For entrepreneurs entering the solar manufacturing sector, financial models are often dominated by two factors: the high cost of capital equipment and the long-term impact of corporate taxation. But certain jurisdictions are changing this equation. The Kingdom of Eswatini, through its designated Special Economic Zones (SEZs), offers a framework designed to attract high-value industrial investment, creating a compelling business case for new solar module factories.

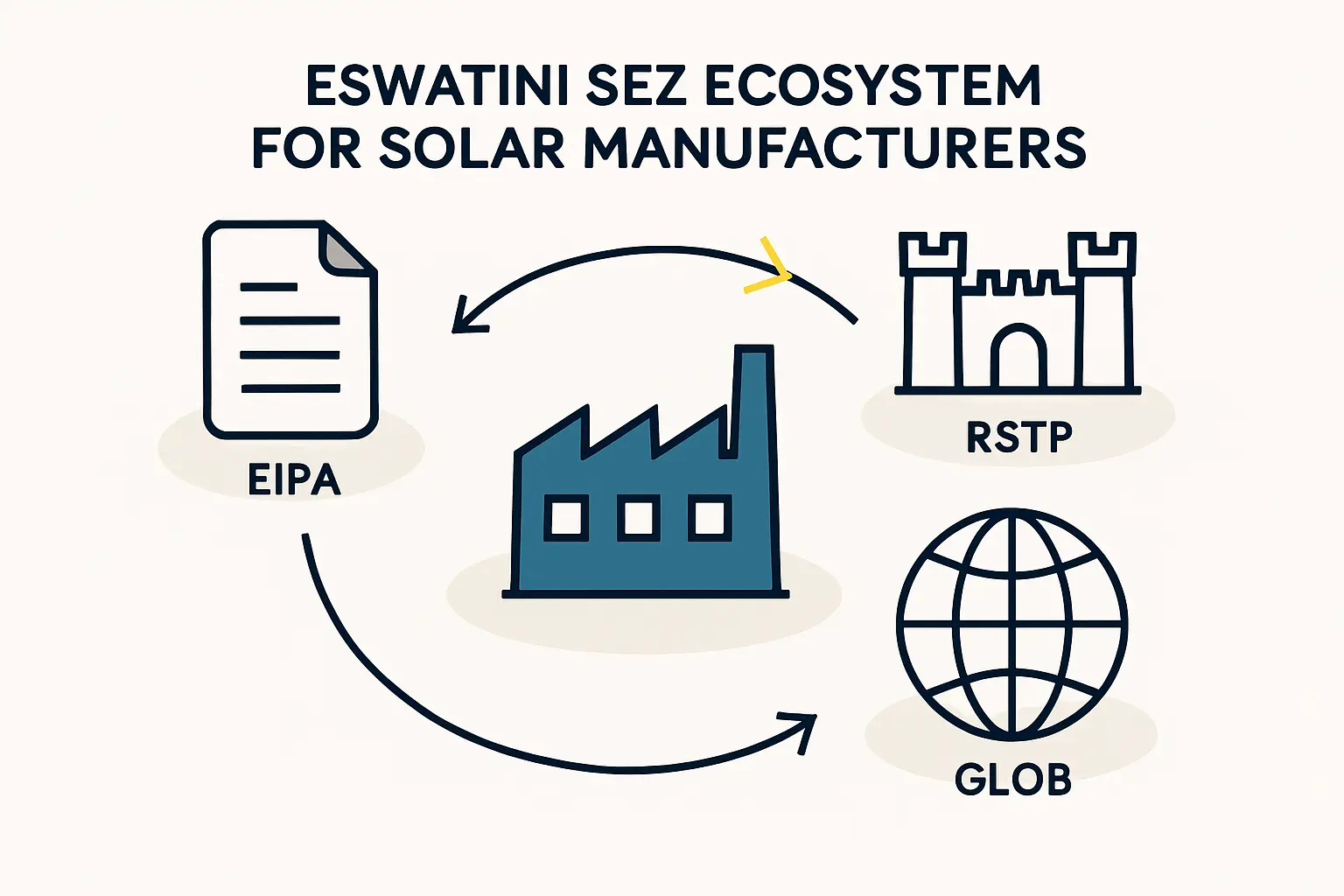

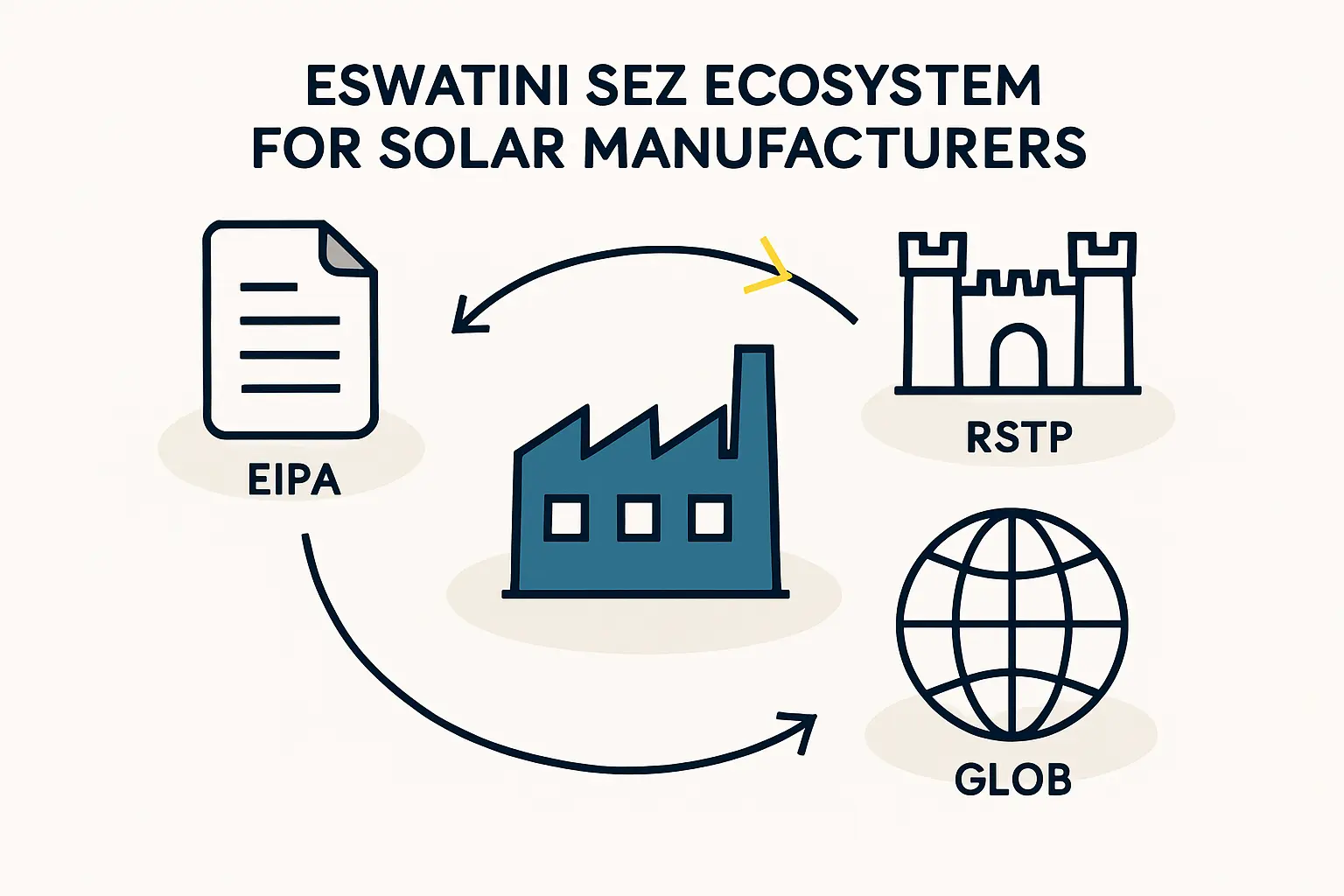

This analysis details the fiscal and operational incentives available to solar manufacturers within Eswatini’s SEZs, such as the Royal Science and Technology Park (RSTP). We explain how these government-backed programs can significantly reduce initial setup costs and improve long-term profitability for investors entering the African solar market.

What is a Special Economic Zone (SEZ)? A Primer for Investors

A Special Economic Zone is a geographically defined area within a country where business and trade laws differ from the rest of the nation. SEZs are primarily designed to increase foreign direct investment, boost manufacturing, and generate employment by offering attractive incentives to businesses that establish operations within their boundaries.

Essentially, an SEZ is a purpose-built ecosystem for industrial development. For a solar module manufacturer, this means access to a regulatory and financial environment tailored to support capital-intensive projects. Eswatini has strategically implemented this model to position itself as a hub for technology and renewable energy manufacturing in Southern Africa.

Key Financial Incentives in Eswatini’s SEZs

The financial advantages offered within Eswatini’s SEZs are substantial, addressing the key cost centers of a manufacturing startup. These incentives are legally enshrined, providing long-term security for investors.

