With a location secured for a new solar module factory in Latvia, a robust business plan, and financing in place, the next critical question shifts from finance to logistics: Where will the millions of components—the glass, cells, frames, and encapsulants—be sourced? This decision will define the factory’s operational efficiency, cost structure, and ultimately, its competitive standing in the European market.

This analysis weighs the strategic choice of sourcing raw materials from Europe versus Asia, comparing the landed costs and lead times for delivery through key Baltic ports like Riga, Ventspils, and Liepāja. It provides a framework for evaluating a choice with implications that extend far beyond the initial price per unit.

The Strategic Importance of Latvian Ports for Solar Manufacturing

Latvia’s position within the European Union offers a distinct strategic advantage. Its ports are not merely entry points into a small national market; they are highly efficient logistical hubs connecting Western Europe, Scandinavia, and the CIS countries.

For a solar manufacturing venture, this means:

-

Tariff-Free Access: Materials sourced from EU member states like Germany or Poland face no customs duties, streamlining inbound logistics.

-

Advanced Infrastructure: The ports of Riga, Ventspils, and Liepāja are equipped with modern infrastructure and supported by extensive rail and road networks, ensuring efficient onward transport to the factory.

-

Market Proximity: A Latvian factory is well-positioned to serve the growing renewable energy markets in the Baltic states, Scandinavia, and Eastern Europe, reducing final-product shipping times.

Understanding Your Core Supply Chain: Two Primary Sourcing Models

For a new solar module manufacturer in Latvia, the global supply chain presents two primary options: sourcing from established industrial centers within Europe or procuring materials from the high-volume manufacturing hubs in Asia. Each path comes with a distinct set of economic and operational variables.

The choice is not simply a matter of geography; it is a fundamental business decision that impacts everything from working capital to production scheduling.

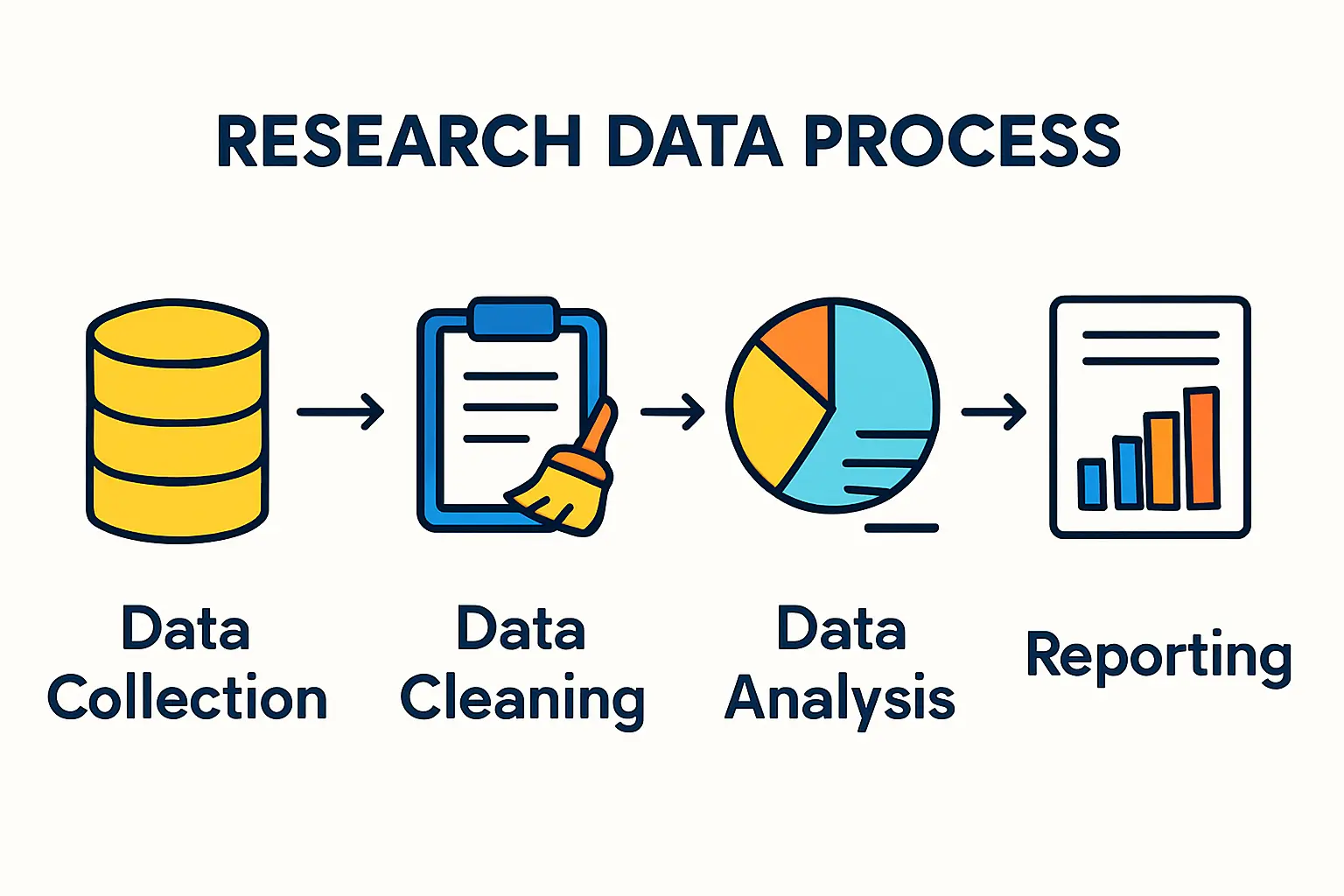

Deconstructing the Landed Cost: More Than Just the Price Tag

A common mistake for those new to manufacturing is focusing solely on the supplier’s quoted price per item. The true financial metric is the Total Landed Cost. This figure represents the complete cost of a product delivered from the supplier’s factory floor to your own.

