For investors evaluating solar module manufacturing in Europe, France presents a compelling, if complex, opportunity. The nation has set ambitious goals for energy independence, spurred by government initiatives to re-shore the photovoltaic supply chain. However, ambition must be weighed against reality. A successful venture depends not just on market demand, but on the practical availability of essential raw materials.

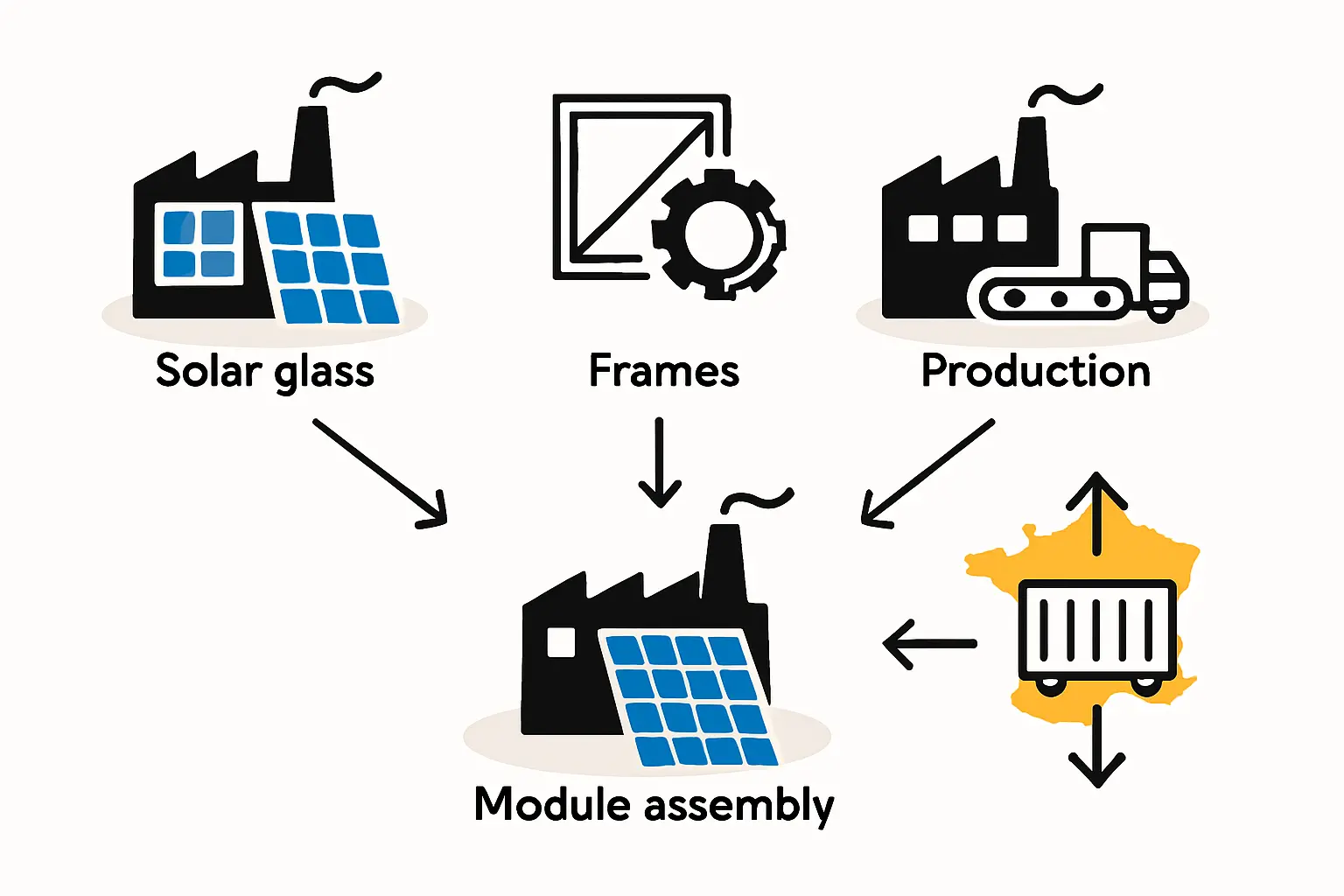

This analysis examines the French domestic supply chain for three critical solar module components: solar glass, aluminum frames, and EVA encapsulant. Understanding the strengths and weaknesses of local sourcing is the first step toward developing a viable business plan.

France’s Strategic Push for Solar Autonomy

The French government has made its intentions clear. Through initiatives like the “Pacte Solaire” (Solar Pact), the country aims to produce 40% of the photovoltaic panels installed in the country by 2030. This policy is not merely about energy; it is a strategic move toward industrial sovereignty that creates a favorable environment for new manufacturing operations.

