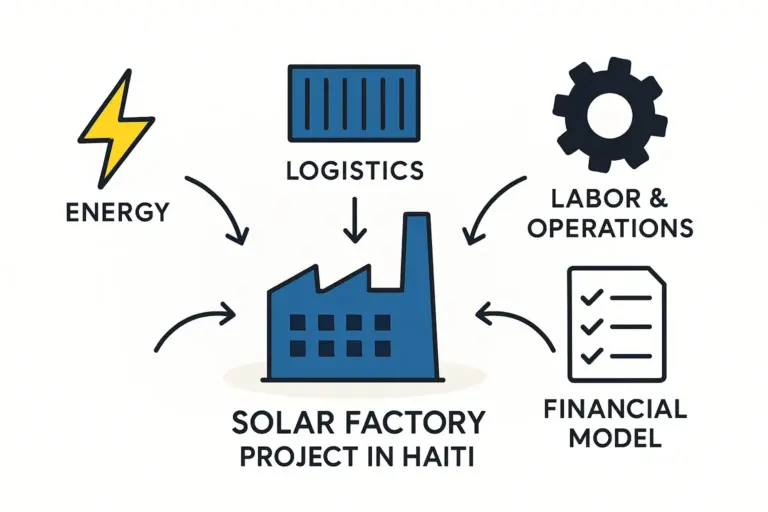

The global demand for renewable energy is creating significant opportunities for entrepreneurs in regions with high solar irradiation. With its pressing energy needs and abundant sunlight, Haiti is a market of considerable interest.

For foreign investors, however, navigating an unfamiliar legal and administrative landscape can be daunting. The complexity of company registration, environmental permits, and operational licenses can often prove a barrier to entry. This guide outlines the procedures required to establish a manufacturing entity in Haiti’s energy sector. It is designed for business professionals who recognize the opportunity but need a clear map to transform their vision into a fully compliant operation.

Understanding the Legal Framework for Foreign Investment in Haiti

Before delving into specific steps, it’s essential to understand the foundational principles that govern business in Haiti. The country’s legal system is based on the French civil code, which provides a structured and codified approach to commercial law.

A cornerstone of this framework is the Constitution of 1987, which explicitly guarantees the right to private property and ensures that foreign investors have the same rights and privileges as local entrepreneurs. This principle of non-discrimination creates a stable legal basis for investment.

To further support foreign investors, the government established the Center for Facilitation of Investments (CFI), a central point of contact that helps streamline administrative procedures.