The key components of landed cost include:

-

Unit Cost: The initial price of the raw materials.

-

Shipping & Freight: Ocean or road transport charges.

-

Insurance: Protecting the goods in transit.

-

Customs & Duties: Taxes and tariffs levied at the port of entry (critical when importing from outside the EU).

-

Port & Handling Fees: Charges for unloading and processing the shipment.

-

Inland Transportation: The cost of moving materials from the Latvian port to your factory.

Evaluating suppliers based on this comprehensive metric reveals the true financial implications of a sourcing strategy.

A Comparative Analysis: Sourcing from Europe vs. Asia

The decision between European and Asian suppliers involves a direct trade-off between component price, speed, and supply chain complexity.

Sourcing from European Suppliers (e.g., Germany, Poland, Italy)

The primary advantage of sourcing within the EU is logistical simplicity and speed. High-quality solar module raw materials can often be transported by road or rail, arriving at a Latvian factory in a matter of days, not weeks.

Advantages:

-

Short Lead Times: Typically 1–2 weeks, allowing for just-in-time inventory management and reducing the need for extensive warehousing.

-

No Customs Duties: The EU single market eliminates tariffs and complex customs clearance procedures.

-

High Quality & Consistency: European suppliers often adhere to stringent quality standards (e.g., ISO, TÜV), simplifying solar panel quality control upon arrival.

-

Lower Working Capital Requirement: Faster delivery means capital is tied up in inventory for a much shorter period.

Disadvantages:

- Higher Unit Cost: The initial purchase price for components is generally higher compared to Asian counterparts.

Sourcing from Asian Suppliers (e.g., China, Vietnam, Malaysia)

Asia, particularly China, is the global center for solar component manufacturing, offering economies of scale that result in lower unit prices.

Advantages:

- Lower Unit Cost: The primary driver for sourcing from Asia is the significant cost savings on components like solar cells and glass.

Disadvantages:

-

Long Lead Times: Ocean freight from Asia to a Baltic port can take 4–6 weeks, plus time for customs and inland transport.

-

Supply Chain Volatility: This route is more exposed to geopolitical risks, shipping container shortages, and port congestion.

-

Higher Working Capital Requirement: Payment for goods is often required upfront, meaning capital is tied up for nearly two months before materials are available for production.

-

Customs & Tariffs: Imports are subject to EU customs procedures and potential tariffs, adding complexity and cost.

The Hidden Factors: Risk, Resilience, and Working Capital

The analysis extends beyond a simple cost comparison. Long lead times from Asia directly impact cash flow. A 6-week shipping time means your business has paid for materials that cannot generate revenue for two months. This can place significant strain on the working capital of a new business.

Supply chain resilience is another critical factor. An unexpected delay from a single-source Asian supplier can halt production entirely. Based on experience from J.v.G. turnkey projects, many new manufacturers find success with a hybrid model: sourcing high-volume, standardized components from Asia while maintaining relationships with European suppliers for critical or specialized materials. This balances the overall investment for a solar factory with operational stability.

Frequently Asked Questions (FAQ)

What are the main raw materials needed for a solar panel factory?

The core materials include tempered solar glass, photovoltaic cells, aluminum frames, encapsulant films (EVA or POE), backsheets (or a second pane of glass for glass-glass modules), and junction boxes with cables.

Are Latvian ports generally ice-free and operational year-round?

The major ports of Ventspils and Liepāja are typically ice-free throughout the year. The Port of Riga may require icebreaker assistance during severe winters but remains fully operational.

How do EU trade policies impact sourcing from China?

Goods imported from China into Latvia are subject to the EU’s Common External Tariff. It is essential to consult with a customs broker to understand the specific duties and VAT applicable to solar components, as these can change.

Is it feasible for a new factory to use suppliers from both Europe and Asia?

Yes, this is a common and often recommended strategy. A hybrid approach allows a factory to leverage the lower costs from Asia for certain components while benefiting from the speed and reliability of European suppliers for others, creating a more resilient and cost-effective supply chain.

Conclusion: Strategic Sourcing as a Competitive Advantage

The choice of where to source raw materials is one of the most impactful decisions a new solar module manufacturer will make. For an entrepreneur establishing a turnkey solar manufacturing line in Latvia, the lower unit price from Asia is tempting, but it comes with longer lead times, higher working capital demands, and greater logistical risk. Sourcing from within Europe offers speed, reliability, and simplicity at a higher component cost.

A successful strategy isn’t about finding the cheapest supplier, but about building the most resilient, efficient, and financially sustainable supply chain for your business model. Understanding these logistical nuances is a critical first step toward building a successful manufacturing operation.