An entrepreneur planning to launch a solar module factory in Italy sees growing demand, supportive European policies, and a prime location for serving markets in Europe and North Africa. Yet, one fundamental question looms: where will the raw materials come from?

The venture’s success hinges on a secure, cost-effective, and reliable supply chain. This isn’t just a logistical puzzle; it’s the central strategic challenge facing Europe’s resurgent solar manufacturing industry.

Driven by policies like the EU’s Net-Zero Industry Act and REPowerEU, the continent is actively reducing its dependence on imported energy technologies. Italy is emerging as a key player in this movement, with significant investments like Enel’s 3Sun Gigafactory in Sicily aiming to scale up production. However, this ambition must be met with pragmatism. A solar module is an assembly of globally sourced components, and establishing a new factory means developing a robust strategy for procuring them.

This guide breaks down the critical raw material supply chain for an Italian solar module factory. It assesses the feasibility of sourcing key components locally versus relying on international suppliers, providing a framework for investors and business leaders to make informed decisions.

The New Landscape for European Solar Manufacturing

For years, the solar manufacturing narrative was dominated by Asia. Today, that story is changing. A combination of geopolitical shifts, supply chain vulnerabilities exposed during the pandemic, and a strategic push for industrial sovereignty is fueling a manufacturing renaissance in Europe.

The European Union has set a goal to produce at least 40% of its annual clean technology needs by 2030. This has created powerful momentum for projects within member states. In Italy, this is more than a theoretical target. FuturaSun, for example, is developing a gigafactory in Veneto, demonstrating confidence in the region’s industrial capabilities.

This growth, however, exposes a critical dependency. While assembly lines can be built in Europe, many essential materials are still predominantly manufactured in China, creating a significant bottleneck. For an investor planning a new facility, understanding this dynamic is the first step in building a resilient business model. The key is not to wait for a perfect, fully localized supply chain, but to navigate the existing one strategically.

