When an entrepreneur considers a solar module factory in Central America, the initial focus is often on market demand and production technology. However, the venture’s success depends just as much on a less visible but critical factor: the efficiency of its supply chain.

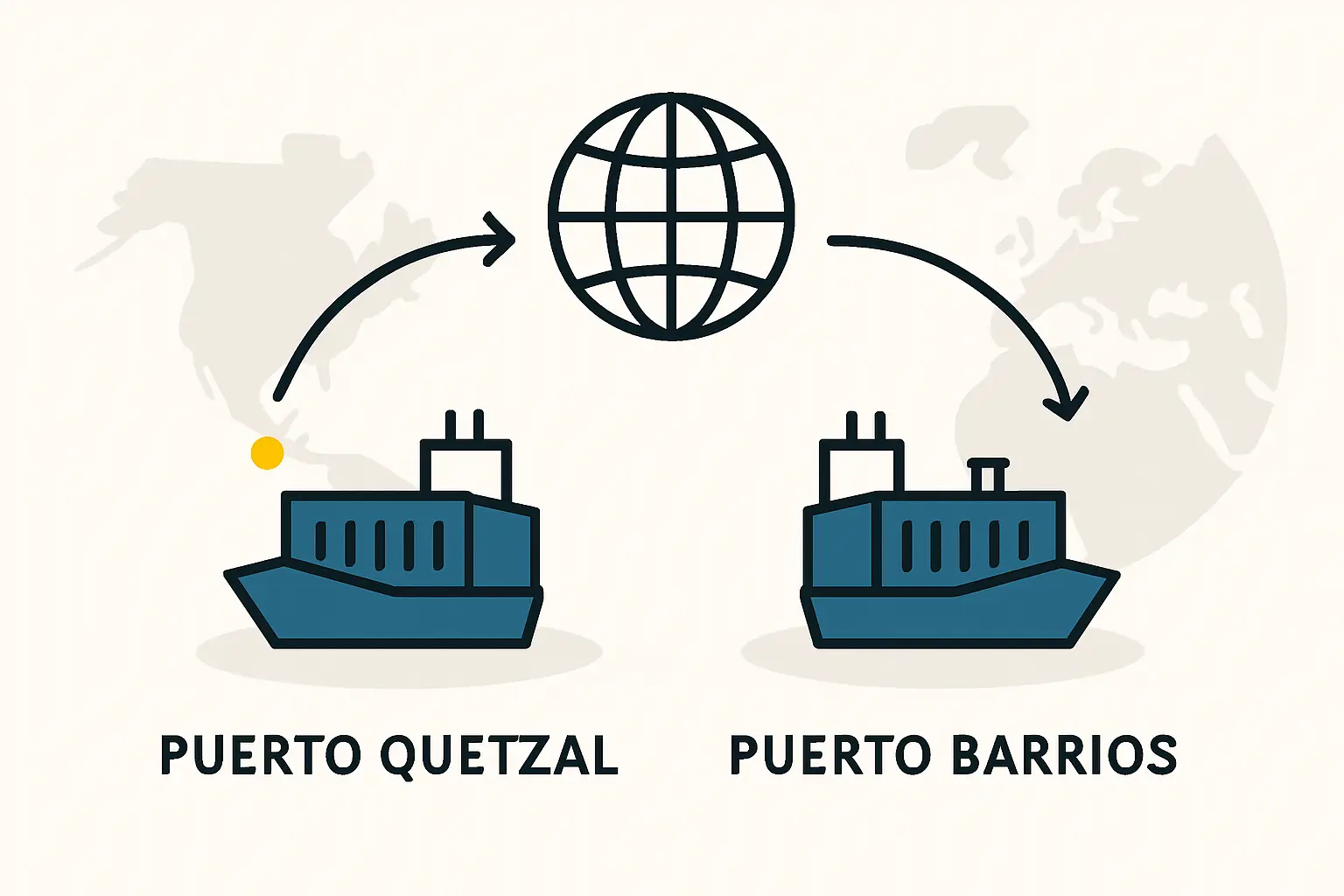

The ability to import raw materials cost-effectively and export finished products reliably is the backbone of any manufacturing operation. Guatemala, with its unique geographical position, presents a compelling case. It is one of the few countries in the region with direct port access to both the Pacific and Atlantic Oceans—an advantage that offers strategic flexibility for managing a global supply chain and serving regional markets.

This guide breaks down Guatemala’s logistical framework, focusing on its primary ports and inland transport networks to give potential investors a clear picture.

Guatemala’s Strategic Position: The Two-Ocean Advantage

The country’s coastline is divided between the Pacific Ocean to the south and the Caribbean Sea to the east. This geography allows a manufacturer to source materials from Asia via the Pacific while exporting finished modules to North American and Caribbean markets via the Atlantic, all from the same industrial base.

Pacific Access (Puerto Quetzal):

The ideal entry point for shipments from China, South Korea, and other major Asian suppliers of essential raw materials like solar cells, EVA encapsulant, and backsheets.