Step 1: Choosing the Right Business Structure

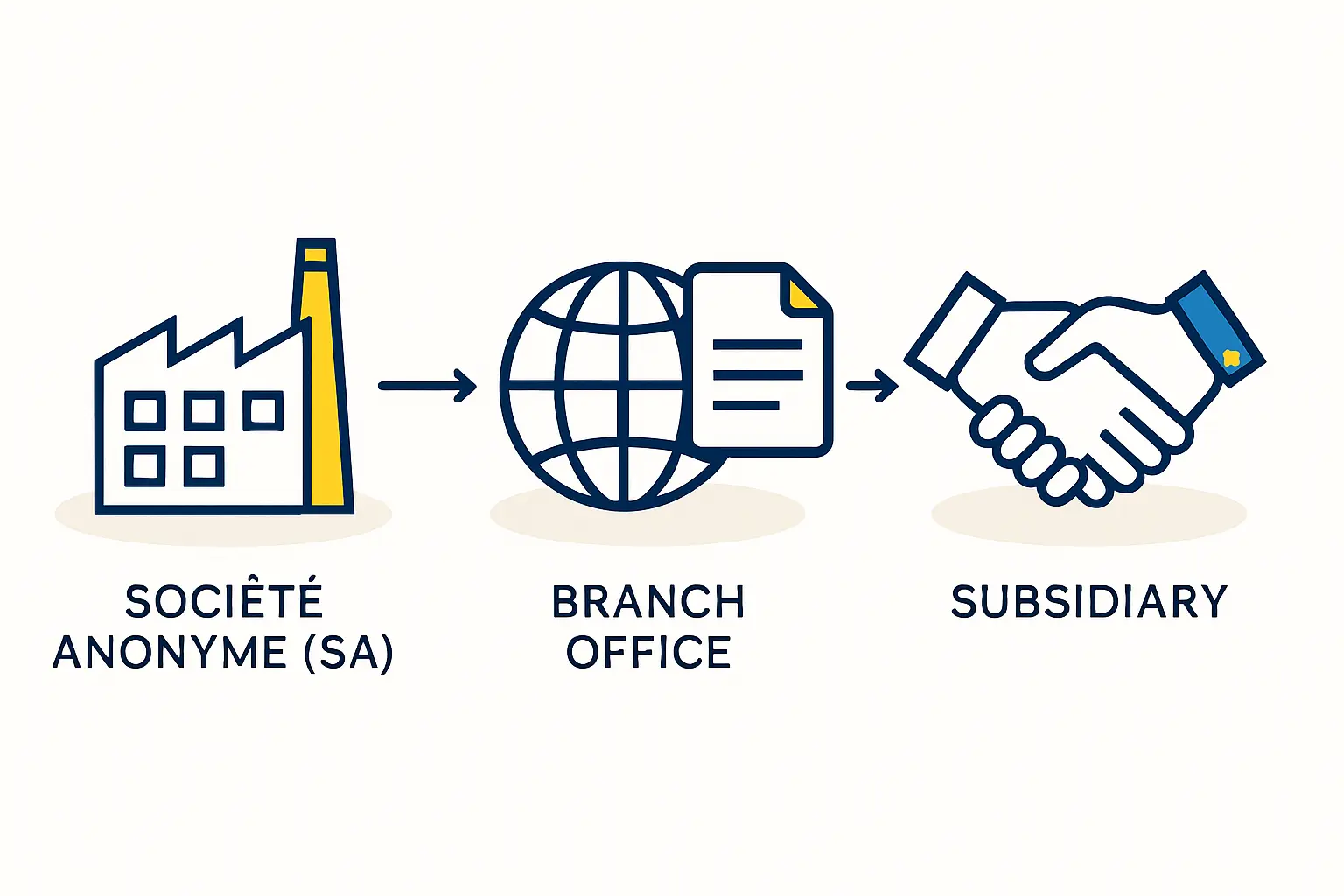

The first decision for any investor is selecting the appropriate legal structure for the new enterprise. For commercial manufacturing operations in Haiti, two primary corporate forms are most relevant.

The Public Limited Company (Société Anonyme – SA)

The Société Anonyme is comparable to a public limited company (PLC) or a corporation in other jurisdictions. This structure is best suited for larger-scale operations that may require significant capital investment from multiple shareholders or public financing. With a required board of at least three members, the SA’s governance structure is more formal. For extensive projects targeting national or international markets, the SA provides the corporate framework necessary for complex financial arrangements.

The Limited Liability Company (Société à Responsabilité Limitée – SARL)

The Société à Responsabilité Limitée is the equivalent of a limited liability company (LLC). This structure is considerably simpler to manage and is an excellent choice for small to medium-sized enterprises (SMEs). For an entrepreneur planning to launch a pilot or a 20-50 MW solar module production line, the SARL offers a robust yet flexible framework that protects personal assets while minimizing administrative overhead.

Step 2: The Core Business Registration Process

Once the business structure is chosen, the formal registration process begins. This sequential process involves several government ministries.

-

Company Name Verification: The proposed company name must be verified as unique and reserved at the Ministry of Commerce and Industry (MCI).

-

Notarization of Founding Documents: The company’s articles of incorporation and bylaws must be drafted and notarized by a licensed Haitian notary, formalizing its legal foundation.

