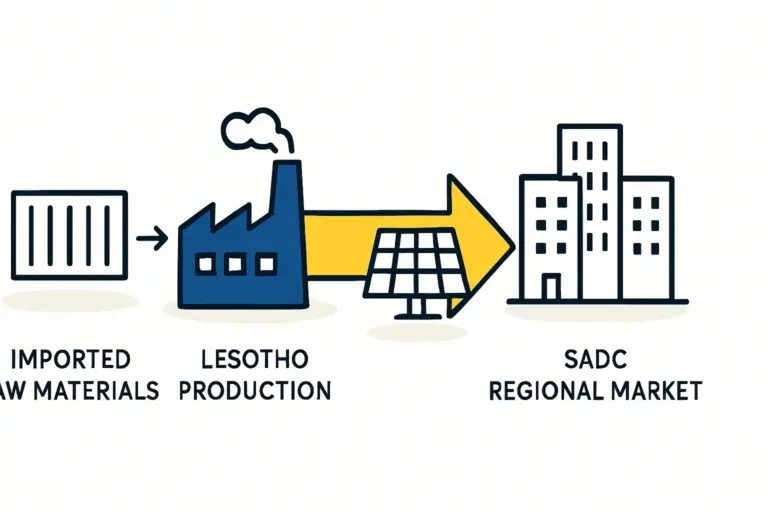

An entrepreneur planning a solar module factory in Lesotho might focus on its strategic location, favorable labor conditions, and access to growing African markets. They often assume that raw materials can be imported at world-market prices from leading suppliers in Asia.

However, a critical factor frequently overlooked at this initial stage is Lesotho’s membership in the Southern African Customs Union (SACU).

This membership has profound financial and logistical implications for your supply chain. Understanding the SACU tariff structure is not just an administrative task; it is a strategic necessity that will directly influence your factory’s profitability and operational resilience. This article explains the impact of SACU’s Common External Tariff (CET) on key solar components and provides a framework for developing a smart sourcing strategy.

What is SACU and How Does It Affect Your Factory?

The Southern African Customs Union is the world’s oldest surviving customs union, comprising five member states: Botswana, Eswatini, Lesotho, Namibia, and South Africa. For a business operating within this bloc, its most important feature is the Common External Tariff (CET).

The CET means that any goods imported from outside the SACU area are subject to the same set of customs duties, regardless of which member country serves as the port of entry. Whether your container of solar cells arrives in Durban, South Africa, or Walvis Bay, Namibia, the import tariff applied will be identical. Once inside SACU territory, these goods can then move between member states without any additional tariffs.

For a solar manufacturer in Lesotho, this creates a fundamental strategic question: Is it more cost-effective to import components from global suppliers and pay the CET, or to source them from a manufacturer within SACU, such as in South Africa? The answer lies in the specific tariffs applied to each component.

Analyzing Import Duties on Key Solar Manufacturing Materials

The SACU tariff schedule is not uniform across all goods. It is designed to protect certain local industries while allowing for the cost-effective import of materials not produced regionally. This directly impacts the sourcing of the raw materials needed for a solar panel production line.

Solar Cells: A Strategic Advantage

Solar photovoltaic cells are the most technologically sensitive and highest-value component in a solar module. The vast majority of these are manufactured in China and Southeast Asia. Recognizing that there is no large-scale cell manufacturing capacity within the customs union, the SACU tariff on imported solar cells is typically set at 0%.

This is a significant advantage for a Lesotho-based factory. It allows you to source the most critical electronic component from the world’s best suppliers without the burden of import duties, keeping your core technology costs globally competitive.

Solar Glass and Aluminum Frames: The Protectionist Hurdle

The situation changes considerably for other essential, yet less technologically complex, components like solar glass and aluminum frames. Manufacturing capabilities for these materials exist within the SACU region, particularly in South Africa. To protect these local industries, the CET on these items is often set much higher.

-

Solar Glass (Tempered, Low-Iron): Imports from outside SACU can face tariffs of up to 15%.

