For any business professional considering entering a new industry, market stability is a critical factor. Volatile, unpredictable demand can undermine even the most efficient operation.

Imagine, however, a market where a significant portion of demand is not just predictable but mandated by government policy for the next decade. This is the strategic advantage South Korea’s Renewable Portfolio Standard (RPS) creates for aspiring solar module manufacturers.

This article breaks down the mechanics of the RPS program and explains how this national policy translates into a stable, long-term domestic market for solar modules—a crucial element for sound business planning.

What is a Renewable Portfolio Standard (RPS)?

At its core, a Renewable Portfolio Standard is a regulation that requires utility companies to source a minimum percentage of their electricity from renewable energy. It is a common policy tool used by governments worldwide to stimulate investment in clean energy infrastructure, such as solar, wind, and hydropower.

Think of it as a government directive for the country’s energy mix. By setting incrementally increasing targets, the policy creates a clear, long-term roadmap for the energy sector. This foresight is invaluable for everyone along the supply chain, from investors financing new power plants to the manufacturers producing the necessary equipment.

The Mechanics of South Korea’s RPS Program

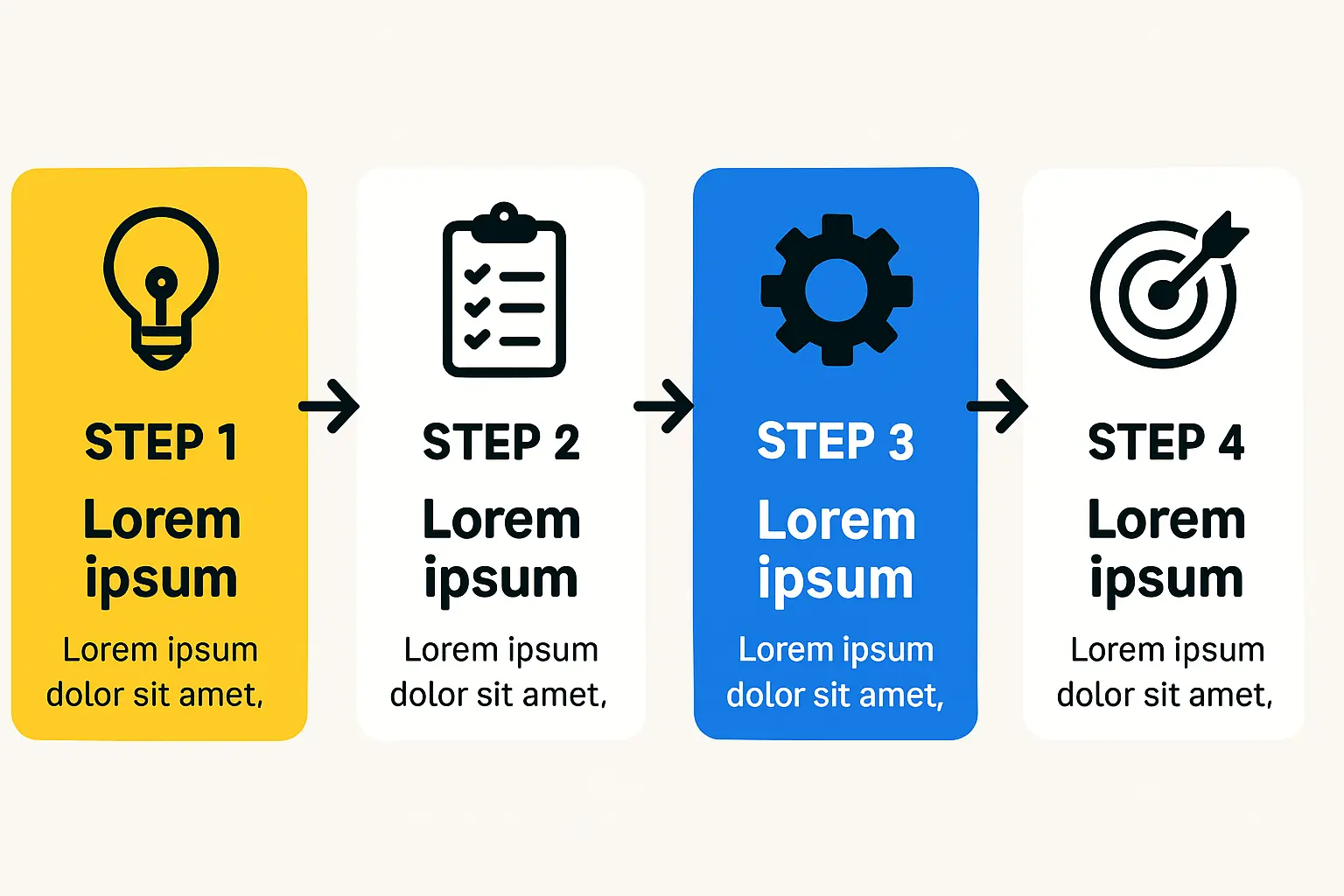

South Korea implemented its RPS program in 2012, establishing a robust framework that has driven significant growth in its renewable energy sector. The system is built on clear obligations and a market-based mechanism for compliance.