Sourcing Key Solar Module Materials in Italy

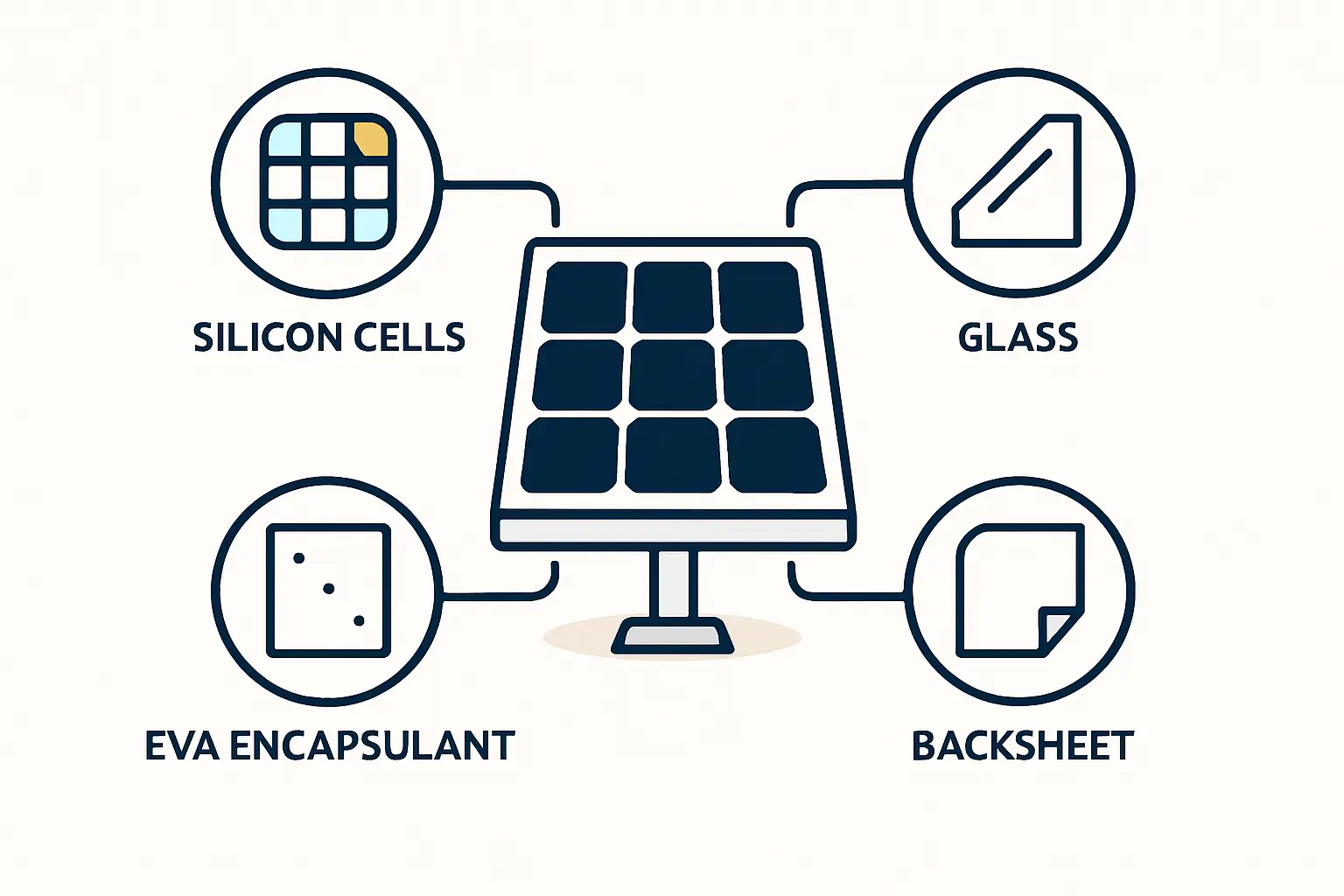

A solar panel’s performance and cost are determined by its Bill of Materials (BOM). For a new factory in Italy, the sourcing strategy for each component directly impacts logistics, cost, and risk. Let’s examine the most significant solar module components.

1. Solar Glass: The Local Potential

Solar glass is not ordinary window glass. It must be a low-iron, high-transparency product, often patterned to reduce reflection and maximize light absorption. Its weight and fragility also make transportation costs a significant factor.

Italy, particularly the Veneto region, has a long and distinguished history of glass manufacturing—an industrial heritage that presents a clear opportunity. While Italian manufacturers haven’t historically focused on solar-grade glass, the underlying expertise and infrastructure are in place. The strategic move by FuturaSun to potentially co-locate a glass plant with its module factory is a testament to this logic. Sourcing glass locally could dramatically reduce shipping costs, shorten lead times, and give manufacturers greater control over quality.

Verdict: A strong candidate for local or regional sourcing, but this would require stimulating new production lines or forming partnerships with existing Italian glassmakers.

2. Aluminum Frames: A Promising Regional Hub

The aluminum frame provides structural integrity to the module, protecting it from mechanical stress and the elements for decades.

Here, Italy holds a distinct advantage. The industrial region around Brescia is one of Europe’s largest hubs for aluminum extrusion, a proximity that represents a major strategic asset. A factory in northern Italy can source high-quality, custom-profiled aluminum frames with minimal transportation costs and just-in-time delivery schedules. This contrasts sharply with ordering frames from Asia, a process that involves months of lead time and significant shipping expenses for a bulky, relatively low-value product.

Verdict: An excellent candidate for local sourcing. The existing industrial ecosystem in regions like Lombardy is well-equipped to serve a new solar factory.

3. Encapsulants (EVA/POE): The Global Dependency

Encapsulant films, typically Ethylene Vinyl Acetate (EVA) or Polyolefin Elastomer (POE), are critical for bonding the module’s layers and protecting the solar cells from moisture and dirt.

This component represents one of the biggest sourcing challenges. The production of high-quality encapsulant films is heavily concentrated in Asia. While some European chemical companies are exploring production, the scale is not yet sufficient to meet the demand of a multi-gigawatt European industry. For the foreseeable future, new investors must plan to rely on established international suppliers. This reliance introduces risks related to shipping delays, price volatility, and trade policy shifts.

Verdict: Primarily an imported component. Building strong relationships with multiple international suppliers is a key risk mitigation strategy.

4. Solar Cells and Junction Boxes: The Long Road to Reshoring

The solar cell is the heart of the module, and sourcing it is the most complex piece of the puzzle. Currently, over 90% of the world’s solar cells are manufactured in Asia. Major initiatives like Enel’s 3Sun are a crucial first step toward building European capacity, but it will be years before domestic production can meet the continent’s full demand.

