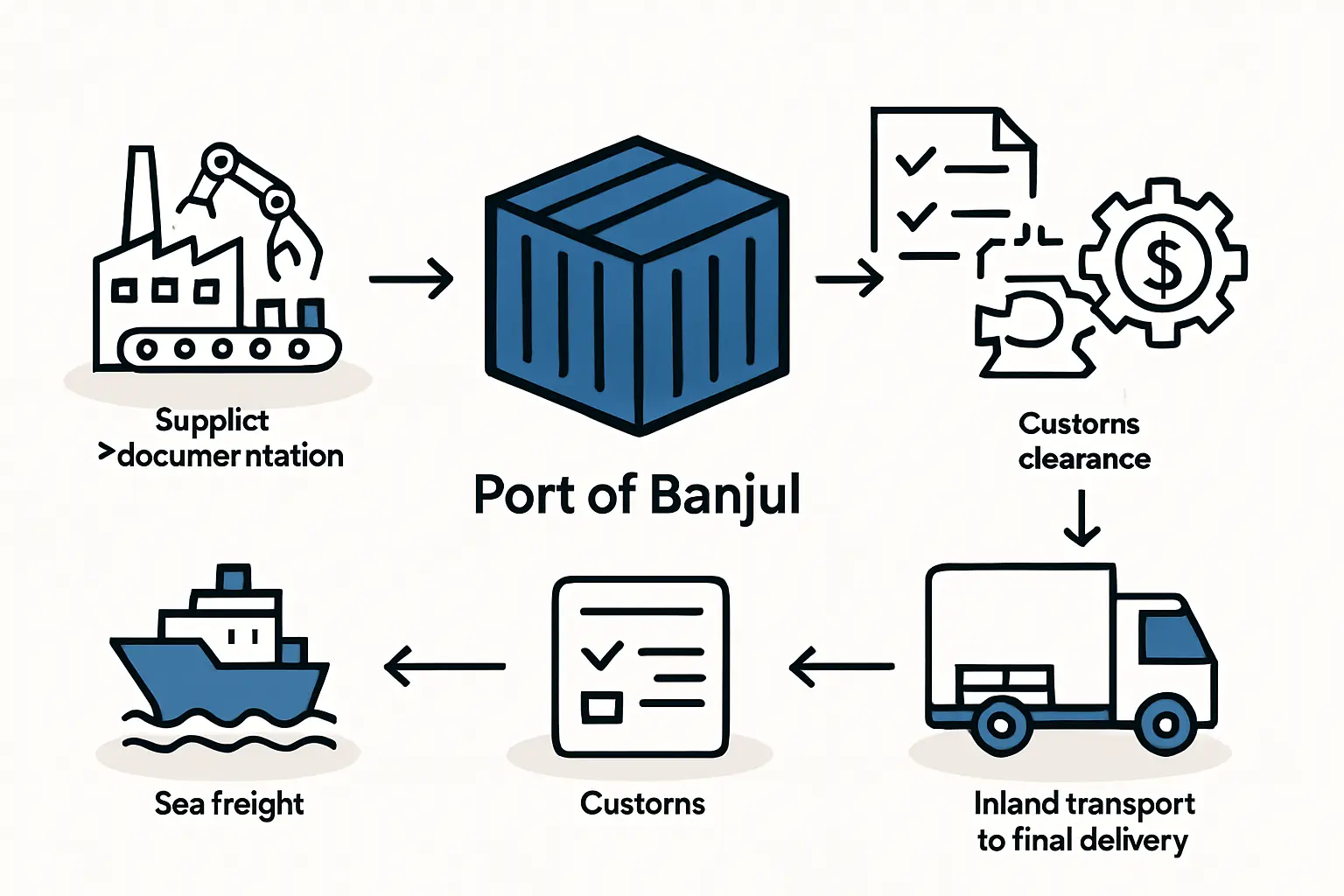

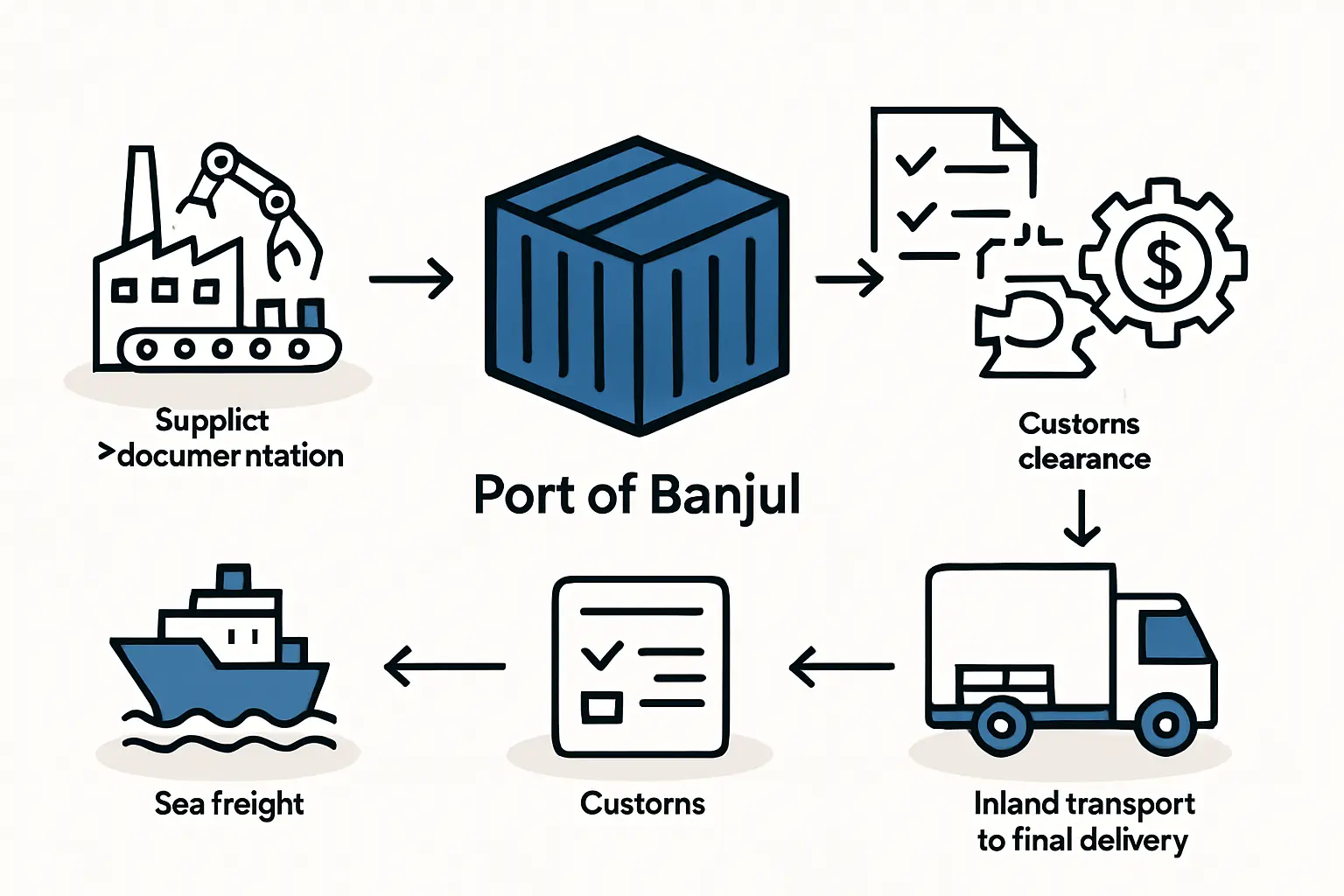

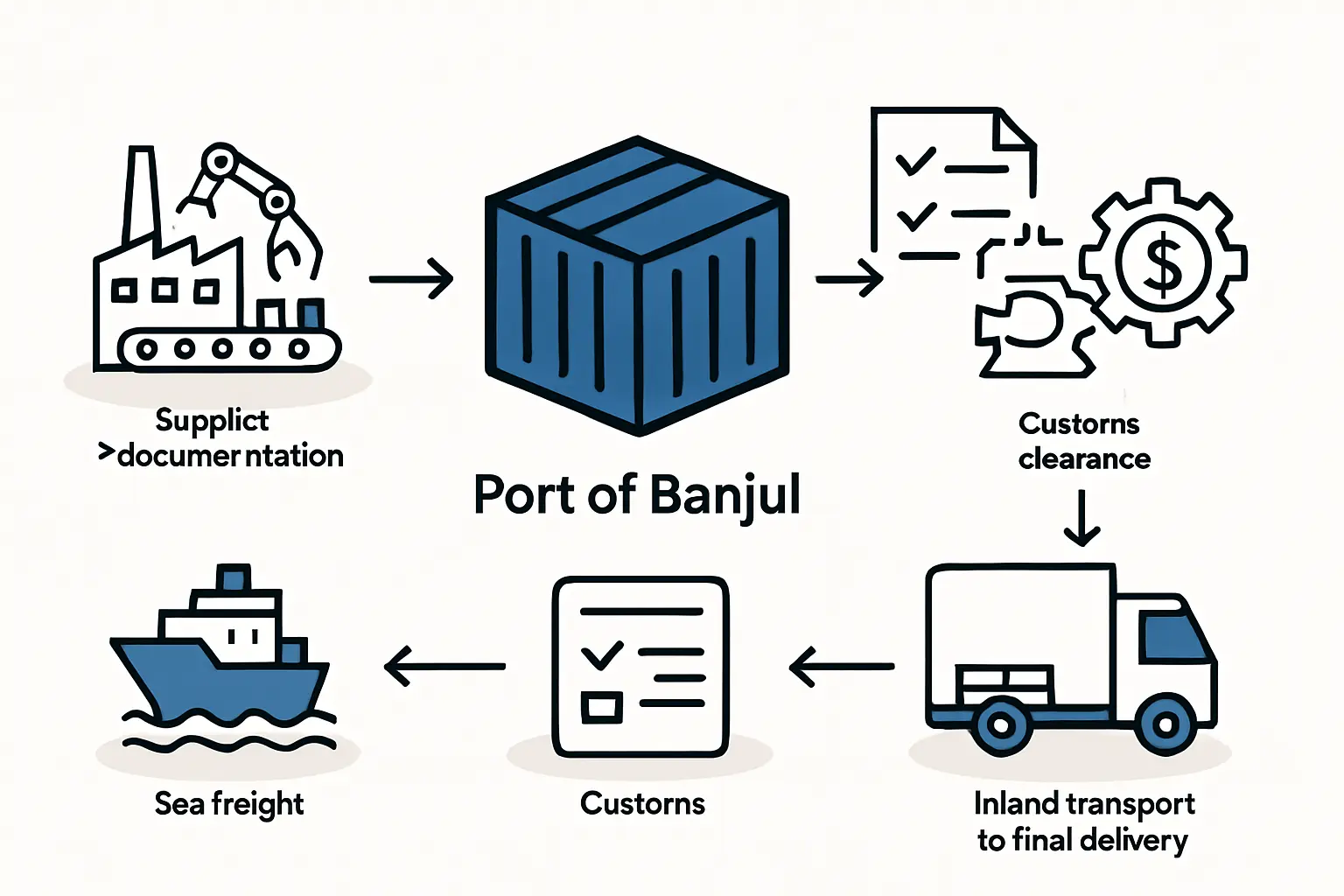

An entrepreneur entering The Gambia’s solar energy sector often focuses on market demand, panel efficiency, and government incentives. Yet the success of a new solar assembly plant frequently hinges on a less visible but critical element: mastering the flow of raw materials through the Port of Banjul.

