For entrepreneurs exploring new manufacturing ventures, the global landscape can seem crowded and complex. While established markets in Europe or Asia often have high barriers to entry—from significant capital requirements to intense competition—a closer look reveals opportunities in emerging economies actively courting investment with powerful financial incentives. Kosovo, in the heart of the Balkans, makes a compelling case for anyone looking to enter the solar module manufacturing industry.

This guide offers a detailed overview of the government and EU-backed financial frameworks available to new investors in Kosovo’s solar sector. We explain the specific tax exemptions, grants, and support structures designed to reduce initial investment costs and accelerate the path to profitability.

Understanding the Strategic Advantage: Why Kosovo?

Kosovo’s government has identified renewable energy, particularly solar, as a cornerstone of its strategy for economic development and energy independence. This commitment is not merely rhetorical; it is backed by a robust legal and financial framework designed to attract foreign direct investment. For investors, this translates into a stable, predictable environment where the government acts as a partner, not a barrier.

The country offers a unique combination of a strategic European location, a young, motivated workforce, and direct access to growing regional energy markets. These advantages, combined with the incentives detailed below, create a compelling business case for any entrepreneur planning a new manufacturing facility.

Key Government Incentives for Solar Manufacturers

The government of Kosovo has implemented a multi-layered incentive program to de-risk investment and lower operational costs for manufacturers. These measures are particularly beneficial for capital-intensive projects like a turnkey solar production line, where machinery and equipment represent a major expense.

The Law on Strategic Investments: A Gateway for Major Projects

For substantial ventures, Kosovo’s Law on Strategic Investments provides a streamlined path and enhanced benefits. A project typically qualifies as ‘strategic’ if the investment exceeds a certain threshold, often in the range of €10–30 million, depending on the sector and the number of jobs created.

Benefits for a designated Strategic Investor include:

-

Use of Immovable Property: Long-term leases (up to 99 years) on public land at favorable rates.

-

Regulatory Fast-Track: A simplified and accelerated process for obtaining necessary permits, licenses, and authorizations.

-

Access to State Aid: Potential for direct financial support, co-financing, or state guarantees.

This framework gives large-scale investors security and clarity, ensuring that significant projects can progress from planning to operation with minimal bureaucratic friction.

Tax Relief and Exemptions: Reducing Initial and Ongoing Costs

Perhaps the most direct financial benefits come from Kosovo’s favorable tax regime.

-

VAT Exemption on Production Assets: Imported solar module manufacturing equipment, production lines, and essential raw materials are exempt from the standard 18% Value Added Tax (VAT). The result is a substantial and immediate capital saving. For an equipment investment of €5 million, this exemption translates into a direct cash flow benefit of €900,000.

-

Customs Duty Relief: Equipment and raw materials that are not produced within Kosovo are exempt from customs duties, further lowering the initial setup cost.

-

Low Corporate Income Tax (CIT): Kosovo maintains a flat CIT rate of 10%, one of the most competitive in Europe. For Strategic Investors, further tax holidays or reductions can be granted for up to 10 years, significantly improving a new factory’s financial projections.

The Role of KIESA: Your Partner in the Investment Process

Navigating a new regulatory environment can be a challenge. The Kosovo Investment and Enterprise Support Agency (KIESA) was established as a central point of contact for foreign investors. KIESA facilitates the entire investment process, providing services such as:

-

Information on the legal and regulatory framework.

-

Assistance with business registration and licensing.

-

Facilitation of meetings with relevant government bodies.

-

Support in identifying suitable factory locations.

Engaging with KIESA early in the process helps ensure that all opportunities for support are identified and properly secured.

Accessing European Union (EU) and International Financial Support

Beyond national incentives, Kosovo’s status as a potential EU candidate country unlocks access to a broader range of financial instruments supported by international partners.

The Western Balkans Investment Framework (WBIF)

The WBIF is a joint initiative of the EU, international financial institutions (like the EBRD and EIB), and bilateral donors. While many WBIF projects are large-scale public infrastructure developments, the framework also provides technical assistance and grants that can benefit private sector projects in the green energy space. These grants can be used for feasibility studies, environmental impact assessments, and project preparation, effectively de-risking the early stages of a significant investment.

Opportunities Through International Financial Institutions (IFIs)

Institutions like the European Bank for Reconstruction and Development (EBRD) actively promote green energy investments across the Balkans. For a well-structured solar manufacturing project, the EBRD and similar IFIs may offer:

-

Favorable long-term loans.

-

Equity participation.

-

Risk-sharing facilities and guarantees.

Securing financing from such reputable institutions not only provides capital but also adds a layer of credibility and stability to the project. This phase often requires a detailed solar manufacturing business plan to meet their stringent due diligence requirements.

