An entrepreneur has finalized a detailed business plan for a new solar module factory. The financial projections are solid, the market analysis is promising, and the technical specifications are in place. Yet a significant challenge remains: the high initial cost of importing specialized machinery and the tax burden during the critical first years of operation. For many investors looking at emerging markets, these factors can be a major barrier to entry.

In Guinea-Bissau, a structured government framework addresses this common obstacle, designed to attract foreign investment in key sectors like renewable energy. The Investment Promotion Agency (API-GB) is the central body guiding this process, offering a clear pathway to significant financial incentives. This guide outlines the step-by-step API-GB application process for securing these benefits for a solar manufacturing project.

Understanding the Role of API-GB: Your One-Stop-Shop for Investment

The Agência para a Promoção do Investimento e Exportação (API-GB) was established as a Guichet Único, or ‘one-stop-shop’, for investors. Its primary purpose is to simplify and centralize all administrative procedures related to private investment. Instead of navigating multiple government ministries, an investor deals directly with API-GB, which coordinates the entire process.

This framework is governed by the Private Investment Code (Law No. 1/2011), which provides the legal foundation for the rights and benefits granted to both national and foreign investors. For any business professional entering the Guinea-Bissau market, understanding API-GB’s role is the first step toward leveraging the country’s pro-investment policies.

Key Financial Incentives for Solar Manufacturing Investors

The benefits available through API-GB are substantial, directly addressing the key financial hurdles of establishing a new industrial facility. They fall into three broad categories: tax exemptions, customs duty reductions, and legal guarantees.

Tax Exemptions

For a new enterprise, tax obligations in the initial years can severely impact cash flow and profitability. The API-GB framework provides considerable relief:

-

Industrial Tax Exemption: Approved projects are exempt from industrial tax for five years in priority development zones and three years in other areas. This allows a new solar factory to reinvest a larger portion of its early earnings into operations, expansion, or workforce training.

-

Property Tax Exemption: A five-year exemption on property tax applies to new buildings constructed for the project, lowering the factory’s fixed overhead costs.

-

Capital Gains Tax Exemption: For five years, any capital gains realized are exempt from taxation, offering flexibility for future financing or asset management.

-

Stamp Duty Exemption: A range of legal and administrative acts, including incorporation and contracts, are exempt from stamp duty, reducing bureaucratic costs.

Customs and Import Duty Reductions

This is arguably the most significant incentive for a solar manufacturing project, where the high cost of specialized equipment is a major capital expenditure. Through API-GB, investors receive a full exemption from customs duties on the importation of:

-

Machinery and equipment required for the factory setup.

-

Raw materials and intermediate components necessary for production.

This single benefit can reduce the initial setup cost of a solar module production line by a significant margin, fundamentally improving the project’s financial viability from day one.

Guarantees for Foreign Investors

Beyond direct financial benefits, the framework provides essential assurances that build investor confidence:

-

Repatriation of Capital: The law guarantees foreign investors the right to transfer profits and dividends abroad.

-

Security of Assets: The state guarantees the security of an investor’s property and rights related to the investment.

