For entrepreneurs and investors exploring the solar manufacturing sector, the choice of location is a critical decision with lasting financial and operational consequences. While many focus on proximity to raw materials or end-markets, certain jurisdictions offer a unique combination of fiscal incentives, logistical advantages, and market access. Georgia, with its established Free Industrial Zones (FIZs), presents a compelling case for those planning an export-oriented solar module production facility.

This guide outlines the benefits, regulatory framework, and operational considerations of establishing a solar module factory within a Georgian FIZ, such as those in Poti or Kutaisi. It is designed for business professionals evaluating strategic locations for regional and international exports.

Why Georgia Merits Consideration for Solar Manufacturing

Georgia has strategically positioned itself as a business-friendly hub connecting Europe and Asia. Its government has actively cultivated an environment that attracts foreign direct investment, particularly in manufacturing and trade.

For a capital-intensive business like solar module production, the country’s Free Industrial Zones offer a framework designed to maximize profitability and streamline operations for export-focused enterprises. The primary appeal lies in a legal structure that significantly reduces the tax burden and administrative complexity of setting up and running a manufacturing plant.

Understanding Georgia’s Free Industrial Zones (FIZs)

A Free Industrial Zone in Georgia is a designated territory where a special economic and tax regime applies. Companies registered within an FIZ are considered to be outside Georgia’s customs territory—a distinction that is key to their favorable treatment. The most prominent FIZs are located in Poti, adjacent to the country’s largest seaport, and Kutaisi, a major industrial and logistical hub.

The core principle of an FIZ is to encourage the production of goods for export. While companies can trade with the domestic Georgian market, the system is structured to overwhelmingly favor international sales.

The Core Financial Advantages: A Nearly Tax-Free Environment

The most significant incentive for establishing a factory in a Georgian FIZ is the exemption from nearly all major corporate taxes. This structure can dramatically alter the financial projections of a new manufacturing venture.

Key tax exemptions for companies operating within an FIZ include:

- Corporate Profit Tax (0%): Profits generated from exporting goods manufactured within the FIZ are not subject to corporate profit tax. This is a fundamental advantage that directly boosts the company’s bottom line.

- Value Added Tax (VAT) (0%): Transactions between companies within an FIZ, as well as the supply of goods and services into the zone, are exempt from VAT.

- Import & Export Duties (0%): All machinery, raw materials (such as solar cells, glass, and aluminum frames), and components can be imported into the FIZ without incurring customs duties. Finished solar modules exported from the FIZ are also exempt from duties.

- Property Tax (0%): Any buildings, infrastructure, and land owned by the FIZ company within the zone’s territory are exempt from property tax.

- Dividend Tax (0%): For foreign founders or shareholders, dividends distributed by the FIZ company are not subject to taxation.

Notably, trade with the domestic Georgian market (outside the FIZ) is subject to a 4% tax on the invoice value, reinforcing the zone’s design for export-oriented businesses.

Strategic and Logistical Benefits Beyond Taxation

While the tax regime is the primary draw, Georgia offers several other strategic advantages that support a successful manufacturing operation.

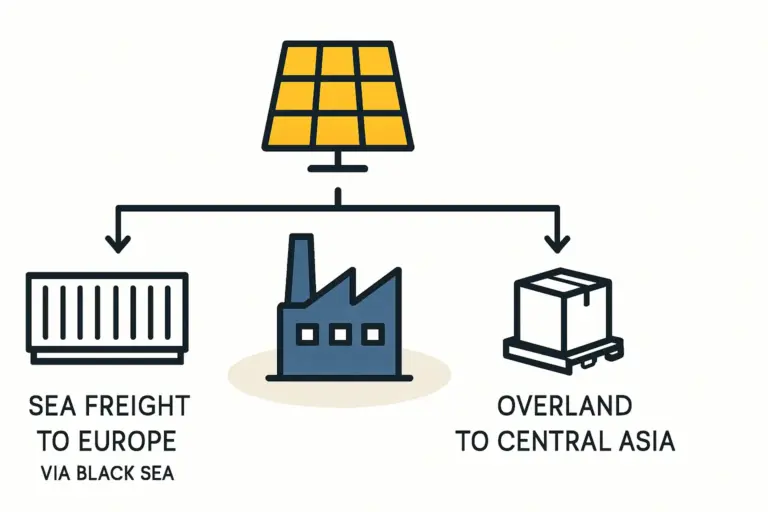

A Gateway to Global Markets

Georgia’s geographical location is a significant logistical asset. Situated at the crossroads of Eastern Europe and Western Asia, it provides a natural bridge for trade.

