Any entrepreneur considering a new venture in West Africa faces a critical question: how can the high initial costs of importing specialized machinery be managed? For those looking to establish a solar module production facility, the capital outlay for technology is substantial.

However, countries keen on industrial development and energy independence, like Ivory Coast, have established legal frameworks designed to ease this financial burden. This guide breaks down the Ivorian ‘Code des Investissements’ (Investment Code), explaining how its provisions directly benefit investors in the solar manufacturing sector. Understanding these incentives is key to building a viable and competitive business case.

Understanding the ‘Code des Investissements’

Ivory Coast’s Investment Code is a strategic tool designed to attract foreign and domestic investment into priority sectors of the economy. It offers a package of significant tax and customs benefits to qualifying new businesses.

The goal is to reduce the initial financial burden and operational costs during the crucial start-up phase, improving the project’s profitability and long-term sustainability.

The primary government body responsible for administering this code is the Centre de Promotion des Investissements en Côte d’Ivoire (CEPICI). It acts as a one-stop shop for investors, guiding them through the application process and ensuring that qualifying projects receive their entitled benefits. For an entrepreneur new to the region, engaging with CEPICI is a critical first step.

Key Incentives for Solar Module Producers

The Ivorian government considers the renewable energy sector, particularly local manufacturing, a priority area. This designation unlocks the most advantageous benefits under the Investment Code. For a new solar module factory, these incentives fall into two main categories.

1. Tax Exemptions

The most significant financial relief comes from exemptions on major corporate taxes. Under the investment approval regime (régime d’agrément), a new solar manufacturing facility can benefit from:

-

Corporate Income Tax (BIC) Exemption: A complete exemption from corporate income tax for a period typically ranging from five to seven years, depending on the project’s location and scale. This allows the business to reinvest its early profits directly into growth and stabilization.

-

Exemption from Business License Tax (Patente): For the same duration, the company is often exempt from this key operational tax, further reducing fixed annual costs.

-

VAT Exemption on Local Purchases: In many cases, the government may grant an exemption on Value Added Tax (VAT) for goods and services acquired locally during the factory construction and setup phase.

These tax benefits create a crucial window for the new enterprise to achieve financial stability before facing the full national tax regime.

2. Customs Duty Relief

For a solar module factory, the largest initial expense is often the importation of the production line. The Investment Code directly addresses this through substantial customs incentives:

-

Total Exemption on Imported Equipment: All necessary manufacturing equipment—from cell stringers and laminators to testers and framing machines—can be imported free of customs duties and fiscal taxes. This can reduce the initial capital expenditure by a significant margin, often 20% or more.

-

Reduced Duties on Raw Materials: While full exemptions on raw materials are less common, the code often provides for reduced tariff rates on imported components like solar cells, EVA film, backsheets, and glass for a set period. This lowers the production cost per module, enhancing market competitiveness.

Based on experience from J.v.G. turnkey projects, navigating the customs clearance process for specialized equipment is a common challenge for new investors. The certification provided by CEPICI under the Investment Code is the key to simplifying this process and legitimizing these duty-free imports.

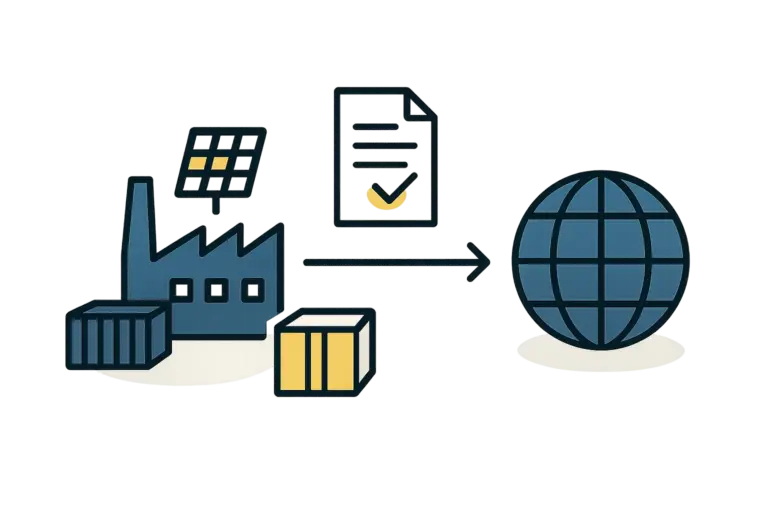

The Practical Path to Approval

Securing these benefits is a formal process requiring careful documentation and planning. Though the specifics can be complex, the general pathway is a structured process managed by CEPICI.

-

Company Registration: The first step is the legal incorporation of the business entity in Ivory Coast.

-

Preparation of the Investment File: This is a comprehensive application that includes the business plan, financial projections, details on job creation, technical specifications of the equipment, and an environmental impact assessment.

-

Submission to CEPICI: The complete file is submitted to CEPICI for review.

-

Inter-Ministerial Commission Review: CEPICI facilitates a review by a commission that includes representatives from the Ministry of Finance, Customs, and other relevant bodies.

-

Issuance of Approval (Agrément): Once approved, the investor receives an official ‘Agrément’ certificate. This legal document is the formal proof of entitlement to all the specified tax and customs benefits.

The entire process, from submission to approval, can take several months, so it’s crucial to begin early in the project planning phase.

Impact on the Overall Business Case

The direct financial impact of these incentives cannot be overstated. By removing customs duties on machinery, the overall investment requirements for a 50 MW production line can be reduced substantially. This saved capital can be reallocated to other critical areas, such as workforce training, raw material inventory, or marketing.

The tax exemption period allows the business to reach its break-even point faster and build a stronger balance sheet. This improved financial health makes the venture more attractive for future financing or expansion. These government-backed incentives transform a potentially challenging investment into a much more secure and profitable long-term project.

Frequently Asked Questions (FAQ)

What is the minimum investment required to qualify?

While the exact threshold can be updated, projects typically need to exceed an investment of several hundred million West African CFA francs (XOF) to qualify for the full approval regime (‘régime d’agrément’). Smaller projects may fall under a declaration regime (‘régime de la déclaration’) with fewer benefits.

Are these benefits available to both local and foreign investors?

Yes, the Ivorian Investment Code is designed to apply equally to both domestic and international investors, ensuring a level playing field.

How long do the customs and tax benefits last?

The benefits are granted for a set period, typically between five and fifteen years, depending on factors like the investment amount and the geographic location of the factory within Ivory Coast. They are designed to support the establishment phase of the business.

Is the process of applying to CEPICI complex?

The process is rigorous and requires detailed documentation. However, CEPICI’s role as a one-stop shop is to streamline and assist investors. Working with experienced consultants who understand local administrative procedures can greatly simplify the application.

Next Steps in Your Project Journey

Understanding and leveraging the Ivorian ‘Code des Investissements’ is not just an administrative task, but a strategic advantage that can define the financial success of a new solar manufacturing plant. This framework signals a clear commitment from the government to support industrial growth in the renewable energy sector.

For entrepreneurs and business leaders, the next step involves integrating these incentives into a comprehensive feasibility study and financial model. This comprehensive planning forms the foundation for any successful venture. Further guidance on this topic is available in resources that detail the process of starting a solar module factory from the initial concept to full-scale production.