An investor looking to enter the European solar manufacturing market might naturally look to established industrial centers. Yet, a significant state-supported opportunity is unfolding in Italy, driven by a strategic push to reshore critical renewable energy production.

The decision of where to locate a facility in Italy is therefore a critical choice between two distinct economic and operational models: the industrial north and the developing south. This analysis provides a business-focused comparison of the key variables, examining the trade-offs between the established infrastructure of Northern Italy and the compelling financial incentives offered by the South, particularly within its Special Economic Zones (ZES).

The Strategic Landscape: Why Italy Is Attracting Solar Investment

For decades, solar manufacturing has been dominated by producers in Asia. However, recent European Union policies aimed at supply chain resilience and energy independence have created a favorable environment for new manufacturing ventures in Europe.

Italy, with its central Mediterranean location, extensive coastline, and strong industrial base, is poised to become a key player in this manufacturing renaissance. The Italian government has bolstered this opportunity with significant national and EU-funded incentives, fostering a competitive landscape for entrepreneurs looking to establish production lines. The central question for any new entrant is where to best capitalize on this environment.

Northern Italy: The Established Industrial Powerhouse

The regions of Northern Italy, such as Lombardy, Veneto, and Emilia-Romagna, represent the country’s economic engine. This area has a long history of advanced manufacturing, engineering excellence, and integration with the wider European economy.

Strengths: Infrastructure and Talent

The North offers a high degree of predictability. Its logistical infrastructure is world-class, with major ports like Genoa and Trieste providing efficient access to global shipping lanes. Road and rail networks are highly developed, simplifying the transport of raw materials and finished goods to key markets in Germany, France, and beyond.

The region also boasts a deep pool of skilled labor, from experienced technicians and engineers to factory managers. This access to talent can accelerate the initial setup and operational ramp-up of a new facility.

Challenges: Costs and Competition

This established ecosystem comes at a premium. Land acquisition, construction, and labor costs are significantly higher in the North compared to the South. These elevated operational expenditures can impact a new venture’s initial investment calculations and long-term profitability. The environment is also more competitive, with many established players vying for the same resources and talent.

Southern Italy: The Emerging Opportunity Zone

Historically, the southern regions of Italy (the Mezzogiorno), including Sicily, Calabria, and Puglia, have faced economic challenges. However, a concerted effort by the Italian government and the EU is transforming this area into a highly attractive zone for new industrial investment, particularly in green technology.

The Power of Incentives: Understanding the ZES

The most significant advantage of Southern Italy is its designation as a Special Economic Zone (ZES). As of 2024, these zones have been unified into a single entity, the ZES Unica, which covers all southern regions. This program offers a powerful suite of benefits designed to attract investment.

Key benefits include significant tax credits, where companies can receive credits of up to 60% on investments in new capital goods required for a production line. The ZES also provides simplified bureaucracy with a ‘one-stop-shop’ for permits, drastically reducing administrative timelines. Overall, red tape for procedures from construction to environmental assessments is streamlined.

These incentives directly address an investor’s primary concerns, lowering the financial barrier to entry and accelerating the timeline to production.

Favorable Economics and Logistical Gateways

Beyond the official incentives, Southern Italy offers fundamentally lower operating costs. Labor rates are more competitive, and the availability of industrial land is greater. This enables a more cost-effective operational model over the project’s lifespan.

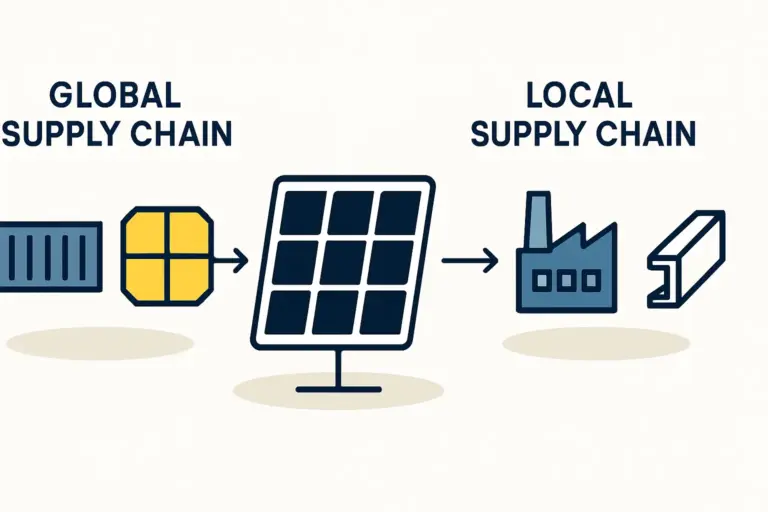

The South also has major deep-water container ports like Gioia Tauro, which are strategically positioned to receive raw materials (e.g., solar cells, glass, aluminum frames) from Asia. These ports also serve as ideal export hubs for finished solar modules destined for the growing markets in Africa and the Middle East.

