An entrepreneur planning to establish a solar module factory often focuses first on technology, machinery, and production output. However, the venture’s long-term profitability and stability hinge on an equally important, though less visible, foundation: its corporate and tax structure.

For a foreign investor considering Hungary, understanding this framework isn’t just a formality—it’s a critical strategic advantage. With the European Union’s lowest corporate income tax rate, the country presents a compelling financial case, provided the investor navigates the setup correctly.

This article outlines the essential legal and tax considerations for establishing a foreign-owned solar manufacturing operation in Hungary. The goal is to ensure the financial structure of your enterprise is as robust as the modules you plan to produce.

Choosing the Right Legal Vehicle for Your Investment

The first decision in establishing a presence in Hungary is selecting the appropriate legal entity. This choice impacts liability, administrative requirements, and future fundraising capabilities. For foreign investors, two primary structures are most relevant.

The Kft. (Korlátolt Felelősségű Társaság): The Preferred Choice for Foreign Investors

The Kft. is the Hungarian equivalent of a Limited Liability Company (LLC) or a German GmbH. It is the most common and often the most practical choice for new manufacturing ventures. Its key advantages include:

- Limited Liability: The personal assets of the owners (members) are protected from the company’s debts and liabilities.

- Flexibility: It offers a relatively flexible governance structure suitable for a single owner or a small group of partners.

- Credibility: The Kft. is a well-established and respected corporate form within the EU.

- Low Capital Requirement: The minimum required share capital is HUF 3 million (approximately €8,000), making it accessible for new enterprises.

Based on experience from J.v.G. turnkey projects, the vast majority of new market entrants find the Kft. structure offers the ideal balance of legal protection and operational simplicity for a 20 MW to 100 MW solar factory.

The Zrt. (Zártkörűen Működő Részvénytársaság): A Structure for Larger Ambitions

The Zrt. is a Private Company Limited by Shares, comparable to a UK Ltd. or a US S-Corp. This structure is typically chosen for larger-scale operations or for ventures with a long-term strategy that includes raising capital by issuing new shares to private investors. While offering the same limited liability protection as a Kft., it involves more stringent corporate governance, formal reporting requirements, and a higher minimum share capital of HUF 5 million (approximately €13,000).

The Core of Hungary’s Financial Appeal: Corporate Income Tax (CIT)

The single most significant factor attracting manufacturing investment to Hungary is its corporate income tax (CIT) rate.

At a flat rate of 9%, Hungary has the lowest corporate income tax in the entire European Union.

This is not a temporary incentive or a special economic zone rate; it is the standard national rate applicable to all corporate profits. For a solar module factory, this creates a powerful financial advantage, allowing for greater reinvestment into growth, technology upgrades, and faster returns for shareholders. This simplified, low-tax system enables predictable financial planning and eases profit repatriation.

Beyond the Headline Rate: Understanding the Full Tax Picture

While the 9% CIT is a compelling headline, a comprehensive business plan must account for the complete tax environment. Several other taxes and regulations come into play for manufacturing operations.

Local Business Tax (LBT): The Municipal Factor

Municipalities in Hungary are entitled to levy a Local Business Tax (LBT) on a company’s net sales revenue, adjusted for certain costs. The maximum rate is capped at 2% of the tax base. The exact rate varies by location, making the choice of municipality a critical financial decision.

When evaluating potential locations, it is crucial to assess not only logistics and infrastructure but also the LBT rate. Thorough due diligence is required, as some industrial parks have special agreements that may offer more favorable terms. This is why the factors to consider when selecting a factory site extend beyond the physical building.

Value Added Tax (VAT): Managing Cash Flow

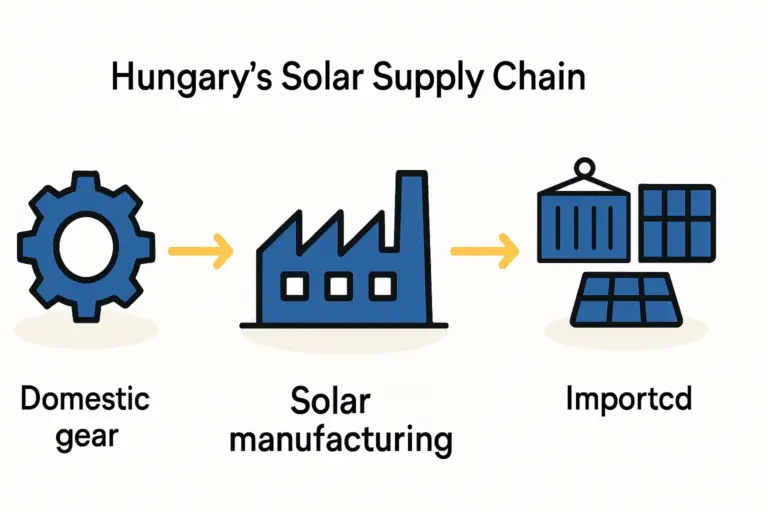

The standard Value Added Tax (VAT) rate in Hungary is 27%. As a manufacturer, the factory will pay VAT on its purchases of raw materials, machinery, and local services. However, a solar factory established for export benefits from a significant cash flow advantage.

