When exploring solar manufacturing, many entrepreneurs instinctively focus on the largest national markets, like South Africa or Nigeria. A deeper analysis, however, reveals that the most strategic location for a new solar module factory isn’t necessarily the largest market, but one with the best access to a group of markets. For Southern Africa, this logic points directly to an often-overlooked manufacturing hub: Lesotho.

The business case for establishing a solar module production facility in Lesotho to serve the broader Southern African Development Community (SADC) is compelling. This opportunity is built not on the size of the domestic market, but on powerful trade agreements, logistical efficiencies, and a colossal regional energy deficit.

The Unmistakable Demand: The SADC Energy Deficit

The Southern African Development Community—a regional economic bloc of 16 member states—faces a persistent and significant energy shortfall. According to the SADC Centre for Renewable Energy and Energy Efficiency (SACREEE), the region has an electricity access rate of only around 50%.

To meet its development goals, the region requires an estimated 61 gigawatts (GW) of new generation capacity. This gap represents one of the most substantial market opportunities for renewable energy in the world. While governments and utilities work on large-scale projects, there is a vast and growing demand for decentralized solar solutions, from commercial and industrial rooftop installations to rural mini-grids. A manufacturer strategically positioned within the region can supply this market more effectively than international competitors.

Lesotho’s Strategic Position: A Gateway to 350 Million People

Lesotho’s primary advantage isn’t its geography, but its membership in key economic alliances that dismantle trade barriers and create a seamless regional market.

The Southern African Customs Union (SACU)

Lesotho is a member of the Southern African Customs Union, the world’s oldest active customs union. Its members include Botswana, Eswatini (formerly Swaziland), Namibia, and South Africa.

For a manufacturer, SACU membership provides a critical benefit: goods produced in Lesotho can be transported and sold within any other member country without customs duties. This grants a Lesotho-based factory tariff-free access to the largest and most industrialized economy in the region, South Africa.

The Southern African Development Community (SADC)

Beyond SACU, Lesotho is part of the broader SADC Free Trade Area. This agreement aims to eliminate tariffs and non-tariff barriers among all 16 member states. Manufacturing within a member state like Lesotho allows a company’s products to qualify for preferential treatment across the region, from the Democratic Republic of Congo to Tanzania and Angola.

This status is governed by ‘Rules of Origin,’ which stipulate that a certain percentage of a product’s value must be generated within the SADC region to qualify for duty-free access. A solar module assembly plant in Lesotho easily meets these criteria, creating a powerful competitive advantage over modules imported from Asia or Europe, which would face import tariffs.

The Business Case: A Central Hub for Regional Distribution

The combination of vast regional energy demand and Lesotho’s unique trade advantages creates a clear and defensible business strategy. A factory in Lesotho is not just a Lesotho factory; it is a SADC factory with a logistical home base.

Logistical and Export Advantages

While landlocked, Lesotho is fully integrated into the Southern African transport network, primarily via road and rail corridors through South Africa to major ports like Durban. This established infrastructure allows for the efficient import of raw materials and the distribution of finished solar modules to customers across the region.

The core strategy is to operate an export-oriented hub:

- Import Raw Materials: Cells, glass, frames, and other components are imported into Lesotho.

- Manufacture and Assemble: The components are assembled into finished solar modules in a Lesotho-based facility.

- Distribute Duty-Free: The finished modules, now qualifying as a ‘Made in SADC’ product, are exported to high-demand markets like South Africa, Botswana, Zimbabwe, and Zambia without incurring import tariffs.

This model creates a significant cost advantage over international competitors and positions the business as a local or regional supplier—a status often favored in both private and public procurement processes. The initial solar factory investment requirements for such a setup are often more accessible than entrepreneurs assume, particularly for a facility focused on serving a regional niche.

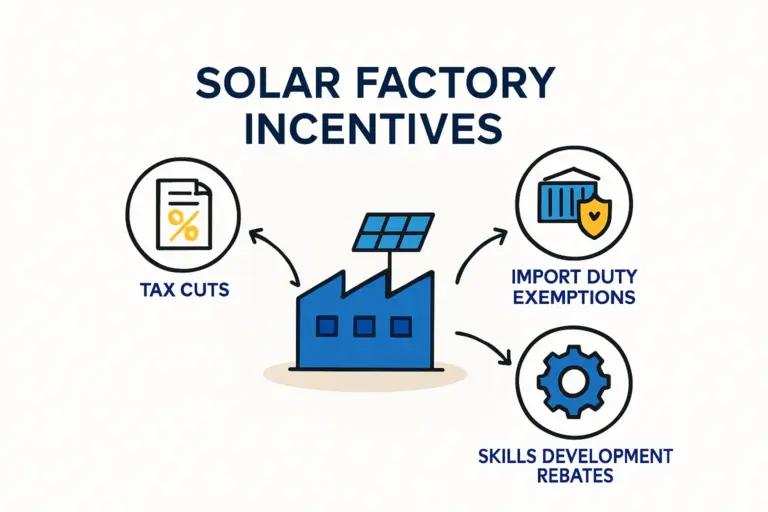

Building a Compliant and Competitive Operation

Capitalizing on this opportunity requires careful planning. The factory must be designed from the ground up to meet both international quality standards (like IEC certifications) and the SADC Rules of Origin. This calls for a well-structured plan for sourcing materials, managing production, and handling regional logistics.

Many new entrants to the market find that partnering with experienced advisors is crucial. Using frameworks for turnkey solar production lines can de-risk the technical aspects of the project, allowing business owners to focus on market strategy and distribution. Experience from J.v.G. turnkey projects in Africa shows that securing a reliable logistics partner early in the planning phase is a key factor for success.

Frequently Asked Questions (FAQ)

Why not establish a factory directly in South Africa?

While South Africa is the largest single market, Lesotho can offer advantages like a more stable labor environment, potentially lower operating costs, and streamlined administrative processes for new businesses. Crucially, due to its membership in SACU and SADC, a Lesotho-based factory enjoys the same tariff-free access to the South African market as a domestic producer.

What are the main logistical hurdles for a landlocked country?

The primary challenge is the reliance on road and rail transport through a neighboring country (South Africa) to reach a seaport. However, these corridors are well-established and highly trafficked. Effective management of freight forwarding and customs clearance at the border is critical, but it is a standard and predictable part of doing business in the region.

How difficult is it to import raw materials into Lesotho?

As a member of SACU, the customs procedures for goods entering Lesotho from or through South Africa are highly streamlined. For international shipments arriving at a South African port like Durban, goods can be moved ‘in bond’ to Lesotho, with final customs clearance handled efficiently at the destination.

What is a realistic starting size for a factory using this strategy?

A common and practical entry point is a semi-automated production line with an annual capacity of 20 MW to 50 MW. This size is large enough to be efficient and serve multiple regional clients, yet it doesn’t require the massive capital outlay of a gigawatt-scale factory. It allows a business to establish a foothold and scale operations as its regional market share grows. For those new to the industry, understanding how to start a solar module factory is the foundational first step.

The business case for establishing a solar factory in Lesotho is a powerful example of how strategic positioning within trade blocs can create outsized opportunities. The combination of a massive, underserved regional market and the tariff-free access granted by SACU and SADC membership transforms Lesotho from a small, landlocked nation into an ideal manufacturing and export hub.

For the discerning entrepreneur or investor, this represents a chance to build a resilient and competitive business that directly addresses Southern Africa’s pressing energy needs. Success requires thorough planning, technical expertise, and a clear understanding of regional logistics, but the underlying strategic foundation is exceptionally sound.