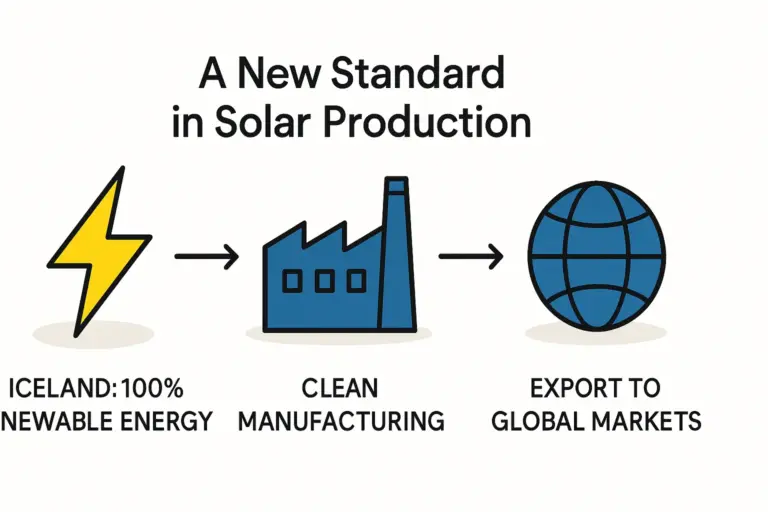

For the international entrepreneur exploring new frontiers, Iceland often presents a paradox. Known globally for its dramatic landscapes, Iceland is also one of the world’s most advanced and stable locations for green energy manufacturing. This is thanks to a unique confluence of geology and policy: 100% of the country’s electricity comes from renewable hydropower and geothermal sources. This unique energy profile offers a compelling advantage for businesses aiming to build supply chains with a verifiably low carbon footprint.

However, capitalizing on this opportunity requires a clear understanding of the local regulatory and financial landscape. This guide provides a detailed overview of the government incentives, tax advantages, and permitting processes available to foreign investors looking to establish renewable energy manufacturing operations in Iceland. It is aimed at the business professional who recognizes the strategic value of green production but requires a map to navigate the practical steps.

Why Iceland? The Strategic Advantage for Green Energy Manufacturing

In an era where consumers and regulators alike demand transparency in carbon accounting, a manufacturing base powered entirely by renewable energy is a significant competitive differentiator. By locating a factory in Iceland, a business can embed sustainability directly into its product from the very first stage of production.

Beyond its clean energy profile, Iceland offers several foundational benefits:

-

Political and Economic Stability: As a member of the European Economic Area (EEA), Iceland provides a stable, transparent, and modern business environment.

-

Skilled Workforce: The country has a highly educated and multilingual workforce, proficient in technology and engineering disciplines.

-

Strategic Location: Situated between Europe and North America, Iceland offers logistical access to key markets.

These factors, combined with a government actively seeking to attract foreign investment in high-value industries, create fertile ground for green manufacturing ventures.

Understanding Iceland’s Financial Incentive Framework

To attract foreign investment, particularly for projects that align with its goals of economic diversification and sustainable development, the Icelandic government has structured a series of incentives designed to reduce the initial financial burden and enhance the long-term profitability of new enterprises.

Investment Agreements for Large-Scale Projects

For substantial investments, the government offers a framework for customized incentive packages. Projects with an initial investment exceeding €100 million or those creating over 150 new jobs can enter into direct negotiations with the authorities.

These agreements, which require approval from the Minister of Industry and the Icelandic parliament (Althingi), can provide specific derogations from standard taxes and fees, including concessions on income tax, property tax, and customs duties. This tailored approach allows the government and the investor to create a mutually beneficial arrangement that ensures the project’s long-term success.

Tax Incentives for Foreign Experts

Recognizing the need for specialized knowledge when establishing a new industrial operation, Iceland offers an attractive incentive for hiring key international talent. Foreign experts are eligible for a significant income tax deduction, with 25% of their income considered non-taxable for the first three years of their employment. This incentive makes it considerably easier for a new company to attract the world-class engineers, technicians, and managers needed to launch and operate a modern factory.

R&D Tax Credits and Innovation Support

To foster a culture of continuous improvement and technological advancement, companies in Iceland can benefit from a 20% tax credit on their research and development (R&D) costs. The credit is a powerful tool for manufacturers planning to innovate on production processes, materials, or product design.

Further support is available through public funds like the Icelandic Centre for Research (Rannís) and the Technology Development Fund, which provide grants for promising innovation projects. This innovation-focused ecosystem encourages manufacturers not only to set up operations but also to establish Iceland as a hub for their future technological development.

Navigating the Permitting and Regulatory Landscape

A clear and efficient regulatory process is fundamental to the success of any new industrial project. Iceland has streamlined its processes to be as transparent as possible for foreign investors.