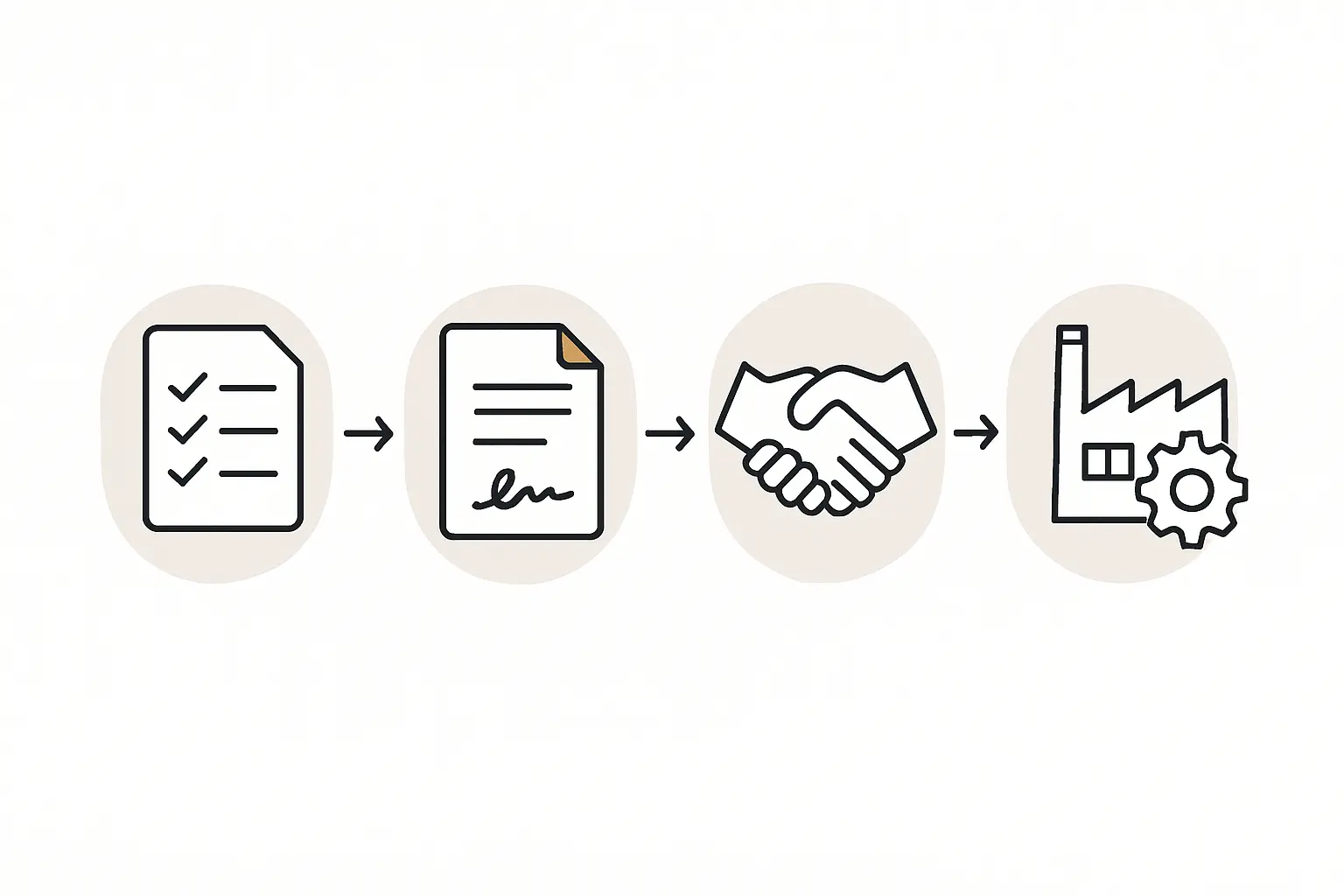

The Application Process: A Step-by-Step Walkthrough

The API-GB application process is designed to be transparent and structured. Securing the ‘Investor Certificate’—the official document granting access to all incentives—involves these core steps.

Step 1: Preparing Your Investment Project Proposal

The foundation of a successful application is a comprehensive, professionally prepared project proposal. This dossier, submitted to API-GB, must contain several key documents:

-

Completed Application Form: Provided by API-GB.

-

Investor Identification: Legal identification for the individual or corporate entity.

-

Proof of Financial Capacity: Evidence that the investor has the necessary funds to execute the project.

-

A Comprehensive Project File: This is the most critical component. It must include a detailed business plan and feasibility study, outlining the project’s technical specifications, market analysis, financial projections, and operational plan.

Based on experience from J.v.G. Technology GmbH’s turnkey projects, the quality and detail of the feasibility study often determine an application’s success. The study must clearly demonstrate the project’s viability and its alignment with the host country’s economic goals.

