For an entrepreneur entering the solar manufacturing sector, choosing a factory location is one of the most consequential decisions they will make. It extends far beyond securing a piece of land; it’s about positioning the business within an ecosystem that will dictate its logistical efficiency, access to talent, and long-term operating costs. As France accelerates its commitment to renewable energy and industrial sovereignty, understanding its regional advantages becomes a critical strategic imperative.

The French government’s “Green Industry Bill” and its ambitious goal of reaching 100 GW of installed solar capacity by 2050 have created powerful momentum. This policy push, combined with a renewed focus on re-industrialization, presents a unique window of opportunity for investors looking to establish a “Made in Europe” manufacturing footprint.

Key Factors for Evaluating a Solar Factory Location

Before comparing specific regions, it’s essential to establish a clear framework for evaluation. The ideal location is rarely the cheapest, but rather the one that offers the optimal balance of several interconnected factors.

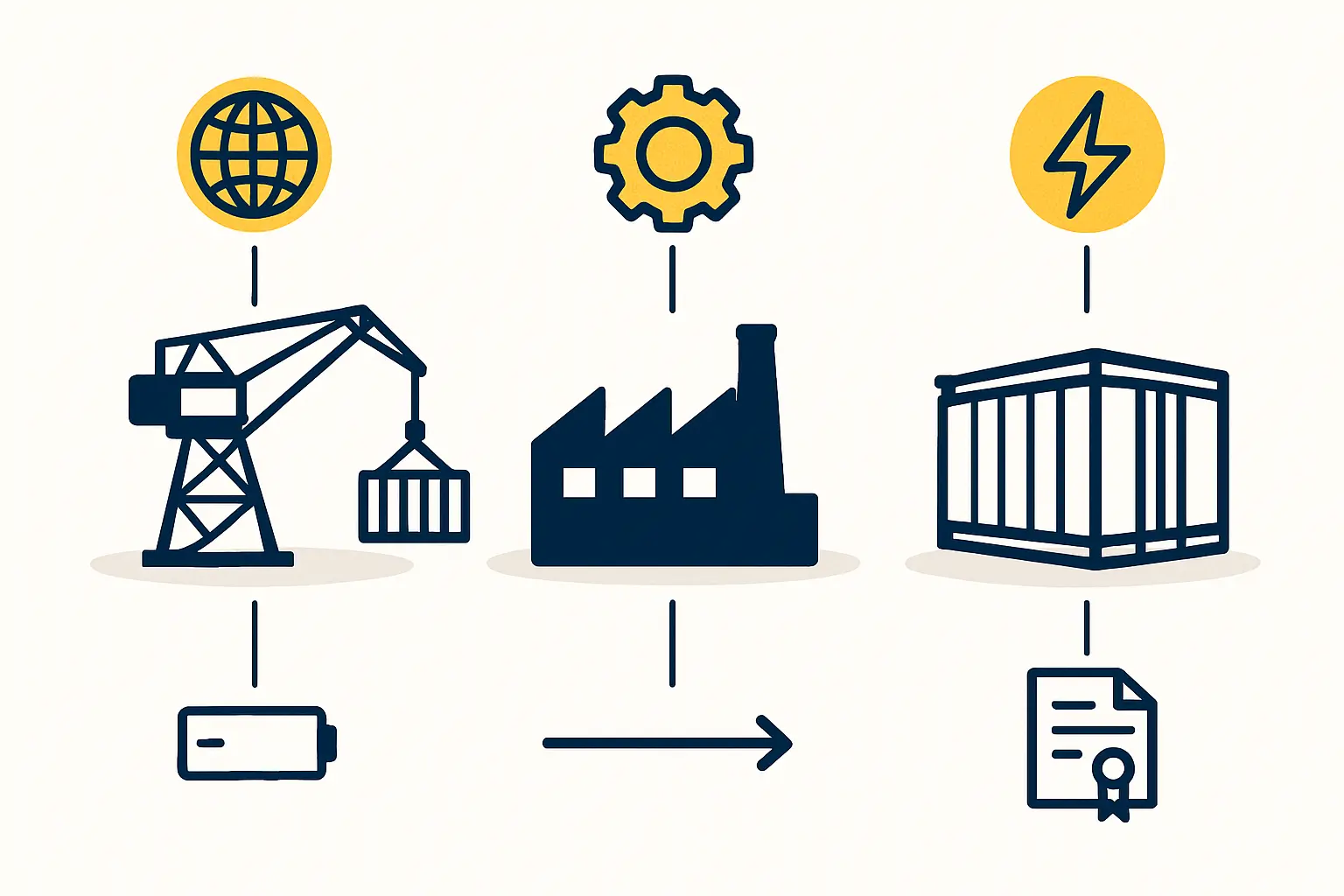

Supply Chain and Logistics

A solar module factory is fundamentally a logistics operation. Its location must facilitate the efficient import of raw materials—such as solar glass, aluminum frames, polysilicon, and EVA film—and the subsequent shipment of finished modules to project sites across Europe and beyond.

