Imagine carefully crafting a business plan for a new manufacturing facility in Kenya. Your budget is sound, profit margins are calculated, and you have a clear breakeven point. The entire plan is based on a USD/KES exchange rate of 125.

Six months later, as the first shipment of raw materials is due, the rate has shifted to 155. Suddenly, your procurement costs have jumped by nearly 25% without a single change to the operational plan. This isn’t a hypothetical scenario; it’s the reality for many businesses operating with a KES-revenue, USD-cost model.

This article provides a foundational understanding of foreign exchange (forex) risk for entrepreneurs and business leaders in Kenya. It outlines the core challenges they face and offers practical strategies for shielding a business from the damaging effects of currency volatility.

The Fundamental Challenge: Earning in Shillings, Spending in Dollars

The core of the issue is a structural mismatch. A manufacturing business in Kenya typically generates revenue in Kenyan Shillings (KES) from local sales. However, the costs for critical inputs—such as specialized machinery, raw materials, and components—are often denominated in U.S. Dollars (USD) or Euros (EUR).

Recent history shows just how significant this risk can be. Between early 2022 and late 2023, the Kenyan Shilling depreciated against the U.S. Dollar from approximately 113 to over 160. For a manufacturer, that translates directly into a severe, unplanned increase in the cost of goods sold, eroding profitability and straining cash flow.

This volatility is influenced by both global and local factors. A rise in U.S. interest rates can strengthen the dollar globally, while on the local front, high demand for dollars to pay for imports can outstrip supply. While the Central Bank of Kenya (CBK) may intervene to stabilize the market, these interventions often address symptoms rather than the underlying structural imbalance, leaving businesses to navigate an unpredictable environment.

Why Standard Business Forecasting Can Be Misleading

Traditional financial planning often relies on stable, predictable input costs. When a primary cost component is subject to double-digit percentage swings, however, standard forecasting becomes unreliable. A business plan that looks profitable at one exchange rate can quickly become unviable at another.

This creates several critical business challenges:

-

Margin Compression: If sales prices in KES cannot be adjusted quickly, every upward movement in the USD/KES rate directly reduces the gross profit margin.

-

Cash Flow Uncertainty: Unpredictable import costs make it difficult to manage working capital effectively. A company might find itself needing significantly more KES than budgeted to settle a USD-denominated invoice.

-

Inaccurate Investment Planning: The viability of large capital expenditures, a key part of the initial investment for a factory, is difficult to assess when costs can change dramatically between the planning and procurement phases. This is especially true when purchasing manufacturing equipment, which is almost exclusively priced in foreign currency.