- Exports to non-EU countries are exempt from Hungarian VAT.

- Sales to VAT-registered businesses in other EU countries (intra-community supplies) are typically zero-rated.

This means that while the company pays VAT on its inputs, it does not collect it on most of its sales. The company is therefore entitled to reclaim the input VAT from the tax authority, which directly benefits its operational cash flow.

Withholding Taxes and Double Taxation Treaties

When the Hungarian company pays dividends to its foreign parent company, a withholding tax may apply. However, Hungary has an extensive network of double taxation treaties with over 80 countries. These treaties often reduce or completely eliminate the withholding tax, preventing profits from being taxed once in Hungary and again in the investor’s home country. This is a critical mechanism for efficient cross-border profit distribution.

Strategic Incentives and Financial Planning

The Hungarian government, through the Hungarian Investment Promotion Agency (HIPA), actively encourages foreign direct investment, especially in manufacturing and technology sectors.

Investment Incentives and Grants

For significant investments that create jobs and bring new technology into the country, a range of incentives may be available. These can include:

- Cash Grants: Non-refundable grants tied to the number of jobs created or the value of the investment.

- Development Tax Allowances: A powerful incentive that allows a company to reduce its future CIT liability over a period of up to 10 years.

Securing these incentives requires a detailed application and negotiation process but can substantially improve the financial viability of the project. A well-structured business plan is essential for accessing this support and is a key part of the overall guide on financing your solar factory.

Transfer Pricing Considerations

If the Hungarian factory transacts with related entities—for example, buying solar cells from a parent company or selling finished modules to a sister distribution company—it must adhere to transfer pricing regulations. These regulations require all inter-company transactions to be conducted at ‘arm’s length,’ meaning the prices must be consistent with what unrelated parties would agree to. Maintaining proper documentation to justify these prices is a standard compliance requirement for international businesses.

A Practical Timeline: From Decision to Operation

Setting up a legal entity (a Kft.) in Hungary can be completed in just a few weeks with proper legal assistance. However, the entire project timeline is more extensive. From the initial decision to securing a location, applying for incentives, and completing the full turnkey solar production line setup, an entrepreneur should plan for a 9 to 12-month execution cycle.

Frequently Asked Questions (FAQ)

What is the minimum capital required to start a Kft. in Hungary?

The statutory minimum share capital for a Kft. is HUF 3 million, which is approximately €8,000. This must be made available upon registration.

Can a foreign national be the sole director of a Hungarian company?

Yes. There is no requirement for a Hungarian resident to be appointed as a director. A foreign national can be the sole managing director of a Kft.

How complex is the accounting and reporting process?

Hungary follows accounting standards based on EU directives and IFRS. The process is standardized and transparent. It is mandatory to hire a qualified local accountant or firm to handle bookkeeping, VAT filings, and annual financial statements.

Are profits easy to repatriate to the home country?

Yes. As an EU and OECD member, Hungary has a liberal policy regarding capital flows. Once taxes are paid, profits (dividends) can be freely repatriated, subject to the terms of any applicable double taxation treaty.

Do I need a local partner to set up a business in Hungary?

No, it is not legally required. A foreign individual or corporation can be the 100% owner of a Hungarian Kft. or Zrt.

Conclusion: Building a Foundation for Success

Hungary’s business environment offers a potent combination of a low-tax regime, a stable EU legal framework, and strategic government incentives. For an entrepreneur entering the solar manufacturing industry, these factors can create a significant competitive advantage in the European market.

However, capitalizing on this opportunity requires careful planning. Choosing the right legal structure, understanding the full tax landscape beyond the 9% CIT rate, and strategically selecting a location are foundational decisions that must be made long before the first machine is installed. A thorough understanding of this business environment is the first and most critical step in any successful manufacturing project. Resources like the pvknowhow.com e-course are designed to guide entrepreneurs through these essential planning stages.