This government support offers concrete advantages for manufacturers, particularly through the CRE (Commission de régulation de l’énergie) tenders. These tenders often favor projects using solar modules with a low carbon footprint, creating a direct commercial advantage for producers who can source key materials locally and prove their environmental credentials through specific certifications.

Assessing Key Component Availability in France

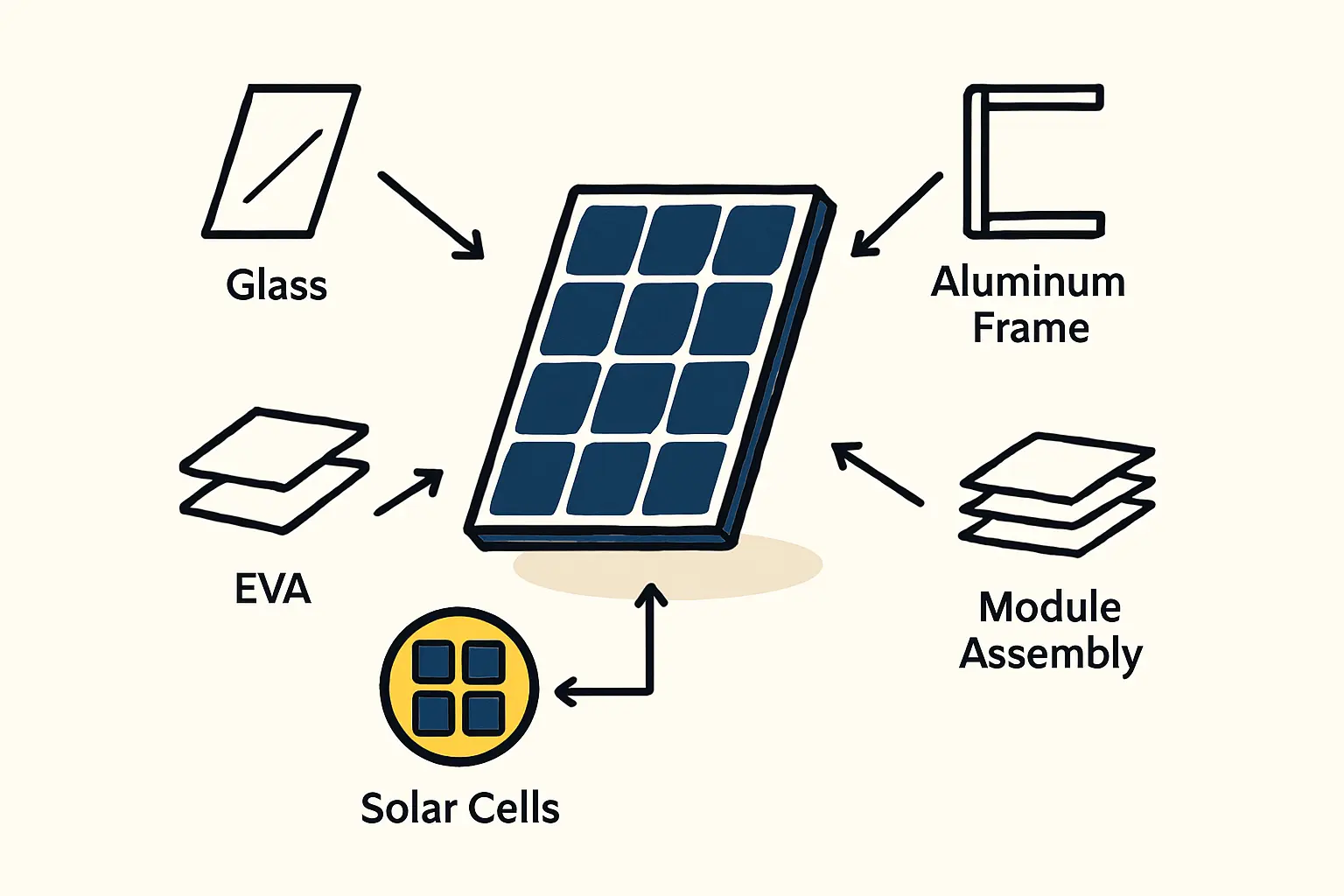

A solar panel is an assembly of several key components. For a potential manufacturer in France, the core question is which of these can be reliably sourced domestically and which must be imported. The answer reveals both significant opportunities and notable vulnerabilities in the current landscape. To assess these factors, an investor needs a clear understanding of a module’s full bill of materials (BOM).

