To many entrepreneurs considering solar module manufacturing, the global supply chain appears monolithic and heavily concentrated in Asia. Yet a closer look reveals a robust and strategically advantageous ecosystem within Germany and the broader European Union. Understanding this landscape is more than an academic exercise—it’s a critical step toward building a resilient, competitive, and sustainable manufacturing operation.

This article explores the key components of the German and EU solar supply chain, showing how leveraging this local network can enhance logistical security, improve product quality, and create a strong brand identity rooted in European engineering standards.

The Strategic Importance of a Diversified Supply Chain

Recent years have highlighted the inherent risks of relying on geographically concentrated, long-distance supply chains. Shipping disruptions, geopolitical tensions, and fluctuating trade policies can create unforeseen delays and cost increases, severely impacting a new factory’s ability to meet production targets.

For professionals entering the solar industry, supply chain strategy is a foundational decision that influences everything from initial investment requirements for a solar factory to long-term profitability. By diversifying sourcing and considering European suppliers, new manufacturers can mitigate these risks and build a more predictable operational framework. This approach shifts the focus from simply securing the lowest component price to achieving the best total cost of ownership when factoring in logistics, quality, and reliability.

Core Components within the European Ecosystem

While not fully comprehensive, the European supply chain offers high-quality options for the most critical materials in solar module production. Germany, with its long history of industrial engineering, serves as a central hub for many of these key suppliers.

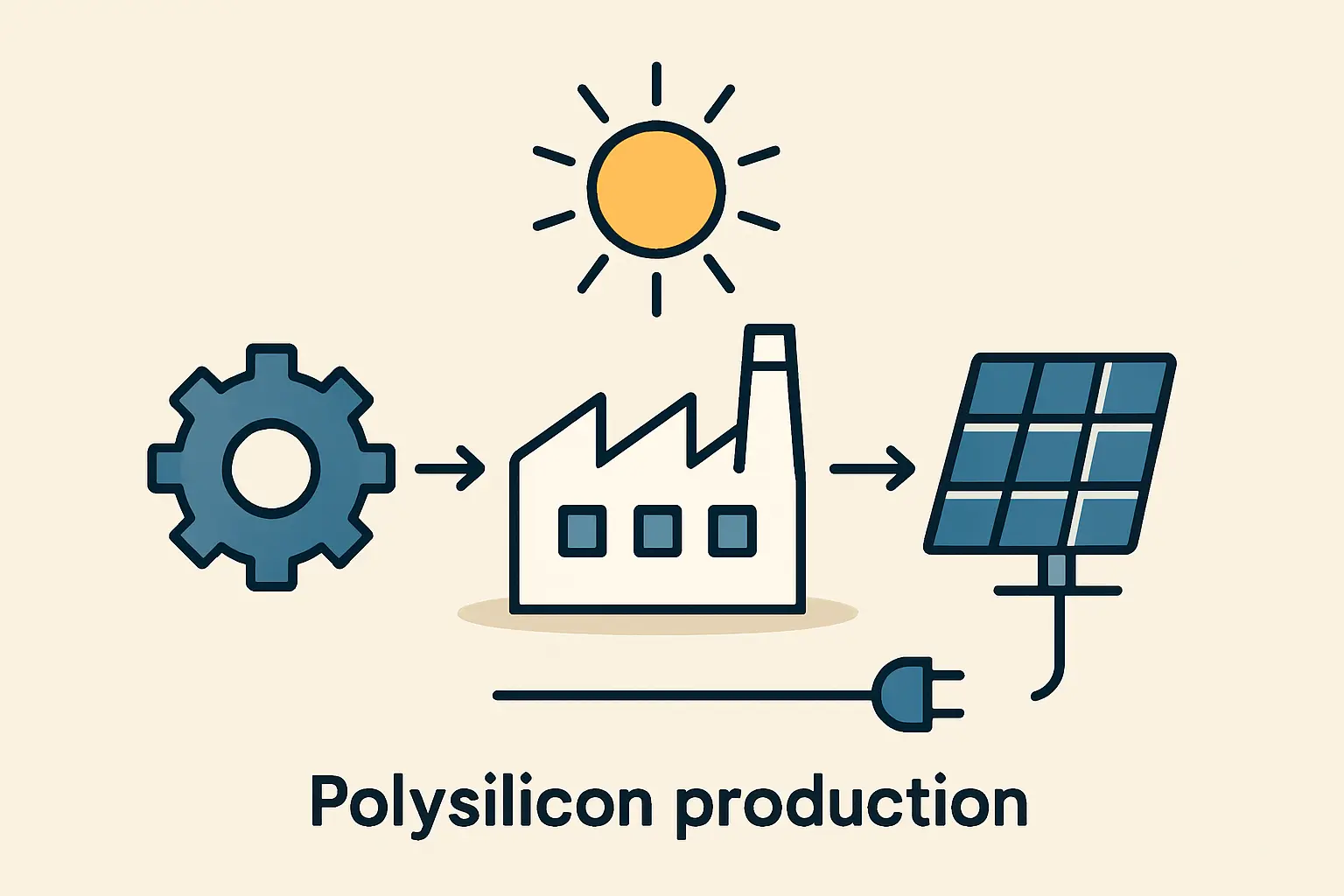

Polysilicon: The Foundation of High-Efficiency Modules

A solar module’s quality begins with the purity of its core material: polysilicon. Germany is home to Wacker Chemie AG, one of the world’s leading producers of hyper-pure polysilicon. This material is essential for manufacturing the high-efficiency solar cells that are in growing demand.

