Establishing a solar module factory is a significant undertaking, but choosing where to build it is paramount for its long-term success. For an entrepreneur considering Iraq, a country with immense solar potential, the landscape is anything but uniform.

One location might offer logistical advantages but pose security challenges, while another with a stable administrative environment could come with higher operational costs. This initial decision will influence everything from supply chain efficiency and market access to project security.

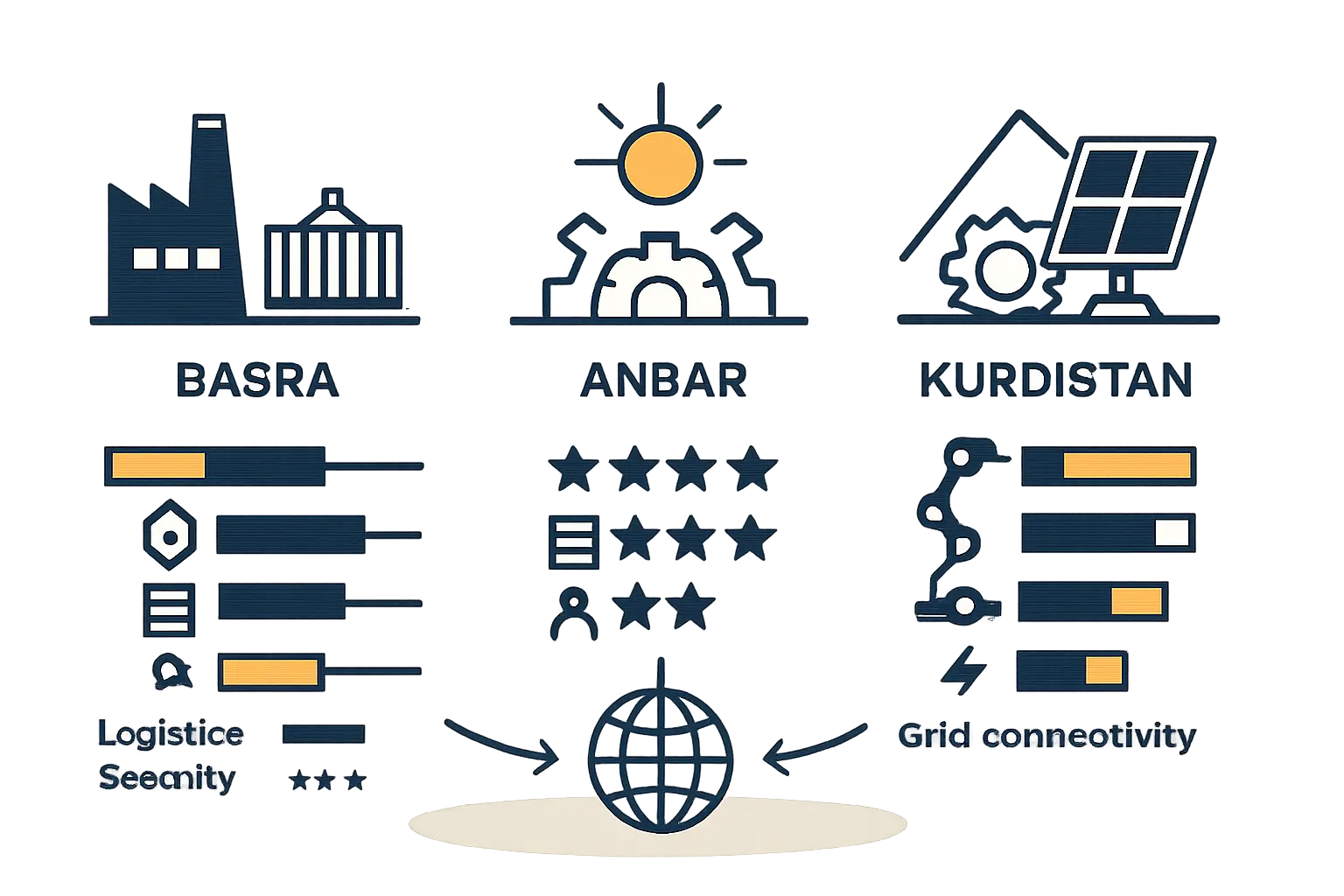

This analysis compares three distinct regions within Iraq as potential sites for a solar manufacturing facility: the southern port of Basra, the vast western governorate of Anbar, and the autonomous Kurdistan Region in the north. Our objective is to provide potential investors with the foundational knowledge to evaluate these locations based on critical business and operational factors.

