An entrepreneur in the Middle East, already successful in logistics, sees a significant opportunity in solar energy. He aims to build a solar module factory to serve his region but wants to leverage the credibility and engineering excellence associated with Germany.

This raises a key question: how can he structure his enterprise to benefit from the German ecosystem, even if his primary operations will be elsewhere? The answer often lies in establishing a German legal entity, a Gesellschaft mit beschränkter Haftung, or GmbH.

This article serves as a procedural guide for business professionals from outside the European Union on establishing a German GmbH for a solar manufacturing venture. It is not legal advice but a strategic overview of the process, its benefits, and the key considerations involved.

Why a German Legal Entity Matters for Your Global Solar Project

For an international entrepreneur, founding a company in Germany may seem like an unnecessary layer of complexity. However, for a capital-intensive project like a solar module production line, a GmbH offers distinct strategic advantages that extend far beyond German borders.

Insights from numerous turnkey projects managed by J.v.G. Technology show that international partners often choose this structure for three primary reasons:

1. Unmatched Credibility and Bankability

A German GmbH operates within one of the world’s most stable legal and economic frameworks. This stability lends immense credibility when seeking international financing, negotiating with suppliers, or forming partnerships. Lenders and investors view a German-registered company as a lower-risk entity with transparent governance.

2. Streamlined Procurement and Logistics

Sourcing high-quality manufacturing equipment is a critical step. A German company simplifies contracting with German and other European machinery suppliers. It also facilitates payment processing, export financing (such as Hermes cover), and VAT handling—a significant administrative advantage.

3. The “Engineered in Germany” Seal of Quality

While the factory may be located in Africa or Asia, having a German engineering and holding company signals a commitment to quality. It associates the venture with Germany’s global reputation for precision engineering, a powerful branding tool in the competitive solar market.

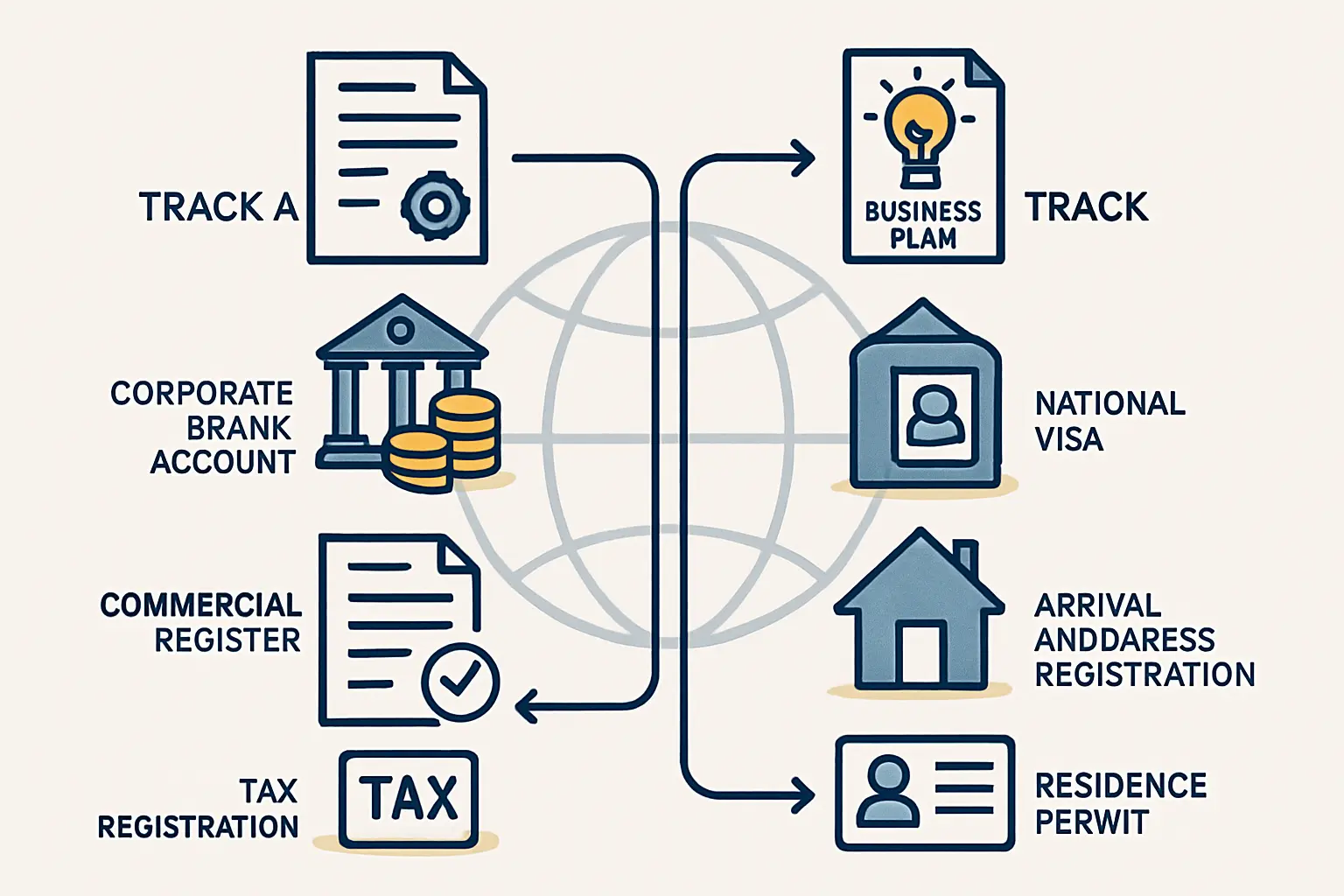

The Core Steps to Forming a GmbH in Germany

Establishing a GmbH is a highly regulated and methodical process, ensuring legal certainty for all parties. For a non-EU investor, it typically involves working closely with a German notary, lawyer, and tax advisor.

