For an international entrepreneur considering a new venture, navigating an unfamiliar regulatory landscape is one of the first major hurdles. The prospect of dealing with multiple government ministries, each with its own procedures and timelines, can be a daunting barrier to entry.

In Ivory Coast, however, the government has established a clear and centralized path for investors, designed specifically to streamline this process. This path is managed by a single, pivotal organization: the Centre de Promotion des Investissements en Côte d’Ivoire (CEPICI). For any company looking to establish a solar manufacturing facility in the region, understanding CEPICI’s function is not just helpful—it is an essential first step toward a successful market entry.

What is CEPICI and Why is it Essential for Investors?

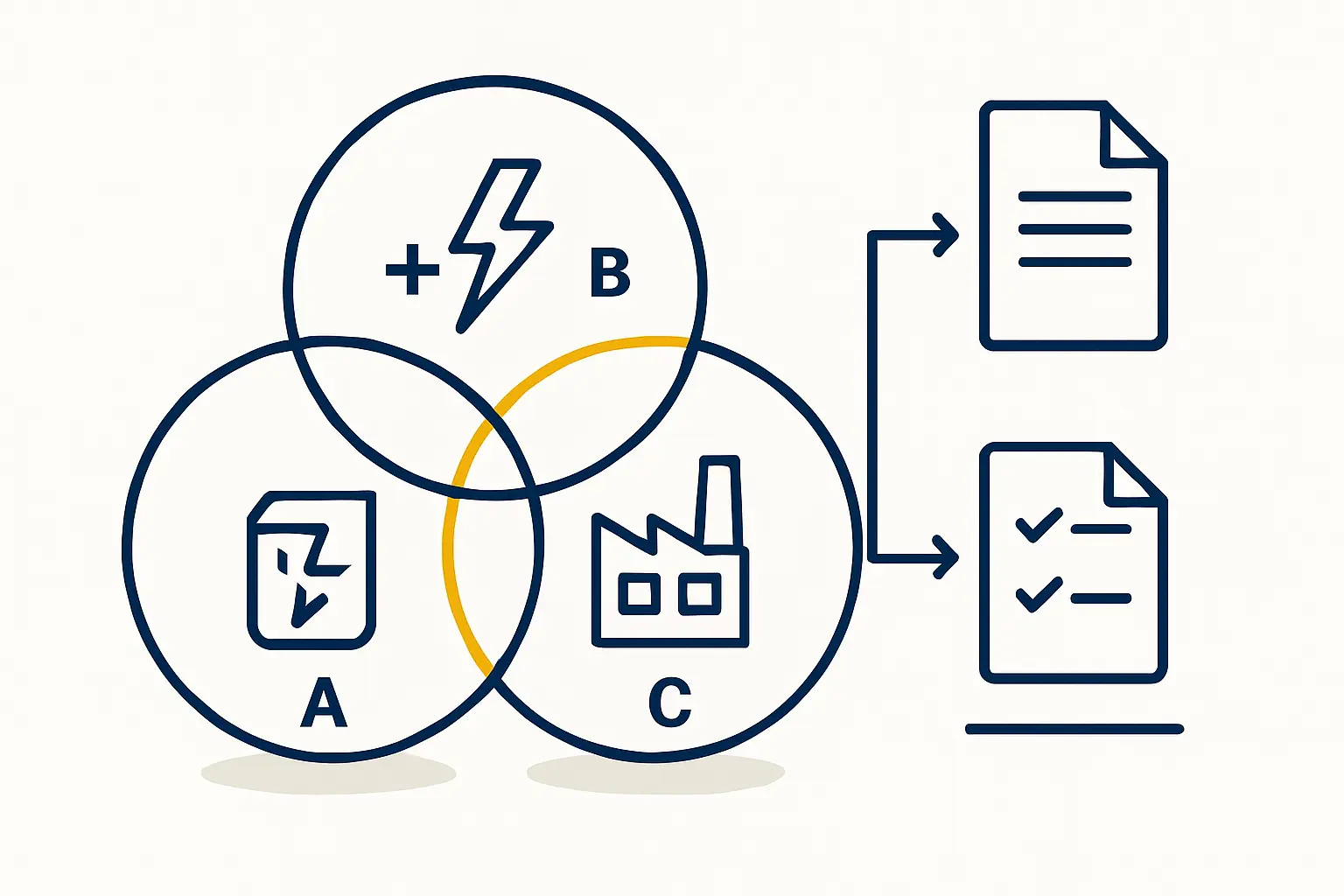

CEPICI is the official government agency dedicated to promoting and facilitating private investment in Ivory Coast. Its primary mandate is to simplify the complex administrative procedures required to establish and operate a business. The agency achieves this through its “Guichet Unique,” or one-stop shop, which serves as a single interface between the investor and all relevant state administrations.

Rather than requiring an investor to independently secure approvals from the Ministry of Commerce, the Tax Authority, and other bodies, CEPICI centralizes these functions. This consolidation dramatically reduces the administrative burden and accelerates the entire setup process. For a capital-intensive project like a solar panel factory, this efficiency translates directly into lower initial costs and a faster path to revenue.

The core services provided by the CEPICI one-stop shop include:

