded and redeployed for growth without being diminished by taxes, accelerating the path to profitability and scale.

Simplified, Location-Independent Administration

Estonia’s business ecosystem is built on digital efficiency. Company formation, tax declarations, and annual reporting are all handled online through a simple interface. This minimizes bureaucracy and administrative overhead, freeing business owners to focus on the core operational challenges of running the factory—a stark contrast to the paper-intensive and time-consuming administrative processes common in many other jurisdictions.

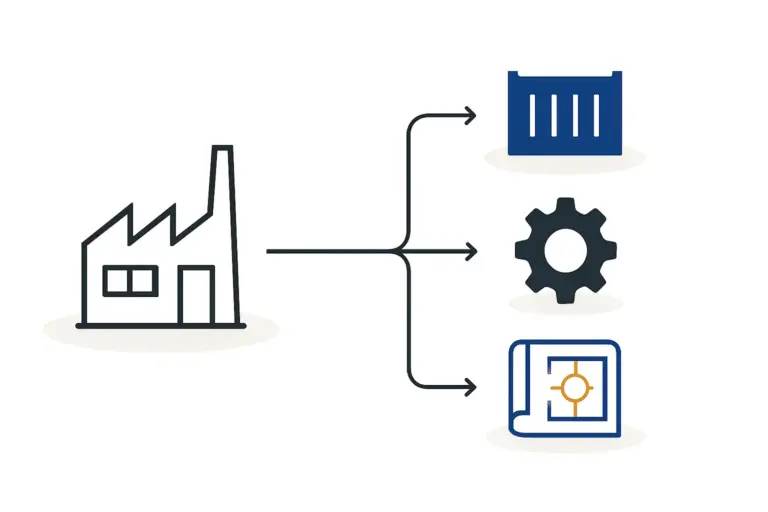

Structuring Your Solar Business: An Estonian HQ for a Global Operation

The ‘aha moment’ for many entrepreneurs is realizing how to structure their business using this tool. The Estonian company (typically a private limited company, or Osaühing – OÜ) does not need to be where the factory is located. Instead, it can serve as the holding company or central management entity.

This two-part structure works as follows:

-

The Estonian Holding Company (OÜ): This EU-based entity handles international contracts, manages intellectual property, receives payments from international clients, and secures financing. It serves as the public-facing corporate headquarters.

-

The Local Operating Entity: This is the physical factory in the entrepreneur’s home country (e.g., Nigeria, Egypt, or Mexico). It employs local staff, manages day-to-day production, and complies with all local manufacturing and environmental regulations.

This separation of corporate governance from physical operations offers powerful risk mitigation. The financial and legal core of the business is protected within the stable EU system, while the factory operates under local laws. This structure is a sophisticated component of a well-planned business model designed for global competitiveness.

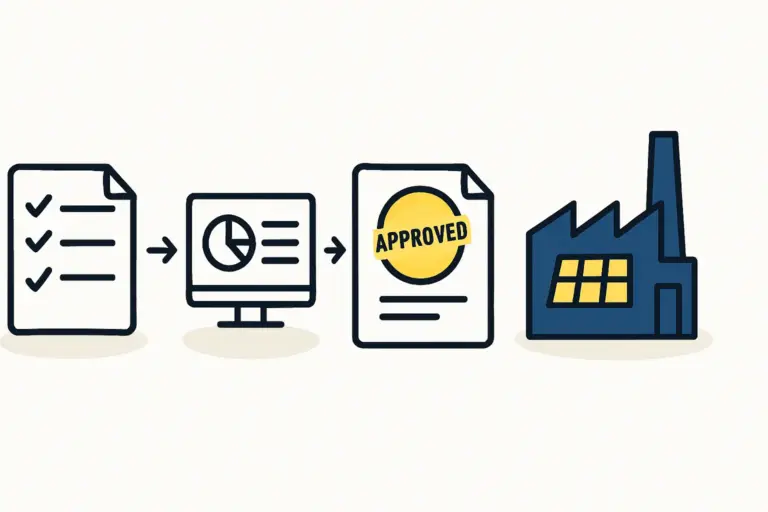

The Process: A Step-by-Step Guide to Registration

The journey to establish an Estonian company is remarkably straightforward. While there are nuances, the primary steps are clear and can be completed in a matter of weeks.

-

Apply for e-Residency: The first step is to complete an online application on the official Estonian e-Residency website, providing personal details and your motivation for applying. The application fee is typically between 100 EUR and 130 EUR.

-

Collect the e-Residency Kit: Once the background check is complete and your application is approved (usually within 3-8 weeks), you can collect the kit from a designated Estonian embassy or consulate around the world.

-

Engage a Local Service Provider: By law, every Estonian company must have a legal address and a licensed contact person in Estonia. This is a critical step for non-residents. Numerous service providers offer packages that include these services, as well as accounting and compliance support.

-

Register the Company Online: With your e-Residency card and a service provider in place, you can register the company online through the Estonian Business Register. The process can take as little as one business day.

-

Establish Banking Solutions: The final step is opening a bank account. This can be done entirely online with a modern fintech provider (like Wise or Payoneer) or with a traditional Estonian bank, which may require an in-person visit.

Once these steps are complete, the entrepreneur has a fully functional EU company ready to support the larger project to start a solar panel factory.

Practical Considerations for Solar Manufacturing

While the e-Residency framework is powerful, it is essential to approach it with a clear understanding of its role and limitations.

-

Local Compliance is Separate: The Estonian company does not replace the need for local business permits, environmental approvals, and labor law compliance for the physical factory. Entrepreneurs remain fully responsible for meeting all legal requirements in the country of operation.

-

Tax Advisory is Crucial: A dual-entity structure creates cross-border tax implications, such as transfer pricing (how the holding company and the factory transact with each other). Seeking professional tax advice is imperative to ensure full compliance in both Estonia and the factory’s home country.

-

Focus on Core Operations: The administrative efficiency gained through e-Residency should be leveraged to concentrate on what matters most: setting up a high-quality, efficient, and profitable solar module production line.

Frequently Asked Questions (FAQ)

Does e-Residency grant me the right to live in Estonia or the EU?

No. E-Residency is a digital identity for business purposes and does not confer any rights of physical residency, citizenship, or travel within the EU.

Can my physical factory be located anywhere in the world?

Yes. The Estonian company can manage or own an operational entity located in any country, provided the local laws of that country permit such a structure.

What are the ongoing costs of an Estonian company?

Annual costs typically include fees for the local service provider (for the legal address and contact person), accounting services, and the submission of an annual report. These costs are generally low compared to traditional corporate structures.

Is an e-Residency company legal and recognized internationally?

Absolutely. It is a legally registered company within the European Union and is recognized as such by banks, governments, and business partners worldwide.

Conclusion and Next Steps

For international entrepreneurs entering the solar manufacturing industry, Estonia’s e-Residency program offers a modern, strategic solution to the long-standing challenges of corporate structuring and international credibility. By creating a location-independent EU company, a business owner can build a resilient, growth-oriented enterprise with a favorable tax environment and simplified administration.

This corporate framework provides a solid foundation, but it is only one part of the equation. The venture’s success ultimately depends on meticulous planning and execution of the manufacturing operation itself. Comprehensive guidance on factory layout, machine selection, and process optimization is essential. Structured educational resources can help entrepreneurs navigate these technical and operational complexities with confidence.