Ireland is more often associated with pharmaceuticals and technology giants than with solar panel production. But for the discerning entrepreneur, this perception creates a unique opportunity. The country’s stable economy, access to the European market, and advantageous corporate tax structure build a compelling, if unconventional, case for establishing a solar module factory.

This article lays out a high-level financial model for a 50 MW solar module assembly line in Ireland to illustrate the potential return on investment. It serves as a foundational blueprint for business professionals evaluating entry into this industry, breaking down the essential financial components from initial investment to long-term profitability.

Understanding the Core Components of a Solar Factory Financial Model

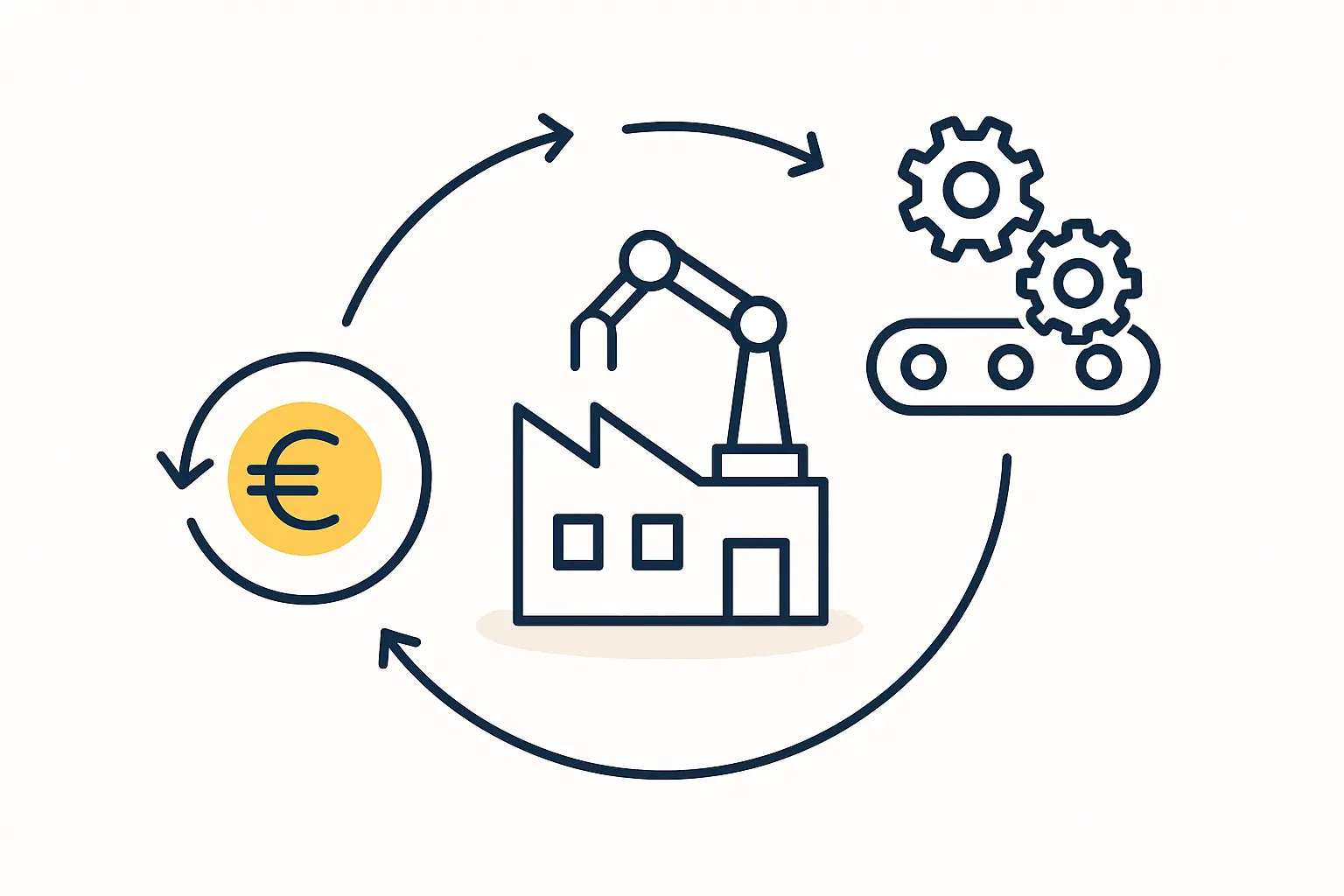

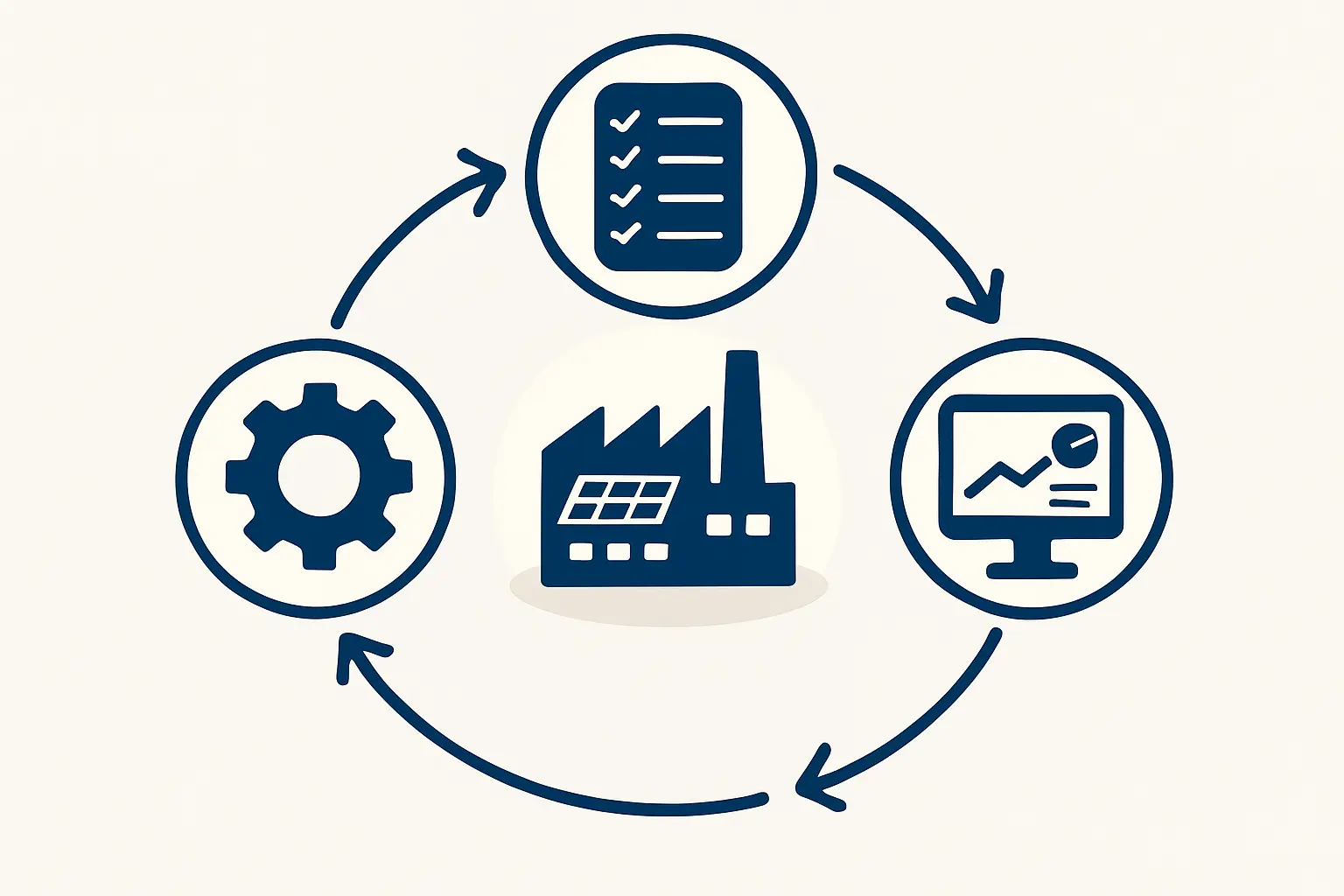

Before diving into specific figures, it’s essential to understand the three pillars of any manufacturing financial model: Capital Expenditure (CapEx), Operational Expenditure (OpEx), and Revenue Projections.

An analogy helps: think of constructing a commercial building. CapEx is the one-time cost to purchase the land and erect the structure. OpEx covers the recurring costs of running it—utilities, maintenance, and staff. Revenue is the income generated from leasing the space. A successful venture depends on a precise understanding of all three.

Capital Expenditure (CapEx): The Initial Investment

Capital expenditure represents the total upfront investment required to get the factory operational. For a 50 MW semi-automated production line, this is a significant undertaking that must be planned meticulously.

