Imagine a state-of-the-art solar module factory. Production is efficient, quality is high, and the order books are full. Yet, profitability stalls. The reason isn’t manufacturing, but movement. Finished modules face costly delays in transit, eroding margins before they ever reach the customer.

This scenario highlights a critical truth for any manufacturing venture: a world-class production line is only as strong as the logistics network supporting it.

For investors considering Georgia for solar module manufacturing, understanding its unique logistical landscape isn’t just an operational detail—it’s the cornerstone of a viable business plan. This analysis examines the country’s key ports and overland corridors, providing a practical framework for assessing the opportunities and challenges of exporting from this strategic crossroads.

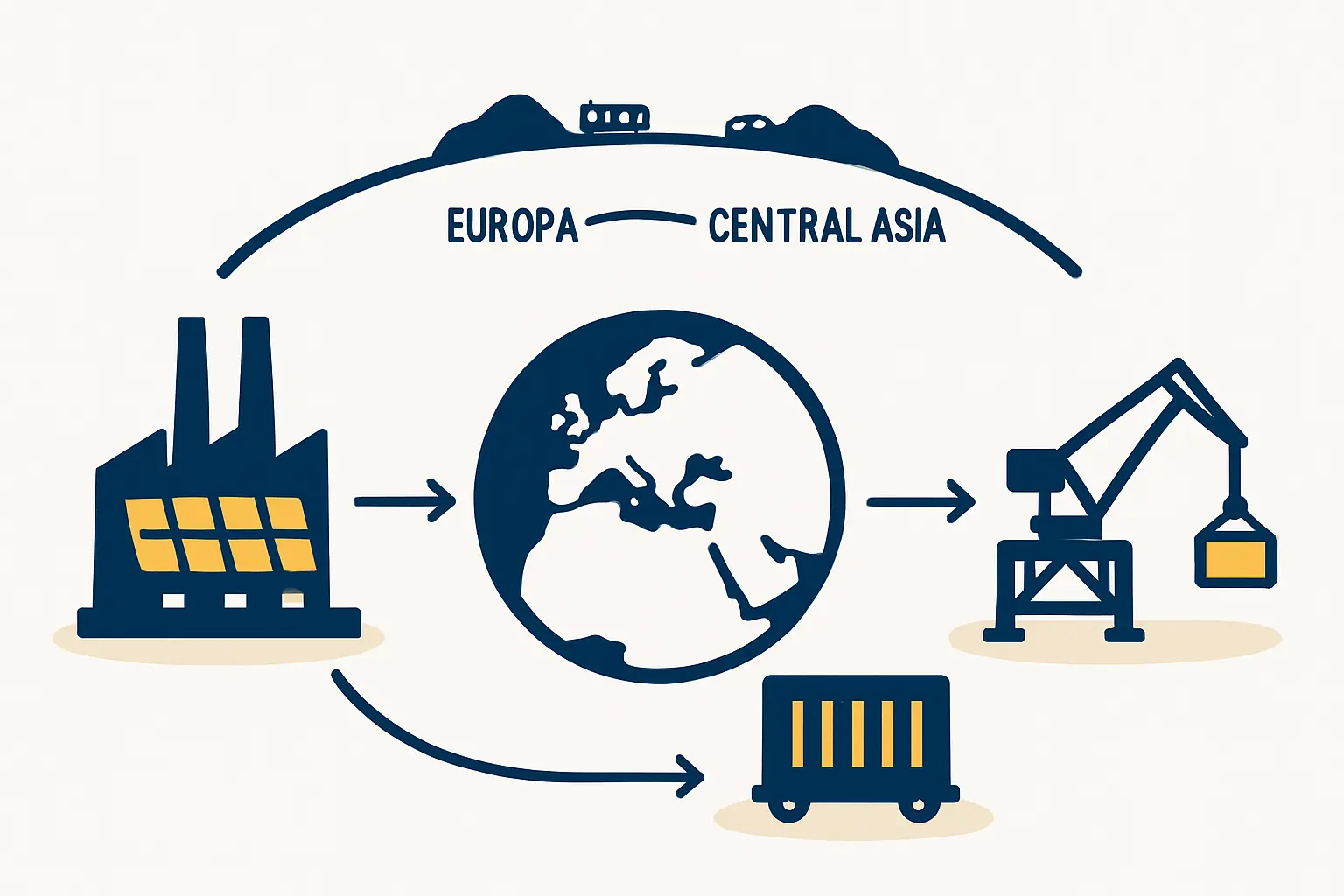

Georgia’s Strategic Position: The Middle Corridor Advantage

Georgia’s geographic location is one of its most compelling assets. It forms a natural land bridge between the Caspian and Black Seas, positioning it as a critical hub in the Trans-Caspian International Transport Route (TITR), often called the “Middle Corridor.”

