When considering a new venture, an investor’s business plan often fills up quickly with data on market analysis, capital equipment, and revenue projections. For many entrepreneurs exploring the solar manufacturing sector in Lebanon, however, the ‘Operating Expenses’ section—and specifically labor costs—can be a significant challenge.

This variable is shaped not just by salaries but by complex regulations, currency fluctuations, and a unique local talent market. This guide provides a clear framework for understanding and forecasting workforce costs in Lebanon.

Designed for business professionals who need practical data for accurate financial planning, it outlines the specific roles, salary expectations, and legal obligations involved in staffing a small to medium-sized solar module factory. Any well-structured solar panel manufacturing business plan must be built on a solid foundation of these local realities.

Understanding the Core Components of Labor Cost in Lebanon

The figure on an employee’s payslip is only one part of an employer’s total cost. A comprehensive budget must also account for mandatory social security contributions and taxes, which add a substantial percentage to the base salary.

Gross Salary, NSSF, and Taxes: A Breakdown

In Lebanon, the total labor cost combines an employee’s gross salary with the employer’s mandatory contributions to the National Social Security Fund (NSSF).

Gross Salary: This is the agreed-upon salary before any deductions. While the official minimum wage is set in Lebanese Pounds (LBP), severe currency depreciation means that for skilled positions, salaries are almost always negotiated and paid in US Dollars to attract and retain talent.

National Social Security Fund (NSSF): This mandatory government scheme covers sickness, maternity, family allowances, and end-of-service indemnity. The contribution is calculated on the employee’s salary (up to a ceiling) and is split as follows:

Employer’s Contribution: 23.5%

Employee’s Contribution: 3% (deducted from the gross salary)

Tax on Salaries: Income tax is progressive, with rates ranging from 2% to 25%. The employer deducts this from the employee’s salary and is responsible for remitting it to the Ministry of Finance.

A critical factor for any international investor is the currency. The official exchange rate differs vastly from the market rate, making it standard practice to structure budgets, contracts, and financial models using the prevailing market rate to reflect the true cost in USD.

Staffing Your Solar Factory: Roles, Skills, and Expected Salaries

A typical 20-50 MW solar module assembly plant requires a workforce with three distinct skill levels. The salaries listed below are based on 2023/2024 market analysis and presented in USD to provide a stable benchmark.

The Engineering Team: Technical Leadership

Engineers are the technical foundation of the factory, responsible for process optimization, quality control, troubleshooting complex machinery, and training technicians.

Typical Qualifications: A university degree in Electrical, Mechanical, or Industrial Engineering.

Responsibilities: Overseeing production line efficiency, implementing quality assurance protocols (like ISO standards), and leading maintenance efforts.

Expected Monthly Salary Range: $1,000 – $2,500+ USD, depending on experience and specific expertise.

The Technicians: The Backbone of Production

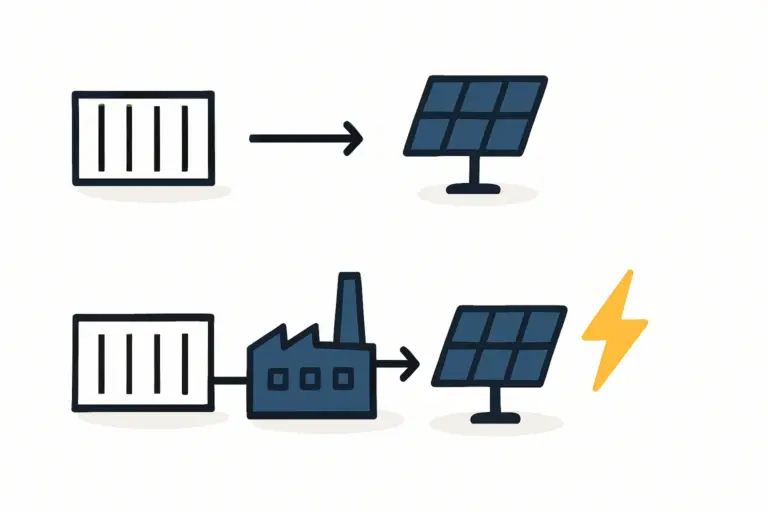

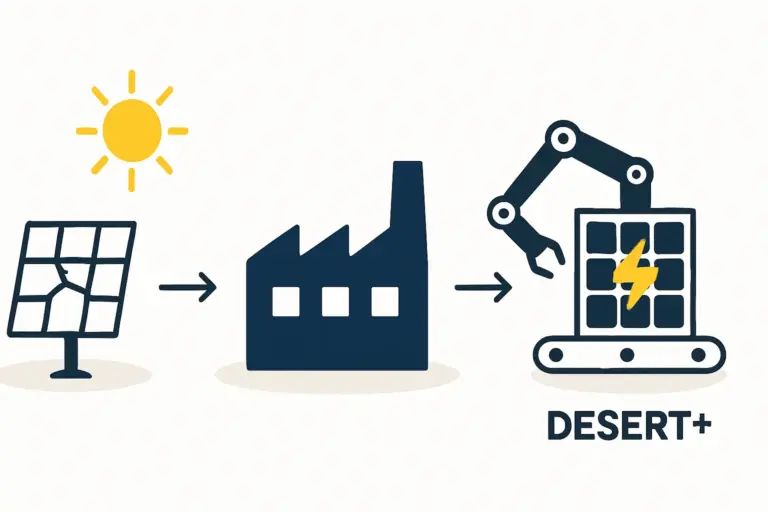

Technicians are the skilled operators who run the critical machinery. Their competence directly impacts the factory’s output and final product quality. A turnkey solar manufacturing line depends on well-trained technicians to operate equipment like the stringer, laminator, and solar simulator.