-

Registration with the MCI: The notarized documents are submitted to the MCI to be officially recorded, which legally establishes the company.

-

Publication in the Official Journal: A notice of the company’s formation must be published in Haiti’s official journal, “Le Moniteur,” which serves as public notification that the new entity exists.

-

Obtaining a Tax Identification Number (NIF): Every business must register with the Direction Générale des Impôts (DGI) to receive a Numéro d’Immatriculation Fiscale (NIF). This unique tax identifier is essential for all financial transactions, from opening a bank account to processing payroll.

-

Social Security Registration: The company and its employees must be registered with the social security bodies: the National Old-Age Insurance Office (ONA) and the Office of Occupational Injury, Sickness, and Maternity Insurance (OFATMA).

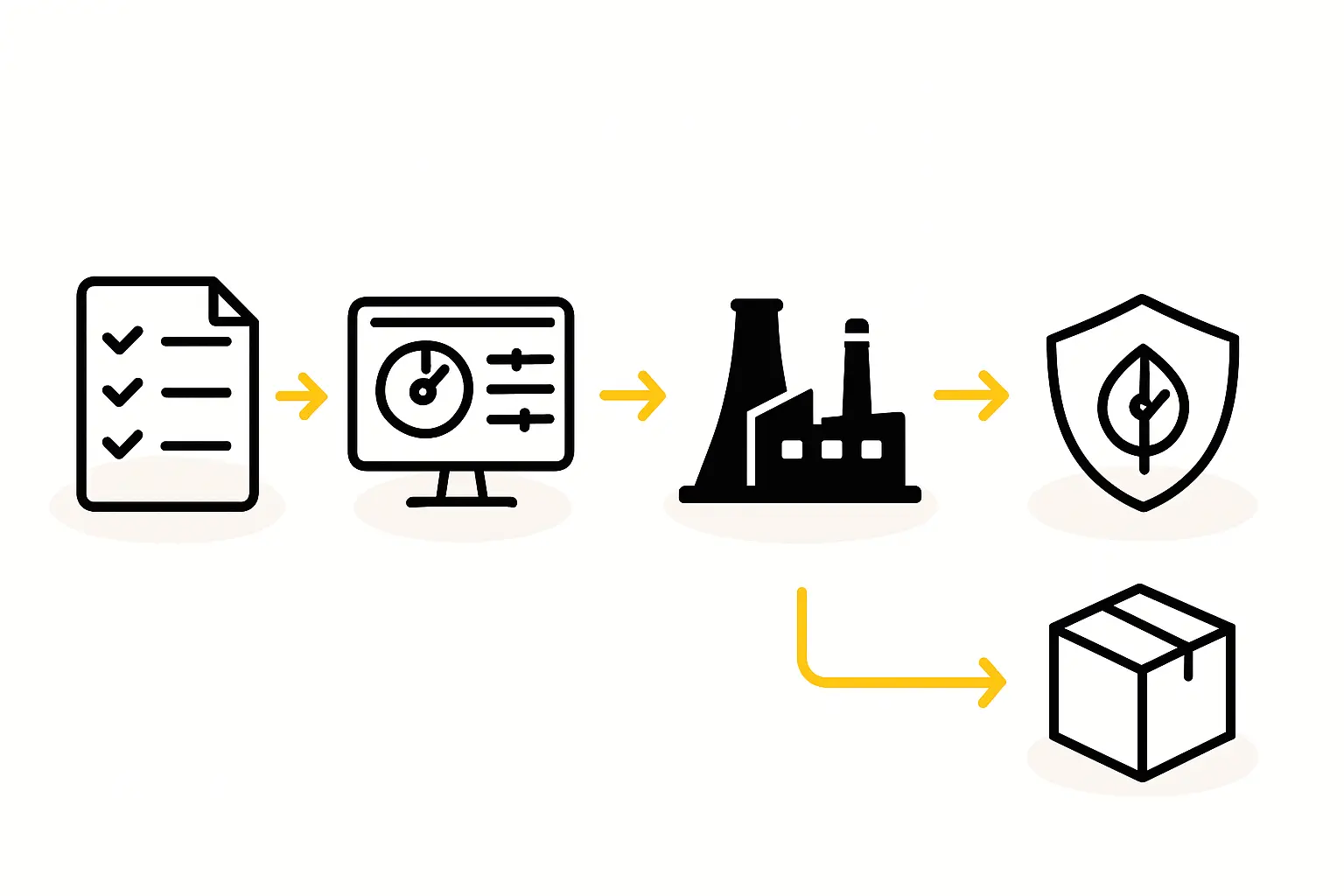

Step 3: Securing Essential Permits for Energy Manufacturing

With the business legally registered, the next phase involves obtaining permits specific to a manufacturing operation in the energy sector.

Environmental Impact Assessment and Permitting

Any industrial project requires clearance from the Ministry of Environment (MDE). An Environmental Impact Assessment (EIA) is usually required to evaluate the factory’s potential effects on the local environment. This process assesses factors such as waste management, resource consumption, and emissions.

For a solar module factory, this is often a straightforward process, as its manufacturing is relatively clean compared to other industries. A successful EIA results in an environmental permit, which is a prerequisite for beginning construction.

Energy Sector-Specific Approvals

The Ministry of Public Works, Transport and Communications (MTPTC) oversees the energy sector. For a manufacturing facility, the MTPTC will issue permits related to production standards, operational safety, and quality control. If the factory plans to connect a significant electrical load to the grid, the ministry will also manage the necessary approvals for that connection.

Navigating Challenges and Leveraging Opportunities

While the procedural framework is clear, investors should be aware of potential challenges. Bureaucratic delays and political instability can impact timelines. Experience from J.v.G. turnkey projects shows that engaging competent local legal counsel from the outset is the most effective way to navigate and mitigate these risks. A local expert can anticipate administrative hurdles and ensure all documentation is correctly prepared.

