An entrepreneur’s ultimate measure of success isn’t just the profit a venture generates, but the ability to access and utilize that capital. For any professional considering an investment in a new country, a critical question arises: “Once my business is profitable, how straightforward is it to transfer those earnings back home?” This concern is no minor detail; it’s a fundamental pillar of any sound investment strategy.

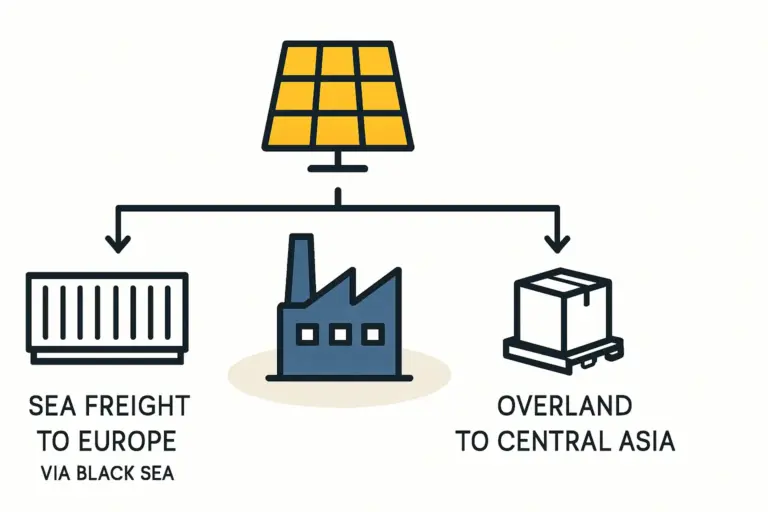

This article outlines the financial regulations governing foreign investors in Georgia, focusing specifically on profit repatriation and currency controls. Understanding this framework is essential for accurately assessing the financial viability and long-term potential of establishing a manufacturing operation, such as a solar module factory, in the country.

Understanding Georgia’s Pro-Business Financial Framework

Georgia has deliberately cultivated one of the most liberal and open economic environments in the region. This approach is reflected in its financial and legislative frameworks, which are designed to minimize bureaucratic hurdles and maximize investor confidence.

International benchmarks consistently validate this strategy. For years, the World Bank’s “Ease of Doing Business” report has ranked Georgia highly, underscoring its commitment to a transparent and predictable business climate.

The country’s financial system is overseen by the National Bank of Georgia (NBG), which functions as a modern, independent regulator. Rather than imposing restrictive capital controls, the NBG’s primary focus is on maintaining price stability, ensuring the transparency of the financial system, and adhering to international standards for anti-money laundering (AML). This fosters an environment where legitimate business transactions can proceed efficiently.

Capital and Profit Repatriation: The Legal Guarantees

For a foreign investor, the term “repatriation” refers to the process of converting local currency profits into foreign currency and transferring them to the investor’s home country. This can include dividends, proceeds from the sale of an asset, or the initial capital invested.

In Georgia, the right of a foreign investor to repatriate capital and profits after paying all due taxes is legally guaranteed. The Law of Georgia on Promotion and Guarantees of Investment Activity explicitly protects this right, providing a strong legal foundation for investors. This means there are no legal or administrative barriers preventing the transfer of legitimately earned funds out of the country.

The Process of Repatriating Funds

Repatriating funds is a straightforward process handled through Georgia’s commercial banking sector.

-

Conversion: Funds held in the local currency, the Georgian Lari (GEL), are converted into the desired foreign currency (e.g., USD, EUR) at the prevailing market exchange rate.

-

Transfer: The commercial bank executes an international wire transfer to the investor’s designated foreign bank account.

-

Taxation: While the transfer itself is unrestricted, the profits are subject to taxation. For example, dividends distributed to a non-resident individual or foreign enterprise are typically subject to a 5% withholding tax at the source.

This clear, simple process is a significant advantage, removing the uncertainty and potential for long delays that can affect investors in other jurisdictions.

Currency Controls: A Notable Absence

Currency controls are government regulations that limit or prohibit the flow of foreign currency into and out of a country. Such controls can present significant challenges for international businesses, creating obstacles to paying foreign suppliers, repatriating profits, or managing cash flow.

A key pillar of Georgia’s appeal is the absence of significant currency controls. Foreign investors can freely and without delay:

- Open bank accounts in foreign currencies.

- Convert and transfer unlimited amounts of capital related to their investment.

- Conduct transactions without seeking special permission from a central authority for each transfer.

This financial freedom is a crucial competitive advantage. It ensures that business owners have full control over their capital, allowing for agile financial management and reducing the operational risk associated with trapped cash or unpredictable currency regulations.

The Role of the National Bank of Georgia (NBG)

While investors enjoy significant freedom, this doesn’t mean the financial system is unregulated. The National Bank of Georgia ensures that all commercial banks comply with international standards for Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT).

For an investor, this means that while transfers are unrestricted, banks will require standard documentation—such as invoices, contracts, or resolutions on dividend distribution—to verify the legitimacy of the funds. This is a hallmark of a mature and trustworthy financial system, providing assurance rather than creating barriers.

Practical Considerations for Investors

To ensure smooth financial operations, investors should consider the following points:

-

Select a Reputable Banking Partner: Georgia is home to several well-established local and international banks. Choosing a bank with a strong track record in handling international business transactions is advisable.

-

Understand Double Taxation Treaties: Georgia has signed Double Taxation Treaties (DTTs) with over 50 countries. These agreements prevent income from being taxed twice (once in Georgia and again in the investor’s home country). Investors should verify if their country of residence has such a treaty with Georgia.

-

Maintain Clear Documentation: Proper and transparent bookkeeping is fundamental. Well-maintained financial records ensure that any requests for transaction verification from banks are handled swiftly.

Frequently Asked Questions (FAQ)

Are there any limits on the amount of profit that can be repatriated?

No. Under Georgian law, there are no restrictions on the amount of legally earned profit or capital that a foreign investor can repatriate after paying taxes.

How long does a typical international transfer from Georgia take?

Transfers are subject to standard international banking timelines, which typically range from 2 to 5 business days, depending on the corresponding banks and destination country.

Is special government permission required to transfer profits out of the country?

No. The process does not require special case-by-case approval from the government or central bank. It’s managed through licensed commercial banks following standard procedures.

What taxes apply when repatriating profits?

The transfer itself is not taxed, but the profit is. For example, when a Georgian company distributes profits as dividends to a foreign owner, a 5% withholding tax is typically applied at the source.

Conclusion: Financial Freedom as a Foundation for Growth

Financial and regulatory predictability is paramount for any entrepreneur planning a significant capital investment, and Georgia’s legal framework provides exactly that. The robust legal guarantees for profit repatriation, combined with the absence of restrictive currency controls, create a secure and highly attractive environment for foreign direct investment.

This financial clarity removes a major point of uncertainty from the business planning process. It allows entrepreneurs to build financial models with confidence, knowing that the fruits of their investment can be freely accessed. Understanding these regulations is a crucial first step in the due diligence process and forms a key component of the comprehensive business plan required to launch a successful solar manufacturing facility.