Access to this high-purity silicon enables manufacturers to produce premium modules that can command higher prices and deliver better performance—a key differentiator in a competitive market. Sourcing from a German supplier provides not only a quality advantage but also the traceability and stability often difficult to secure from more distant markets.

Solar Glass and Aluminum Frames: Structure and Durability

The protective layers and structural frame are vital to a module’s 25-to-30-year lifespan.

Solar Glass: Companies like Interfloat Corporation (part of HSG) in Brandenburg, Germany, specialize in producing high-transmission, tempered solar glass. Proximity to such a supplier simplifies logistics for this fragile, heavy material and allows for closer collaboration on specifications, like applying anti-reflective coatings.

Aluminum Frames: Major European aluminum extruders like Hydro are increasingly focusing on the solar industry. They offer frames made with a high percentage of recycled material, significantly lowering the product’s carbon footprint. This is a powerful selling point for sustainability-focused customers and aligns with emerging regulations like the Carbon Border Adjustment Mechanism (CBAM).

Critical Connectors and Protective Layers

Beyond the main components, the European market is home to specialists in other essential components. Manufacturers like Stäubli produce junction boxes and connectors renowned for their reliability, reducing the risk of field failures. While the market for backsheets and encapsulants is competitive, European suppliers provide options that meet stringent EU quality and durability standards, contributing to the finished module’s overall integrity.

The Business Case: Balancing Cost, Quality, and Resilience

New investors often ask whether sourcing from Europe is more expensive. While some component prices may be higher than Asian alternatives due to labor costs, a holistic business case reveals a more nuanced picture.

Logistical Advantages and Reduced Lead Times

Sourcing components within Europe drastically cuts down on shipping times—from several weeks by sea to just days by truck or rail. This offers several distinct advantages:

- Reduced Inventory: Less capital is tied up in inventory that is in transit.

- Greater Flexibility: The factory can respond more quickly to changes in demand or product specifications.

- Lower Shipping Costs: Transport within the EU is often cheaper and more predictable than intercontinental freight.

Based on experience from J.v.G. turnkey projects, simplifying logistics is one of the most effective ways for a new factory to de-risk its initial operations and accelerate its path to profitability.

The ‘Made in Europe’ Quality Premium

By sourcing from established European suppliers, a manufacturer can build a brand around quality, reliability, and sustainability. The “Made in Europe” label carries significant weight in many global markets, including North America and the Middle East. It signals adherence to high manufacturing standards and environmental regulations, justifying a premium price point and appealing to discerning buyers.

This is particularly relevant for entrepreneurs in regions with high solar irradiation, where module durability and long-term performance are paramount. A module built with high-grade European components is better positioned to withstand harsh environmental conditions.

Navigating EU Policy and Future Trends

The European Union is actively strengthening its domestic manufacturing capabilities. Initiatives like the Critical Raw Materials Act and the Net-Zero Industry Act are designed to foster industrial growth. These policies aim to streamline permitting, facilitate investment, and ensure a level playing field for local producers. For a new manufacturer, this political tailwind can translate into long-term stability and support.

Practical Integration for New Market Entrants

Integrating with the European supply chain begins with understanding what constitutes a Bill of Materials (BOM) for a solar panel. The BOM lists every component required, and making strategic sourcing decisions at this stage is crucial.

For entrepreneurs without a background in photovoltaics, navigating this supplier landscape can be challenging. An experienced technical partner with deep roots in the German market can offer invaluable guidance for qualifying suppliers and negotiating terms. This ensures every component selected as part of the solar module manufacturing process meets the required technical and quality specifications.

Frequently Asked Questions

Is it significantly more expensive to source solar components from Europe?

While some component costs may be higher, the total cost of ownership can be competitive when factoring in lower shipping expenses, reduced inventory needs, no import tariffs (for EU-based factories), and fewer costs associated with quality control or delays.

Can a new factory mix components from both Asia and Europe?

Yes, this is a common and often effective strategy known as “multi-sourcing.” For example, a factory might source high-purity polysilicon and glass from Europe to ensure quality, while sourcing other standardized components from Asia. This requires robust supply chain management to coordinate logistics.

What is polysilicon, and why is its purity so important?

Polysilicon is the highly purified form of silicon that serves as the raw material for solar cells. The higher its purity (often measured in “nines,” e.g., 9N for 99.9999999% pure), the more efficiently the resulting solar cell can convert sunlight into electricity. High-efficiency cells are key to producing powerful and competitive solar modules.

How does the EU actively support new solar manufacturers?

The EU provides support through policy frameworks like the Net-Zero Industry Act, which aims to simplify regulations and foster investment in green technologies. There are also funding programs and development banks that may offer financial support for projects that align with the EU’s strategic goals for energy independence and industrial resilience.

Building a Resilient Manufacturing Future

While Asia remains the center of gravity for global solar manufacturing volume, the German and EU supply chain offers a compelling strategic alternative built on quality, innovation, and resilience. For the discerning entrepreneur, tapping into this ecosystem is a powerful way to mitigate risk, build a premium brand, and establish a sustainable footing in the growing global solar market.

Deciding where to source components is fundamental to success. By looking beyond the obvious and analyzing the strategic advantages of the European supply chain, new manufacturers can build an operation that is not just competitive today, but resilient for the future.