The Obligated Suppliers: Who Must Comply?

The mandate applies to 23 of the country’s largest power generation companies, each with a capacity exceeding 500 MW. These entities, referred to as ‘obligated suppliers,’ form the core customer base in the RPS system. They are legally mandated to ensure a growing portion of their energy portfolio comes from renewable sources.

The Mandate: A Growing Target

The power of the RPS lies in its predictable, escalating targets. The obligation began at 2% in 2012 and was scheduled to reach 10% in 2023. Looking forward, the government has set an ambitious target of 25% by 2030.

This legislated growth path provides an exceptional level of market visibility. For a business planner, this means the domestic demand for renewable energy is not a matter of speculation; it is a calculated trajectory backed by national policy.

The Compliance Mechanism: Renewable Energy Certificates (RECs)

Obligated suppliers have two primary ways to meet their RPS targets:

- Direct Investment: They can build and operate their own renewable energy power plants.

- Indirect Investment: They can purchase Renewable Energy Certificates (RECs) from other, independent power producers (IPPs).

A REC is a tradable, market-based instrument representing proof that one megawatt-hour (MWh) of electricity was generated from a renewable source. For large utility companies, purchasing RECs is often more flexible and economically efficient than developing new energy projects directly. This has created a vibrant market where smaller IPPs can build solar farms, generate power, and sell the resulting RECs to the obligated suppliers.

How the RPS Translates into Stable Demand for Solar Modules

The connection between this high-level policy and the business case for a local solar module factory is direct and powerful. The RPS framework establishes a clear and reliable chain of demand.

A Predictable Market for Power Producers

The REC market guarantees that independent power producers have a customer base for the renewable energy they generate. The 23 obligated suppliers must buy RECs to meet their quotas, which ensures that well-executed solar farm projects have a clear path to revenue. This drastically reduces the market risk associated with building new energy generation facilities.

A Stable Customer Base for Module Manufacturers

With reduced financial risk, solar farm developers and IPPs can confidently plan and execute new projects. Their primary need is a consistent supply of high-quality, reliable solar modules. This is where a domestic manufacturer gains a significant advantage.

By creating a stable pipeline of solar energy projects, the RPS underwrites the demand for their core component: the solar modules. This allows a local manufacturer to forecast production needs with greater accuracy, optimize the entire solar panel manufacturing process, and build long-term relationships with domestic project developers.

This policy-driven stability is a cornerstone for business planning. It simplifies financial modeling and strengthens the case when seeking funding, as the initial investment for a solar factory can be assessed against a more predictable revenue landscape.

Strategic Implications for New Market Entrants

For an entrepreneur evaluating the solar manufacturing sector, understanding the local policy environment is paramount. A market like South Korea’s, with a strong RPS, offers a distinct advantage over markets that are primarily reliant on exports.

Export-driven models are vulnerable to international trade policy shifts, tariffs, volatile shipping costs, and fluctuating currency exchange rates. While exports may represent a growth opportunity, a strong domestic market provides a foundational revenue stream that insulates a business from such global uncertainties.

A manufacturer with a deep understanding of local needs and access to a turnkey solar manufacturing line can become a reliable, high-quality partner for the domestic developers building the nation’s renewable energy future. As projects supported by J.v.G. Technology have shown, aligning factory output with the specific requirements of the domestic market is a key success factor.

Frequently Asked Questions (FAQ)

What is the primary benefit of the RPS for a new solar module manufacturer?

The primary benefit is predictable, long-term domestic demand. The government mandate for large power companies to source renewable energy creates a stable pipeline of solar projects, which in turn require a steady supply of modules. This significantly reduces market entry risk.

Does the RPS favor local manufacturers over imports?

While the policy itself may not explicitly favor domestic products, its effect creates a strong incentive for a local supply chain. A stable domestic market makes local manufacturing more viable. Local producers can also offer logistical advantages, faster delivery times, and more responsive service to domestic solar farm developers.

How do Renewable Energy Certificates (RECs) help a module manufacturer?

RECs are the financial engine of the RPS system. They create a market mechanism that makes it profitable for independent producers to build solar farms. The constant demand for RECs from obligated utilities directly fuels the demand for new solar projects, and those projects require solar modules. Ultimately, a healthy REC market translates directly into a healthy market for module manufacturers.

Is the South Korean RPS model unique?

The RPS concept is utilized in many countries and regions. However, the specific structure of South Korea’s program—with its large, clearly defined obligated suppliers, escalating targets, and robust REC market—creates a particularly stable and attractive environment for investment throughout the renewable energy supply chain.

Conclusion: A Policy-Driven Foundation for Growth

South Korea’s Renewable Portfolio Standard is more than an environmental initiative; it is a powerful piece of industrial policy that has cultivated a secure and growing domestic market for renewable energy. For any business professional planning to enter the solar module manufacturing industry, this policy provides a critical foundation of predictable demand.

By understanding how the RPS mandates consumption, facilitates compliance through RECs, and de-risks investment for power producers, entrepreneurs can appreciate the unique stability of this market. This policy framework transforms a significant portion of business risk into a calculated and forecastable opportunity, offering a solid base upon which a successful manufacturing operation can be built.