An entrepreneur in Tbilisi has a robust business plan for a new 50 MW solar module assembly line. With financing structured, a building identified, and market demand clear, one critical question will determine the project’s long-term profitability: where will the raw materials be sourced?

Is it feasible to rely on local industries in Georgia and the surrounding Caucasus region, or is an international supply chain the only viable path?

This is not a question unique to Georgia. For any investor considering photovoltaic manufacturing, understanding the supply chain is as crucial as understanding the technology itself. This analysis explores the practical realities of sourcing key solar module components in the Caucasus and provides a framework for assessing regional industrial capabilities against global supply standards.

Understanding the Core Components: The Bill of Materials (BOM)

Before assessing sourcing options, we need to understand what goes into a modern solar panel. A typical crystalline silicon module is an assembly of several critical components, each with specific technical requirements. By weight and cost, the primary materials are glass and the aluminum frame.

A simplified Bill of Materials (BOM) for a standard solar module includes:

- Front Glass: Specially tempered, low-iron glass for maximum light transmission and durability.

- Encapsulant (EVA): Ethylene Vinyl Acetate sheets that laminate the components and protect cells from moisture and impact.

- Photovoltaic (PV) Cells: The core technological component that converts sunlight into electricity.

- Backsheet: A multi-layer polymer sheet that provides electrical insulation and mechanical protection on the rear side of the module.

- Aluminum Frame: Anodized aluminum profiles that provide structural integrity and a means for mounting.

- Junction Box: An enclosure on the back of the module containing bypass diodes and connection cables.

Each of these items presents a different sourcing challenge, especially in a region developing its industrial base for renewable energy. A successful sourcing strategy requires a careful analysis of local capabilities versus the complexities of importation.

Local Sourcing Potential in Georgia: A Component-by-Component Analysis

Georgia’s strategic location and growing industrial sector present interesting possibilities for local sourcing. However, a detailed examination reveals a mixed landscape of opportunities and limitations.

Solar Glass: The Question of Specialization

At first glance, local glass sourcing seems promising. Georgia is home to glass manufacturers like Mina JSC, which produces container glass. The fundamental question for a solar investor, however, is whether this production can be adapted to meet the stringent specifications of solar glass.

Solar glass must be:

- Low-Iron: To maximize sunlight transmission, its iron content must be extremely low, giving it higher clarity than standard glass.

- Tempered: The glass must be heat-treated to increase its strength and ensure it shatters into small, safe pieces if broken.

- Precisely Cut: It must be available in the exact dimensions required for module assembly, with high-quality edge finishing.

While a local factory may produce glass, retooling a furnace for low-iron production and investing in tempering and cutting lines represents a significant capital expenditure. For a local glass producer, this investment is justified only if the demand from one or more solar factories is large and consistent. As a result, a new module manufacturer in Georgia will likely need to import solar glass initially, with Turkey being the most logical and cost-effective source due to its advanced glass industry and logistical proximity.

Aluminum Frames: Assessing Local Extrusion Capabilities

The situation with aluminum frames is more optimistic. The aluminum profiles used for solar modules are created through a standard industrial process called extrusion. Georgia has several aluminum extrusion companies capable of producing various profiles for construction and other industries.

The key considerations for sourcing frames locally are:

- Die Specification: The local extruder must be able to produce a die for the specific, often complex, profile of a solar frame. This is generally feasible.

- Anodizing Quality: The quality of the anodizing—an electrochemical process that creates a durable, corrosion-resistant oxide layer—is critical for the 25-year lifespan of a solar module. A potential local supplier’s anodizing process must be thoroughly audited to ensure it meets international standards (e.g., 15-20 microns thickness).

- Precision Machining: The frames must be cut and machined with high precision to ensure a perfect fit during module assembly.