Conversely, Haiti offers significant opportunities for investors. The Investment Code of 2002 provides a range of incentives, including potential customs duty exemptions on imported machinery and equipment, as well as possible tax holidays for up to 15 years. These incentives can substantially improve the financial viability and reduce the initial investment required for a solar factory.

Frequently Asked Questions (FAQ)

How long does the entire registration process typically take?

Timelines can vary. A straightforward SARL registration may be completed in a few weeks, while a more complex SA incorporation with extensive permitting could take several months. Effective project management and local expertise are key to staying on schedule.

Is it mandatory to have a Haitian partner?

No. Haitian law permits 100% foreign ownership of a business. This gives investors full control over their operations and capital.

What are the minimum capital requirements for an SA or SARL?

The legally mandated minimum capital is relatively low. However, the practical capital required to finance the land, building, and machinery for a solar module factory is the more significant financial consideration.

Can pvknowhow.com assist with the legal and registration process?

While pvknowhow.com provides comprehensive technical and project management guidance for setting up a solar factory, it does not offer legal services. As part of a turnkey project, J.v.G. facilitates introductions to pre-vetted, reliable local legal and administrative consultants to manage these critical tasks.

What is the role of the Center for Facilitation of Investments (CFI)?

The CFI is a “one-stop shop” for foreign investors. It provides information, helps coordinate with different ministries, and works to streamline the investment process from start to finish.

Conclusion and Next Steps

Establishing a manufacturing business in Haiti’s energy sector is a structured process guided by a clear legal framework. While the process requires careful attention to detail and an understanding of local administrative procedures, it is an entirely navigable path for a well-prepared investor. The combination of a welcoming foreign investment code and immense domestic demand for energy creates a compelling business case.

With a clear understanding of the legal requirements, the next step is to define the physical and operational aspects of the project. Further exploration into topics such as typical factory building requirements or equipment selection will provide a more complete picture of the journey ahead.