Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

Indonesia’s Solar Paradox: Why a Local Factory is the Key to Off-Grid Power

Indonesia presents a compelling paradox for investors. It is a nation of over 17,000 islands blessed with abundant solar irradiation, yet millions of its citizens live without reliable electricity.

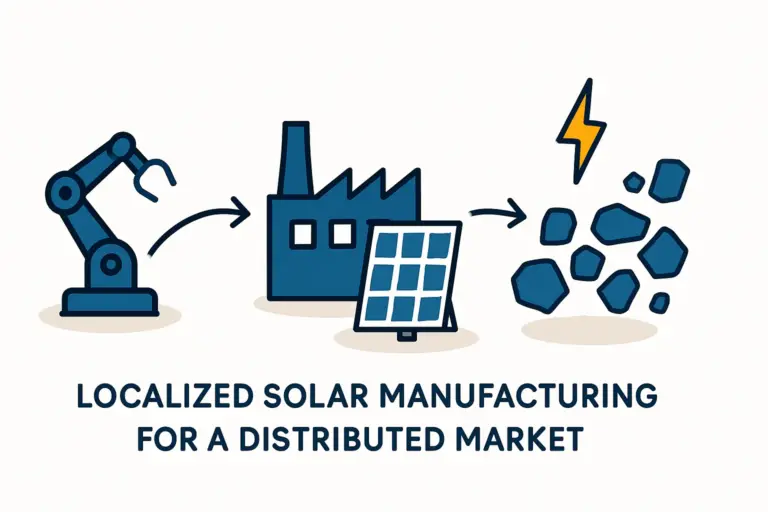

While large-scale solar farms are often discussed, the true challenge—and a significant business opportunity—lies in reaching the scattered, remote communities where extending the national grid is economically unfeasible. This is where a strategic shift from large-scale importation to localized, small-scale manufacturing presents a powerful case for investment.

This analysis explores the feasibility of establishing a 20–50 MW solar module factory in Indonesia, tailored to serve the nation’s burgeoning off-grid and micro-grid markets.

The Archipelago’s Energy Challenge

Understanding Indonesia’s energy needs starts with its sheer geographical scale. The state-owned utility, Perusahaan Listrik Negara (PLN), faces an immense logistical and financial challenge in its mandate to electrify the entire country. Extending the grid across vast expanses of ocean to serve small island populations is often prohibitively expensive.

This geographical reality has shaped government policy, with a national target of generating 23% of energy from renewable sources by 2025. Solar micro-grids are a critical technology for achieving this goal, providing a decentralized and resilient solution for rural electrification.

However, this strategy relies on a steady supply of solar modules. For an entrepreneur or project developer, here lies the first major hurdle: logistics.

The Business Case for Localized Manufacturing

Most off-grid projects in Indonesia currently depend on imported solar modules. While this approach seems straightforward, the economics prove challenging for several key reasons.

The High Cost of Logistics

Importing modules involves international shipping, port handling, customs clearance, and, most critically, complex inter-island transportation. These steps add significant costs and lead times to any project.

A container of modules arriving in Jakarta still has a long and expensive journey ahead to reach a remote village in Maluku or West Papua. This logistical overhead can represent a substantial portion of a project’s total budget, making many vital projects financially unviable.

Meeting Market-Specific Needs

Large, international manufacturers typically produce high-wattage modules optimized for utility-scale farms. However, off-grid applications in Indonesia often require different specifications:

- Durability: Modules must withstand harsh tropical conditions and potential mishandling during transport.

- Size and Wattage: Smaller, more manageable panels are often better suited for rooftop installations, solar water pumps, and small community micro-grids.

- Local Content: Government tenders and development programs may increasingly favor or mandate the use of locally manufactured components to stimulate the domestic economy.

A local factory can produce modules specifically designed for these conditions, creating a competitive advantage over standardized imported products.

Designing a Factory for the Off-Grid Market

The solution is not to replicate a massive, gigawatt-scale factory. Instead, a smaller, more agile production facility of 20–50 MW per year offers a more strategic fit for Indonesia’s distributed energy market. This scale is large enough to supply numerous off-grid projects annually without the massive capital outlay required for a larger plant.

The availability of scalable, semi-automated production equipment makes this model possible. Modern manufacturing lines can be designed with a smaller footprint, lower initial capital expenditure, and the flexibility to produce various module types.

This approach—the basis for a turnkey solar module manufacturing line—allows an investor to enter the market with a right-sized operation. The solar module manufacturing process can be optimized for local conditions, focusing on product quality and durability rather than just chasing the lowest cost-per-watt.

Based on experience gained from European PV manufacturers’ turnkey projects, a 20 MW line can be operated effectively by a team of 25–30 employees, making it a manageable venture for a new industry entrant.

Financial and Operational Considerations

Establishing a manufacturing facility begins with a clear understanding of the financial landscape. The investment requirements for a 20–50 MW line are substantially lower than for a gigawatt-scale factory, placing it within reach of private investors and entrepreneurs.

Financing for such ventures is also becoming more accessible, with several factors creating a favorable financial environment:

- Green Funds: International development banks and climate funds are actively seeking to finance projects that support renewable energy transition and rural development.

- Government Incentives: The Indonesian government may offer tax breaks or other incentives for investments in domestic manufacturing, particularly in strategic sectors like renewable energy.

- Project Offtake Agreements: A local factory can establish direct relationships with off-grid project developers, potentially securing offtake agreements that guarantee a baseline level of demand.

From an operational standpoint, a local factory bypasses the most volatile aspects of the supply chain. While raw materials must still be sourced, the finished product is immediately available for the domestic market, reducing exposure to international shipping disruptions and currency fluctuations.