Key Criteria for Site Selection in an Emerging Market

Before examining the specific regions, it’s essential to define the parameters that determine a location’s suitability. In a complex market like Iraq, these factors extend far beyond simple land cost.

Key considerations include:

-

Logistical Infrastructure: The ability to efficiently import raw materials (glass, cells, aluminum frames) and potentially export finished modules.

-

Economic and Administrative Environment: The legal framework for investment, the presence of special economic zones, and the general ease of doing business.

-

Security and Stability: The operational security of the facility, its assets, and its personnel is a primary concern for any significant capital investment.

-

Labor and Skills: The availability of a trainable workforce for technical and administrative roles. A 20-50 MW factory, for instance, typically requires a team of 30-50 employees.

Based on J.v.G. Technology’s experience guiding turnkey projects, a thorough evaluation of these four pillars is the first step toward any successful venture.

Logistical Infrastructure: Access to Global Supply Chains

A manufacturing operation’s efficiency is directly tied to its supply chain. For a solar factory, that means reliable and cost-effective access to international ports and robust inland transportation networks.

Basra Governorate

Basra’s primary advantage is its direct access to the Persian Gulf through the port of Umm Qasr, Iraq’s main deep-water port.

Strengths: This maritime gateway makes Basra the logical entry point for containerized raw materials from Asia and Europe. Proximity to the port significantly reduces inland transportation costs and lead times—a critical factor for managing inventory.

Challenges: While port access is excellent, road infrastructure leading north into central Iraq can present bottlenecks. Any investor must factor in the condition and security of these routes.

Anbar Governorate

Anbar is an expansive, landlocked governorate bordering Jordan, Syria, and Saudi Arabia. Its logistics, therefore, are oriented toward terrestrial trade.

Strengths: Its strategic position offers long-term potential for overland trade with neighboring Levant countries. The main international highway connecting Baghdad to Amman runs through Anbar, providing a vital commercial artery. Land is also more readily available and typically costs less than in congested port areas.

Challenges: All raw materials must first be imported via Basra and then transported hundreds of kilometers overland, adding significant cost and complexity to the supply chain.

Kurdistan Region (KRI)

The KRI is also landlocked, relying on its borders with Turkey to the north and Iran to the east for international trade.

Strengths: The border crossing with Turkey at Ibrahim Khalil is a well-established, efficient conduit for goods from Europe. The region has also invested heavily in its internal road network, connecting major cities like Erbil, Sulaymaniyah, and Duhok.

Challenges: Goods arriving from Asia by sea must transit through Turkish ports (like Mersin) and then be transported overland, which can be more expensive and time-consuming than direct shipping to Basra.

Economic and Administrative Environment

Navigating the legal and bureaucratic landscape is often one of the biggest challenges for foreign investors, and the framework varies significantly between Federal Iraq and the Kurdistan Region.

Basra and Anbar (Federal Iraq)

Both governorates operate under the National Investment Law No. 13 of 2006. This law provides guarantees and exemptions for foreign investors, including tax holidays and the ability to repatriate capital and profits.

As the economic engine of Iraq, Basra has a more established industrial culture and support infrastructure. However, the central government’s bureaucracy can be slow and complex. Securing permits, licenses, and land use rights requires patience and, often, the guidance of a knowledgeable local partner. Any comprehensive business plan must account for these potential administrative delays.

Kurdistan Region (KRI)

The KRI operates under its own Investment Law No. 4 of 2006, administered by the Kurdistan Board of Investment (KBOI). Many investors find the KRI’s investment environment more transparent, predictable, and business-friendly.