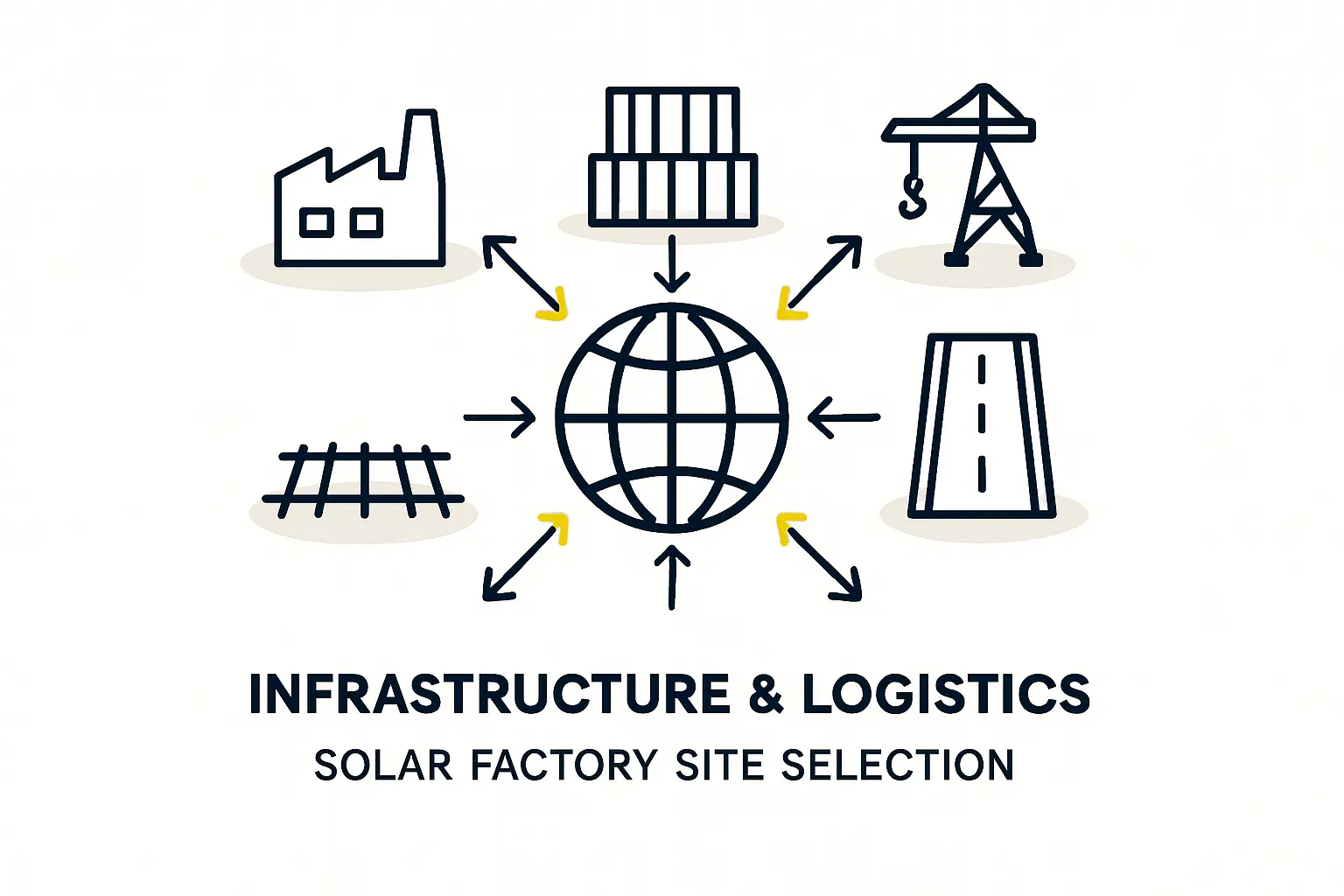

A site with direct access to major transport arteries like sea, rail, and road can dramatically reduce both costs and lead times. Proximity to a major container port, for instance, can eliminate days of transit and thousands of euros in haulage fees per container.

Infrastructure and Utilities

Consistent, high-capacity infrastructure is non-negotiable. This includes a stable and affordable electricity supply, a significant operational expense for energy-intensive processes like lamination and cell testing. France’s reliable, low-carbon nuclear energy grid is a notable advantage in this regard.

Access to water, gas, and high-speed data connectivity are also fundamental requirements for any modern industrial facility. It’s crucial to examine the specifics of a site’s factory building requirements and utility connections early in the planning process.