Drawing on experience from J.v.G. turnkey projects, the initial CapEx typically ranges from 5 million to 7 million euros.

Production Machinery

The production line is the heart of the factory, consisting of specialized machines that work in sequence to assemble solar modules. Key equipment includes:

- Cell Stringer: Welds solar cells together into strings.

- Layup Station: Assembles the layers of the module (glass, EVA, cell strings, backsheet).

- Laminator: Uses heat and pressure to bond the layers into a durable panel.

- Framer: Attaches the aluminum frame.

- Sun Simulator / IV Tester: Tests the finished module’s electrical performance.

The total cost for a reliable 50 MW equipment line from a reputable European supplier is typically between 3 million and 5 million euros. A detailed assessment of solar module manufacturing equipment is a critical part of the planning phase.

Facility and Infrastructure

A 50 MW line requires a facility of approximately 2,500 to 3,500 square meters to accommodate the production line, raw material storage, finished goods warehousing, and administrative offices. The production area itself often needs cleanroom-like conditions with controlled temperature and humidity, which adds to the initial setup cost.

Ancillary Costs

Beyond machinery and the building, several other costs are critical:

- Technology Transfer and Training: Ensuring your team can operate and maintain the equipment efficiently.

- Initial Bill of Materials: A substantial stock of raw materials (solar cells, glass, etc.) is needed to begin production.

- Certifications: Budgeting for product certifications, such as IEC 61215 and IEC 61730, is non-negotiable for market access. This process underscores the importance of solar panel certification for quality and safety.