Step 2: Submission and Evaluation by API-GB

Once the proposal is submitted, API-GB conducts a thorough evaluation. The agency’s technical teams review the project from multiple perspectives:

-

Technical Viability: Is the proposed technology sound and appropriate?

-

Economic and Financial Viability: Are the financial projections realistic? Does the project have a clear path to profitability?

-

Legal Compliance: Does the project adhere to national laws and regulations?

Step 3: Receiving the Investor Certificate

After a positive evaluation, API-GB issues an official opinion and grants the project the Certificate of Investor. This certificate is the legal document that formally entitles the project to all tax exemptions, customs benefits, and guarantees outlined in the Investment Code.

Step 4: Post-Certificate Formalities

With the Investor Certificate in hand, establishing the business can proceed efficiently. API-GB continues to assist the investor with subsequent steps, including company registration, operational licensing, and other administrative formalities.

Frequently Asked Questions (FAQ)

What is the minimum investment amount to qualify for these incentives?

The Private Investment Code does not specify a rigid minimum investment. The focus is on the project’s viability, seriousness, and potential economic impact rather than a specific monetary value. A well-structured plan for a smaller, scalable production line is often viewed more favorably than an ill-defined plan for a larger one.

Are these incentives only available for new companies?

The incentives are designed to promote new private investment, so they primarily apply to new projects and the establishment of new companies. Significant expansions of existing businesses that qualify as new investments are also eligible.

How long does the application process typically take?

While API-GB is designed for efficiency, timelines can vary depending on the project’s complexity and the completeness of the submitted documents. A thorough and well-prepared application is the best way to ensure a smooth and timely review.

Do I need a local partner in Guinea-Bissau to apply?

The Investment Code permits 100% foreign ownership, so a local partner is not a legal requirement to qualify for incentives. However, for navigating local logistics and markets, engaging with local expertise can be a strategic advantage.

Conclusion and Next Steps

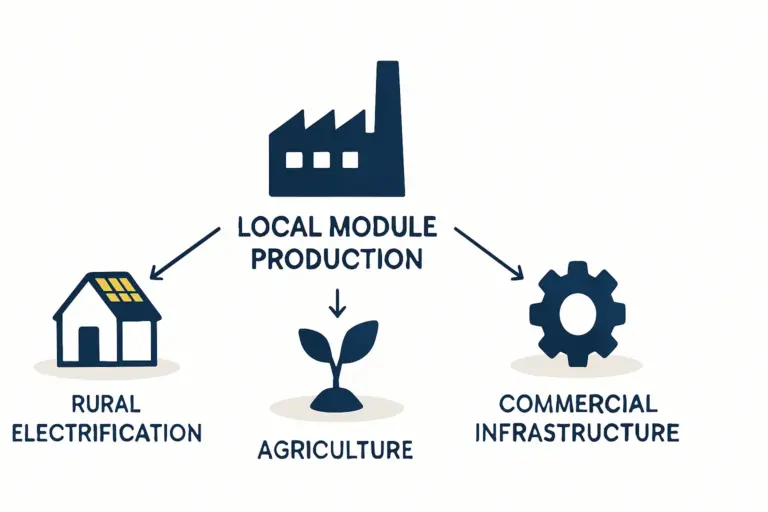

For entrepreneurs and companies considering the solar manufacturing sector in West Africa, Guinea-Bissau presents a compelling opportunity. The government, through API-GB, has created a transparent and highly attractive framework that directly mitigates the primary financial risks of new industrial projects. The exemptions on import duties for machinery and the multi-year tax holidays can fundamentally improve the financial case for investment.

The key to success lies in meticulous preparation. A professional, data-driven business plan and feasibility study are not just formalities; they are the essential tools for securing the Investor Certificate and unlocking the full potential of this supportive environment.

With a clear understanding of these financial incentives, the next step in planning is to define the facility’s physical requirements. Exploring the standards for a solar factory building and infrastructure will help you create a more accurate and comprehensive project proposal for submission.