The journey from a supplier in Asia or Europe to a factory floor in the Greater Banjul Area is a complex process involving specific rules, documentation, and costs. This analysis details the customs procedures, tariff structures, and inland transport considerations for importing key solar components. For investors planning to enter the solar module manufacturing industry, understanding these logistics is more than an operational task—it’s a strategic necessity that directly impacts project timelines and financial viability.

Understanding the Port of Banjul’s Role in Your Solar Venture

As The Gambia’s primary maritime gateway, the Port of Banjul handles the vast majority of the country’s international trade. For a solar manufacturing enterprise, this port is the single point of entry for essential components like photovoltaic cells, EVA film, backsheets, and aluminum frames.

While the port offers a significant opportunity to access the regional market, it also poses logistical challenges that require careful planning. An efficient supply chain managed through this port is essential for maintaining production schedules and controlling costs.

The Customs Clearance Process: A Step-by-Step Guide

The Gambia Revenue Authority (GRA) manages all customs procedures, which are standardized and largely digitized through the ASYCUDA++ system. Navigating this system efficiently requires a clear understanding of the steps involved.

Step 1: Declaration Lodgment

All imported goods must be declared electronically via the ASYCUDA++ platform. This declaration must be completed by a licensed clearing and forwarding agent. For a foreign investor, engaging a reputable local agent is a crucial first step.

Step 2: The Selectivity Lanes

Once a declaration is submitted, the system automatically assigns it to one of four ‘selectivity lanes,’ which determines the level of scrutiny:

-

Green Lane: The shipment is considered low-risk and is cleared for release upon payment of duties without documentary or physical inspection. This is the fastest route.

-

Yellow Lane: Requires documentary checks. Customs officers will review the commercial invoice, bill of lading, and other supporting documents against the declaration.

-

Blue Lane: A post-clearance audit lane, where goods are released but the declaration is subject to a later, more detailed audit.

-

Red Lane: The highest level of inspection. This lane requires both a full documentary check and a physical examination of the goods. Shipments here will experience the longest delays.

Based on experience from J.v.G. turnkey projects, new importers should factor in the potential for Red Lane inspections in their initial project timelines to avoid unexpected production delays.

Step 3: Valuation, Assessment, and Payment

The GRA determines the customs value of goods based on the transaction value—the price actually paid or payable for the goods, in alignment with WTO standards. Once the value is confirmed and tariffs are calculated, an assessment notice is issued. Payment of all duties and taxes must be completed before the goods can be released.

Step 4: Release and Exit

After payment confirmation, a release order is issued. The clearing agent can then present this order at the port gate to take delivery of the container and arrange transport to its final destination.

Required Documentation: Preparing for a Smooth Import Process

Incomplete or inaccurate documentation is the most common cause of costly delays. A typical shipment of solar components will require the following:

-

Bill of Lading (B/L): The contract between the owner of the goods and the carrier, serving as a receipt and title document.

-

Commercial Invoice: A detailed list of the goods, including their value, which is the primary basis for customs valuation.

-

Packing List: Specifies the contents of each package within the shipment, including weights and dimensions.

-

Certificate of Origin: Certifies the country where the goods were produced. This can be important for qualifying for preferential tariffs under trade agreements like ECOWAS.

-

Insurance Certificate: Proof that the goods are insured for transit.

Ensuring these documents are accurate and consistent is essential for clearing the Yellow or Red lanes without complications.

Navigating Tariffs and Taxes for Solar Components

The Gambia uses the ECOWAS Common External Tariff (CET), which categorizes goods into five tariff bands. Understanding where your key solar components fall within these bands is vital for accurate financial forecasting.