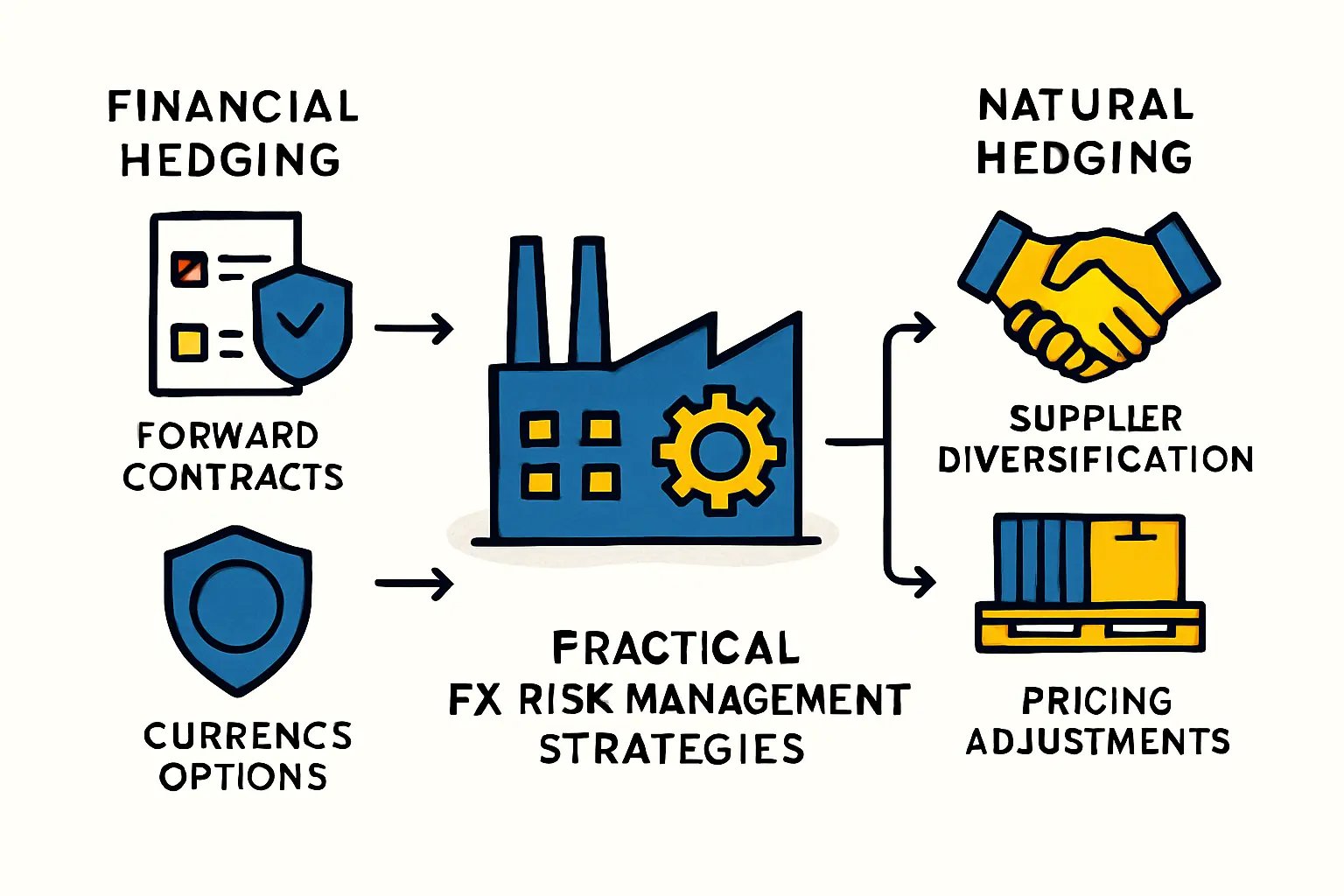

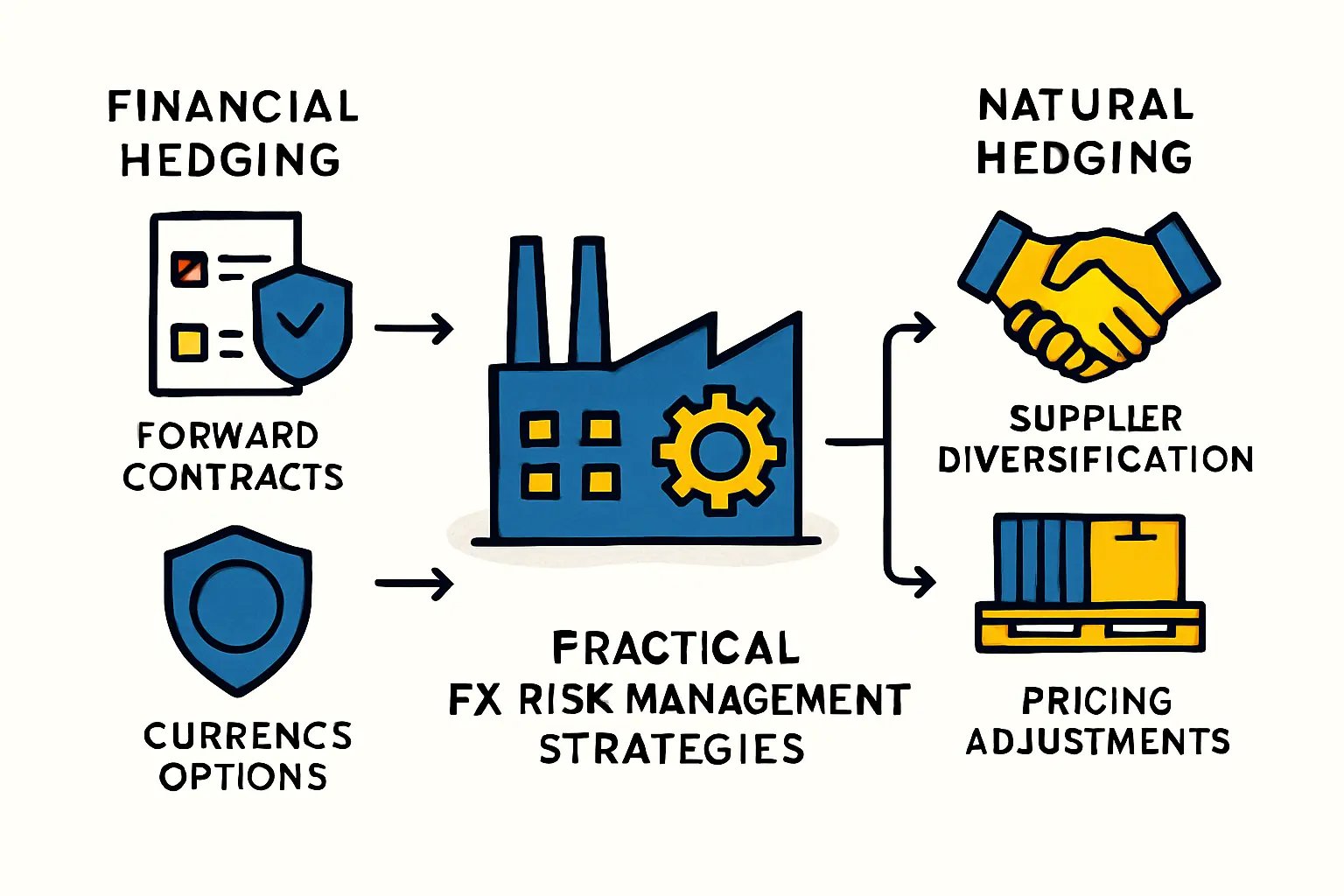

Key Strategies for Managing Forex Exposure

While eliminating currency risk entirely is impossible, a proactive approach can significantly mitigate its impact. Strategies range from simple operational adjustments to more sophisticated financial instruments.

1. Financial Hedging Instruments

Hedging is a strategy designed to protect against adverse price movements, akin to buying insurance for your future currency transactions.

-

Forward Contracts: A forward contract is a simple and common hedging tool. It is an agreement with a financial institution to exchange a specific amount of currency on a future date at a pre-agreed rate. This effectively ‘locks in’ the exchange rate for a future transaction and removes uncertainty. For example, if a business needs to pay a $100,000 invoice in three months, it can enter a forward contract today to buy dollars at, say, 160 KES, regardless of the market rate in three months’ time.

-

Currency Options: An option provides the right, but not the obligation, to buy or sell a currency at a set price on or before a specific date. This offers more flexibility than a forward contract, protecting a business from unfavorable rate movements while allowing it to benefit from favorable ones. That flexibility, however, comes at a cost, known as a premium.

2. Operational and Strategic Approaches

Beyond financial instruments, businesses can embed forex risk management into their core operations.

-

Dynamic Pricing: Where the market allows, businesses can implement a pricing model that adjusts product prices in KES to reflect changes in the cost of imported materials. This requires clear communication with customers but is an effective way to protect margins.

-

Building a USD Buffer: Maintaining a portion of cash reserves in USD can act as a natural hedge. This is particularly useful for businesses with consistent and predictable USD-denominated expenses.

-

Supplier Negotiations: It may be possible to negotiate more favorable payment terms with international suppliers. This could include extending payment deadlines to allow more time for favorable rate movements or, in some cases, agreeing to price a portion of the invoice in KES.

3. Sourcing and Managing Hard Currency

