An entrepreneur considering Lebanon’s solar market might first examine the cost of importing finished panels, which face a standard 5% customs duty—a routine business expense.

A closer look, however, reveals a critical distinction: the raw materials needed to manufacture those same panels locally can be imported with zero customs duty. This policy creates a significant competitive advantage, forming the foundation of a compelling business case for establishing local production.

This article examines the customs duties and tax incentives available in Lebanon for entrepreneurs in the renewable energy sector, exploring how these fiscal policies favor local manufacturing and what that implies for a potential investment.

The Core Incentive: Understanding Lebanon’s Customs Duty Structure

Governments often use customs tariffs to protect and encourage domestic industries. In Lebanon, the policy for solar equipment is a clear example of this strategy.

By creating a tariff differential between finished products and the components used to make them, the framework actively rewards local value addition and assembly.

Finished Solar Modules vs. Raw Materials: A Direct Comparison

The key to understanding the opportunity lies in the specific Harmonized System (HS) codes and their associated tariffs:

Imported Finished Solar Panels (HS Code 8541.40): These are subject to a 5% customs duty. For every one million dollars of panels imported, the tariff cost is $50,000.

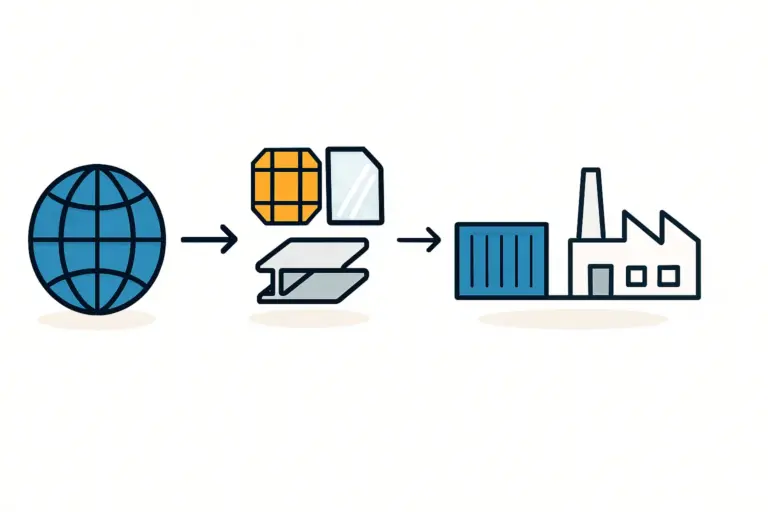

Imported Raw Materials for Manufacturing: The essential components for assembling solar modules are exempt from customs duties. This 0% tariff applies to:

- Solar Cells (HS Code 8541.40.10)

- EVA Film (HS Code 3920.99.90)

- Backsheets (HS Code 3921.90.90)

- Solar Glass (HS Code 7007.19.00)

- Aluminum Frames (HS Code 7604.21.00)

- Junction Boxes (HS Code 8536.90.90)

This policy directly reduces the Bill of Materials (BOM) cost for a local manufacturer, creating an immediate price advantage over competitors who solely import and resell finished panels.

Beyond Tariffs: Lebanon’s Investment Incentives for Manufacturers

Complementing the favorable customs regime is a suite of investment incentives from the Investment Development Authority of Lebanon (IDAL). As the national agency responsible for promoting investment, IDAL operates under Investment Law No. 360, which provides a framework for project-based incentives.

Key Fiscal Benefits Offered by IDAL

For qualifying projects, particularly in designated sectors like technology and industry, IDAL can grant a package of benefits that significantly enhance a project’s financial viability. These incentives are often structured as a contract between the investor and the Lebanese government. Key benefits include:

-

Full Exemption on Corporate Income Tax: Qualifying projects may receive up to a 100% exemption on corporate income tax for a period of up to 10 years.