The KBOI acts as a “one-stop shop” designed to streamline the registration and licensing process. Because it is an autonomous region, its regulations are distinct from those of Federal Iraq. This can create complexities for any business planning to operate extensively in the southern provinces, potentially requiring separate registrations or compliance checks.

Security and Stability

A stable operating environment is non-negotiable for any long-term capital investment. Perceptions and realities of security differ starkly across Iraq.

The Kurdistan Region is widely regarded as the most secure and stable part of the country. It maintains its own security forces (Peshmerga) and has largely been insulated from the conflicts that have affected other parts of Iraq. This security premium is a major draw for international businesses.

In Basra, a vital economic hub, security is a high priority for the state. While it has faced challenges from tribal disputes and political rivalries, the core economic infrastructure is well-protected. Investors typically operate within secured industrial zones.

Anbar was severely impacted by the conflict with ISIS. While the security situation has improved dramatically since 2017, the region is still in a phase of reconstruction and stabilization. Investment here requires a very high risk tolerance and rigorous, on-the-ground security assessments. For an investor with a high-risk, high-reward profile, the opportunity to be a first-mover in the region’s redevelopment could be appealing.

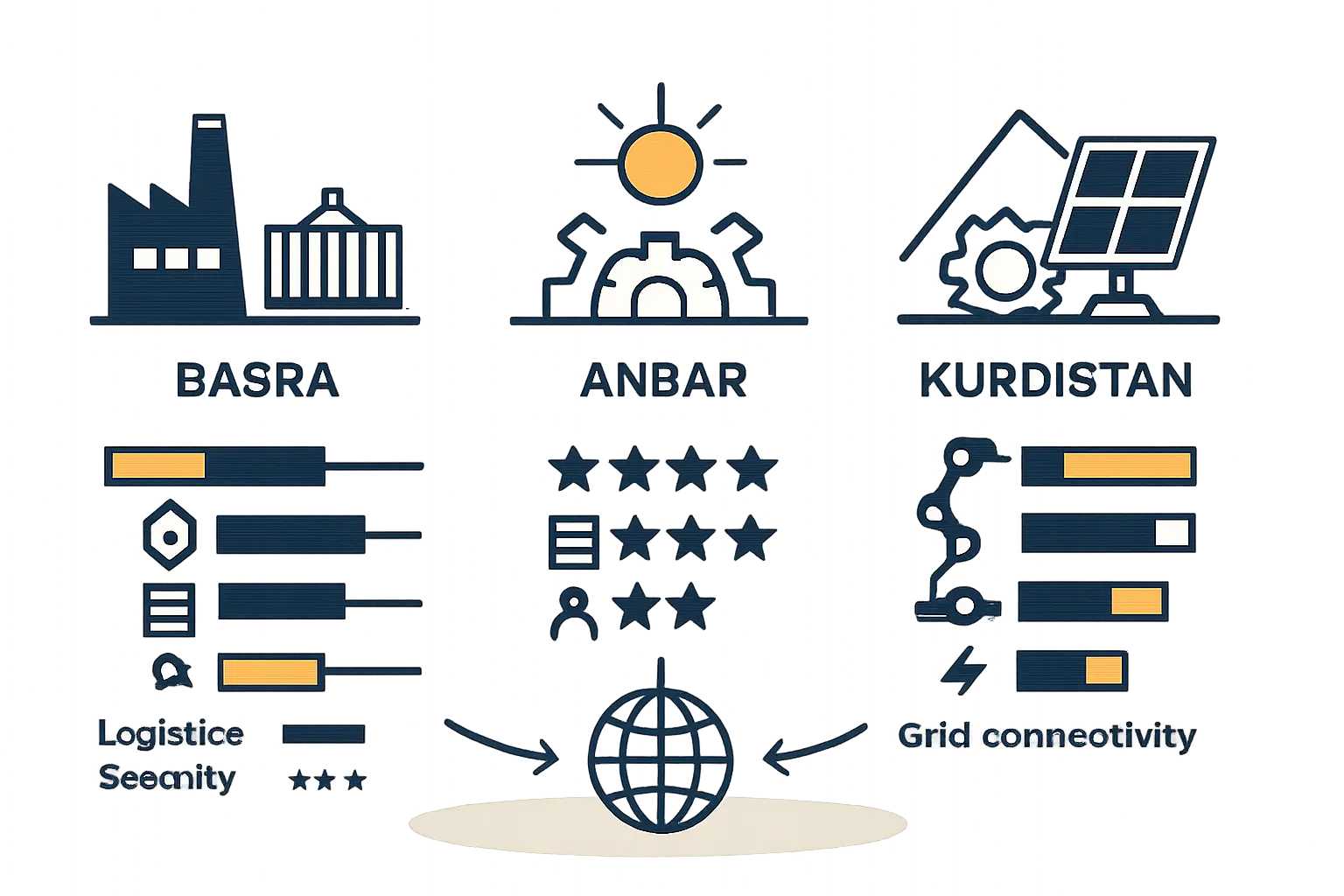

Comparative Summary

| Feature | Basra Governorate | Anbar Governorate | Kurdistan Region (KRI) |

|---|---|---|---|

| Primary Advantage | Direct seaport access | Low land cost, reconstruction potential | Security and administrative stability |

| Logistics | Excellent for sea freight; inland routes are a key consideration | Overland focus; reliant on Basra port for raw materials | Efficient overland trade with Turkey; reliant on Turkish ports |

| Administrative | Federal Law; established industrial base but can be bureaucratic | Federal Law; focus on attracting new investment for reconstruction | Separate Investment Law; often seen as more streamlined |

| Security | Generally stable in economic zones; requires active management | Significantly improved but requires high risk tolerance and due diligence | Highest level of stability and security in Iraq |

| Ideal Investor Profile | Focused on export or serving the entire Iraqi market; prioritizes logistics | High risk tolerance; focused on domestic market and reconstruction | Prioritizes stability and a predictable business environment |