Based on J.v.G. Technology GmbH’s experience in similar markets, it is often possible to develop a local supply chain for aluminum frames. This requires close collaboration with a local extrusion company to ensure they can meet the required quality and precision standards. A successful partnership here can significantly reduce logistics costs and import duties, improving the factory’s overall cost structure. This is a vital part of the initial investment requirements analysis.

The Import Imperative: Sourcing High-Tech Components

While glass and frames present opportunities for regional sourcing, the core technological components of a solar module almost always require an international supply chain, primarily from Asia.

Photovoltaic Cells, EVA, and Backsheets

PV cells are the most technologically sensitive and highest-value components in the module. Their manufacturing is a highly complex process concentrated in a few regions globally, with China as the dominant producer. The same is true for the specialized polymer films used for EVA encapsulant and backsheets.

For a new assembly plant in Georgia, there is no practical alternative to importing these materials. The management team’s primary focus should be on:

- Supplier Vetting: Identifying and qualifying reliable international suppliers.

- Logistics Management: Establishing efficient and cost-effective shipping routes (e.g., via the ports of Poti or Batumi).

- Quality Control: Implementing rigorous incoming quality control processes to test materials upon arrival.

A detailed guide to the complete list of necessary components is available in our overview of the Bill of Materials (BOM).

Junction Boxes and Connectors

Similarly, junction boxes, cables, and connectors are specialized components that require sourcing from established international manufacturers to ensure safety, reliability, and compliance with international certifications like TÜV and UL.