Navigating the Application Process: A Step-by-Step Overview

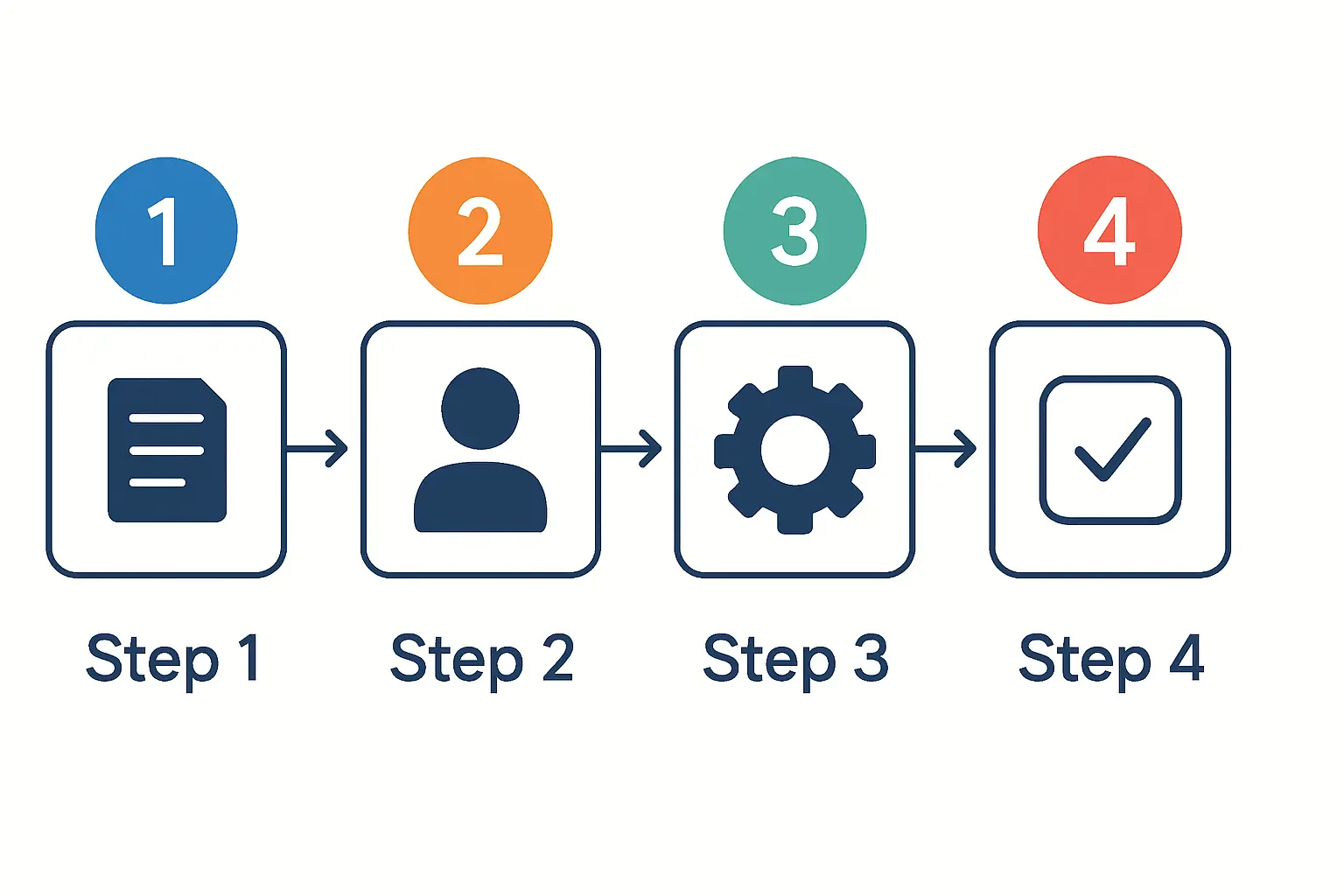

While the incentives are attractive, accessing them requires a structured approach. Based on experience from J.v.G. turnkey projects, a technically sound and financially viable project proposal is the most critical factor for success.

-

Initial Research and Due Diligence: Understand the legal framework and identify the specific incentives that apply to your planned factory’s scale.

-

Business Registration: Register the business entity in Kosovo, a process known for its simplicity and speed.

-

Develop a Comprehensive Project Proposal: This document should include a detailed business plan, technical specifications for the production line, financial projections, and an analysis of job creation. A clear understanding of the required solar production equipment is essential.

-

Engage with KIESA: Present the project proposal to KIESA to formally begin the process of applying for incentives and, if applicable, Strategic Investor status.

-

Secure Approvals and Permits: Work with KIESA and other ministries to obtain all necessary construction, environmental, and operational permits.

Frequently Asked Questions (FAQ)

What is the minimum investment to qualify for incentives?

While smaller investments qualify for standard tax and customs benefits, larger incentives under the Law on Strategic Investments typically require a multi-million Euro commitment. The exact threshold depends on the specific project and its economic impact.

Are these incentives available only to foreign investors?

No, the incentives are available to both domestic and foreign investors to ensure a level playing field and encourage local economic development.

How long does the application process typically take?

For standard incentives, the process is integrated into customs and tax filings. For Strategic Investor status, the timeline can range from three to nine months, depending on the project’s complexity.

Is political stability a concern for investors in Kosovo?

Kosovo has made significant progress in establishing a stable, democratic, and pro-business environment. Its legal framework is aligned with EU standards, and investment protection agreements are in place with numerous countries.

What kind of support can an investor expect after setting up the factory?

KIESA provides aftercare services to help investors navigate operational challenges, potential expansions, and ongoing communication with government authorities.

Planning Your Next Steps

Kosovo presents a compelling, incentive-rich environment for entrepreneurs aiming to establish a solar module manufacturing presence in Europe. The combination of direct financial benefits, government support, and access to international financing creates a unique opportunity to build a competitive and profitable enterprise.

Success, however, hinges on thorough preparation. These attractive incentives must be matched by a robust, well-researched business plan. Educational resources, like the structured e-courses provided by pvknowhow.com, can help prospective investors navigate the technical and business planning phases of such a venture. A logical starting point is to define the scope and scale of your planned solar factory, which directly influences the required investment and your eligibility for certain incentives.