How to Secure Tax Abatements for Solar Manufacturing Equipment in Georgia

For entrepreneurs entering the solar manufacturing sector, the initial cost of equipment is one of the biggest financial hurdles. Strategic government incentives, however, can dramatically change that picture.

The state of Georgia has positioned itself as a key destination for solar manufacturing, leveraging its logistical advantages and powerful tax abatement programs. Successfully navigating these programs can slash initial equipment costs by millions of dollars, transforming a project’s financial viability from the outset.

This guide offers a step-by-step overview of the primary tax incentive available in Georgia for solar manufacturing equipment—the Sales and Use Tax Exemption—and explains how to qualify.

Understanding the Financial Landscape: Why Georgia?

The recent Inflation Reduction Act (IRA) has created a highly favorable environment for domestic manufacturing in the United States. In response, states like Georgia have amplified their own incentives to attract investment. The most impactful of these for a new solar factory is the exemption from sales and use tax on manufacturing machinery.

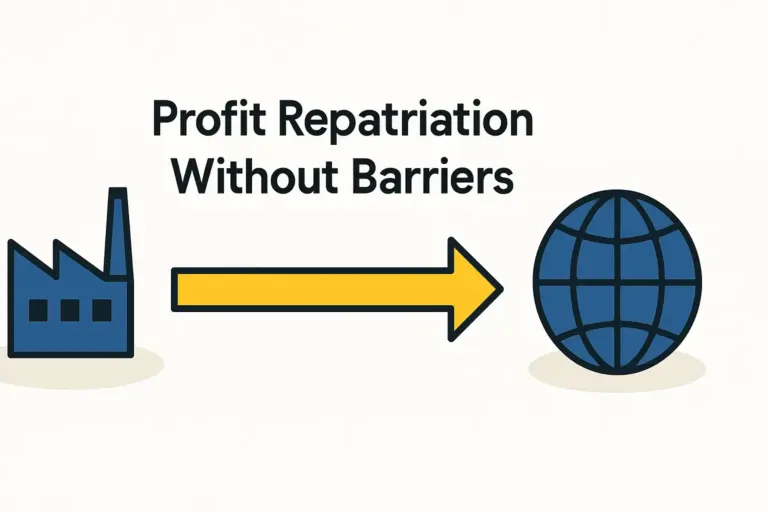

In Georgia, the state sales tax is 4%, but local taxes can increase the combined rate to over 8%. For a new solar module production line where equipment investment can easily range from $5 million to over $20 million, this exemption translates into a direct capital savings of $200,000 to over $1.6 million. This isn’t a future credit; it’s an immediate reduction in the required initial investment.

The Core Incentive: Sales and Use Tax Exemption Explained

The primary program is the Georgia Sales and Use Tax Exemption for Machinery and Equipment Used in Manufacturing. This statute allows new and expanding manufacturers to purchase specific types of machinery and equipment without paying state and local sales tax.

What Qualifies?

The exemption is specifically targeted at machinery that is directly involved in the manufacturing process. For a solar module factory, this would typically include:

- Cell Stringers: Machines that solder solar cells together into strings.

- Layup Stations: Automated systems for assembling the module layers (glass, EVA, cell matrix, backsheet).

- Laminators: The large ovens that cure and bond the module components.

- Framing and Junction Box Machines: Equipment for adding the aluminum frame and electrical junction box.

- Testing Equipment: Sun simulators (flashers) and electroluminescence (EL) testers used for quality control during production.

What Is Typically Not Covered?

The exemption is strict about the “direct use” clause. Generally, it does not cover equipment that supports operations but isn’t integral to the physical transformation of raw materials into a finished solar module. Examples include:

- Office furniture and computer systems.

- Warehouse racking and forklifts.

- Vehicles for transporting goods.

- General building components like HVAC systems.

Understanding this distinction is critical for accurate financial forecasting and compliance. A detailed analysis of solar module manufacturing equipment is crucial for correctly categorizing each asset.

A Step-by-Step Guide to the Application Process

Securing the exemption is a process that begins long before any equipment is purchased. Based on experience from J.v.G. Technology GmbH turnkey projects, a proactive and organized approach is essential for a smooth approval.

Step 1: Initial Engagement with Economic Development Authorities

Before any formal application, your first step is to contact the Georgia Department of Economic Development (GDEcD) or the local development authority in your chosen county. These agencies act as guides and partners. Their mission is to attract business, so they are there to provide essential information and support throughout the process. This initial conversation helps establish your project’s credibility and clarifies the specific requirements for the region.

Step 2: Project Scoping and The Letter of Intent

Authorities will require a clear overview of your project, often submitted as a Letter of Intent (LOI) or a detailed project summary. This document should professionally outline:

- Total Projected Investment: The estimated cost for the building, machinery, and setup.

- Job Creation Numbers: A realistic projection of the jobs you will create over a specific timeframe (e.g., 3-5 years). This is a critical metric for state officials.

- Project Timeline: Key milestones from site selection to the start of production.

- Description of Operations: A clear explanation of what the factory will produce.

Step 3: Completing and Submitting Form ST-5M

The official application for the exemption is Form ST-5M, the Sales and Use Tax Certificate of Exemption. On this form, the manufacturer certifies that the machinery purchased will be used directly in the production of tangible personal property. The form is submitted to the Georgia Department of Revenue. While the form itself is straightforward, it represents the culmination of your prior engagement and project validation with economic development authorities.