Frequently Asked Questions (FAQ)

What are the main differences in investment laws between the KRI and Federal Iraq?

The primary difference is administrative. The KRI’s law is managed by the Kurdistan Board of Investment, often seen as a more centralized and responsive body. Federal Iraq’s law is handled by the National Investment Commission and provincial bodies, which can be a more fragmented and lengthy process. Both laws, however, offer similar incentives like tax breaks and profit repatriation.

How critical is a local partner for setting up a factory in Iraq?

A trusted local partner is almost indispensable. They provide invaluable help navigating bureaucracy, understanding local customs, managing community relations, and overcoming unforeseen obstacles. Their involvement can significantly de-risk an investment and accelerate the setup process.

What is the typical solar panel manufacturing plant cost and timeline in this context?

While costs vary, a semi-automated 20-50 MW production line typically requires an initial investment of USD 2-5 million for machinery and setup. With proper planning and execution, the timeline from finalizing a business plan to starting production can be under 12 months, though administrative hurdles can cause delays.

Which region has the best solar irradiation?

All three regions have excellent solar irradiation levels, making them technically ideal for solar energy projects. Anbar, with its vast desert landscape, has some of the highest and most consistent irradiation in the country. However, the difference between regions is not significant enough to outweigh factors like logistics or security.

Conclusion: Matching Location to Business Strategy

There is no single “best” location for a solar factory in Iraq. The optimal choice depends entirely on an investor’s business strategy, risk appetite, and market focus.

Basra is the logical choice for an operation that prioritizes supply chain efficiency and plans to serve both the large Iraqi domestic market and potential export markets.

The Kurdistan Region is ideal for investors who place the highest premium on security, political stability, and a predictable administrative environment.

Anbar represents a frontier opportunity for a resilient investor with a high-risk tolerance, aiming to play a foundational role in the reconstruction of a vast and energy-deficient region.

To move forward, a serious entrepreneur must develop a detailed feasibility study and business plan. This next phase requires on-the-ground due diligence, engagement with local authorities, and a precise strategy for supply chain, operations, and market entry tailored to the chosen location.