Atlantic Access (Puerto Barrios & Santo Tomás de Castilla):

This corridor is strategic for importing specialized equipment from Europe or the United States and for exporting finished solar panels to markets across the Caribbean, the US Gulf Coast, and South America’s Atlantic coast.

This configuration can significantly reduce shipping times and costs compared to operating from a single-ocean country, where goods might need to transit through the Panama Canal or be transported long distances overland.

Analyzing Key Ports for Solar Manufacturing Imports

Choosing the right port of entry is a critical decision that impacts everything from raw material costs to production timelines. The choice depends almost entirely on the origin of the goods.

Puerto Quetzal: The Gateway to the Pacific

Located on the Pacific coast, Puerto Quetzal is Guatemala’s largest and most modern Pacific port. For a solar module factory, it is the essential gateway, as the majority of photovoltaic components are manufactured in Asia.

Infrastructure: The port is equipped with modern gantry cranes and container yards capable of handling the large vessels that ply trans-Pacific shipping routes. Its annual container throughput makes it the country’s primary commercial port.

Proximity to Industrial Zones: Puerto Quetzal is situated near the department of Escuintla, a major industrial region. Its location just 100 km from Guatemala City means inland transport to a factory in the central industrial corridor is direct and relatively efficient.

Business Metrics: Experience from J.v.G. turnkey projects in similar regions shows that sourcing from Asia via a well-equipped Pacific port can optimize the cost-per-watt of raw materials by leveraging established, high-volume shipping lanes.

Puerto Barrios & Santo Tomás de Castilla: The Atlantic Corridor

On the Caribbean coast lie the neighboring ports of Puerto Barrios and Santo Tomás de Castilla. This complex serves as the country’s primary link to Atlantic trade routes.

Export Focus: While some raw materials may arrive from Europe or North America through these ports, their primary strategic value for a solar manufacturer is for exports. Finished modules can be shipped efficiently to island nations in the Caribbean or to markets in the Southeastern United States.

Special Economic Zones: The area around Santo Tomás de Castilla is home to ZOLIC (Zona Libre de Industria y Comercio), a free trade zone that offers significant fiscal and customs advantages. Establishing a factory within or near such a zone can streamline import-export processes and reduce the tax burden—a key factor for managing initial investment.

The Inland Supply Chain: From Port to Production Line

Once a container of raw materials arrives at port, the next critical link is the inland transportation network. The journey from Puerto Quetzal or Puerto Barrios to a factory in the central highlands is a key operational cost.

The country’s primary highways—the CA-9 (connecting the Atlantic coast to the capital) and routes connecting to the CA-2 (running parallel to the Pacific coast)—are the arteries of this network.

Cost Considerations: Inland freight for a 40-foot container from Puerto Quetzal to an industrial park near Guatemala City typically ranges from $450 to $700. This cost is influenced by fuel prices, road conditions, and security requirements. Budgeting accurately for this recurring expense is essential to maintain competitive production costs.

Common Challenges: Entrepreneurs new to the region sometimes underestimate logistical hurdles like customs delays, road security risks, and seasonal weather disruptions. Partnering with an established, insured local logistics provider is not an optional extra but a fundamental requirement for operational stability. These factors should be reviewed in detail during the initial site selection and factory planning process.

Frequently Asked Questions (FAQ)

Which port is better for importing raw materials for solar panels?

For a typical solar module assembly line, the vast majority of components (cells, glass, EVA, backsheets) are sourced from Asia. Therefore, Puerto Quetzal on the Pacific coast will be the primary import hub. Puerto Barrios is more relevant for importing specialized machinery from Europe or for exporting finished goods.

What are the average customs clearance times in Guatemala?

With correct and complete documentation, standard customs clearance typically takes three to seven business days. However, delays can occur. Engaging a reputable, experienced customs broker is critical to ensure paperwork is filed correctly and to navigate any procedural complexities, minimizing costly port storage fees.

How does Guatemala’s infrastructure compare to other Central American countries?

Guatemala’s primary competitive advantage is its dual-ocean port access, a feature not shared by all its neighbors. Its road network connecting the main ports to the central industrial corridor is well-established, though like in many developing economies, secondary roads can present challenges.

Are there free trade zones that benefit a solar manufacturer?

Yes. Guatemala has legislated for ZDEEPs (Zonas de Desarrollo Económico Especial Públicas) and operates the ZOLIC free trade zone near Santo Tomás de Castilla. These zones offer benefits such as exemptions from import duties on raw materials and machinery, as well as corporate income tax breaks for a specified period. Investigating these advantages is a worthwhile step during business planning.

Conclusion: Planning for Logistical Success

Guatemala’s port infrastructure provides a solid foundation for a solar module manufacturer aiming to serve both local and regional markets. The strategic advantage of its Pacific and Atlantic access creates a versatile supply chain framework capable of optimizing import costs and export reach.

However, leveraging this potential requires meticulous planning. A successful operation depends on a thorough understanding of inland transport costs, customs procedures, and choosing the right logistics partners. These elements are as crucial to the business plan as the production technology itself. By addressing these logistical realities from the outset, an investor can build a resilient and competitive manufacturing operation in the heart of Central America.