A common oversight for new investors is focusing only on the favorable tariff for PV modules while underestimating the duties on other necessary parts of a complete bill of materials (BOM).

Applicable rates for typical solar components, based on their Harmonized System (HS) codes, include:

-

Photovoltaic Cells & Modules (HS Code 8541.40): 0% Import Duty

-

Inverters (HS Code 8504.40): 10% Import Duty

-

Lead-Acid Batteries (HS Code 8507.20): 20% Import Duty

-

Charge Controllers (HS Code 9032.89): 10% Import Duty

-

Junction Boxes & Panels (HS Code 8537.10): 20% Import Duty

Additional Taxes and Levies:

Beyond the import duty, several other charges are applied to the CIF (Cost, Insurance, and Freight) value of the goods:

-

Value Added Tax (VAT): 15% (applied to the sum of CIF value + duty)

-

ECOWAS Levy: 0.5%

-

AU Levy: 0.2%

-

Processing Fee: 1.5%

-

National Health Insurance Levy: 1%

These cumulative levies can significantly increase the landed cost of materials, a factor that must be included in any serious business plan for a solar factory.

Strategic Cost Management: The GIEPA Investment Certificate

The Gambia Investment and Export Promotion Agency (GIEPA) offers incentives to attract investment in priority sectors, including renewable energy. By obtaining a Special Investment Certificate (SIC), a new enterprise may be eligible for significant fiscal incentives, including exemptions on import duty and VAT for capital equipment and raw materials.

Securing this certificate should be a primary objective during the early stages of business planning, as it can fundamentally alter financial projections and improve the venture’s long-term profitability. The certificate is a key tool The Gambia uses to support investors who contribute to its economic development goals.

Inland Transport and Logistics Beyond the Port

Once goods are cleared, the final logistical challenge is inland transportation from the Port of Banjul to the factory site. Key considerations include:

-

Trucking Availability: Securing reliable and insured road freight services.

-

Road Conditions: Factoring in the state of road networks, which can affect travel times and the risk of damage to sensitive components.

-

Warehousing: Ensuring a secure, dry, and accessible facility is ready to receive the materials upon arrival.

Frequently Asked Questions (FAQ)

Q1: Do I need a local agent to clear my goods at the Port of Banjul?

Yes. Using a licensed clearing and forwarding agent is mandatory for lodging declarations in the ASYCUDA++ system. This partner is essential for navigating local procedures.

Q2: What is the most common cause of customs delays?

The most frequent causes are incorrect or inconsistent documentation and the random selection of a shipment for ‘Red Lane’ physical inspection. Meticulous preparation of all paperwork is the best way to mitigate these risks.

Q3: Are the customs tariffs fixed?

The tariffs are based on the ECOWAS CET, which provides a stable framework. However, rates and national levies can change based on government fiscal policy, so it is always advisable to verify the current rates before shipment.

Q4: How does customs determine the value of my imported goods?

The Gambia Revenue Authority uses the ‘transaction value’ method, which is the price you actually paid for the goods, as evidenced by the commercial invoice and proof of payment. This is compliant with World Trade Organization (WTO) valuation agreements.

Conclusion: Your Next Steps in Planning Your Gambian Solar Supply Chain

Successfully importing solar components through the Port of Banjul is a structured process that rewards careful planning and preparation. While the 0% import duty on photovoltaic cells and modules offers a significant advantage, investors must account for the full range of tariffs, taxes, and levies on other essential materials.

Engaging a reliable local clearing agent, meticulously preparing all documentation, and proactively seeking a GIEPA Investment Certificate are critical steps for saving considerable time and money. Understanding these logistical details is fundamental to the feasibility studies that J.v.G. Technology GmbH supports for its clients. A well-structured plan that accounts for these real-world costs and timelines from the outset is the foundation for a resilient and profitable solar manufacturing operation in The Gambia.