Step 1: Foundational Planning and Documentation

Before any legal steps are taken, a solid foundation must be laid. This involves preparing two key documents:

-

Articles of Association (Gesellschaftsvertrag): This document serves as the company’s constitution. It defines the company’s name, its registered office in Germany, the business purpose (e.g., “engineering, procurement, and consulting for photovoltaic manufacturing”), the amount of share capital, and the shareholders.

-

Shareholder List (Gesellschafterliste): A straightforward document listing the names, addresses, and respective shareholdings of all founding members.

During this phase, it is also crucial to develop a comprehensive solar panel manufacturing business plan. While not strictly required for the GmbH formation itself, it is essential for securing financing and guiding the project.

Step 2: The Notary Appointment

In Germany, the formation of a GmbH must be certified by a public notary (Notar). The managing director(s) and shareholders must appear before the notary to sign the articles of association. For non-EU investors, physical presence is not always mandatory. They can often grant a power of attorney to a legal representative in Germany who can attend the appointment on their behalf. This power of attorney must be notarized in the investor’s home country and certified with an apostille for international recognition.

Step 3: Capital Contribution and the Corporate Bank Account

A GmbH must have a minimum share capital (Stammkapital) of €25,000. At the time of formation, at least half of this amount (€12,500) must be paid into a corporate bank account opened in the company’s name.

Opening a bank account can be a major hurdle for non-resident founders due to strict international anti-money laundering (AML) and know-your-customer (KYC) regulations. German banks require extensive documentation about the business and its ultimate beneficial owners, so starting this process early with the help of a local advisor is highly recommended.

Step 4: Entry into the Commercial Register (Handelsregister)

Once the notary has certified the formation documents and received proof of the capital contribution from the bank, they will submit the application to the local court for entry into the Commercial Register. The company legally comes into existence only upon its registration, a process that typically takes a few weeks.

Step 5: Trade Registration and Tax Formalities

After registration in the Commercial Register, the company must be registered with the local trade office (Gewerbeamt). The tax office (Finanzamt) then issues the company’s tax number and VAT identification number, both of which are necessary for conducting business operations.

Key Considerations for the International Investor

Non-EU nationals navigating the GmbH formation process should be aware of several specific challenges and requirements.

Managing Director and Residency

Every GmbH must have at least one managing director (Geschäftsführer). While this person does not need to be a German citizen, they must be legally able to enter Germany at any time to fulfill their duties. For a non-EU national appointed as managing director, this often means applying for a German residence permit for self-employment or management. This process involves demonstrating the economic viability of the business venture and its positive impact on the German economy.

Timelines and Costs

While the process is straightforward, it is not instantaneous. A realistic timeline for establishing a GmbH, from initial planning to full operational readiness, is typically four to eight weeks, assuming all documentation is in order. The direct costs include notary fees, court registration fees, and professional fees for lawyers and tax advisors. The overall investment needed for solar module manufacturing is substantial, and these formation costs represent a small but necessary part of that initial investment.

The Importance of Local Expertise

Engaging experienced German legal and tax professionals from the outset is not an optional extra; it is a prerequisite for a smooth process. They can foresee potential hurdles, ensure all documents comply with local laws, and communicate efficiently with notaries, banks, and government offices.

Frequently Asked Questions (FAQ)

Can I run the GmbH entirely from my home country?

Yes, it is possible to manage the company remotely. However, the appointed managing director must be able to travel to Germany if required. The company must also maintain a registered address in Germany, for which virtual office services are commonly used.

Is German language proficiency mandatory?

While not a legal requirement for shareholders, it is highly practical. All official documents, court correspondence, and communication with tax authorities will be in German. The managing director should either speak German or have reliable professional support for translation and communication. Notarizations can be conducted with a certified interpreter present.

What are the annual compliance requirements for a GmbH?

A GmbH must file annual financial statements and corporate tax returns, and depending on its size, it may also be subject to an audit. Maintaining proper bookkeeping according to German commercial law is also mandatory.

How does the GmbH structure protect my personal assets?

As the name “company with limited liability” implies, the shareholders’ liability is generally limited to their capital contribution. This means personal assets are protected from the company’s debts, a critical advantage for a large-scale industrial project.

From Legal Structure to Operational Success

Establishing a German GmbH is more than a legal formality; it is a strategic decision that provides a robust and credible foundation for a global solar manufacturing enterprise. While the process is detailed and requires careful planning, it is a well-established path that any serious international investor can navigate successfully with expert guidance.

This legal structure serves as the corporate bedrock for a successful factory—one that can leverage German engineering standards to produce high-quality solar modules for markets around the world.