This route has gained significant strategic importance as a reliable alternative for connecting Asia and Europe. For a solar module manufacturer, this means access to two distinct and valuable markets from a single production base: westward to Europe via the Black Sea and eastward to Central Asia via the Caspian Sea.

The corridor functions as a multimodal system integrating rail, road, and sea transport. A typical journey might involve rail transport from Central Asia, a sea crossing of the Caspian, another rail journey across Azerbaijan and Georgia, and then a final sea crossing of the Black Sea to reach European markets.

Successfully leveraging this corridor requires a clear understanding of its key infrastructure, particularly Georgia’s Black Sea ports.

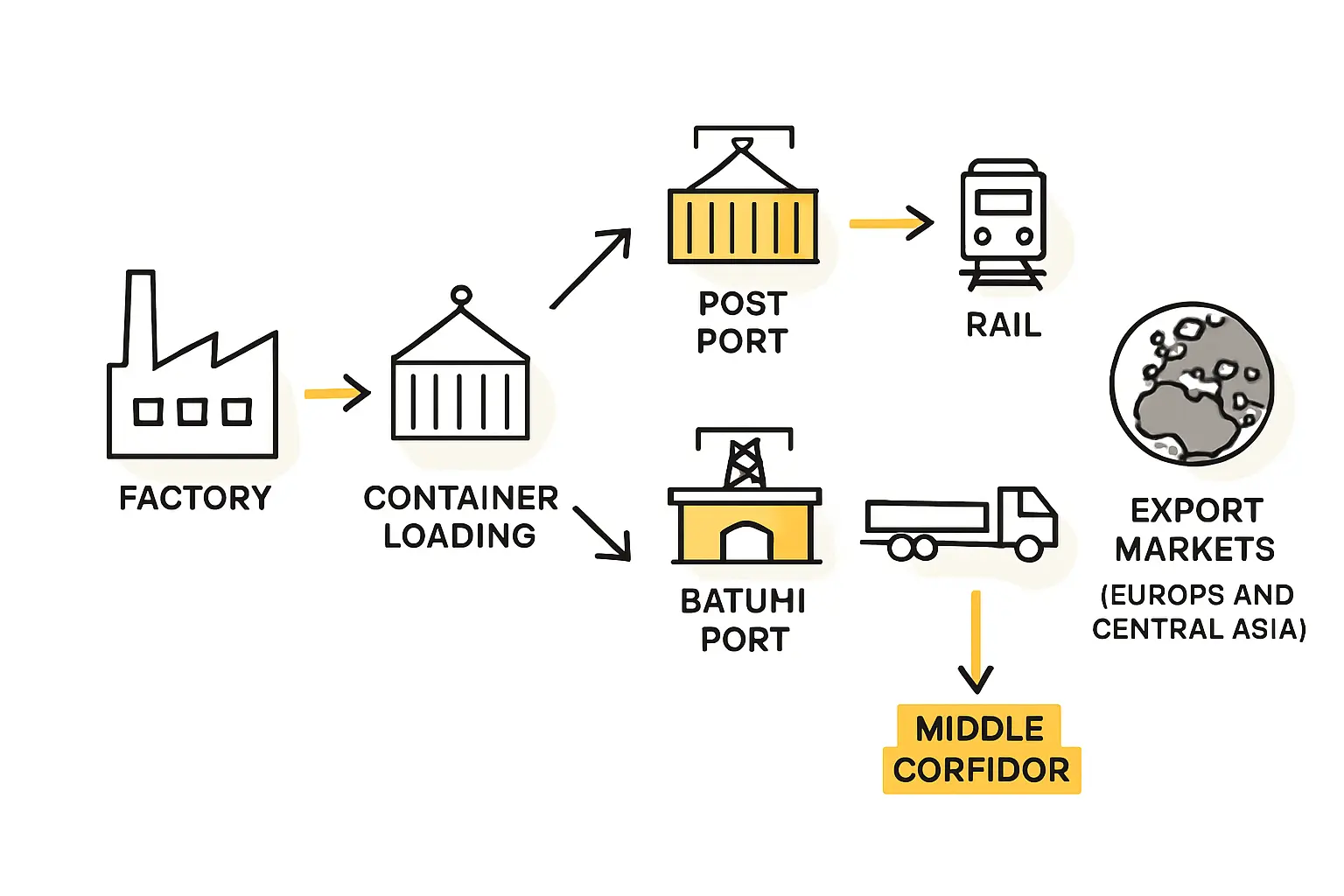

Black Sea Ports: The Gateway to Europe

For exporting high-volume, relatively heavy products like solar modules, sea freight remains the most cost-effective method. Georgia’s coastline is dominated by two key ports, each with distinct characteristics that shape an exporter’s strategy.