Labor Availability and Skill Level

Solar manufacturing requires a diverse workforce, from assembly line technicians to quality control engineers and maintenance specialists. A region with a strong industrial heritage and access to technical schools or universities offers a deeper talent pool. While French labor costs are higher than in some other parts of the world, this is often offset by high productivity and technical proficiency.

Government Incentives and Regional Support

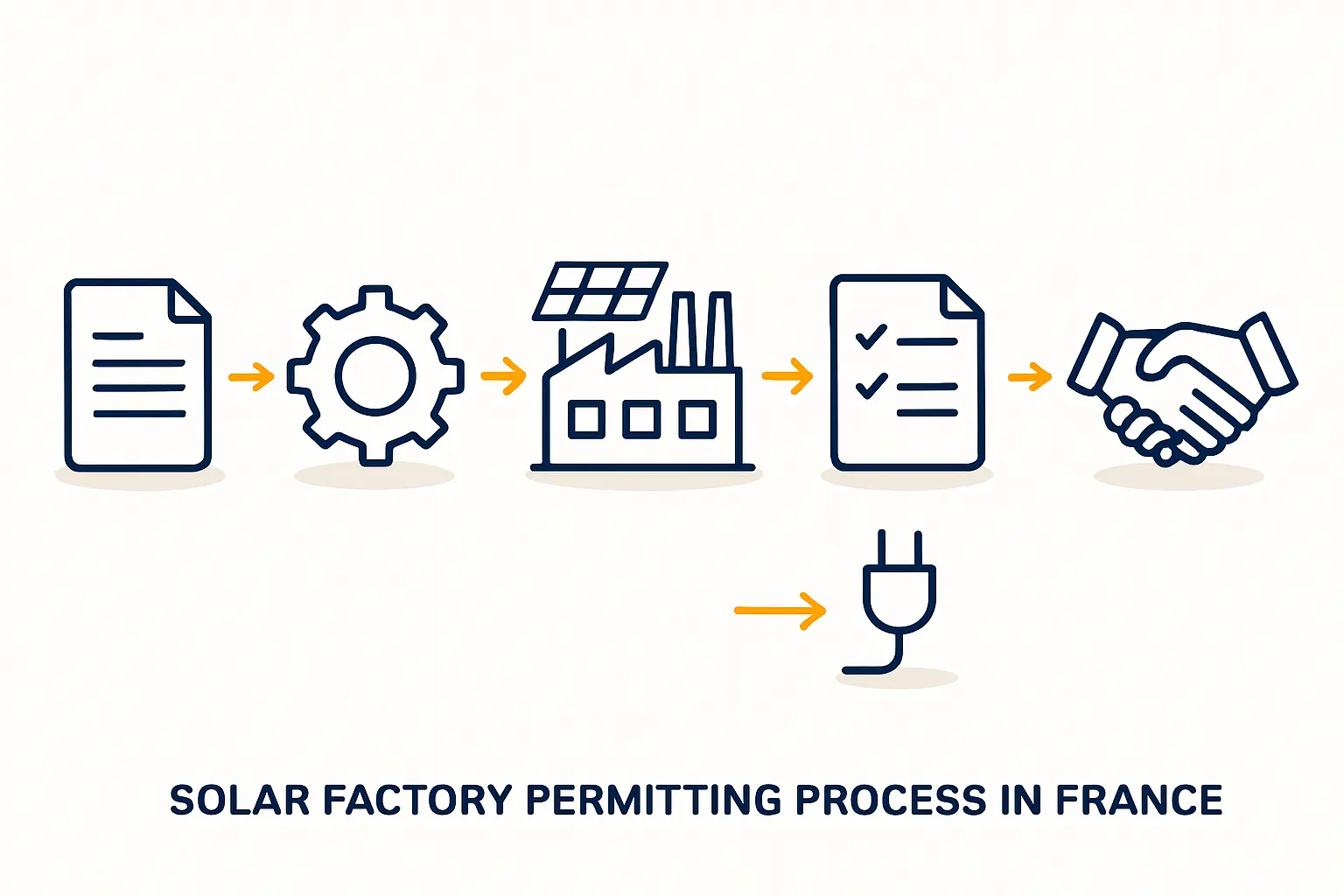

France offers a range of incentives to attract industrial investment, particularly in the green technology sector. These can include investment tax credits, R&D grants, and subsidies for job creation. Regional development agencies often play a proactive role, assisting with site selection, permit applications, and connecting investors with local supply chains.

A Comparative Analysis of Key Industrial Zones in France

With these criteria in mind, several key regions in France stand out as prime candidates for a solar manufacturing facility, each offering a distinct set of advantages.

The Port Hubs: Marseille-Fos and Le Havre

For operations heavily reliant on imports and exports, locating near a major port is a compelling strategy.