- Business Registration: Formalizing the legal creation of a company, a process CEPICI aims to complete within 24 hours.

- Investment Approval: Managing the application for benefits under the national Investment Code.

- Permit and License Facilitation: Assisting with securing necessary documents, such as building permits, environmental impact assessments, and operational licenses.

By serving as a central coordinator, CEPICI provides a structured and predictable framework that is critical for mitigating risk in a new market.

The Investment Code: Unlocking Incentives for Solar Manufacturers

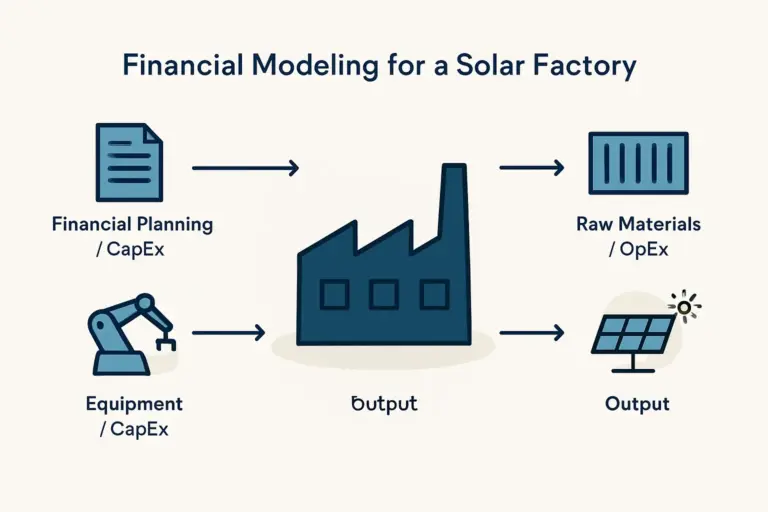

A key function of CEPICI is administering the Investment Code of 2018, a legislative framework designed to attract foreign direct investment through a range of significant financial incentives. For an entrepreneur planning to start a solar panel factory, these incentives can fundamentally improve the project’s financial viability.

The benefits are typically structured in two phases:

1. The Investment Phase (Setup)

During the construction and equipping of the manufacturing facility, approved projects can receive exemptions from:

- Customs Duties: On all imported equipment, materials, and machinery required for the factory.

- Value Added Tax (VAT): On both imported goods and local purchases made during the setup period.

These exemptions directly reduce the initial capital outlay, lowering the project’s overall investment requirements.

2. The Operational Phase (Production)

Once the factory begins production, the benefits continue for a period that can range from five to fifteen years, depending on the project’s location and scale. These often include:

- Corporate Income Tax Exemption: A full or partial holiday on taxes levied on company profits.