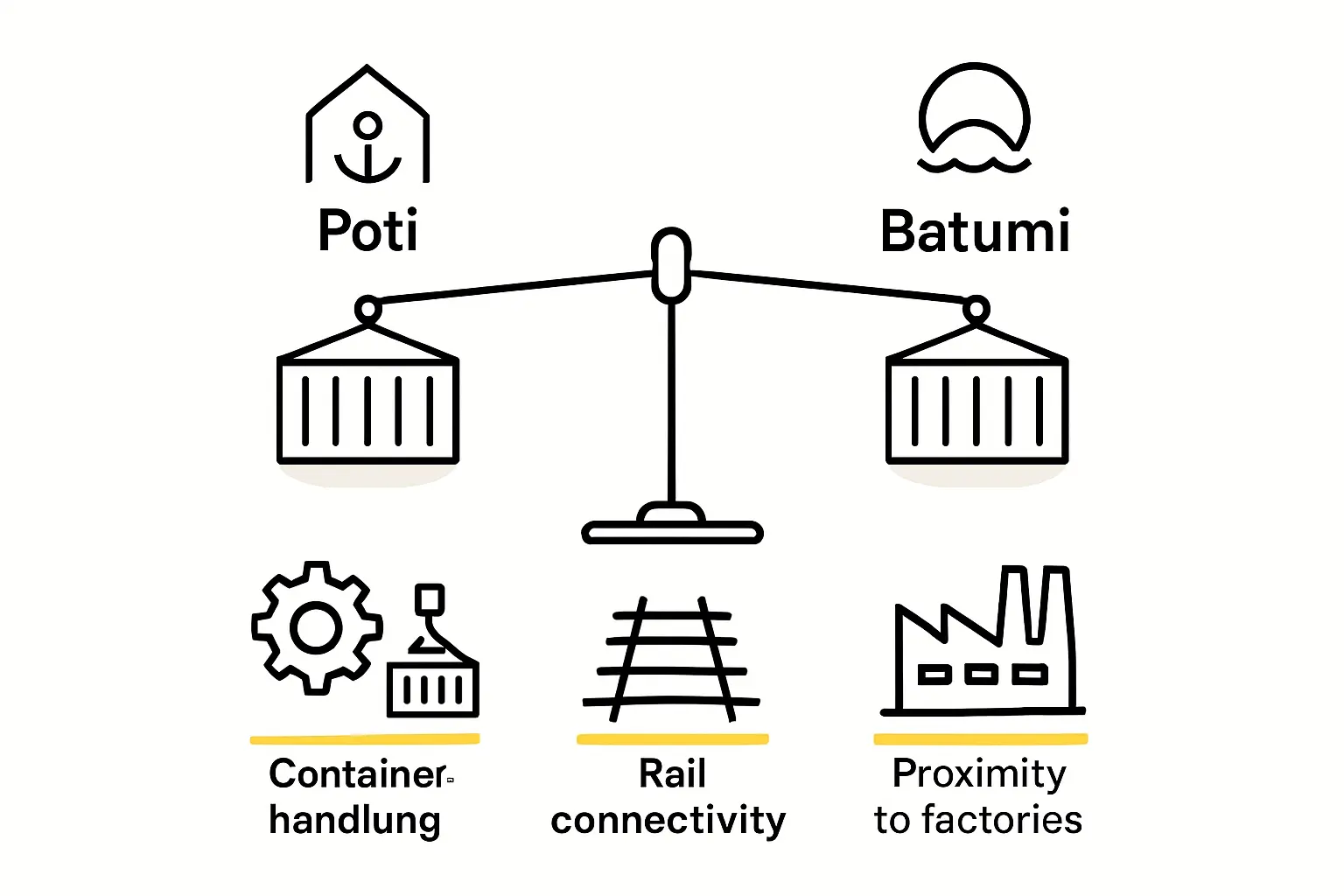

The Port of Poti: The Primary Container Hub

The Port of Poti is the commercial heart of Georgia’s maritime trade, handling over 80% of the country’s container traffic. Operated by APM Terminals, a global leader in port management, Poti offers established infrastructure and processes for containerized cargo—the standard for shipping solar modules securely.

However, investors must be aware of its physical limits. The port’s current draft of approximately 8.5 meters restricts access for larger, more economical container ships like the Panamax class. This restriction can lead to higher shipping costs per unit, as freight must be routed on smaller feeder vessels to larger trans-shipment hubs in the Black Sea or Mediterranean.