Frequently Asked Questions (FAQ)

-

Why not just continue importing modules?

Importing modules involves significant logistical costs, long lead times, and potential damage during inter-island transport. A local factory eliminates these issues and allows for the production of modules specifically tailored to the demanding conditions of Indonesia’s off-grid market. -

What factory size is realistic for a new market entrant?

A 20–50 MW annual capacity is a common and strategic entry point. This scale is large enough to be profitable and serve numerous projects, yet small enough to keep initial capital investment manageable and allow for operational flexibility. -

Is a deep technical background required to start a solar module factory?

While technical understanding is beneficial, it is not a prerequisite. With structured guidance and a partnership with an experienced engineering firm like an established European industrial solutions provider, business professionals can successfully enter this industry. The focus is on providing a complete, turnkey system with the necessary training and support. -

What about the supply chain for raw materials?

Sourcing the bill of materials (BOM)—such as solar cells, glass, and aluminum frames—is a critical part of the planning process. Established consultants can help new manufacturers create reliable supply chains by connecting them with qualified international suppliers. -

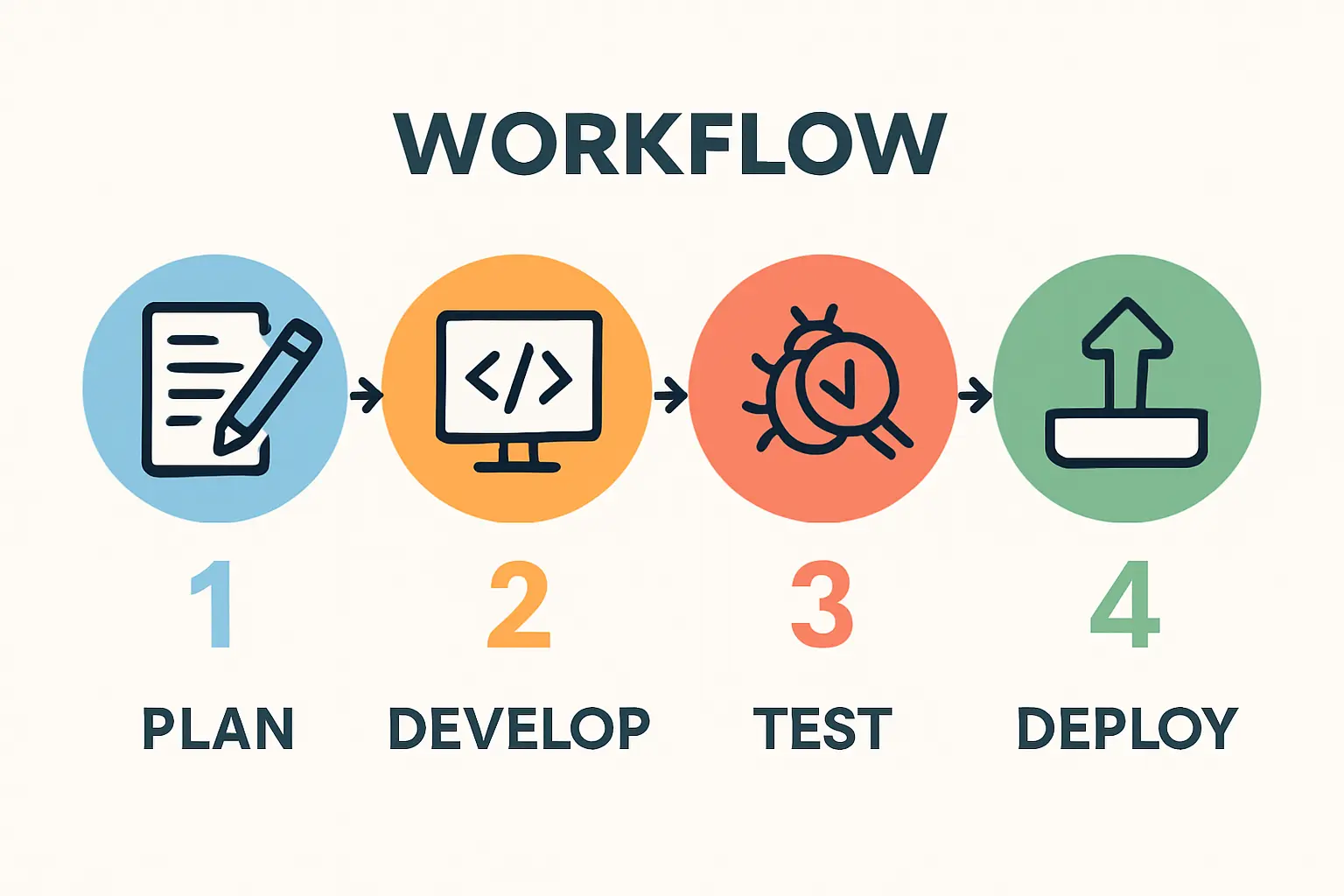

How long does it typically take to establish a 20 MW production line?

With a well-defined plan and an experienced partner, a turnkey solar module line can be fully operational in under 12 months, from initial planning to the production of the first certified modules.

Next Steps for Deeper Exploration

The opportunity to establish local solar module manufacturing in Indonesia is driven by clear market needs and supported by favorable economic conditions and government policy. For entrepreneurs and investors, this represents a chance to build a profitable business while contributing directly to the nation’s energy independence and development.

To move forward, the next logical step is to develop a detailed business plan based on this overview, including market analysis, financial modeling, and technical specifications for the production line.

Download: Indonesia Off-Grid Electrification Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.