This prime location is bolstered by a series of crucial free trade agreements, including:

- Deep and Comprehensive Free Trade Area (DCFTA) with the European Union.

- Free Trade Agreements with EFTA countries (Switzerland, Norway, Iceland, Liechtenstein), CIS countries, Turkey, and China.

These agreements allow goods manufactured in Georgia to enter vast consumer markets with reduced or eliminated tariffs, providing solar module exporters a substantial competitive edge.

Operational Efficiency and Infrastructure

Setting up and operating a business within a Georgian FIZ is a straightforward process. The zones typically offer “one-stop shop” services for all administrative needs, including company registration, licensing, and permits, minimizing bureaucracy.

Furthermore, Georgia’s energy sector, dominated by hydropower, provides some of the most competitively priced and reliable electricity in the region—a critical factor for managing costs at an energy-intensive solar factory. The availability of an educated and cost-effective labor force complements these infrastructural benefits. A well-structured solar module manufacturing business plan is essential to accurately forecast these operational advantages.

Practical Considerations for Factory Setup

Establishing a production facility in an FIZ involves a structured process. After completing company registration, the next phase focuses on the physical and technical setup of the plant.

Based on experience from turnkey projects, the process involves detailed planning for factory layout, utility requirements, and equipment procurement. Many investors opt for a turnkey solar production line to ensure that all machinery, from the stringer to the final laminator, is integrated efficiently and commissioned by experienced engineers.

While the FIZ model drastically reduces ongoing tax liabilities, investors must still factor in the initial investment requirements. These include the cost of the manufacturing license, land or building lease, machinery, and initial working capital for raw materials and labor.

Frequently Asked Questions (FAQ)

What is the primary purpose of a Georgian FIZ?

The main goal is to attract foreign direct investment by creating a highly favorable environment for export-oriented businesses, with a legal and tax framework designed to minimize costs and administrative hurdles.

Are there any hidden costs or taxes?

The regime is transparent. The main cost outside of standard operational expenses is the annual license fee for operating in the FIZ. The only significant tax is the 4% levy on the value of goods sold to the domestic Georgian market outside the zone.

Is it complicated for a foreign national to own a company in a Georgian FIZ?

No, the system is specifically designed for foreign investors. The company registration process is streamlined, and 100% foreign ownership is permitted without requiring a local partner.

What markets can be efficiently supplied from Georgia?

Due to its comprehensive free trade agreements, a factory in Georgia is well-positioned to export tariff-free to the European Union, EFTA nations, CIS countries (including Russia), Turkey, and China. Its port access also facilitates shipping to the Middle East and North Africa.

How does the infrastructure in the FIZs support manufacturing?

FIZs in locations like Poti and Kutaisi offer developed infrastructure, including access to major highways, rail connections, and seaports. They provide reliable electricity, water, and communications—all of which are essential for uninterrupted industrial production.

Conclusion: A Strategic Launchpad for Regional Exports

For investors planning to enter the solar module manufacturing industry with a clear focus on exports, Georgia’s Free Industrial Zones offer a unique set of advantages. The combination of a near-zero tax environment, strategic geographic location, and preferential access to major international markets creates a powerful foundation for a competitive and profitable enterprise.

By leveraging this framework, a new solar factory can not only minimize its tax burden but also build a resilient supply chain with efficient access to Europe, Asia, and the Middle East. This makes Georgia a premier strategic launchpad, not just a low-cost production site.