While plans for a new deep-water port are underway to address this, current operations depend on the existing infrastructure.

The Port of Batumi: A Complementary Asset

South of Poti, the Port of Batumi offers a different profile. While it handles less container traffic, its main advantage is a deeper draft of around 12 meters, allowing it to service larger vessels.

Historically, Batumi has focused more on oil and dry bulk cargo. For a solar module exporter, it remains a viable secondary option, but Poti’s specialization in container handling makes it the more logical primary choice.

Future Developments: The Anaklia Deep Water Port Project

The long-term potential of Georgia’s maritime logistics hinges on the Anaklia deep-water port. This project, which has seen several phases of planning and delays, aims to create a port capable of accommodating the largest container vessels. Its completion would be transformative, significantly lowering sea freight costs and transit times while enhancing Georgia’s appeal as an export-oriented manufacturing base.

Overland Routes: Reaching Central Asia and Beyond

While seaports are vital for European markets, Georgia’s overland infrastructure provides direct access to Turkey and the landlocked nations of Central Asia.

The Baku-Tbilisi-Kars (BTK) Railway

The BTK railway is the steel backbone of the Middle Corridor. This line provides a direct rail link from the Caspian coast in Azerbaijan, through the Georgian capital of Tbilisi, and into Turkey’s national rail network. For a solar module manufacturer, this opens up the Turkish market and provides a crucial land route to Central Asian republics via connecting rail systems across the Caspian.

The East-West Highway

Complementing the railway is the ongoing modernization of Georgia’s East-West Highway. This major infrastructure project is upgrading the primary road connecting the Azerbaijani border with the Black Sea ports. For a manufacturer, this means faster and more reliable inland transport, reducing the time it takes to move finished modules from the factory to the port of departure.

Practical Considerations for Solar Module Exporters

A theoretical understanding of infrastructure must translate into practical business decisions. Based on experience from J.v.G. turnkey projects, several key factors stand out:

-

Factory Siting: The decision of where to build is paramount. Proximity to the Port of Poti or a major hub on the East-West Highway or BTK railway can significantly reduce domestic logistics costs and complexity, making a thorough site analysis a critical first step.

-

Logistical Bottlenecks: For all its advantages, the Middle Corridor is not without challenges. It involves multiple border crossings and transfers between transport modes, such as from rail to ship at the Caspian Sea. These handovers can introduce delays and require careful coordination with logistics partners.

-

Trade Agreements: A major advantage for a Georgia-based manufacturer is the country’s Deep and Comprehensive Free Trade Area (DCFTA) with the European Union. This agreement allows for tariff-free export of goods to the EU, providing a significant competitive edge over manufacturers in countries without such an arrangement.

-

Cost vs. Speed: Exporters must balance the cost-effectiveness of sea freight to Europe against the potentially faster, though often more expensive, overland rail routes to Turkey and its neighbors. The optimal choice depends on the end market, order size, and delivery deadlines.

Frequently Asked Questions (FAQ)

Is Poti or Batumi better for exporting solar modules?

For standard containerized shipments, the Port of Poti is generally the preferred choice due to its specialized container-handling infrastructure and higher traffic volume. However, its draft limitations are a key factor to consider in your cost calculations.

How do Georgia’s logistics compare to other regional manufacturing hubs?

Georgia’s unique advantage is its central role in the Middle Corridor, offering direct routes to both Europe and Central Asia. Combined with its favorable trade agreements, particularly the DCFTA with the EU, it presents a compelling case for export-focused manufacturing.

What are the main bottlenecks when exporting from Georgia?

The primary bottlenecks are the vessel size limitations at the Port of Poti and the multiple trans-shipment points along the overland Middle Corridor route. These can add complexity and potential delays if not managed carefully.

Does the logistics infrastructure affect the initial investment in a solar factory?

Yes, indirectly. While the logistics network is external, your factory’s location relative to this network directly impacts long-term operational costs. Factoring logistics into the site selection process can have a significant positive impact on the overall investment.

Can an external partner assist with navigating these logistics?

Absolutely. Engaging with partners who provide turnkey solutions for solar manufacturing is highly recommended. Experienced consultants factor in logistical considerations from the earliest planning stages, ensuring the factory’s location and layout are optimized for efficient export to your target markets.

Georgia offers a robust and rapidly developing logistics network that can be a powerful enabler for an export-oriented solar module business. By understanding the specific capabilities and limitations of its seaports and overland routes, an investor can make informed strategic decisions that turn geographic potential into a tangible competitive advantage.