For entrepreneurs exploring new frontiers in renewable energy, the global map presents a mosaic of opportunities and challenges. Certain locations, however, offer a uniquely structured advantage. Through its updated investment legislation, the Republic of Fiji has established a compelling framework for foreign investors, particularly in the manufacturing sector.

This framework offers a targeted set of incentives designed to attract capital-intensive, export-oriented businesses. This guide examines Fiji’s Tax-Free Zone (TFZ) incentives for prospective solar panel manufacturers, outlining the legal basis, tangible financial benefits, and strategic considerations an investor must evaluate when planning an entry into the Pacific market.

Understanding Fiji’s Investment Framework: The Tax-Free Zone (TFZ)

The foundation for these incentives is the Fiji Investment Act 2021, legislation designed to streamline and clarify the environment for foreign capital. At its core is the establishment of Tax-Free Zones, which grant a special status to qualifying businesses.

To be considered for TFZ designation, a business must meet two primary criteria:

-

Minimum Investment: The project must involve a minimum investment of FJD 2 million (approximately USD 900,000, subject to exchange rate fluctuations).

-

Export Mandate: The business must export at least 80% of its products or services annually.

This structure immediately signals the government’s intent: to foster industries that generate foreign exchange and create local employment without displacing existing domestic businesses. For a solar module manufacturer, whose business model typically relies on international sales, this export requirement aligns naturally with standard operational goals.

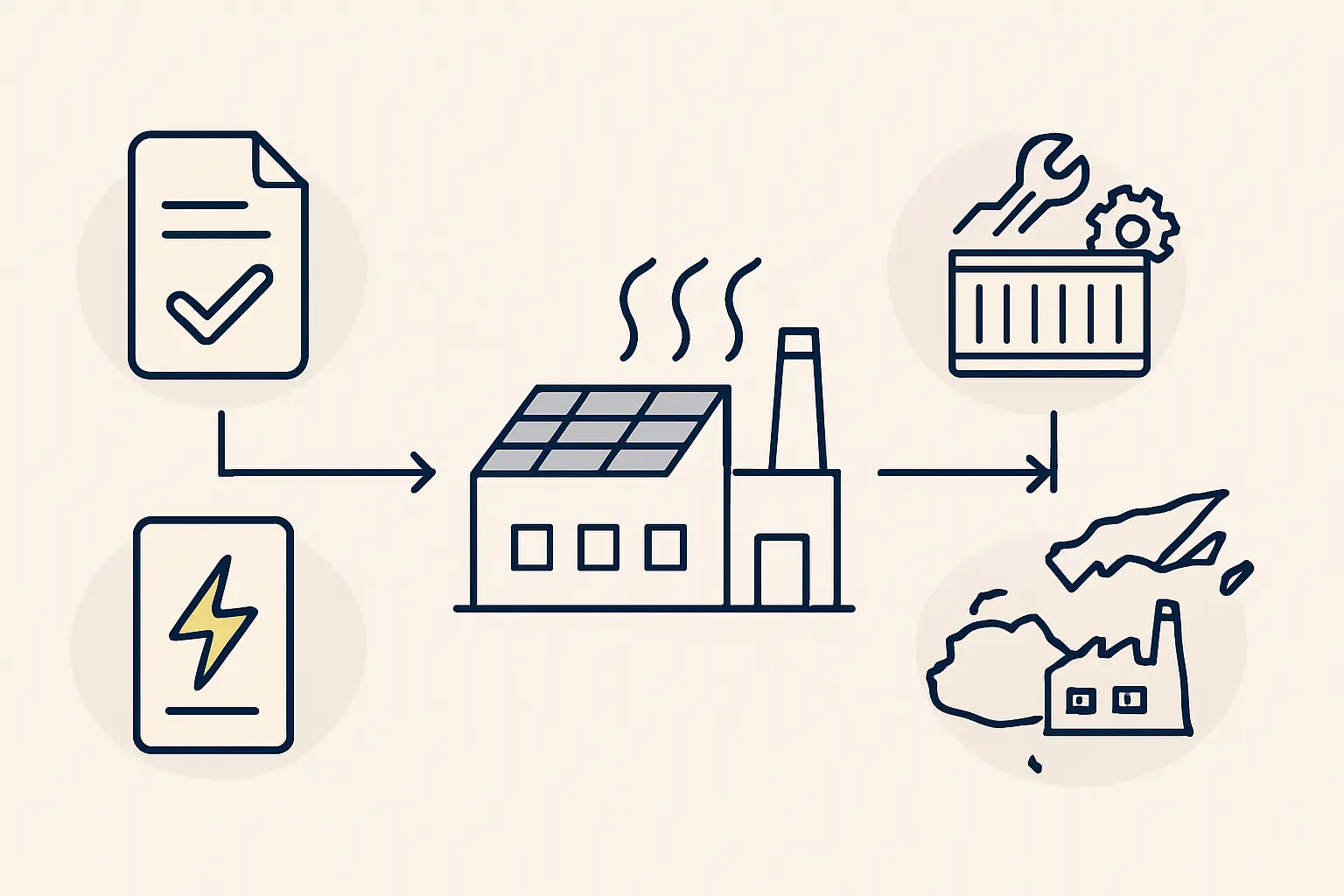

Core Incentives for Solar Manufacturers

Once a business is granted TFZ status, it gains access to a comprehensive package of financial benefits that directly address the primary costs of a new manufacturing operation. These incentives are designed to significantly de-risk the initial investment and accelerate the path to profitability.

