Many entrepreneurs exploring new manufacturing hubs are drawn to the promise of low operational costs and access to emerging markets. Yet they often find that attractive labor costs are offset by complex regulations, tariffs, and barriers to foreign ownership.

For investors and manufacturers considering the Middle East and Central Asia, Iran offers a unique proposition: a network of Free Trade and Special Economic Zones designed to help export-oriented businesses bypass these common obstacles.

These zones are not merely designated areas; they function as distinct economic territories with their own legal and regulatory frameworks, offering incentives that can significantly strengthen a manufacturing venture’s financial model. This article assesses these zones from a technical and business perspective, focusing on the strategic advantages and practical challenges of establishing a solar module production facility.

Geographic and Strategic Advantages for Export

The primary purpose of Iran’s Free Trade Zones (FTZs) is to facilitate international trade by leveraging the country’s strategic geographic position. Situated at the crossroads of the Middle East, Central Asia, and South Asia, these zones provide direct access to a market of several hundred million people. For a solar module manufacturer, this translates into shorter, more cost-effective supply chains to target regions.

Each major zone offers a distinct geographic advantage:

Chabahar Free Trade-Industrial Zone

Located on the Gulf of Oman, it provides direct ocean access that bypasses the Strait of Hormuz. It is a key node in the International North-South Transport Corridor (INSTC), offering a strategic route to India, Afghanistan, and Central Asia.

Qeshm Free Zone

Situated in the Strait of Hormuz, this island zone is exceptionally well-positioned for maritime trade with Gulf Cooperation Council (GCC) countries like the UAE, Oman, and Qatar.

Aras Free Trade Zone

Bordering Armenia, Azerbaijan, and the Nakhchivan Autonomous Republic, this zone serves as a gateway to the Caucasus region and, by extension, to Russia and Eastern Europe.

Anzali Free Trade Zone

As Iran’s primary port on the Caspian Sea, Anzali is another critical link in the INSTC, facilitating trade with Russia and other Caspian littoral states.

These locations are not just points on a map; they are integrated logistics hubs designed to streamline the movement of goods, from raw material import to finished product export.

Key Financial and Regulatory Incentives

The commercial appeal of Iran’s FTZs stems from a powerful set of incentives designed to attract foreign investment. For those planning a solar module factory, these benefits directly reduce initial capital outlay and boost long-term profitability.

Tax Exemptions

Perhaps the most significant incentive is substantial tax relief. Businesses registered and operating within an FTZ are granted a 20-year exemption from corporate and income taxes, starting from their date of operation. This allows a new venture to retain a much larger portion of its earnings during the critical early years, which can then be reinvested into scaling production, research, or market expansion.

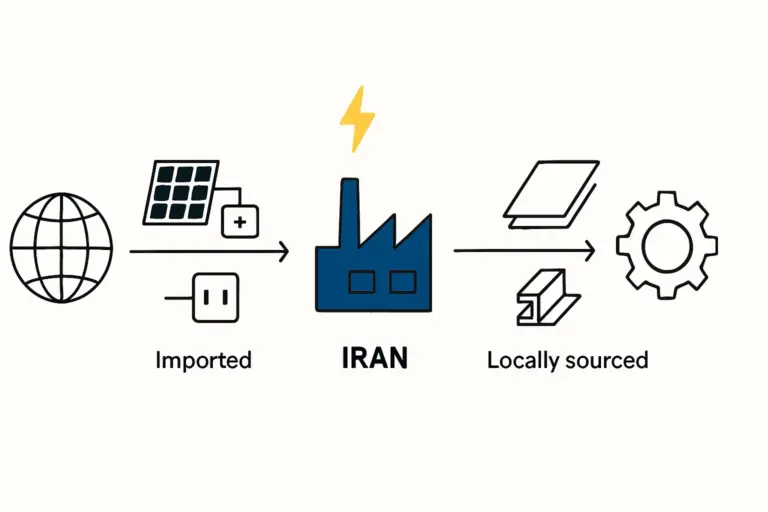

Customs and Tariff Benefits

For a manufacturing business, import duties on machinery and raw materials are a major part of the initial investment. Within an FTZ, these costs are effectively eliminated. Machinery, equipment, and raw materials needed for the solar panel manufacturing process can be imported into the zone without paying customs duties or commercial benefit taxes.

The finished products—in this case, solar modules—can then be exported to international markets, again free from customs duties. This creates a highly efficient, low-friction environment for an export-focused business model.

Simplified Legal and Foreign Investment Framework

Unlike mainland Iran, FTZs operate under a more flexible legal regime for foreign investment. Key provisions include:

-

100% Foreign Ownership: Foreign nationals and companies can own 100% of a business or factory within an FTZ, without needing a local partner.

-

Freedom of Capital Repatriation: Investors are legally entitled to repatriate all capital and any profits generated from their operations in foreign currency.

-

Flexible Labor Laws: The zones are governed by specific employment regulations that are generally more flexible than those on the mainland, providing greater autonomy in hiring and management.