Unprecedented Corporate Tax Holiday

Perhaps the most significant incentive is a complete exemption from corporate income tax. Businesses operating within a designated SEZ, such as the RSTP, are granted a 0% corporate tax rate for up to 20 years. This extended tax holiday allows a new venture to retain and reinvest its earnings during the critical early stages of growth, accelerating its return on investment and enabling faster expansion.

Favorable Post-Holiday Tax Structure

The benefits continue even after the 20-year tax-free period ends. The corporate tax rate is then set at a highly competitive 5%, a fraction of the standard rates found in many other countries. This structure ensures sustained profitability and long-term financial viability for the manufacturing operation.

VAT and Customs Duty Exemptions

The initial solar panel manufacturing plant cost is heavily influenced by the price of imported machinery and raw materials. Eswatini’s SEZ framework directly addresses this expense. All capital goods, machinery, equipment, and raw materials imported for use within the SEZ are fully exempt from Value Added Tax (VAT) and customs duties. This exemption can translate into millions of dollars in upfront savings, freeing up capital for other operational areas.

Unrestricted Repatriation of Profits

A crucial consideration for any international investor is the ability to move capital freely. Eswatini’s SEZ legislation guarantees the unrestricted repatriation of profits and dividends to an investor’s home country. This policy provides financial flexibility and removes a common barrier to foreign investment.

Operational Advantages Beyond Taxation

While fiscal incentives are the primary draw, the operational environment within an SEZ like the Royal Science and Technology Park (RSTP) offers practical benefits that streamline factory setup and day-to-day management.

Streamlined Administration

SEZs typically feature a “one-stop-shop” service center managed by an authority like the Eswatini Investment Promotion Authority (EIPA). This centralized body assists investors with company registration, licensing, permits, and other bureaucratic procedures, significantly reducing administrative delays and complexity. This frees management to focus on core business activities rather than navigating complex regulatory landscapes.

Quality Infrastructure

A key challenge in some emerging markets is the reliability of utilities. SEZs are developed with high-quality, reliable infrastructure, including stable power grids, water supply, and high-speed telecommunications. For a sophisticated manufacturing process like a solar panel production line, this reliable infrastructure is a critical operational advantage.

Tying the Incentives to a Business Plan

To understand the tangible impact, consider a typical solar module factory. The initial investment in machinery and the subsequent years of operation are fundamentally reshaped by this SEZ framework. An exemption from import duties on a multi-million dollar production line provides immediate, substantial capital relief.

Over the first two decades, the 0% corporate tax rate means all profits can be directed toward paying down debt, funding research and development, or expanding production capacity. This creates a powerful compounding effect on the business’s growth trajectory. As feasibility studies by J.v.G. Technology GmbH for clients exploring African markets have shown, such incentives can shorten the break-even point by several years compared to a standard investment model.

Frequently Asked Questions (FAQ)

What exactly is the Royal Science and Technology Park (RSTP)?

The RSTP is a specific Special Economic Zone in Eswatini focused on attracting technology-based businesses, including renewable energy manufacturing. It offers the full suite of SEZ incentives along with modern infrastructure and facilities.

Is the 0% tax rate guaranteed for the full 20 years?

Yes, the incentives, including the tax holiday, are legislated under Eswatini’s Special Economic Zones Act of 2018. This creates a stable and predictable legal framework for investors. However, companies must remain compliant with the terms of their SEZ license.

Are there specific requirements to qualify for these benefits?

Yes, businesses must apply for an SEZ license and typically must meet certain criteria related to the nature of their business (e.g., being export-oriented), minimum investment levels, and job creation targets.

What happens after the 20-year tax holiday ends?

After the initial 20-year period, the corporate tax rate for SEZ-based companies increases to a preferential rate of 5%.

Who is the main point of contact for investing in an Eswatini SEZ?

The Eswatini Investment Promotion Authority (EIPA) is the government agency responsible for facilitating foreign investment and serves as the primary contact for anyone interested in the SEZ program.

Can a foreign investor own 100% of a company in the SEZ?

Yes, Eswatini’s investment laws permit 100% foreign ownership of businesses established within the Special Economic Zones.

Conclusion: A Strategic Entry Point into the African Market

Eswatini’s Special Economic Zones offer one of the most attractive fiscal and operational packages for solar module manufacturers in the world. The combination of a 20-year tax holiday, duty-free importation of goods, and a streamlined administrative environment directly addresses the primary financial and logistical challenges of establishing a new factory.

For entrepreneurs and established companies looking to serve Africa’s growing demand for renewable energy, this framework transforms a high-capital venture into a strategically sound and financially viable long-term investment. To capitalize on this unique opportunity, your essential next steps are a detailed feasibility study and a comprehensive business plan.