The 10-Year Corporate Tax Holiday

The most significant incentive is a complete exemption from corporate income tax for 10 years. For a new venture, this means all profits generated during the first decade can be reinvested into the business—funding expansion, research, or debt servicing—free from corporate taxes. This provides a substantial competitive advantage during the critical early growth phase.

Duty-Free Import of Machinery and Materials

Setting up a solar panel factory requires a substantial capital outlay on specialized equipment. The TFZ designation allows for the duty-free importation of all raw materials and capital equipment needed to build the plant. This directly reduces the upfront investment for a solar panel factory and can shorten the capital recovery period considerably. When sourcing a complete turnkey solar production line, this concession can translate into savings of hundreds of thousands of dollars, freeing up capital for other essential areas like training and logistics.

VAT Exemptions and Other Concessions

Goods and services supplied to a TFZ-licensed entity are exempt from Value Added Tax (VAT). This further reduces operational costs on local procurement and services, contributing to improved cash flow management throughout the 10-year incentive period.

Why These Incentives are a Strategic Fit for Solar Manufacturing

Fiji’s TFZ incentives are particularly well-suited to the business model of a modern solar module assembly plant.

First, the high initial capital expenditure (CAPEX) common to the industry is directly offset by the duty-free import provision. This makes the initial financial hurdle more manageable for entrepreneurs.

Second, the 80% export requirement is an asset, not a constraint. Manufacturers in smaller domestic markets must target larger international markets to achieve the scale necessary for profitability. Fiji’s strategic location offers excellent logistical access to markets in Australia, New Zealand, the Pacific Islands, and even the west coasts of the Americas.

This package of incentives makes Fiji a highly competitive base for an export-focused manufacturing strategy, especially when compared to other developing regions where incentives may be less defined or legally robust.

The Application Process and Post-Incentive Outlook

Securing TFZ status requires a formal, detailed application process. An investor must submit a comprehensive proposal to Investment Fiji, the national investment promotion agency.

This proposal is the cornerstone of the application. It must include a robust solar module manufacturing business plan, complete with detailed financial projections, a clear export strategy, employment forecasts, and technical specifications of the planned facility. The authorities will assess the project’s viability, economic contribution, and alignment with the goals of the TFZ scheme. A well-structured plan that clearly articulates the project’s value proposition is critical for success.

Investors must also plan for the long term. After the 10-year tax holiday expires, the company’s profits will be subject to Fiji’s prevailing corporate tax rate, which currently stands at 25%. A prudent financial model will account for this transition from day one.

A Key Consideration: The 80% Export Requirement

While the benefits are substantial, the 80% export mandate is a strict requirement that must be actively managed. This is not a passive benefit. It necessitates a sophisticated and well-executed international sales and distribution strategy from the moment the factory becomes operational.

An investor must secure offtake agreements or establish strong distribution channels in target markets before or during the factory’s construction. Relying on spot markets to meet this threshold is a high-risk approach. Therefore, a significant portion of the initial business planning must be dedicated to market entry, logistics, and international sales.

Frequently Asked Questions (FAQ)

What is the exact minimum investment required to qualify for TFZ status?

The minimum capital investment required is FJD 2,000,000.

Can a business operating in a Tax-Free Zone sell to the local Fijian market?

Yes, but sales into the domestic market are capped at 20% of the company’s total annual output.

What are the consequences if a company fails to meet the 80% export target?

Failure to meet the export threshold can put the company’s TFZ status at risk. This could lead to the revocation of the tax and duty concessions, so consistent compliance is essential.

Are these incentives exclusive to the solar industry?

No, the Tax-Free Zone incentives are available to other qualifying industries, primarily in manufacturing and information and communication technology (ICT), provided they meet the investment and export criteria.

Conclusion and Next Steps

The Republic of Fiji offers one of the most structured and financially attractive incentive packages available globally for export-oriented solar manufacturers. The 10-year tax holiday, combined with duty-free importation of capital equipment, directly addresses the primary financial challenges of starting a new production facility.

However, these powerful incentives are tied to the firm requirement of exporting 80% of production. This demands a robust, pre-planned international strategy. For the prepared entrepreneur, Fiji presents a unique opportunity to establish a highly competitive manufacturing base in the heart of the Pacific.

To move forward, an investor must quantify the impact of these incentives. Developing a detailed financial model and a comprehensive business plan is the essential next step to validate the opportunity and prepare a compelling proposal for Fijian authorities.