-

Exemption on Dividend Distribution Taxes: Taxes on profits distributed as dividends can also be fully exempted for the same duration, maximizing returns for shareholders.

-

Reduced Fees: This can include exemptions from land registration fees when purchasing property for the project.

-

Streamlined Permitting: IDAL facilitates the process for securing necessary permits, including work permits for foreign labor, reducing administrative delays.

These incentives are typically tied to specific geographic zones within Lebanon and the scale of the investment, making a thorough feasibility study essential to confirm eligibility. Experience from J.v.G. turnkey projects shows that aligning the business plan with IDAL’s criteria from the outset is a critical step.

The Market Context: Why These Incentives Matter in Lebanon

These government policies are not abstract; they are a direct response to Lebanon’s pressing energy challenges and clear market opportunities. The country suffers from high electricity costs and chronic power shortages, forcing businesses and households to rely on expensive and polluting diesel generators.

This situation has created strong and sustained demand for reliable, cost-effective energy alternatives. With over 300 sunny days per year, solar power is the most logical solution.

The financial incentives for local manufacturing are designed to build domestic capacity to meet this demand, reducing reliance on imports of both fuel and finished solar products. An investment in a solar module production line in Lebanon is therefore not just an industrial project; it is a direct response to a fundamental market need.

Strategic Considerations for the Prospective Investor

Understanding these incentives is the first step. The next is to integrate them into a robust business strategy.

Calculating Your Competitive Edge

The 0% duty on raw materials directly lowers the production cost per watt, creating a competitive buffer against importers. This advantage allows a local manufacturer to either offer more competitive pricing to capture market share or achieve higher profit margins. For investors planning a small-scale solar manufacturing plant, these savings can be the deciding factor in achieving a faster return on investment and long-term profitability.

Navigating the Application Process

Securing incentives from IDAL requires a well-documented application including a comprehensive business plan, financial projections, and details on job creation. The process is structured and transparent but demands meticulous preparation. Engaging with advisors who understand both the technical requirements of setting up a factory with the right solar panel manufacturing machines and the administrative landscape of Lebanon can significantly streamline this process.

Frequently Asked Questions (FAQ)

What is the main customs advantage for manufacturing solar panels in Lebanon?

The primary advantage is the 0% customs duty on imported raw materials (like solar cells, glass, and EVA film), compared to the 5% duty levied on imported, fully assembled solar panels. This provides an immediate cost advantage to local producers.

Are these tax incentives available to foreign investors?

Yes, the incentives offered by the Investment Development Authority of Lebanon (IDAL) are available to both local and foreign investors. The framework is designed to attract foreign capital and expertise.

Do I need a local partner to benefit from these incentives?

While not always mandatory, having a local partner can be beneficial for navigating administrative processes. However, Lebanese law allows for foreign ownership of companies, and a properly established local subsidiary of a foreign company can be eligible for IDAL incentives.

How complex is the process of applying for IDAL incentives?

The process is formal and requires a detailed application, including a robust business plan and financial model. It is not overly complex but requires professional and thorough preparation to meet all of IDAL’s criteria.

Which raw materials are specifically exempt from customs duties?

Key exempt materials include solar cells, ethylene vinyl acetate (EVA) film, solar glass, polymer backsheets, aluminum frames, and junction boxes, which together constitute the majority of a solar module’s components.

Conclusion: A Favorable Climate for Local Solar Production

Lebanon’s fiscal policies present a clear and intentional strategy to foster a domestic solar manufacturing industry. The combination of a 0% customs duty on raw materials and the potential for extensive tax holidays via IDAL creates a highly attractive environment for investment.

For entrepreneurs and business professionals looking to enter the renewable energy sector, this framework transforms a challenging energy market into a significant manufacturing opportunity. By leveraging these incentives, a well-planned manufacturing facility can achieve a sustainable competitive advantage, serve a growing local market, and contribute to Lebanon’s energy independence. To take the next step, explore the complete guide to starting a solar panel factory.