Junction boxes, which house the module’s electrical components, face a similar situation. While there are some specialized European manufacturers, the bulk of the market is served by imports.

Verdict: Initially, these will almost certainly be imported. A long-term strategy should monitor the growth of European cell and component producers for future integration.

Strategic Sourcing Models: Local vs. Global

For a new entrant, the choice isn’t a simple ‘either/or’ but a strategic blend designed to optimize cost, quality, and resilience.

Local/Regional (EU) Sourcing

- Advantages: Reduced shipping costs and lead times, simplified logistics, easier quality audits, resilience against international shipping disruptions, and strong ‘Made in Europe’ marketing credentials.

- Disadvantages: Fewer supplier options for specialized materials (e.g., encapsulants) and potentially higher unit costs until local production scales up.

Global (Primarily Asia) Sourcing

- Advantages: Access to a vast, established supplier base; competitive pricing due to immense economies of scale; and a wide range of product specifications available.

- Disadvantages: Long and unpredictable lead times (3-4 months is common), high vulnerability to geopolitical risks and shipping crises, and complex quality control from a distance.

Experience from J.v.G. Technology GmbH turnkey projects shows that a dual-sourcing or hybrid strategy is often the most pragmatic path, mitigating initial risks while capitalizing on emerging opportunities.

Building a Resilient Supply Chain: A Phased Approach

A new solar module factory in Italy shouldn’t aim for 100% localization from day one. A more realistic and resilient strategy involves a phased approach.

-

Phase 1: Launch (Year 1-2): Prioritize local sourcing for materials where Italy has a clear advantage, such as aluminum frames and potentially glass. For critical components like solar cells and encapsulants, establish relationships with two or more reputable international suppliers to avoid single-source dependency. This is a crucial step in understanding how to set up a solar module production line.

-

Phase 2: Scale-Up (Year 3+): As production volume grows, this increased demand can be used as leverage to engage more deeply with emerging European suppliers for cells and other components. A larger order volume makes the factory an attractive partner for new local producers, potentially influencing their investment decisions and helping to build the very ecosystem it needs.

This measured approach balances the immediate need for reliable components with the long-term strategic goal of a more secure, localized supply chain.

Frequently Asked Questions (FAQ)

What is the biggest supply chain challenge for a new factory in Italy?

The primary challenge is the heavy dependence on Asia for technologically sensitive components like solar cells and encapsulant films. While European production is growing, it will take several years to reach self-sufficiency. This makes robust international supplier relationships essential for the near term.

Can a solar factory in Italy source 100% of its materials from Europe?

At present, this isn’t realistic. Key inputs like high-purity silicon, solar cells, and specific polymers for encapsulants are predominantly imported. However, a high percentage of a module’s value and weight—particularly from glass and aluminum frames—can be sourced from Italy or neighboring EU countries.

How does a ‘Made in Europe’ label affect business prospects?

A ‘Made in Europe’ or ‘Made in Italy’ label is a significant commercial advantage. It is often favored in public procurement tenders and by commercial clients who prioritize supply chain security, a lower manufacturing carbon footprint, and faster delivery. In short, it signals resilience and quality.

What is the first step in creating a sourcing strategy?

The first step is a detailed analysis of the Bill of Materials (BOM) for your chosen module technology. This involves identifying every component, defining its specifications, and then mapping potential suppliers both locally and globally. This BOM cost analysis is intrinsically linked to understanding the overall investment requirements for a solar panel factory.

Conclusion and Next Steps

Launching a solar module manufacturing facility in Italy offers a compelling opportunity to play a part in Europe’s industrial energy transition. The strategic sourcing of raw materials is central to this endeavor. The landscape presents a clear dual pathway: capitalizing on Italy’s industrial strengths for bulky components like glass and frames, while managing the global dependencies for high-tech items like cells and encapsulants.

A successful venture will be one that builds a flexible, resilient, and intelligent supply chain—balancing the opportunities of today with the vision of a more localized ecosystem tomorrow.

For a structured overview of the entire process, from factory layout to final certification, exploring comprehensive resources on project planning can provide a solid foundation for your venture.