Operational Expenditure (OpEx): The Ongoing Costs

OpEx covers the recurring monthly and annual costs of running the factory. Projecting these accurately is fundamental to determining the facility’s break-even point and overall profitability.

Bill of Materials (BoM)

The BoM is the single largest component of OpEx, often accounting for 60-75% of the cost to produce a single module. It includes all the physical components required for assembly:

- Solar cells

- Tempered glass

- EVA (Ethylene Vinyl Acetate) film

- Backsheet or rear glass

- Aluminum frames

- Junction boxes

Managing the supply chain for the bill of materials for a solar panel is therefore one of the most critical operational functions of the business.

Labor Costs in the Irish Context

A semi-automated 50 MW line typically requires a workforce of 30 to 40 people, including skilled machine operators, quality control technicians, maintenance engineers, and administrative staff. While Ireland has a highly educated workforce, its labor costs are higher than in many other regions. An accurate financial forecast must factor in competitive local salaries, social contributions, and training.

Energy Costs: A Critical Factor in Ireland

Solar module manufacturing is an energy-intensive process, especially during lamination. Ireland’s industrial electricity prices are a significant operational variable, with current rates averaging between 0.15 and 0.25 euros per kWh. This makes energy-efficient machine selection not just an environmental consideration, but a crucial financial one. While Ireland’s grid is stable, these higher energy costs must be built into the pricing model to maintain profitability.