A practical challenge in the Kenyan market has been the scarcity of U.S. Dollars through official channels. This often leads to a discrepancy between the official CBK rate and the effective market rate available to businesses. Building strong, long-term relationships with multiple banking partners is crucial for ensuring access to foreign currency when needed.

Frequently Asked Questions (FAQ)

What exactly is foreign exchange risk?

Foreign exchange risk, or currency risk, is the financial risk that arises from the changing value of one currency in relation to another. For a Kenyan business, this is the risk that the KES will lose value against the USD, making its dollar-denominated costs more expensive.

Are hedging strategies only suitable for large multinational corporations?

While large corporations have dedicated treasury departments, the principles of hedging are scalable. Financial instruments like forward contracts are increasingly accessible to small and medium-sized enterprises (SMEs) through commercial banks. Operational strategies like dynamic pricing are available to businesses of any size.

How often should a business review its currency risk strategy?

In a volatile market like Kenya, a currency risk strategy should not be static. A business should review its exposure and strategy at least quarterly, or more frequently during periods of high volatility. This review should be part of the regular financial planning cycle.

Can my business completely eliminate forex risk?

Eliminating forex risk entirely is nearly impossible without ceasing international trade. The goal of a forex management strategy is not elimination but mitigation—transforming an unpredictable threat into a manageable and quantifiable business cost.

Conclusion: Integrating Forex Management into Your Core Strategy

For any entrepreneur planning a venture like starting a solar module factory in Kenya, managing foreign exchange risk is not an afterthought; it is a central component of a resilient business strategy. Ignoring currency volatility is equivalent to leaving a major cost variable to chance.

Understanding the underlying challenges and proactively implementing a mix of financial and operational strategies allows business leaders to protect their financial health, ensure more predictable planning, and build a more robust enterprise capable of thriving in a dynamic economic environment.