A Direct Comparison: Key Factors for Decision-Making

Choosing the right location requires a careful evaluation of the trade-offs. The optimal choice depends entirely on an investor’s priorities, risk tolerance, and business strategy.

Labor Costs and Availability

-

North: Higher costs but a readily available pool of highly skilled, experienced manufacturing personnel.

-

South: Significantly lower labor costs, though targeted training programs are often necessary to develop the specialized technical skills required.

Logistics and Supply Chain

-

North: Mature, highly efficient logistics network integrated with mainland Europe. Ideal for serving customers in Central and Western Europe.

-

South: Strategic port locations for global shipping routes (Asia-Suez-Mediterranean), excellent for importing materials and exporting to non-EU markets. Inland logistics, however, can be less developed than in the North.

Financial Incentives and Bureaucracy

-

North: Standard national and regional incentives may be available, but they are far less substantial than in the South. Bureaucratic processes are standard.

-

South: Massive financial advantages through the ZES, including major tax credits and drastically simplified administrative procedures. This is the single most compelling reason to consider the South.

Practical Considerations for the Investor

Based on experience from J.v.G. Technology GmbH turnkey projects, a successful factory launch in either region depends on thorough preparation. A detailed feasibility study is non-negotiable. This study must account for local variables, including the reliability of the power grid, availability of specific technical skills, and the local supply chain for ancillary materials like packaging.

Navigating regional administrative bodies and ensuring compliance with local regulations requires specialized knowledge. While the ZES in the South simplifies this, expert guidance remains crucial to avoid costly delays. A turnkey solar factory solution—which bundles planning, equipment procurement, and commissioning—is often an effective way to manage these complexities. This approach is particularly valuable for investors new to the solar industry or the region.

Frequently Asked Questions (FAQ)

What is a ZES and how does it directly benefit a solar factory?

A Special Economic Zone (ZES) is a designated geographical area where businesses benefit from favorable financial and administrative regulations. For a solar factory in Southern Italy, this primarily means receiving a large tax credit on the initial investment in machinery and buildings, as well as a fast-tracked process for obtaining all necessary permits to build and operate.

Are there enough skilled workers in Southern Italy?

Southern Italy has a large and available workforce. However, the specialized skills for operating advanced solar manufacturing equipment may not be widespread. Most successful projects incorporate a robust training program, often developed in partnership with local technical institutes and equipment suppliers. The lower labor costs often more than compensate for this initial training investment.

How long does it take to set up a factory in Italy?

The timeline can vary. In the North, it might take 18-24 months, largely dependent on standard permitting timelines. In the South, thanks to the ZES streamlined procedures, it is possible to have a line operational in under 12 months, assuming financing and equipment orders are in place.

What are the primary logistical challenges for importing raw materials?

The main challenge is managing the global supply chain for key components like solar cells, which predominantly come from Asia. Choosing a factory location near a major container port (like Gioia Tauro in the South or Genoa in the North) is critical to minimize inland transport costs and delays.

Making an Informed Decision

The choice between Northern and Southern Italy is a classic business trade-off.

Northern Italy offers lower risk, established infrastructure, and a skilled workforce, but at a significantly higher cost. It is the conservative choice for an investor prioritizing stability and proximity to the core European market.

Southern Italy presents a higher-reward scenario, driven by powerful financial incentives that can substantially de-risk the initial investment. It is the strategic choice for an investor focused on cost leadership and access to global sea lanes for both import and export.

For most new entrants without an existing European footprint, the financial advantages and administrative support offered by the ZES in Southern Italy present a compelling, and perhaps decisive, argument. A carefully planned project in the South can achieve a faster path to profitability and a stronger competitive position in the global market.