- Business License Tax Exemption: Relief from certain local operational taxes.

Securing these advantages requires a formal application process managed by CEPICI. Investors must demonstrate that the project aligns with national development goals, such as job creation and technology transfer.

The Practical Process: How CEPICI Streamlines Your Entry

Engaging with CEPICI follows a logical sequence. While the specifics can vary based on project complexity, the general pathway provides clarity for investors.

Step 1: Application for Investment Approval (Agrément d’Investissement)

The process begins with submitting a detailed application file to CEPICI. This file typically includes the company’s statutes, a comprehensive business plan, financial projections, and details on the technical aspects of the planned solar manufacturing line.

Step 2: Business Creation and Formalization

Simultaneously, the one-stop shop facilitates the legal registration of the local entity. This involves registering with the Commercial Court, the Tax Authority (DGI), and the Social Security institution (CNPS) through a single, unified procedure.

Step 3: Securing Essential Permits

Once the business is registered and the investment is approved in principle, CEPICI assists in securing sector-specific permits. For a factory, this includes the building permit (Permis de Construire), environmental compliance certificates, and any other licenses relevant to industrial operations.

This structured flow replaces uncertainty with a clear, step-by-step process, allowing investors to focus on their core business objectives rather than administrative complexities.

Navigating Potential Challenges and Best Practices

While CEPICI provides a highly effective framework, success still depends on diligent preparation. Based on experience with numerous turnkey projects in emerging markets, investors should consider the following:

- Thorough Documentation: The quality and completeness of the business plan and financial model are paramount. These documents form the basis of the investment approval and must be professional, realistic, and well-supported.

- Local Advisory: Engaging local legal or financial advisors can be invaluable for navigating the specific nuances of Ivorian corporate law and ensuring full compliance.

- Clear Timelines: While CEPICI accelerates the process, project planning should still account for realistic timelines for each approval stage. Consistent and professional follow-up is key.

An experienced technical partner can often provide crucial support in preparing the necessary documentation, particularly the technical specifications and production forecasts required for the application.

Frequently Asked Questions (FAQ)

-

How long does the entire approval process with CEPICI typically take?

While CEPICI can create a legal business entity within 24 hours, the full investment approval process, including securing all benefits under the Investment Code, generally takes several weeks to a few months. The timeline depends heavily on the quality of the submitted application and the complexity of the project. -

Are the Investment Code incentives automatically granted to all investors?

No, the incentives are not automatic. Investors must formally apply through CEPICI and receive an “Agrément d’Investissement” (Investment Approval). The project is evaluated based on its economic and social contributions, such as job creation, export potential, and use of local resources. -

Does CEPICI assist with finding local partners or suppliers?

CEPICI’s primary role is administrative and regulatory facilitation. While its staff may offer general guidance, its core mandate does not typically include business matchmaking. Investors are usually responsible for identifying their own local partners, suppliers, and distributors. -

What are the obligations after a factory is operational and receiving incentives?

Approved companies are subject to periodic monitoring by CEPICI and other relevant ministries. They must submit regular reports to demonstrate they are meeting the commitments made in their business plan (e.g., employment targets, investment levels). Meeting these commitments is essential to maintaining the tax benefits. In addition, operators must ensure their products meet market standards, which often involves obtaining the correct solar panel certifications.

Conclusion: Your Strategic Partner in Ivory Coast

For any entrepreneur or company exploring solar manufacturing in West Africa, CEPICI represents a critical strategic advantage. By acting as a central facilitator, it transforms a potentially fragmented and confusing bureaucratic process into a manageable and predictable pathway.

Its role goes beyond simple administration; it is a clear signal of the Ivorian government’s commitment to attracting and supporting private investment. By understanding and effectively engaging with CEPICI, investors can significantly de-risk their market entry, reduce setup costs, and accelerate their journey from initial concept to a fully operational solar module factory.