The Port of Marseille-Fos is France’s largest port and a primary gateway to the Mediterranean, North Africa, and trade routes from Asia via the Suez Canal. For an investor sourcing materials from China or Southeast Asia, a location within the Marseille-Fos industrial zone offers unparalleled logistical efficiency. The direct connection shortens the supply chain, reduces the risk of delays, and lowers inland transportation costs.

On the northern coast, the Port of Le Havre is part of the HAROPA PORT complex, one of Europe’s largest port systems. It provides excellent connectivity to Northern Europe and trans-Atlantic shipping lanes, making it an ideal choice for a factory targeting markets in the Americas or the UK.

Key Consideration: While port zones offer superior logistics, competition for prime industrial land can be high, and costs may reflect this demand.

The Industrial Heartland: The Lyon-Grenoble Axis

The Auvergne-Rhône-Alpes region, particularly the corridor between Lyon and Grenoble, is a powerhouse of French industry and technology. This area is home to leading research institutions like the French National Solar Energy Institute (INES) and a dense network of high-tech companies.

Choosing a location here offers access to a highly skilled workforce, a robust ecosystem of potential suppliers for automation and specialized solar manufacturing machines, and a culture of innovation. This is particularly advantageous for manufacturers looking to incorporate advanced technologies or R&D into their operations.

Key Consideration: Being inland, logistics for imported raw materials will be more complex and costly compared to a port location. This requires careful calculation to ensure the benefits of the industrial ecosystem outweigh the additional transport expenses.

The Emerging Northern Cluster: Dunkirk and Hauts-de-France

The Hauts-de-France region, particularly around the port of Dunkirk, is undergoing a major industrial transformation. Driven by massive investments in electric vehicle battery production, the area is being branded as France’s “Battery Valley.” This has created significant momentum, with the government investing heavily in infrastructure, training programs, and incentives to attract green industries.

A solar manufacturer locating here stands to benefit from this broader industrial renewal. The region boasts abundant and affordable energy, excellent logistics through Dunkirk and nearby Calais, and a proactive government push to streamline investment.

Key Consideration: As a newer hub for green tech, the specific solar manufacturing supply chain may be less mature than in established regions like Lyon. However, the potential to be an early mover in a rapidly growing cluster is a significant strategic opportunity.

A Practical Checklist for Site Selection

Making the final decision requires a detailed, data-driven approach. Experience from numerous J.v.G. Technology turnkey projects suggests a systematic process:

- Conduct a Logistics Cost Analysis: Model the total cost of transporting raw materials from their source to the factory and shipping finished modules to primary target markets for each potential location.

- Assess the Local Labor Market: Engage with local employment agencies to understand the availability of skilled technicians and engineers. Evaluate the proximity of vocational schools and universities.

- Engage with Regional Development Agencies: These organizations (e.g., Business France, regional agencies) are valuable partners. They can provide detailed information on available sites, incentives, and the permitting process.

- Verify Utility Capacity: Confirm that the prospective site has access to sufficient electrical power, water, and other utilities, and understand the timeline and cost for connection.

Frequently Asked Questions (FAQ)

What is the typical size of land required for a 50 MW solar module factory?

A 50 MW annual capacity factory—including the production hall, warehouse space for raw materials and finished goods, and administrative offices—generally requires 8,000 to 12,000 square meters of land.

Are there language barriers for foreign investors in France?

While French is the official language, the business and technical communities, particularly within regional development agencies and major industrial firms, have a high level of English proficiency. Engaging local consultants can help navigate administrative processes.

How do French labor laws impact manufacturing operations?

French labor laws are comprehensive and offer strong protections for employees. While this can seem complex, these regulations also foster a stable and skilled workforce. Standard workweeks, overtime rules, and social contributions must be factored into the business plan.

What is the general timeline for setting up a factory?

From final site selection to the start of production, the timeline can range from 12 to 18 months. This includes building construction or renovation, machine installation and commissioning, hiring and training staff, and obtaining all necessary certifications.

Conclusion and Next Steps

Choosing a factory location in France is a strategic decision that will shape the entire business model. The optimal choice is not a one-size-fits-all answer but a careful balance of logistical costs, access to a skilled workforce, and the strength of the regional industrial ecosystem. Whether the priority is minimizing supply chain friction at a port like Marseille, tapping into the innovation of the Lyon-Grenoble axis, or capitalizing on the momentum of the northern industrial cluster, France offers compelling options for investors.

A thorough feasibility study and a detailed business plan are essential next steps. A clear understanding of the entire process is the foundation for success. For entrepreneurs beginning this journey, exploring a structured overview of how to start a solar module factory can provide the necessary framework for turning an ambitious vision into a tangible and profitable reality.