Overheads and Maintenance

This category covers factory rent or lease payments, insurance, administrative salaries, marketing, and scheduled maintenance for the production equipment. A prudent model will allocate at least 3-5% of the machinery’s value for annual maintenance and spare parts.

Revenue Projections and Profitability Analysis in Ireland

With a clear picture of costs, the next step is to project revenue and analyze the potential return.

Market Pricing and Sales Channels

The price of solar modules is typically quoted in Euro per Watt (€/Wp). This price fluctuates with global supply and demand, raw material costs, and technology type. A factory in Ireland would be well-positioned to serve local installers, commercial project developers, and the broader EU market, benefiting from tariff-free access.

The Irish Advantage: Corporate Tax

Ireland’s most significant strategic advantage is its corporate tax rate: a flat 12.5% on trading income. Compared to the 20-30% rates common in other European countries and North America, this provides a substantial boost to net profit. For an investor, this means retaining a larger portion of generated profits and accelerating the return on investment.

Calculating the Return on Investment (ROI)

A simplified ROI can be projected with the following example:

Annual Production: 50 MW (50,000,000 Watts)

Average Selling Price: €0.25/Watt

Annual Revenue: 50,000,000 W * €0.25/W = €12,500,000

Cost of Production (BoM, Labor, Energy, etc.): Assume €0.21/Watt

Total Annual OpEx: 50,000,000 W * €0.21/W = €10,500,000

Gross Profit: €12,500,000 – €10,500,000 = €2,000,000

Net Profit (after 12.5% tax): €2,000,000 * (1 – 0.125) = €1,750,000

Simple ROI (on a €6M investment): €1,750,000 / €6,000,000 ≈ 29%

This simplified model suggests a potential payback period of under four years—a compelling figure for a capital-intensive industrial project. The tax advantage is a direct contributor to this accelerated timeline.

Potential Grants and Incentives

The Irish government, through agencies like IDA Ireland and the Sustainable Energy Authority of Ireland (SEAI), actively encourages investment in green technology and advanced manufacturing. While not guaranteed, grants for capital equipment, R&D, and job creation may be available. Navigating these programs often requires detailed business planning, an area where platforms like pvknowhow.com provide structured guidance through dedicated courses.

Frequently Asked Questions (FAQ)

What is a realistic timeline to set up a 50 MW factory?

From a final investment decision to the production of the first certified module, a realistic timeline is 9 to 12 months. This includes machine procurement, facility preparation, installation, and staff training.

Do I need a technical background to start this business?

No. While technical understanding is helpful, a strong business background is more critical. Success depends on a robust business plan and partnering with experienced technical consultants who can manage the turnkey factory setup and technology transfer.

Why choose Ireland over a lower-cost country?

The decision rests on strategic priorities. Ireland offers unparalleled access to the EU single market, political and economic stability, a highly skilled workforce, and a powerful tax advantage that can outweigh lower labor or energy costs elsewhere.

How much working capital is needed besides the initial CapEx?

It is prudent to budget for at least 3 to 6 months of operational expenditure as working capital. This ensures sufficient funds to cover raw material purchases, payroll, and other expenses before the business generates consistent positive cash flow.

Conclusion: Evaluating the Opportunity

Establishing a solar module factory in Ireland is a venture that combines the stability of European manufacturing with a uniquely favorable financial environment. The low corporate tax rate provides a clear, quantifiable advantage that directly impacts the speed and scale of the return on investment.

However, this opportunity demands diligence. The financial model presented here is just a starting point. A successful project depends on a comprehensive feasibility study, detailed market analysis, and meticulous planning of every operational detail, from supply chain logistics to energy consumption. With the right preparation and expert guidance, an Irish-based solar manufacturing plant makes for a formidable business case.