Solar Glass: A Clear Strength

The foundation of nearly every solar module is its front glass, and here, France holds a formidable domestic advantage. Saint-Gobain, a global leader in materials, operates a major float glass production facility in Aniche, in the north of France.

The company is investing around €30 million to upgrade and expand one of its production lines specifically for the solar industry. This development ensures a stable, high-quality, and low-carbon supply of a component that makes up a significant part of a module’s weight and cost. For a new factory, having such a critical supplier within the country reduces logistical complexity, transportation costs, and supply chain risk.

Aluminum Frames: A Growing Capability

The structural frame of a solar module provides rigidity and protection. In France, the local supply chain for aluminum frames is strengthening rapidly, driven by investments in recycling and low-carbon production.

A key development is Hydro’s construction of a new aluminum recycling plant in Torcy. Expected to become operational soon, this facility, from the leading Norwegian aluminum and energy company, will produce 120,000 metric tons of low-carbon aluminum annually. A substantial portion of this output is earmarked for the European solar industry. This will give manufacturers in France access to a crucial component that meets the low-carbon criteria often required in public and large-scale commercial tenders.

EVA and Encapsulants: The Critical Gap

While the outlook for glass and frames is positive, the situation for encapsulants—the polymer sheets (most commonly Ethylene Vinyl Acetate, or EVA) that laminate and protect solar cells—is entirely different.

Currently, France has no significant domestic production of EVA or other encapsulant materials. The industry is entirely dependent on imports, overwhelmingly from Asian suppliers. This represents the single largest vulnerability in the French solar component supply chain. This dependence introduces several business risks:

-

Logistical Delays: International shipping can be unpredictable, affecting production timelines.

-

Geopolitical Risk: Reliance on a single geographic region for a critical component creates fragility.

-

Cost Volatility: Shipping rates and currency fluctuations can impact material costs.

Any business plan for a French solar module factory must therefore include a solid strategy for securing a stable and reliable import channel for encapsulants.

The Business Implications for Investors

This supply chain landscape informs a smarter investment strategy. Drawing on experience from J.v.G. Technology turnkey projects across Europe, a clear picture of the pros and cons emerges.

Advantages of Local Sourcing

-

Reduced Logistics Costs: Sourcing heavy materials like glass and aluminum frames domestically significantly cuts transportation expenses.

-

Improved Carbon Footprint: Using locally produced, low-carbon components becomes a major commercial advantage in CRE tenders and appeals to environmentally conscious buyers.

-

Supply Chain Resilience: Reduced reliance on international shipping for key components provides greater stability against global disruptions.

Navigating the Challenges

The primary challenge remains the complete lack of domestic EVA production. A manufacturer must build a resilient procurement strategy. This means thoroughly evaluating potential suppliers from international markets, ideally diversifying sources across multiple companies and regions to mitigate risk. Building strong relationships with established importers or distributors can also provide a buffer against supply shocks.

Frequently Asked Questions (FAQ)

What is the “bill of materials” for a solar module?

The bill of materials, or BOM, is a comprehensive list of all the raw materials and components required to manufacture a finished product. For a solar module, this includes solar cells, glass, backsheet or rear glass, an aluminum frame, encapsulant (EVA), a junction box, and connectors.

Why are low-carbon footprint certifications important in France?

The French government’s energy tenders (CRE) assign a score based on a project’s carbon footprint. Using modules made with locally sourced, low-carbon components like French-made glass and recycled aluminum can give a project a competitive edge, making it more likely to be selected. This creates a strong incentive for local manufacturing.

Is it feasible to start a solar module factory in France relying only on local components?

No. At present, it is not feasible due to the absence of domestic supply for critical components like solar cells and EVA encapsulants. A successful manufacturing operation in France will require a hybrid strategy, combining local sourcing for glass and frames with a reliable import plan for other materials.

What are the main risks associated with the French solar supply chain?

The primary risk is the complete dependence on imports for EVA encapsulants and solar cells. This exposes manufacturers to potential disruptions from international shipping, trade policy changes, and geopolitical instability.

Conclusion: A Balanced Opportunity

France offers a promising environment for new solar module manufacturers, underpinned by strong government support and a robust domestic supply of glass and aluminum. These strengths provide a solid foundation for building a competitive and sustainable business.

However, investors must approach the market with a clear understanding of its current limitations, most notably the critical gap in the encapsulant supply chain. A successful venture is one that capitalizes on local advantages while implementing a smart, resilient strategy for sourcing essential imported components. With careful planning, a manufacturer can navigate this environment and build a thriving operation that contributes to both its own growth and France’s strategic energy goals.