-

Aluminum Frames (Extruded): These components may be subject to a CET of around 10%.

This tariff structure often creates an ‘aha moment’ for planners: the total cost of setting up a solar factory is heavily influenced not just by machine investment, but by the recurring, tariff-driven costs of its bulkiest components.

Backsheets, EVA, and Junction Boxes

Other materials like EVA (ethylene vinyl acetate), backsheets, and junction boxes have varying tariff rates. While often lower than for glass and frames, they must be factored into any detailed financial model. The key is to analyze each component individually rather than assuming a single tariff rate applies to all imported materials.

Developing a Supply Chain Strategy: A Cost-Benefit Analysis

Given the tariff landscape, a factory in Lesotho can consider three primary sourcing strategies. The optimal choice depends on a careful balance of cost, quality, and logistical risk.

Option 1: Full Importation from Outside SACU

This strategy involves sourcing all components from international suppliers, primarily in Asia.

-

Advantages: Access to a wide range of global suppliers, potentially lower ex-factory prices due to economies of scale, and the latest material technologies.

-

Disadvantages: The full 10-15% CET on glass and frames applies, significantly increasing the bill of materials. The factory is also exposed to international shipping volatility, port delays (primarily through Durban), and foreign currency risk.

Option 2: Sourcing Protected Components from within SACU

This approach involves purchasing high-tariff items like glass and frames from manufacturers in South Africa while importing the 0%-tariff cells.

-

Advantages: Avoids the 10-15% import duty on these components. Lead times are drastically shorter, reducing inventory needs. Logistics are simplified to road freight from South Africa to Lesotho.

-

Disadvantages: The base price from a regional supplier may be higher than from a mass producer in Asia. There may also be fewer options in terms of specifications and dimensions.

Option 3: The Hybrid Approach (The Recommended Strategy)

Experience from J.v.G. Technology turnkey projects consistently shows that a hybrid model is the most resilient and profitable strategy for manufacturers in the SACU region.

This balanced approach involves:

-

Importing high-value, low-tariff components like solar cells from top-tier global manufacturers.

-

Sourcing bulky, high-tariff components like glass and aluminum frames from qualified, pre-vetted suppliers within SACU (primarily South Africa).

This strategy captures the best of both worlds. It secures access to world-class cell technology at competitive prices while mitigating the punitive impact of the CET on other materials. It also builds a more resilient supply chain by reducing reliance on long-distance sea freight for key components.

Frequently Asked Questions About SACU Tariffs and Solar Manufacturing

Do SACU tariffs change often?

The Common External Tariff rates can be reviewed and adjusted, but this is typically a slow process. However, businesses should monitor announcements from the International Trade Administration Commission (ITAC) of South Africa, which plays a key role in tariff administration for the union.

Is it cheaper to set up a factory in South Africa than in Lesotho?

Each location has unique advantages. While South Africa has a larger industrial base, Lesotho may offer specific investment incentives, different labor costs, and a distinct business environment. The SACU tariffs on imported components would be the same in either location. The decision rests on a holistic analysis of operational costs, logistics, and market access.

Can I get exemptions from SACU import duties for my factory?

In some cases, industrial rebate programs may be available, allowing manufacturers to import certain components duty-free for use in products destined for export. Securing these rebates requires a complex application process and strict compliance with customs regulations. It should be investigated but not assumed in the initial business plan.

Planning Your Next Steps

The success of a solar module factory in Lesotho is not determined by machinery alone. It requires a smart, nuanced supply chain strategy that acknowledges the realities of the Southern African Customs Union. A plan that assumes all materials will be imported at global market rates is destined for financial challenges.

By contrast, a strategy that leverages the 0% tariff on solar cells while sourcing protected components like glass and frames from within the customs union creates a durable competitive advantage. The first step is developing a comprehensive business plan that accurately models these tariff-related costs and logistical pathways. Understanding these details is a core part of the planning process, one that platforms like pvknowhow.com help entrepreneurs navigate to ensure a project is built on a solid financial and operational foundation.