The Role of Invest in Iceland

Invest in Iceland, a department within Business Iceland, serves as the primary point of contact for foreign investors. It operates as a one-stop shop, providing comprehensive information and confidential assistance throughout the entire setup process. Its services cover everything from initial data collection and site selection to facilitating communication with local authorities and municipalities. Engaging with this agency early can significantly simplify and accelerate the investment journey.

Key Permits and Environmental Approvals

Establishing a manufacturing facility requires several key approvals from authorities like the National Planning Agency (Skipulagsstofnun) and the Environmental Agency (Umhverfisstofnun).

A crucial step for most industrial projects is the Environmental Impact Assessment (EIA). The EIA is a systematic process that evaluates a project’s potential environmental consequences before a decision is made to grant permission. The process in Iceland aligns with European standards, ensuring that projects are developed sustainably and with minimal impact on the natural environment. Understanding and preparing for the EIA is a critical component of the entire process of setting up a factory.

A Practical Look at Business Establishment

Beyond incentives and permits, investors must address the practicalities of forming and operating a company in Iceland.

Choosing the Right Business Structure

The two most common corporate structures for foreign investors are:

-

Public Limited Company (hf.): Requires a minimum share capital of 4 million ISK.

-

Private Limited Company (ehf.): Requires a minimum share capital of 500,000 ISK.

For most new manufacturing ventures, the Private Limited Company (ehf.) is the most suitable and common choice. Company registration is handled by the Register of Enterprises at the Directorate of Internal Revenue and is typically a straightforward process.

Land Acquisition and Industrial Zones

Iceland has several designated industrial zones, often located near deep-water harbors and the main international airport. These zones typically offer land with pre-existing access to electricity, water, and other essential utilities. The availability of these ‘plug-and-play’ industrial plots can dramatically reduce the timeline and complexity of site development—an advantage not always present in other emerging markets.

Potential Challenges and Considerations

While Iceland offers many advantages, a prudent investor must also consider potential challenges.

Labor Market and Logistics

Iceland has a small, highly skilled population, which can lead to a competitive market for specialized labor. Strategic workforce planning is essential. The country’s island location also requires careful logistical planning for both the import of raw materials and the export of finished goods. Although well-connected by sea and air, supply chain management remains a key operational factor that must be addressed in any solar panel manufacturing plant business plan.

Navigating Cultural and Business Norms

As with any international venture, success depends on understanding and adapting to local business practices. Icelandic business culture is generally characterized by flat hierarchies, direct communication, and a high degree of trust. Building relationships with local partners and authorities is therefore crucial for long-term operational success.

Frequently Asked Questions (FAQ)

-

What is the main advantage of manufacturing in Iceland?

The single greatest advantage is access to 100% renewable and competitively priced electricity. This allows manufacturers to produce goods with a near-zero carbon footprint from energy consumption, providing a powerful marketing and ESG (Environmental, Social, and Governance) advantage in the global market. -

Is Iceland only suitable for large-scale investors?

No. While customized investment agreements are reserved for large projects, incentives like the R&D tax credit and the tax deduction for foreign experts are available to companies of various sizes. The supportive business environment is designed to foster growth for any serious industrial venture. -

How long does the permitting process typically take?

The timeline varies depending on the scale and complexity of the project. Engaging Invest in Iceland early can help streamline the process. The Environmental Impact Assessment (EIA) is often the most time-consuming phase, so thorough preparation is key to ensuring an efficient timeline. -

Can a foreign national own a company in Iceland?

Yes. Individuals and legal entities domiciled in an EEA/EFTA member state can own and operate a business in Iceland without restrictions. Investors from outside this area may require permission from the Minister of Industry, a process that is generally straightforward for legitimate industrial projects. -

What kind of support is available after the factory is established?

Support extends beyond the initial setup. The Icelandic innovation ecosystem, including the Technology Development Fund and various industry clusters, provides ongoing opportunities for collaboration, funding, and R&D support to help businesses grow and remain competitive.

Next Steps in Your Icelandic Venture

Iceland presents a unique and compelling case for entrepreneurs looking to establish green energy manufacturing operations. Its combination of 100% renewable energy, a stable business climate, and a supportive government creates an environment where sustainable and profitable businesses can thrive.

The logical next steps for a potential investor involve conducting detailed due diligence, initiating contact with Invest in Iceland to discuss project specifics, and developing a comprehensive business plan. For entrepreneurs new to the solar manufacturing sector, understanding the technical and operational requirements is a critical first step. Educational platforms like pvknowhow.com provide structured guidance on factory planning and technology selection, helping to bridge the gap between business vision and operational reality.