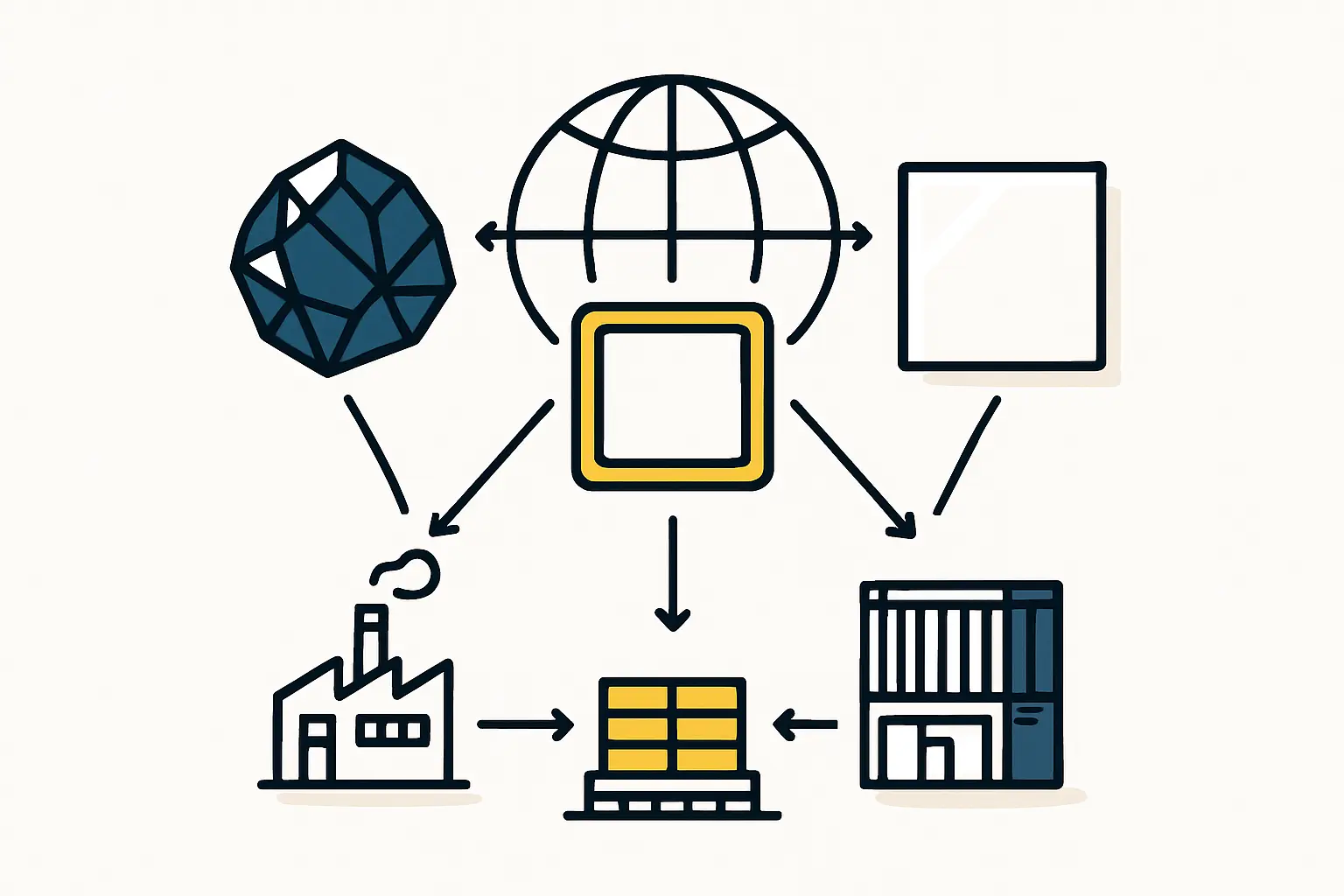

Building a Hybrid Supply Chain Strategy

The most effective approach for a solar factory in Georgia is not a simple choice between local or international sourcing. Instead, a successful operation builds a resilient hybrid supply chain that leverages the strengths of both.

The strategy involves:

- Importing Core Technology: Source PV cells, EVA, backsheets, and junction boxes from top-tier international suppliers.

- Developing Regional Suppliers: Actively work with local or Turkish companies to develop supply chains for bulky, lower-tech items like aluminum frames and, potentially in the future, solar glass.

- Optimizing Logistics: Utilize Georgia’s strategic position as a logistical hub connecting Asia and Europe to manage import and export flows efficiently.

This balanced approach mitigates risk, controls costs, and supports the local economy. This is a foundational element for anyone considering the process of starting a solar module factory.

Frequently Asked Questions (FAQ)

Q1: Is it impossible to source solar cells locally in Georgia?

At present, there is no commercial manufacturing of solar PV cells in Georgia or the immediate Caucasus region. Setting up a cell manufacturing facility is a far more capital-intensive and technologically complex undertaking than a module assembly plant. For the foreseeable future, cells will need to be imported.

Q2: How much do logistics from China to Georgia add to the cost of materials?

Logistics costs can add a significant percentage to the material cost, typically ranging from 5% to 15%, depending on shipping rates, volume, and import duties. This is why sourcing heavier components like aluminum frames and glass from nearby Turkey or locally can create a substantial competitive advantage.

Q3: Can a new factory get reliable quality from a local Georgian aluminum supplier?

Yes, but it requires due diligence. This involves auditing the supplier’s facilities, testing sample products in a certified lab, and establishing a clear quality assurance agreement. The process is more like co-development than a simple purchasing transaction.

Q4: What is the biggest supply chain risk for a factory in this region?

The primary risk lies in dependency on international suppliers for critical components like solar cells. Geopolitical events, shipping disruptions, or changes in trade policy can impact availability and pricing. A well-managed factory mitigates this by working with multiple suppliers and maintaining a strategic inventory of critical materials.

Next Steps for Aspiring Manufacturers

Understanding the nuances of the supply chain is a critical first step. The analysis for Georgia shows that while challenges exist, a carefully planned hybrid sourcing strategy can create a viable and profitable manufacturing operation. The key is to separate the ideal from the practical, focusing on developing local sources where feasible while managing a professional international procurement process for core technologies.

For entrepreneurs and investors looking to move forward, the next phase involves detailed financial modeling, supplier identification, and technical planning. Building a comprehensive business plan that accurately reflects the costs and complexities of a hybrid supply chain is essential for success.