Typical Qualifications: A degree from a vocational or technical institute (e.g., BT/TS diplomas).

Responsibilities: Day-to-day operation of automated equipment, performing routine maintenance, and conducting initial quality checks.

Expected Monthly Salary Range: $500 – $1,200 USD.

Assembly and Operations Workers: Ensuring Throughput

This group makes up the largest part of the workforce, performing essential manual and semi-automated tasks along the assembly line, such as cell sorting, bussing, framing, and packing.

Typical Qualifications: No specific formal education is required, as training is typically provided on the job.

Responsibilities: Material handling, visual inspection of solar cells, module framing, and preparation for shipping.

Expected Monthly Salary Range: $250 – $500 USD. While an LBP minimum wage exists, competitive factories offer a market-rate wage to ensure reliability and reduce staff turnover.

Navigating the Lebanese Labor Law Framework

Compliance with local labor law is essential for operational stability and risk management. While foreign investors should engage local legal counsel, a foundational understanding of key regulations is crucial.

Working Hours, Overtime, and Leave

Standard Work Week: The standard work week is 48 hours, typically spread over six days.

Overtime: Work performed beyond standard hours must be compensated at 1.5 times the regular hourly rate.

Annual Leave: After one year of service, employees are entitled to a minimum of 15 days of paid annual leave. This entitlement increases with seniority.

Employment Contracts and Termination

Contracts: Written employment contracts are strongly advised. They should clearly state the role, responsibilities, salary (and its currency), and other terms of employment.

Probation Period: The law allows for a maximum probation period of three months, during which either party can terminate the contract without notice or indemnity.

Termination: Terminating an employee after the probation period requires a formal process, including a valid justification and adherence to statutory notice periods. Unjustified dismissal can lead to significant indemnity payments, making it essential to follow correct legal procedures.

Critical Considerations for Investors in the Lebanese Market

Beyond salaries and standard regulations, the current economic climate in Lebanon presents unique challenges that must be factored into any business strategy.

Currency Volatility and Payroll Strategy

The most significant operational risk is currency fluctuation. Paying skilled employees in a rapidly devaluing local currency leads to high turnover. As a result, the market standard for professional and technical roles is to denominate salaries in USD. While this provides stability for employees and allows the business to retain critical talent, it requires careful management of currency conversions for local expenses.

The Talent Pool: Opportunities and Risks

Lebanon boasts a highly educated and often multilingual workforce, particularly in engineering and technical fields—a distinct advantage. However, the ongoing economic crisis has led to a significant ‘brain drain,’ with skilled professionals seeking opportunities abroad. Key strategies for mitigating this risk include offering a competitive compensation package, fostering a positive work environment, and providing opportunities for professional development.

Sample Cost Calculation: A Practical Example

To illustrate how these components combine, consider this approximate monthly cost calculation for a mid-level technician.

Agreed Gross Salary: $800 USD

Employer’s NSSF Contribution (23.5% of salary): $800 × 0.235 = $188 USD

Total Monthly Cost to Employer: $800 + $188 = $988 USD

This simple calculation shows that the actual cost to the company is nearly 24% higher than the employee’s gross salary. This multiplier is a critical factor in accurate budgeting and financial forecasting.

Frequently Asked Questions (FAQ)

What is the biggest mistake investors make regarding labor in Lebanon?

The biggest mistake is underestimating the total cost of employment by focusing only on gross salaries and failing to budget for the 23.5% NSSF contribution. Another common error is failing to develop a clear strategy to manage currency volatility in payroll.

Is it difficult to find qualified engineers in Lebanon?

Not necessarily. The country has a strong educational system and a good supply of qualified engineers. The primary challenge is not finding talent but retaining it in the face of economic instability and competition from international markets.

Should employment contracts be in LBP or USD?

This is a matter for careful legal consultation. However, for skilled and professional roles, denominating the salary value in USD within the contract is a common and often necessary practice to provide security for the employee and ensure retention.

How does Lebanon compare to other countries in the region?

Lebanon offers a highly skilled and educated workforce, which can be an advantage over other locations. Its primary challenges, however, are economic instability and bureaucratic complexities, which require more hands-on management than in more stable economies.

Conclusion and Next Steps

Successfully launching a solar factory in Lebanon requires a deep understanding of its unique labor environment. The key takeaways for any investor are clear: budget for total labor costs, not just salaries; structure compensation to mitigate currency risks; and ensure strict compliance with Lebanese Labor Law. Building a business model on these realistic foundations positions an entrepreneur for long-term success.

With these operational details clarified, your next step is to integrate this workforce planning into a broader strategy. Learn more by exploring the complete framework of how to start a solar module production business.