Operational Considerations for a Solar Module Factory

Beyond the legal and financial incentives, practical operational factors make these zones compelling. Iran has a large, well-educated, and technically proficient workforce, with labor costs that are competitive with other regional manufacturing hubs. Furthermore, the country’s abundant natural gas reserves translate into some of the lowest industrial electricity costs in the world—a critical advantage for an energy-intensive process like solar module manufacturing.

This combination of skilled, affordable labor and low-cost energy substantially reduces the per-unit production cost, making modules manufactured in these zones more competitive on the global market. Based on experience from J.v.G. turnkey projects in similar economic environments, a well-planned facility can achieve a competitive production cost structure within its first two years of operation.

A Balanced View: Navigating Potential Challenges

While the incentives are substantial, any serious business assessment must include a clear-eyed view of the challenges. The primary obstacle remains the complex international sanctions environment, which directly impacts:

-

Financial Transactions: Accessing international banking services for payments and financing can be difficult and may require specialized financial channels.

-

Supply Chain Logistics: While many raw materials are available, sourcing specific high-technology components or machinery from Western countries can be complicated and may demand alternative sourcing strategies.

-

Geopolitical Risk: The political climate requires continuous monitoring and robust risk mitigation strategies.

These challenges are not insurmountable, but they demand meticulous planning, expert guidance, and often the establishment of strong local partnerships. Investors must approach this opportunity with a strategy that accounts for these realities from the outset.

Frequently Asked Questions

What is the primary difference between a Free Zone and a Special Economic Zone in Iran?

Free Trade Zones (FTZs) are geared more toward international trade and re-export, offering a broader range of incentives like the 20-year tax holiday. Special Economic Zones (SEZs) are often focused on stimulating domestic industry, and their regulations, while favorable, can be slightly more restrictive than those in FTZs.

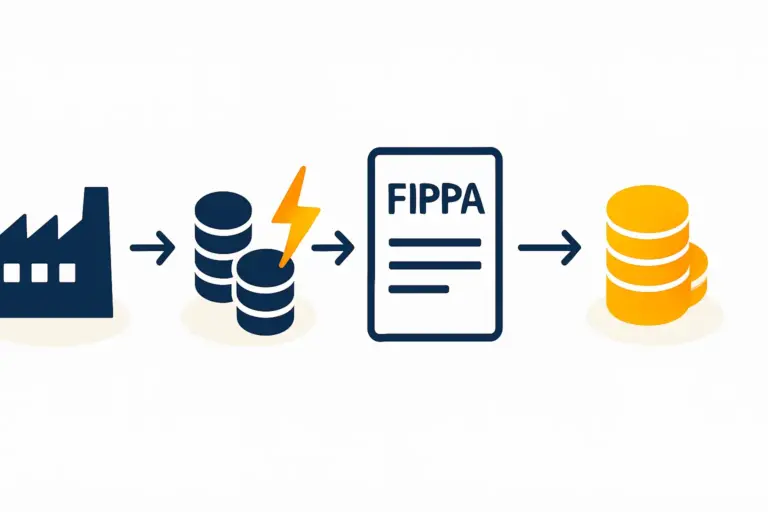

Is 100% foreign ownership truly guaranteed in these zones?

Yes, the laws governing Iran’s FTZs explicitly guarantee the right of foreign investors to 100% ownership of their enterprises within the zone’s boundaries. This right is protected by the Foreign Investment Promotion and Protection Act (FIPPA).

How are profits repatriated from an FTZ?

The FTZ legal framework allows profits and capital to be transferred abroad in foreign currency through the local banking system. However, due to international financial restrictions, the practical execution may require navigating specialized banking channels.

What are the typical steps to register a company in an Iranian FTZ?

The process generally involves applying for an investment license from the organization managing the specific FTZ, registering the company, obtaining the necessary permits for construction and operation, and opening local bank accounts. Each zone has its own administrative body to facilitate this process.

Can modules produced in an FTZ be sold within mainland Iran?

Yes, but mainland customs authorities treat this as an import. The goods would be subject to customs duties and relevant import regulations, though often under preferential terms. The primary model for FTZ manufacturing remains export-oriented.

Conclusion: A Strategic but Complex Opportunity

Iran’s Free Trade Zones offer a compelling, and often overlooked, platform for establishing an export-oriented solar module manufacturing facility. The combination of a 20-year tax holiday, duty-free import of machinery and materials, 100% foreign ownership, and low operational costs creates a powerful financial case. The strategic locations of zones like Chabahar, Qeshm, and Aras provide direct, cost-effective access to rapidly growing energy markets in Asia and the Middle East.

However, this opportunity comes with significant challenges, primarily the international sanctions regime and geopolitical factors. Success requires not just a solid business plan but also a sophisticated understanding of logistics, finance, and risk mitigation. For the prepared investor, these zones represent a high-potential venture that demands careful, expert-led execution from initial planning through to the setup of a complete turnkey solar manufacturing line.